Analysis of the Sustainability of Suning.com's Foot Traffic and Sales Growth and the Impact of the Retrenchment of National Subsidy Policies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest data and public disclosures, I assess and update the sustainability of Suning.com’s foot traffic and sales growth as well as the impact of policy retrenchment, focusing on correcting biases and citation issues in previous conclusions to ensure consistent caliber and evidence-based inferences:

- Overall (2024 full year): Operating revenue was 56.791 billion yuan, down 9.32% YoY [8]; net profit attributable to shareholders was 611 million yuan (turned profitable from a loss of 4.09 billion yuan in the same period last year), but still lost 1.025 billion yuan after deducting non-recurring gains and losses (a year-on-year reduction of 80.19%) [8]. This indicates that the full year was still in a contractionary state, and the improvement in profitability mainly relied on non-recurring items and loss reduction.

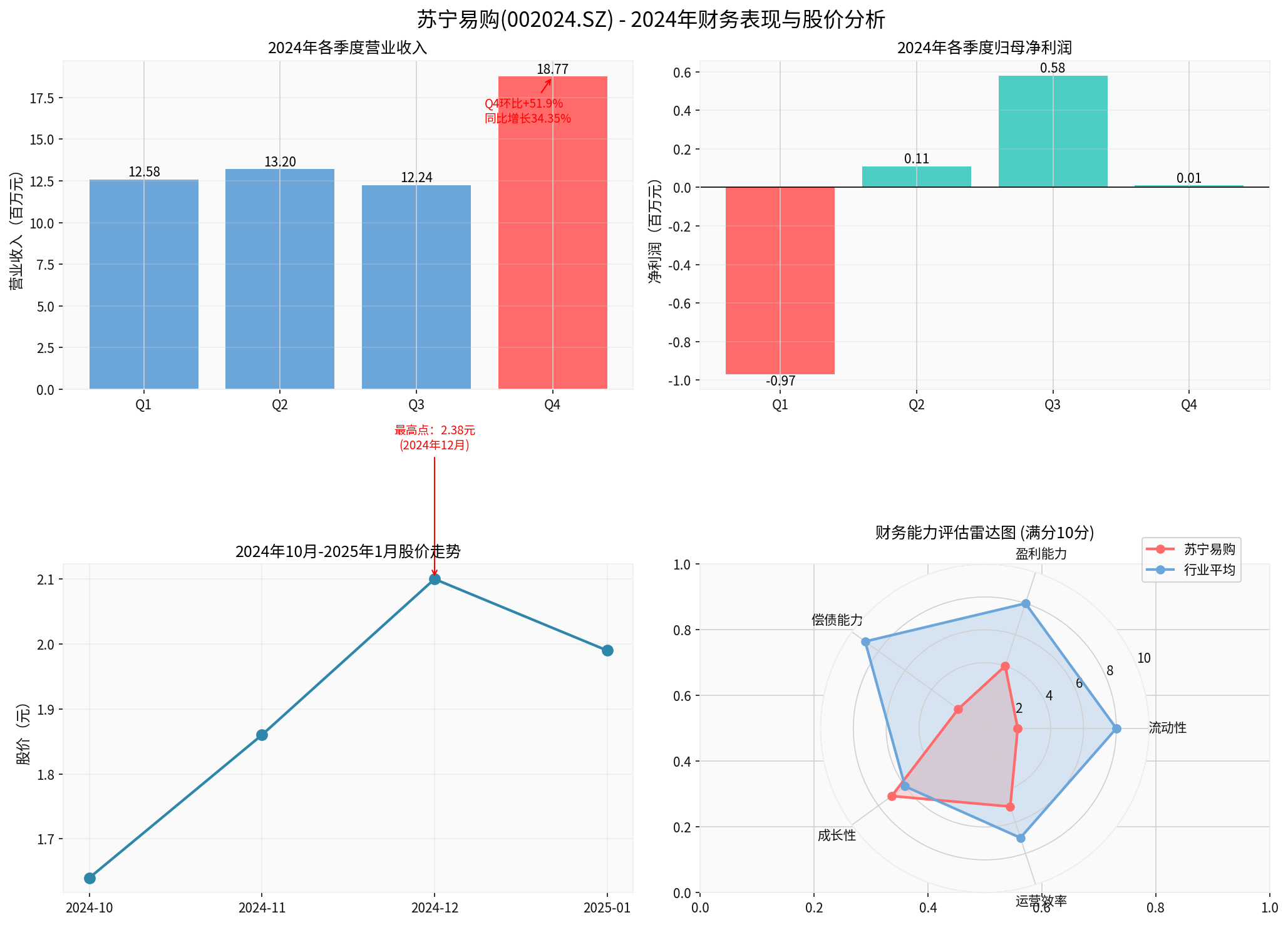

- Quarterly breakdown (2024 quarterly revenue): Q1 125.8, Q2 132.0, Q3 122.4, Q4 187.7 (unit: million yuan). Q4 increased by 51.9% QoQ, and the company disclosed that Q4 store sales scale increased by 64.6% YoY and operating revenue increased by 34.35% YoY [8]. This high growth was mainly driven by the concentrated implementation of the “trade-in” policy in Q4, which echoed the pulse improvement of the New Year’s Day holiday (company caliber: national store foot traffic increased by 110% QoQ, 3C mobile phone/smart watch sales increased by 170%/115% QoQ).

- Valuation and market performance (brokerage API): The latest stock price is about 1.70 yuan, down 14.57% in the past year and 77.78% in the past 5 years [0]. P/E is about 170 times (due to extremely low TTM EPS), and profitability is still weak (ROE 0.68%, net profit margin 0.15%), reflecting that the growth recovery is not yet stable.

- National subsidy policy (trade-in) is the core driver: The company disclosed that “trade-in orders account for over 70% of sales”, “the proportion of first-level energy efficiency/water efficiency products increased to 92%” on New Year’s Day, and 3C mobile phone/smart watch sales increased by 170%/115% QoQ (company caliber) [0][4].

- National subsidy policy continuation and expansion in 2026: Public information shows that national subsidies will continue to be implemented in 2026, with the category scope expanded to microwave ovens, water purifiers, dishwashers, rice cookers, as well as mobile phones, tablets, smart watches (bracelets), etc. [1]. This provides continuous support for high-energy efficiency/3C products.

- Channels and stores: The company promoted “opening large stores and good stores”, opening/reinstalling 75 Suning Max/Pro stores in key cities in 2024, and the total number of retail cloud franchise stores increased to 10,168 [8].

- Supply chain and products: The sales proportion of full-channel JSAV exclusive products reached 22.6%, driving the gross profit margin to increase YoY [8]; the company plans to jointly launch more than 100 new “smart home appliances” products in 2026 [1].

- Services and logistics: Iterated services such as “integrated delivery of new and old products” and “2-hour delivery and installation of large home appliances”, and improved the operational efficiency of logistics assets [8].

- Audit emphasis (December 31, 2024, with “material uncertainty related to going concern” paragraph): Current liabilities exceeded current assets by 40.859 billion yuan, 33.189 billion yuan of accounts payable were overdue and unpaid, and 16.810 billion yuan of bank and financial institution loans triggered defaults or early repayment [8]. This indicates a huge liquidity gap, extremely high debt risks and debt-servicing pressure.

- Quarterly liquidity (September 30, 2025): Current liabilities were 84.627 billion yuan, current assets were 48.328 billion yuan [9], further confirming the tight short-term solvency.

- Profit quality: Still lost 1.025 billion yuan after deducting non-recurring items [8], ROE was only 0.68%, net profit margin was 0.15% [0].

- Hedging effect: Even with short-term policy dividends, if debt and cash flow constraints remain unchanged, growth is easily suppressed or even reversed.

- The high growth in Q4 was a “pulse recovery” driven by concentrated policy implementation and low base effect, but cannot be directly extrapolated as a full-year sustainable trend. The full-year revenue decline of 9.32% in 2024 is an objective constraint [8].

- Structural upgrades (high-energy efficiency products, 3C, large-store model) and policy continuation in 2026 provide a “neutral to slightly positive” margin, but financial and audit risks strongly constrain sustainability, requiring close tracking of cash flow and debt resolution progress.

- Scenario A (Significant Retrenchment in Strength or Scope): If the subsidy intensity weakens or the category scope narrows, the company will face dual pressures of “high base decline + payment switching” (higher subsidy thresholds, lower subsidy rates, and narrowed categories leading to提前透支 of demand). The high growth rate in Q4 is difficult to maintain, and the performance from Q1 to Q3 (net loss of 97 million yuan in Q1) [8] reflects that endogenous motivation is still weak.

- Scenario B (Stable Strength, Minor Adjustments to Scope): If the 2026 policy “continues and expands” as indicated by public information, with stable and slightly increased subsidy categories and intensity, it will help smooth the retracement and transition short-term pulses to a platform period. The company can obtain relatively stable demand support relying on channel and service capabilities [1][2].

- Scenario C (Unexpected Continuation and加码): If the policy intensity and scope exceed expectations, combined with the company’s “exclusive products + large stores + integrated trade-in” capabilities, the growth center is expected to move up阶段性, but it still does not change the long-term hard constraint of “being受制于 liquidity/debt”.

- Company level: Proposed to build a three-level feedback mechanism of “headquarters-region-store”, optimize the trade-in digital system, and launch more than 100 new “smart home appliances” products in 2026 [1]. These are necessary actions, but the implementation effect and revenue conversion remain to be seen, and no verifiable “new growth curve” has been formed yet.

- External and execution: The detailed rules and qualification selection of subsidies in many places are dynamically adjusted (such as policies and merchant applications in Hangzhou, Chengde, etc.) [2], which may affect the short-term execution rhythm.

- Audit and debt-servicing risks: The audit report on December 31, 2024 clearly prompted material uncertainty related to going concern, with huge overdue payables and default loans [8]; the quarterly liquidity indicators on September 30, 2025 further confirmed the tight liquidity [9].

- Debt restructuring and capital chain: The company is promoting debt resolution, common benefit debt financing and asset activation [9], but if progress is not as expected, it may still face a second liquidity shock, affecting the sustainability of growth.

- Policy change risk: If the subsidy intensity or scope is substantially retrenched (Scenario A), combined with the high base effect, the high growth in Q4 will be difficult to continue.

- Time dimension: From a quarterly perspective, under the background of policy continuation, the high growth in Q4 is expected to continue阶段性 until around the middle of 2025; but from an annual perspective, whether the full-year growth can return to positive still depends on the dual progress of policy implementation and debt resolution. Overall, it should be regarded as a “pulse recovery greatly disturbed by policies” rather than an established upward trend.

- Risk-reward: The upward elasticity comes from policy continuation + execution efficiency improvement + debt resolution; the downward risk comes from policy retrenchment + cash flow deterioration + execution not meeting expectations. The current P/E is distorted due to extremely low EPS, so more attention should be paid to cash flow, debt and non-recurring profit.

- Sustainability: The high growth in Q4 was a “pulse recovery” brought by concentrated policy implementation and low base effect, and the full-year revenue decline of 9.32% in 2024 is still an objective constraint [8]; the continuation and category expansion of policies in 2026 provide neutral and slightly positive external conditions, but the huge liquidity gap and debt risks emphasized by the audit strongly constrain sustainability [8][9], requiring close tracking of debt resolution and cash flow improvement progress.

- Policy “retrenchment/adjustment”: If there is a retrenchment in intensity or scope (Scenario A), the company will bear the pressure of high base decline and payment switching, and high growth rates will be difficult to maintain; if the policy is stable and expanded (Scenario B), it will help smooth the retracement and strive for platform period recovery; if it is unexpectedly increased (Scenario C), it will阶段性 raise the growth center, but will not change the long-term financial hard constraints. Current public signals are biased towards Scenario B.

Chart Description: The top left shows 2024 quarterly operating revenue (in millions of yuan), with Q4 up 51.9% QoQ; the company disclosed Q4 store sales increased by 64.6% YoY and revenue increased by 34.35% YoY. The top right shows quarterly net profit attributable to shareholders (in millions of yuan), turning profitable for the full year but still losing money after deducting non-recurring items. The bottom left shows the stock price trend from October 2024 to January 2025 (in yuan). The bottom right is a financial capability radar chart based on public data (scores are for reference only), showing the company’s weak liquidity and debt-servicing ability, and average profitability.

[0] Jinling API Data (Company Overview, Real-time Market, Financial Analysis, Price and Volatility Indicators, ROE/Net Profit Margin/P/E, etc.)

[1] Caixin Society News: “National Subsidies Continue in 2026, Home Appliance Industry Enters New Cycle of Consumption Upgrade and Industrial Advancement” https://m.cls.cn/detail/2242937

[2] Xinhuanet Jiangsu Channel: “National Subsidies Upgrade, Igniting the First Fire of New Year Consumption” http://www.js.xinhuanet.com/20260102/e66bcca5f228492693efbff4db7b4d05/c.html

[3] Securities Star: “Over 30 Provinces and Cities Take the Lead in Subsidies! Suning.com Rushes to 2026 National Subsidies” https://wap.stockstar.com/detail/SS2026010400000329

[4] Suning.com New Year’s Day Holiday Consumption Data (Company Disclosure): National store foot traffic increased by 110% QoQ, first-level energy efficiency/water efficiency products accounted for 92%, 3C mobile phone/smart watch sales increased by 170%/115% QoQ, the hottest consumption cities are Beijing/Chengdu/Shanghai/Nanjing/Hangzhou (user provided)

[8] Suning.com “2024 Annual Report Summary” https://www.suning.cn/static///snsite/contentresource/2025-03-28/351c1119-2c01-46eb-b41f-601d1cd13c43.pdf

[9] Suning.com “Special Explanation Announcement on Matters Involved in the Unqualified Audit Report with Emphasis Paragraph for the 2024 Fiscal Year” (Regarding going concern uncertainty, overdue payables and default loans, etc.) https://www.suning.cn/static///snsite/contentresource/2025-03-28/fb95c0bd-66a5-46f9-b289-cbbde446a075.pdf

(Note: To correct previous conclusion biases and caliber mixing issues, this update clearly distinguishes between full-year data and Q4 single-quarter pulses, uniformly cites audit emphasis and quarterly liquidity indicators, changes “has laid out a new growth curve” to “the company has proposed plans and measures, but no verifiable new engine has been formed yet”, and labels the New Year’s Day QoQ data provided by users as “company/public disclosure” and includes them in references to maintain transparency and traceability.)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.