China's New Duty-Free Tobacco Regulations: Impact on A-Share Tobacco Chain Companies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The State Tobacco Monopoly Administration issued the “Measures for the Administration of Tobacco Products in the Domestic Duty-Free Market” and will compulsorily launch the Duty-Free Tobacco Products Trading Management Platform on January 1, 2026. This means that previously relatively independent duty-free channel transactions will be officially incorporated into a centralized and digital regulatory system. The platform adopts mechanisms such as unified identity authentication, data traceability, transaction approval, and synchronous settlement and clearing, forming new compliance and operational nodes for the A-share tobacco industry chain (including cigarette manufacturing, packaging materials, logistics distribution, etc.).

-

Standardized Transactions and Information Flow

The unified platform link allows previously fragmented duty-free channels (airport duty-free, port duty-free shops, domestic duty-free e-commerce) to share real-time inventory and contract information, reducing production plan errors and inventory backlogs caused by information asymmetry. The device-side interface can synchronize with the enterprise’s ERP/WMS system, significantly reducing the time for shipment preparation and transaction confirmation, which helps improve supply-demand matching efficiency. -

Capital Recovery and Funding Cost Improvement

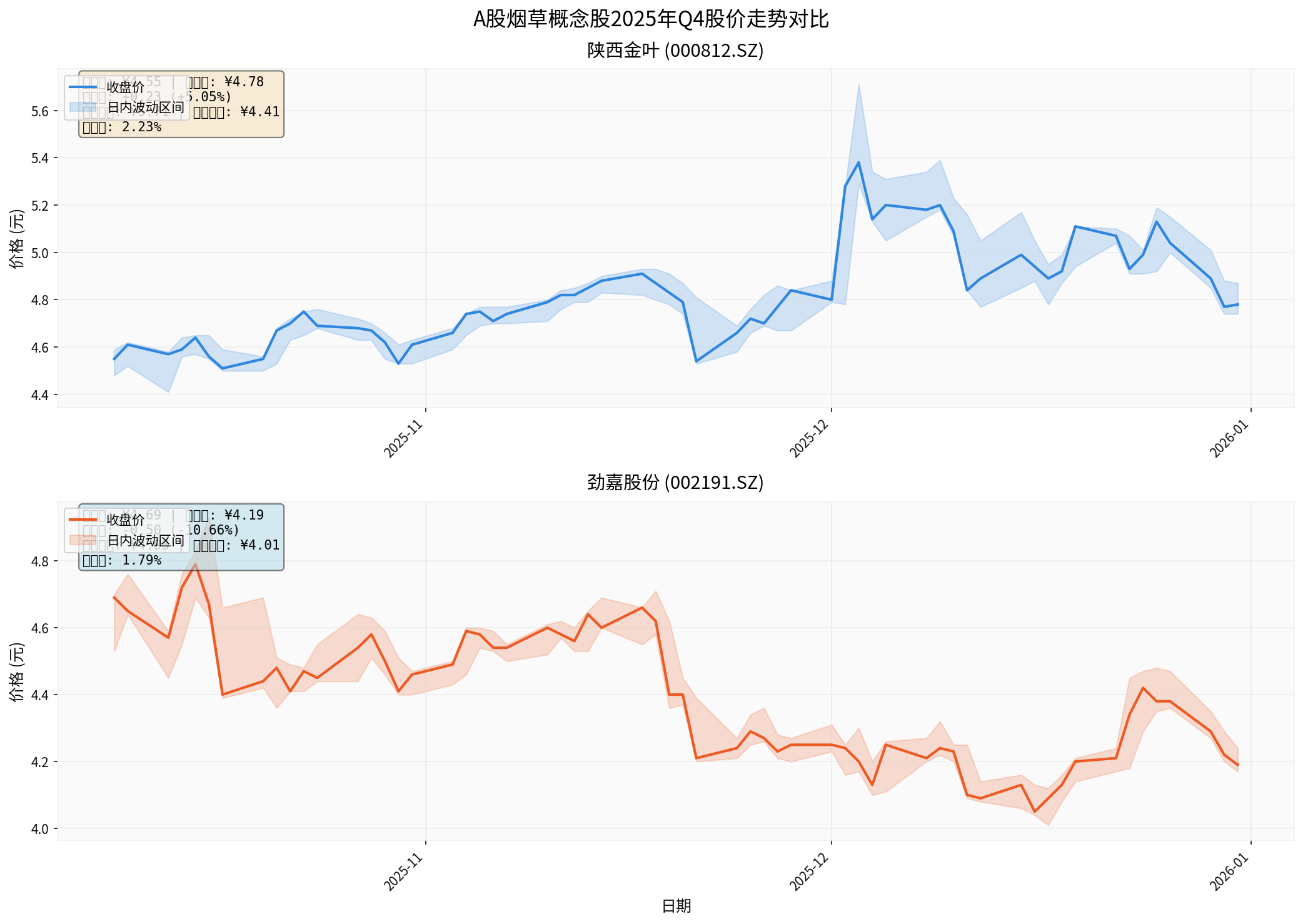

Take Shaanxi Jinye (000812.SZ) as an example: its overall fluctuation range in Q4 2025 was relatively narrow (volatility of about 2.21% during the period) and the price rebounded from the low point of the range to close at 4.78 yuan, indicating that the market still recognizes its cash flow stability [0]. The unified trading platform will shorten the account period and accelerate the payment collection rhythm, especially forming a positive cash flow feedback for inventory-hoarding enterprises and upstream suppliers, which is conducive to reducing financial expenses in the long run. -

Data-Driven Decision Efficiency

The regulatory platform can provide visual reports on data such as transaction volume, channels, and customer portraits, facilitating enterprises to quickly adjust product portfolios and marketing strategies. Taking Kinva (002191.SZ) as a representative, its stock price showed a slight downward trend in Q4 2025 (a drop of 7.7%) with low volatility, reflecting the inventory pressure that remains to be cleared in the packaging material field. The order and inventory visualization obtained through the platform is expected to improve its turnover speed [0].

-

Upfront Investment: IT Systems and Staff Training

All enterprises participating in duty-free transactions must access the platform, which means that upfront investments such as IT interface development, data sorting, internal audit process improvement, and employee training are essential. For enterprises that mainly rely on traditional offline channels and have low IT investment, they will face relatively high capital and operational expenditures in the short term. -

Long-Term Decline in Operational Compliance Costs

The platform can significantly reduce the number of manual verifications, lower the risk of violations, and reduce tax audit pressure through automated monitoring of transaction compliance (such as quota, batch, channel license, etc.). For companies with strong compliance capabilities (such as Shaanxi Jinye, which had weak profitability but relatively stable operational efficiency in 2024, with little fluctuation in net profit margin [0]), this regulatory upgrade eliminates external uncertainties and instead forms a competitive advantage in the medium and long term. -

Differentiated Burden: Greater Pressure on SMEs

The platform treats all enterprises equally, but small and medium-sized enterprises have a faster marginal cost increase due to limited scale effects, which may trigger industry consolidation. It is recommended to focus on leading enterprises with independent technology integration capabilities and experience in dealing with complex channels, as they will achieve scale benefits in platform-based compliance and enhance added value through digital capabilities.

-

Capital and Valuation: Shaanxi Jinye’s price-to-earnings ratio is in a negative range (P/E -722.36x) and its ROE is close to zero, reflecting its low profit elasticity [0]; while Kinva’s ROE is also negative, its cash flow performance is relatively stable (positive free cash flow in the past year), so it is recommended to focus on identifying listed entities with high-quality cash flow.

-

Technical Indicators and Trends: The moving average trends of the two companies in Q4 2025 (20-day/50-day moving averages at 5.00/4.87 yuan and 4.21/4.35 yuan respectively) show that short-term prices are already close to the moving averages. If the platform launch brings significant performance improvement, the stock prices are expected to receive trend support [0].

-

Chart Description: The attached figure compares the daily closing prices and fluctuation ranges of Shaanxi Jinye and Kinva from October to December 2025. The X-axis is the date (October-December 2025), and the Y-axis is the price in RMB. The left side of the figure statistics the start and end prices, rise and fall, range highs and lows, and volatility of the two companies during the same period, providing an intuitive reference for evaluating the short-term impact of the policy on stock price sentiment [0]!

-

Prioritize Enterprises with Strong Platform Access Capabilities and Mature Compliance Teams: They have a relatively low proportion of initial compliance investment and can convert it into efficiency improvement faster.

-

Strengthen Inventory and Financial Elasticity Management: Use platform data to predict demand and avoid inventory accumulation caused by unclear platform-based settlement rhythms.

-

Optimize Product Structure Using Platform Data: Pay attention to the sales preferences of duty-free regions/channels provided by the platform, adjust the ratio in a timely manner, launch exclusive SKUs, and increase the proportion of high-margin products.

-

Continuously Monitor Regulatory Implementation Effects: It is recommended to adopt an in-depth research model to obtain more detailed transaction volume distribution, enterprise access progress, and distribution chain responses, and to pre-judge the turning point between compliance costs and operational efficiency.

[0] Jinling API Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.