Analysis of the Impact of Shanghai's Business Environment Action Plan on Valuations of A-Share Banks and Fintech Enterprises

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

In response to your question, I will conduct an in-depth analysis from three dimensions: policy transmission mechanism, market status, and valuation improvement potential.

Shanghai’s “Business Environment Action Plan (2026)” focuses on improving the financing environment for SMEs, with key measures including [1][2][3]:

- Build a unified financing service platform ‘Suishengrong’: Provide one-stop services for SMEs such as policy integration, product release, and demand response

- Improve the financing coordination mechanism for micro and small enterprises: Break down data barriers between government and banks to enhance financing accessibility

- Implement seamless loan renewal policy: Prevent improper loan withdrawal or termination due to lawsuits to stabilize enterprise capital chains

- Standardize financing intermediary services: Crack down on illegal intermediaries to reduce comprehensive financing costs

Policy implementation → Improved financing for SMEs → Optimized bank asset quality + Increased demand for financial IT

↓

Valuation recovery of bank stocks + Performance growth of fintech enterprises

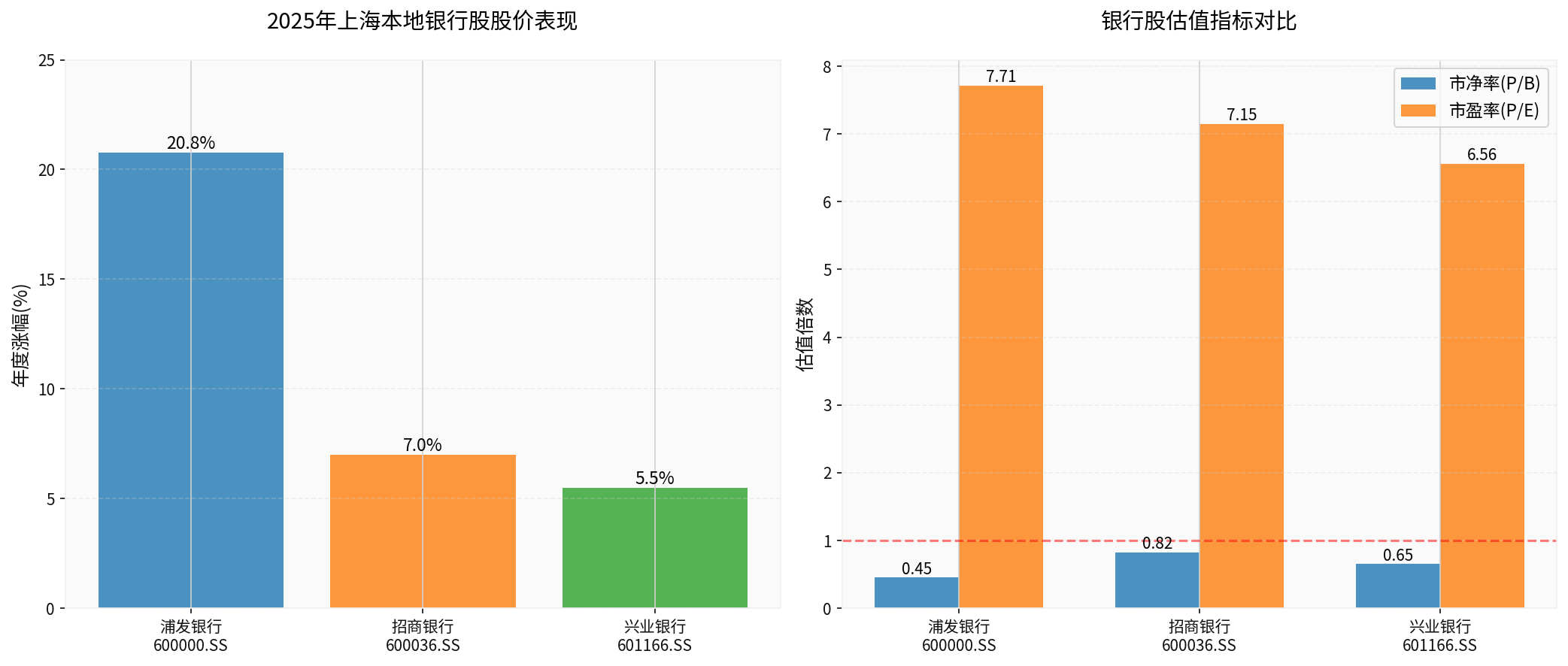

According to brokerage API data [0], Shanghai local bank stocks showed significant divergence in 2025:

| Bank | 2025 Increase | Price-to-Book Ratio (P/B) | Price-to-Earnings Ratio (P/E) | Total Market Capitalization |

|---|---|---|---|---|

| Shanghai Pudong Development Bank (600000.SS) | +20.78% |

0.45x | 7.71x | 390 billion yuan |

| China Merchants Bank (600036.SS) | +6.99% | 0.82x | 7.15x | 1.06 trillion yuan |

| Industrial Bank (601166.SS) | - | 0.65x | 6.56x | 445.7 billion yuan |

- Seamless Loan Renewal Policy: Directly reduces the default risk of SME loans and improves expectations for bank non-performing loan ratios

- ‘Suishengrong’ Platform: Reduces information asymmetry for banks through government credit enhancement and data sharing, improving risk control efficiency

- Crackdown on Illegal Intermediaries: Reduces intermediate costs, allowing banks to access higher-quality, lower-risk credit assets

According to web search data, the bank stock sector showed signs of valuation recovery in 2025; some banks such as Agricultural Bank of China and China Merchants Bank briefly broke through a P/B ratio of 1x, ending the long-term situation of trading below book value [4]. Although the current average P/B ratio of the sector is still 0.62x, the improvement trend is very obvious.

As an international financial center, Shanghai achieved the global optimal level in 22 out of 59 assessment points in the World Bank’s 2025 Business Environment Assessment, surpassing Singapore, New York, London, and Hong Kong [1][2]. This high-quality business environment provides local banks with:

- Higher-quality corporate customer groups

- More complete legal protection

- Richer financial innovation scenarios

Taking Shanghai Pudong Development Bank as an example (current P/B ratio:0.45x):

- Conservative Scenario: P/B ratio recovers to 0.6x, with approximately 33% upside potential

- Neutral Scenario: P/B ratio recovers to0.75x, with approximately67% upside potential

- Optimistic Scenario: P/B ratio recovers to1.0x, with approximately122% upside potential

The chart shows that Shanghai Pudong Development Bank led in stock price performance in 2025 (+20.78%), but its P/B ratio (0.45x) is still at a low level, leaving significant room for valuation recovery.

- Pressure from Narrowing Net Interest Margin: Policies requiring lower financing costs for enterprises may compress banks’ net interest margins

- Policy Implementation Lag: It takes 6-12 months for policies to take effect from release

- Macroeconomic Fluctuations: Economic downward pressure may offset policy dividends

- Hundsun Technologies (600570.SS): Leading fintech company, which won multiple procurement projects from financial institutions in 2025, including Shengjing Bank, Everbright Securities, and Huajin Securities, with bid amounts ranging from 3.25 million yuan to14.88 million yuan [5]

- Business Opportunities:

- Construction and system integration of the ‘Suishengrong’ platform

- Demand for bank risk control system upgrades

- Increased IT investment driven by accelerated digital transformation

- East Money (300059.SZ): Current market capitalization of366.3 billion yuan, P/E ratio of28.98x [0]

- Business Opportunities:

- Traffic growth driven by increased financing demand from SMEs

- Wealth management business benefits from increased investment demand of enterprise owners

- Cross-border Payment Technology: Enterprises providing dynamic identity authentication solutions for the Cross-border Interbank Payment System (CIPS) [5]

- Digital RMB-related Enterprises: Technology service providers participating in the construction of the Central Bank Digital Currency Bridge (mBridge)

- ‘Suishengrong’ Platform Construction: Expected to drive several hundred million yuan in related IT system construction investment

- Digital Transformation of Financial Institutions: Annual growth rate of IT investment in the banking industry is expected to reach15-20%

- Demand for Compliance Technology: Rising demand for data security, anti-fraud, and credit reporting systems

Fintech enterprises usually enjoy higher valuation multiples than traditional banks:

- Technology Premium: Application of new technologies such as AI, big data, and blockchain

- Growth Premium: Revenue growth rate higher than the industry average of traditional banks

- Policy Support Premium: Dividends from policies such as digital economy and independent innovation

Taking Hundsun Technologies as an example, the company has been selected into the FinTech100 global fintech list for15 consecutive years, ranking24th in2022, with strong technical barriers and customer resources [5].

- High Policy Dependence: Business growth is highly dependent on government projects, and the payment cycle may be long

- Increased Competition: Large internet companies are also actively布局 the fintech field

- High Valuation Level: Some fintech enterprises have a P/E ratio of nearly30x, which may overdraw future growth

- Bank Stocks: Focus on the implementation of policy details; prioritize banks with excellent asset quality and high retail business proportion, such as China Merchants Bank

- Fintech: Focus on targets related to the construction of the ‘Suishengrong’ platform, such as winning enterprises like Hundsun Technologies

- Bank Stocks: As policy effects emerge, focus on recovery opportunities for stocks trading deeply below book value, such as Shanghai Pudong Development Bank

- Fintech: Focus on performance fulfillment, select leading enterprises with full orders and stable cash flow

- Thematic Investment Opportunities: Demand for financial infrastructure upgrades brought by the construction of Shanghai’s international financial center

- M&A Integration Opportunities: Small and medium-sized fintech enterprises may be acquired and integrated by large institutions

-

Bank Stocks:

- High Certainty: Policies directly improve asset quality and reduce credit costs

- High Elasticity: Current deep discount to book value provides 50-100% valuation recovery space

- Time Window: Expected to take effect in6-12 months, with the second half of2025 to2026 as the main performance period

-

Fintech Enterprises:

- Stronger Growth: Policies drive IT demand growth, with high performance elasticity

- Relatively High Valuation: Current P/E ratio is generally25-35x, with higher risks of further valuation expansion

- Time Window: Benefit immediately upon policy implementation, but need to be alert to the risk of underperformance

[0] Gilin API Data - Real-time quotes, historical data and financial indicators of Shanghai local bank stocks

[1] People’s Daily Online - “Shanghai’s Multi-dimensional Upgrade of Business Environment Lets Enterprises Root in Fertile Soil and Grow Together” (http://sh.people.com.cn/n2/2026/0104/c138654-41462659.html)

[2] China.org.cn - “Nine Versions of Plans in Nine Years: Changes and Constants of Shanghai” (http://www.china.com.cn/txt/2026-01/04/content_118260280.shtml)

[3] Shanghai Observer - “Shanghai’s First Meeting of the New Year Launches 26 Measures to Build Four Major Business Environments” (https://www.jfdaily.com/news/detail?id=1046220)

[4] Beijing Daily Client - “Behind the ‘Elephant Dance’: The Value Reassessment Road of the 15.6 Trillion Yuan Bank Stock Sector” (https://xinwen.bjd.com.cn/content/s69554eeae4b0687a288f1e9b.html)

[5] Sina Finance - “Hundsun Technologies 30.15(-0.40%)_Stock News” (https://vip.stock.finance.sina.com.cn/corp/go.php/vCB_AllNewsStock/symbol/sh600570.phtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.