Investment Analysis & Evaluation Framework for Brain-Cognitive Inspired Embodied Intelligence

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on in-depth research on the technical route of brain-cognitive inspired embodied intelligence, I will provide you with a comprehensive investment analysis and evaluation framework.

Current embodied intelligence field has three main technical paradigms:

- Core Features: Connectionism of ‘Compression is Intelligence’ based on Transformer/Diffusion architecture

- Representative Enterprises: Mainstream large model vendors like OpenAI

- Technical Bottlenecks: High data dependency, high power consumption, low generalization ability, low interpretability, low online learning ability [1]

- Industry Status: Current mainstream paradigm of LLM-based AI, but has reached its ceiling

- Core Features: Learning from experience through trial and error (Learn from Experience)

- Representative Figure: Richard Sutton (Founder of Reinforcement Learning, Turing Award Winner)

- Applicable Scenarios: Controllable scenarios like games and simulation environments

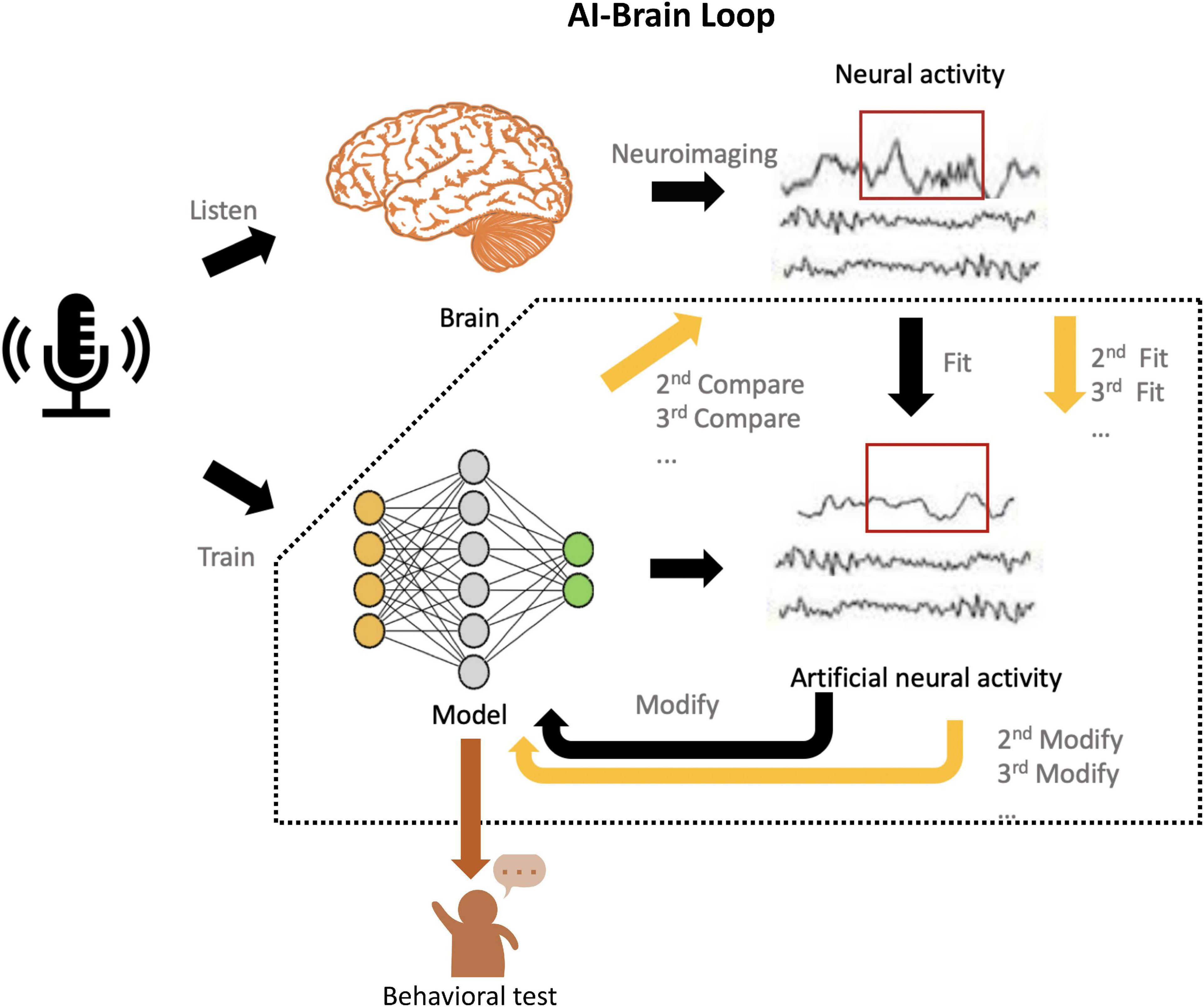

- Core Features: Learning from neuroscience (Learn from Neuroscience) to build world models

- Theoretical Basis: Cognitive neuroscience, Free Energy Principle (FEP), small data for large tasks

- Key Innovations:

- Abstract Concept Learning: Shift from Learn from Tokens to Learn from Concept

- Selective Attention Mechanism: Simulate dynamic focus of human brain to reduce processing costs

- Cognitive Map Mechanism: Enable free exploration across indoor and outdoor open scenes based on grid cells and place cells

- One Brain for Multiple Machines Ability: Achieve generalized migration of ‘one brain for multiple forms’ [1]

According to the verification data of ‘Brain-Inspired Rock’:

- Few-shot Learning: Data demand reduced by 90% compared to deep learning solutions

- Deployment Efficiency: Deployment efficiency of cognitive map-based mobile solutions increased by 40%

- Power Consumption Comparison: The human brain maintains the operation of 8.6 billion neurons with only 25 watts of power through the attention mechanism [1]

- Risk Level: High

- Risk Description: The brain-cognitive inspired paradigm has not undergone large-scale commercial verification and is still in the theoretical exploration stage

- Mitigation Factors: Endorsement by top scientists like Yann LeCun, and systematic support from the ‘China Brain Project’ (50 billion yuan investment over 10 years) [1]

- Risk Level: High

- Specific Challenges: Need interdisciplinary talents who understand both computer science and brain science (extremely scarce); huge engineering gap from laboratory prototype to stable mass production; need to address real-world challenges like environmental changes and abnormal corner cases [1]

- Time Expectation: Zhu Senhua expects the deep learning algorithm paradigm to be replaced in 3-5 years

- Phased Path: 1-3 years: Engineering practice based on VLA, systematic optimization and transformation using cognitive neural mechanisms; After 3-5 years: Completely shift to the brain-inspired technical paradigm [1]

- End-to-end deep learning solutions still have capital and resource advantages (OpenAI, Figure AI, etc.)

- Global top players like Figure AI have raised 1 billion US dollars in a single round, with a valuation of 39 billion US dollars [6]

- Domestic leading enterprises (Galaxy General, Star Motion Era, etc.) have received orders exceeding 500 million yuan [6]

- Competitors have achieved large-scale deployment in industrial scenarios (UBTECH’s annual production capacity exceeds 1000 units, with over 500 units delivered) [8]

- ‘Brain-Inspired Rock’ is still in the seed round financing stage, and commercial verification has not yet started

| Risk Dimension | Risk Level | Impact Degree | Response Strategy |

|---|---|---|---|

| Technical Feasibility | High | Catastrophic | Phased verification: first optimize VLA then switch paradigm |

| Talent Acquisition | Medium-High | Significant | Rely on Huawei background and scarce brain science postdoctoral background |

| Funding Demand | Medium | Significant | Focus on Asia-Pacific go-global strategy to reduce cash burn rate |

| Market Acceptance | Medium | Significant | Choose labor shortage scenarios and lower customer expectations |

| Supply Chain Maturity | Low | Moderate | Only do the ‘brain’ part, no involvement in body hardware [1] |

- Embodied intelligence was written into the government work report for the first time, established as a new engine for the future

- The ‘Recommendations of the Central Committee of the Communist Party of China on Formulating the 15th Five-Year Plan for National Economic and Social Development’ clearly lists embodied intelligence as a new economic growth point [5]

- Local governments have intensively issued special plans (Beijing, Shanghai, Shenzhen, Hangzhou, etc. form the first echelon) [5]

- In the first three quarters of 2025, there were 610 financing events in the domestic robot industry (a year-on-year increase of 107%)

- Total financing amount was about 50 billion yuan (2.5 times that of the same period last year) [5]

- Single financing of 100 million yuan for leading enterprises has become the norm [6]

- Labor Shortage Driven: Japanese convenience stores are willing to pay for embodied robots with ‘60-70 points of ability’ because the 7×24 service model is unsustainable due to severe aging [1]

- Industrial Scene Just Demand: The average labor cost of BYD factories is 180,000 yuan/year, and the payback period for humanoid robots to replace labor is 29-40 months [8]

- High-Risk Operation Scenarios: Ensure personnel safety in scenarios like power inspection and police patrol [4]

Based on Zhu Senhua’s strategic positioning, the commercialization path is as follows:

- First Choice: Developed regions with severe labor shortages and strong willingness to pay

- Focus: Commercial service scenarios in Japan and Singapore

- Implementation: Basic work like convenience store night shift duty and store inventory management [1]

- China has over 310 million elderly people aged over 60, and the supply of elderly care services is in short supply

- Core Needs: Life assistance, health monitoring, emotional companionship, rehabilitation training [8]

- Bottleneck: High cost (robot unit price of hundreds of thousands of yuan) vs. funding constraints of elderly care institutions

- Annual production capacity of industrial humanoid robots jumps from thousands to tens of thousands of units

- Covers 71 major industries like automobile manufacturing, electronic processing, and mechanical equipment [8]

- Define boundaries in specific scenarios, transform complex world model problems into vertical small models

- Avoid ‘big and comprehensive’ competition, focus on extreme optimization of specific scenarios [4]

- Only do the ‘brain’ part, no involvement in body hardware to reduce supply chain risks

- Overcome the upper limit of ‘one brain for multiple machines’ and ‘one brain for multiple forms’ capabilities, and achieve software-hardware decoupling [1]

- Avoid the dilemma that the domestic ‘robots completely replace humans’ business model is difficult to work in the short term

- Solve the core problem of ‘factual labor shortage’ in developed countries and regions [1]

- Does the core team have ‘AI + brain science’ dual backgrounds?

- Does it have practical experience in Huawei Cloud’s embodied robot business from 0 to 1?

- Is there a clear 3-5 year technical roadmap?

- Has the 90% reduction in data demand for few-shot learning been verified by a third party?

- Where are the real cases of 40% improvement in deployment efficiency?

- Is there a public benchmark comparing end-to-end solutions?

- What are the specific technical differences from Yann LeCun’s world model?

- How to solve the engineering difficulties of JEPA-based architecture?

- How to transform the Free Energy Principle (FEP) into an executable algorithm?

- What are the cooperation scenarios with listed companies like Nutag that have been signed?

- What is the first order delivery cycle and customer satisfaction?

- Is there a clear successful POC (Proof of Concept) case?

- Comparison of R&D investment vs traditional end-to-end solutions

- Funding demand calculation for the 3-5 year paradigm shift period

- Is the light asset advantage of only doing the ‘brain’ model real?

- Can brain-inspired algorithms be quickly copied by competitors?

- Has data accumulation formed a moat?

- Does talent scarcity constitute a sustainable barrier?

- Seed Round: Verify technical feasibility, focus on core team and theoretical framework

- A Round: Verify commercial scenarios, focus on first paying customer and POC data

- B Round: Verify large-scale capability, focus on delivery ramp-up and repurchase rate

- While investing in ‘Brain-Inspired Rock’, layout leading enterprises of end-to-end solutions (hedge technical route risks)

- Invest in body manufacturers and core component enterprises through industrial funds (diversify supply chain risks)

- Pay attention to supporting investment opportunities of local embodied intelligence industry funds

- Utilize the risk-sharing mechanism of ‘national team’ funds (Beijing Robot Industry Development Investment Fund, Shenzhen Venture Capital, etc.) [6]

- End-to-end solutions still dominate, but begin to introduce brain-inspired mechanisms as ‘plug-in’ optimization

- ‘Brain-Inspired Rock’ 1-3 year path: Based on VLA engineering practice, systematically transform all links [1]

- Brain-inspired paradigm verified successfully in specific scenarios

- Data efficiency advantages emerge, attracting more manufacturers to follow

- Brain-inspired and end-to-end form a complementary ecosystem

- ‘One brain for multiple machines’ becomes the industry standard

- Regulators have issued risk warnings for the first time, pointing out the risks of ‘product clustering and redundant construction’ [6]

- The National Development and Reform Commission clearly stated that there are more than 150 humanoid robot enterprises, more than half of which are startups or ‘cross-industry’ entrants [6]

- Institutions warn that ‘96% of Chinese robot companies may not survive next year’ [3]

- Shift from ‘scale competition’ (financing amount, order numbers) to ‘value deep cultivation’ (core technology, business closed loop) [6]

- 2026 is expected to be a key turning point for large-scale delivery, but only leading enterprises can cross the mass production gap [6]

- The ‘sweeping’ trend of industrial capital (automobile companies, tech giants) is obvious

- Automobile companies like Geely, Changan Automobile, and Chery have regarded robot business as their ‘second growth curve’ [6]

- UBTECH’s Hong Kong IPO provides a path reference for the humanoid robot field

- More listed companies are expected to emerge in 2026-2027 [6]

- If brain-inspired algorithms are verified successfully, license technology to end-to-end vendors

- Similar to the ARM model, become an ‘underlying algorithm supplier’ in the embodied intelligence field

- Theoretical Correctness: The human brain is the only realized strongest embodied intelligence, so it is an inevitable direction to take it as a blueprint [1]

- Technical Necessity: Deep learning paradigm has reached its ceiling, so a new paradigm is needed for breakthrough [1]

- Time Urgency: The 3-5 year paradigm shift period is the key window for investment layout

- This is not an ‘either/or’ substitution relationship, but a symbiotic relationship of mixed evolution

- End-to-end solutions still have commercial landing advantages in the short term

- The brain-inspired paradigm needs to go through the complete cycle of ‘engineering verification - scenario landing - ecosystem maturity’

- Core Focus: Team scarcity (AI+brain science dual background), completeness of theoretical framework

- Risk Tolerance: High (technical route risk, commercialization time uncertainty)

- Expected Return:10x+ (excess return from technical paradigm shift)

- Core Focus: POC data, first paying customer, delivery capability

- Risk Tolerance: Medium-High

- Expected Return:5-10x

- Strategic Value: Layout next-generation technical paradigm in advance to hedge existing technical route risks

- Synergy Effect: Open application scenarios, supply chain resources, market channels

| Evaluation Dimension | Key Indicator | Qualified Standard |

|---|---|---|

| Technical Verification | Few-shot learning efficiency improvement | ≥80% (target 90%) |

| Commercialization | ARPU of first paying customer | ≥1 million yuan |

| Team | Number of people with AI+brain science dual background | ≥3 |

| Funding | Cash runway | ≥18 months |

| Scenario | Labor shortage degree | Customer labor cost ≥2x robot cost |

- The brain-inspired paradigm may not achieve engineering breakthrough within the expected time

- End-to-end solutions may solve some problems through computing power stacking and engineering optimization

- Customers may not be willing to pay for ‘not mature enough’ technology

- Go-global strategy faces challenges like localization and compliance certification

- Leading manufacturers may catch up quickly through ‘hybrid route’ (end-to-end + brain-inspired plug-in)

- The capital advantage of global top players may shorten the technical gap

[1] 36Kr - Want to ‘Transform’ Robot Brains with Brain Cognition丨Exclusive of Intelligent Emergence (https://www.36kr.com/p/3624490892461057)

[2] Geek Park - Sam Altman’s Brain-Computer Interface Company Just Established, Domestic Counterparts Already Exist (https://www.geekpark.net/news/358830)

[3] InfoQ - Large Models Frenzy, Agents Dominate, 2025 Shuffle Warning: 96% of Chinese Robot Companies May Not Survive Next Year (https://www.infoq.cn/article/RdJt87O52zdYrmi81CEp)

[4] The Paper - From Lab to Real World: Industrial Breakthroughs and Challenges of Embodied Intelligence in 2025 (https://m.thepaper.cn/newsDetail_forward_32293147)

[5] Securities Times/China Securities Journal - Capital Influx Accelerates Development of Embodied Intelligence Track (https://www.cs.com.cn/cj2020/202512/t20251212_6527859.html)

[6] Zhihu Column - November Embodied Intelligence: 35 Financing Events Half Over 100 Million Yuan, Officials Issue Emergency ‘Cold Water’ (https://zhuanlan.zhihu.com/p/1980281075478589830)

[7] Securities Times - Institution: Humanoid Robot Industry Has Entered Commercialization Initial Stage (https://www.stcn.com/article/detail/3565387.html)

[8] Xinhuanet Zhejiang - Embodied Intelligence: Domestic Robots Empower a Better Life (http://www.zj.xinhuanet.com/20251231/3f92f898089c4f37a4146bf172e7ec99/c.html)

[9] Zhidx - Beyond Showmanship: How普渡 Leads Robot Dogs to Become the Best Commercial Species of Embodied Intelligence? (https://m.zhidx.com/p/519930.html)

[10] AI World Today - Yann LeCun World Model AI Threatens OpenAI Dominance (https://www.aiworldtoday.net/p/yann-lecun-world-model-ai-threatens-openai-dominance)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.