Analysis of the Impact of U.S. Policy Changes Toward Venezuela on Global Energy and Emerging Market Investments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- The U.S. has deployed “the largest fleet in the region’s history” [1]

- The U.S. military’s largest aircraft carrier and strike group have arrived in the region [2]

- The U.S. has deployed multiple warships near Venezuela under the pretext of “anti-narcotics” to exert maximum pressure on the country [1]

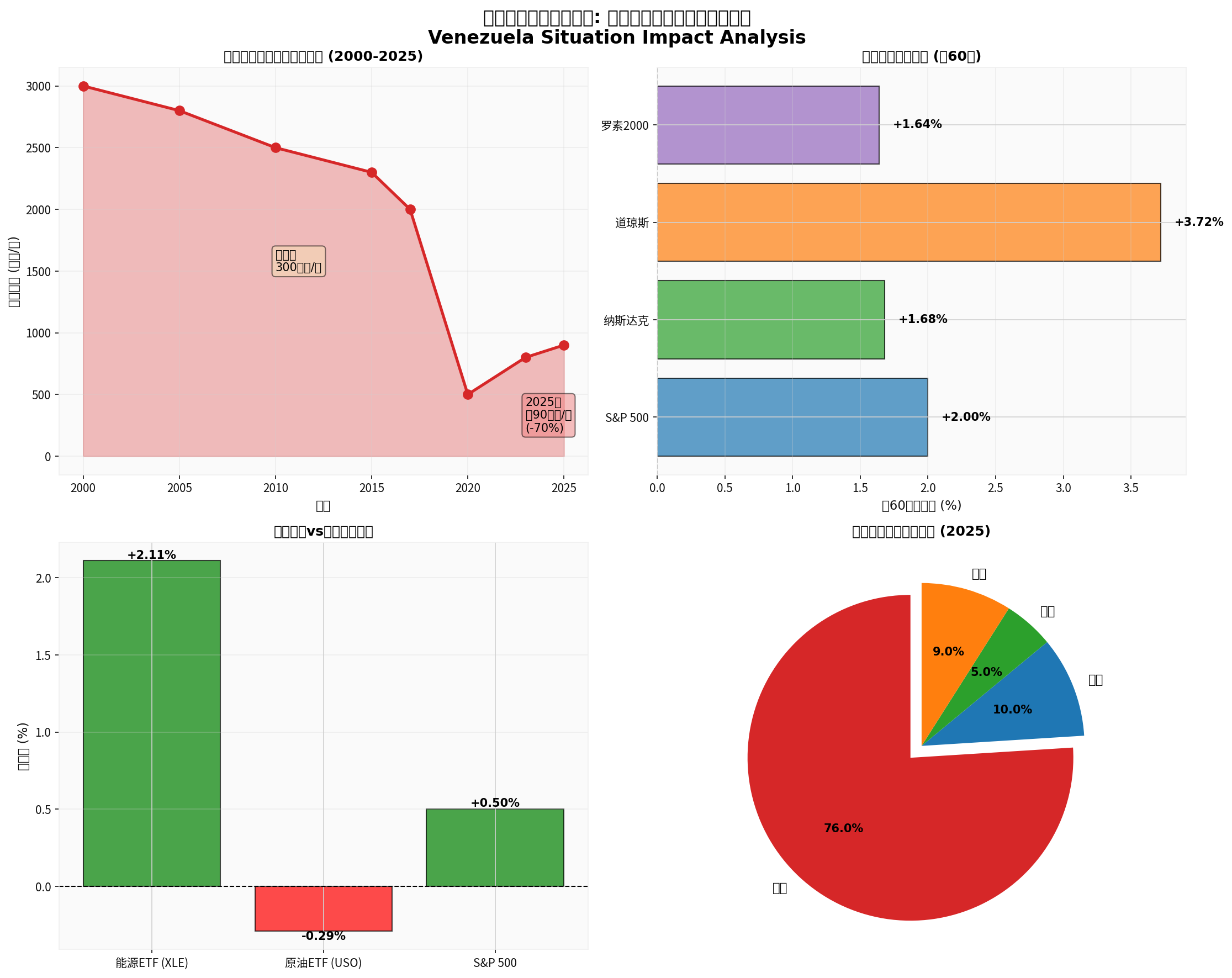

Venezuela has the world’s largest proven crude oil reserves (over 300 billion barrels), far exceeding Saudi Arabia, but its actual production and exports are much lower than its reserve scale. According to the latest data [0][2]:

| Year | Oil Production (thousand barrels/day) | Key Events |

|---|---|---|

| Early 2000s | 3,000+ | Pre-sanction peak |

| 2017 | 2,000 | U.S. first round of sanctions begins |

| 2020 | ~500 | Double blow from intensified sanctions and pandemic |

| 2023 | ~800 | Slight production recovery |

| December 2025 | ~900 (only 540 from Orinoco Belt) | New round of sanctions implemented [2] |

- 2025 production is about 30% of the 2000 peak (a 70% drop)

- December 2025 exports fell to 17.6 million barrels, a drop of over 90% compared to pre-sanction levels [2]

- Production capacity has degraded severely; even if sanctions are lifted, it will be difficult to recover quickly

| Destination | Share | Strategic Significance |

|---|---|---|

| China | 76% | Largest creditor and oil buyer |

| U.S. | 10% | Main market before sanctions |

| India | 5% | Emerging buyer |

| Others | 9% | Europe, Latin America regions |

- WTI Crude: ~$58/barrel [0]

- Brent Crude: ~$61/barrel [9]

- 2025 oil prices fell nearly 20%, the largest annual drop since 2020 [9]

- Energy ETF (XLE): +2.11% (today’s performance, significantly outperforming the broader market) [0]

- U.S. Oil Fund (USO): -0.29% (reflecting short-term volatility) [0]

- Overall Energy Sector: +2.0% (performance over the past week) [0]

- Venezuela’s production is already at a low level (900 thousand barrels/day), with limited impact on the global market

- Strong growth in non-OPEC production in 2025 has弥补了潜在供应缺口

- Slowdown in global demand growth (mainly affected by China’s economic transformation)

- OPEC+ has sufficient spare capacity to respond to supply disruptions at any time [2]

- Latin America and Caribbean markets: If PDVSA operations stall, the region may face supply tightening [9]

- China’s oil imports: Need to shift to Russian and Middle Eastern markets, with procurement costs rising by 10-15% [1]

- U.S. refineries: Although no longer directly importing Venezuelan crude, indirect supply chains may be affected

If the Maduro regime is overthrown and the new government normalizes relations with the U.S.:

- International oil companies may return to Venezuela (Chevron, ExxonMobil, etc.)

- Production capacity will take 3-5 years to recover to 2 million barrels/day [2]

- The U.S. may demand “return of stolen oil and assets”, pointing to losses from Venezuela’s nationalization of the oil industry in 1976 [1]

- Emerging market stocks outperformed developed markets, with outstanding performance [9]

- MSCI Emerging Markets ETF (EEM): +2.80% (today), 52-week range $38.19-$56.31 [0]

- Has recovered from the initial tariff shock in 2025, showing strong resilience [9]

- Supply chain diversification: Adjusting supply chains and reshaping trade flows

- Strengthened domestic demand-driven: Reducing reliance on external demand

- Valuation attractiveness: Some markets still have relatively reasonable valuation levels [9]

| Country | Risk Level | Main Risk Factors |

|---|---|---|

| Venezuela | Extremely High | Regime change, direct U.S. military intervention |

| Colombia | High | Political uncertainty in 2026 election, refugee crisis [5] |

| Brazil | Medium-High | Political polarization, fiscal deficit |

| Mexico | Medium | U.S. trade negotiations, immigration policy pressure [9] |

- Ecuador, Colombia, Mexico: Oil price fluctuations directly affect fiscal balance

- Rising oil prices: Short-term benefit to current accounts of these countries, but long-term dependence remains a structural weakness

- Falling oil prices: May lead to expanded fiscal deficits, currency depreciation, and capital outflows

- Chile (copper), Peru (copper/silver): May benefit from inflationary pressure caused by rising energy costs

- Argentina (lithium, agriculture): Double blow from political risks and energy price fluctuations

- Gold: Geopolitical conflicts usually boost safe-haven demand; may attack again after technical correction [9]

- Dollar-related assets: Dollar index may remain strong due to global uncertainty [9]

- U.S. Treasury bonds: Short-term safe haven, but need to note that rising oil prices may push up inflation expectations [9]

- Energy ETF (XLE): Short-term arbitrage opportunity, but need to set strict stop-loss [9]

- Oil exploration and pipeline stocks: Benefit from oil price upside expectations

- Avoid: Direct investment in Venezuela-related enterprises or bonds

- Low-risk emerging markets: India, Indonesia, Philippines (domestic demand-driven, low correlation with Latin American risks) [9]

- AI supply chain beneficiaries: South Korea, Taiwan (advantages in tech industry chain) [9]

- Avoid: Over-reliance on commodity exports in Latin American countries

- Option hedging: Purchase protective put options to hedge geopolitical risks

- Currency hedging: Emerging market currency volatility may intensify; use currency forwards for hedging

- Diversified allocation: Maintain balance between safe-haven and risky assets (e.g., gold 30% + energy stocks 20% + emerging markets 50%) [9]

- Venezuela reconstruction: If the new government stabilizes and implements market reforms, international capital may return within 2-3 years

- Latin American infrastructure: Despite political uncertainty, the region still needs large-scale infrastructure investment [5]

- Energy transition: Global energy security concerns may accelerate new energy investment, creating new investment themes

- OPEC+ production policy: If Saudi Arabia and other countries decide to compensate for production cuts, oil prices may remain high

- U.S. sanctions scope: Whether it will expand to other Latin American oil-producing countries or countries supporting Venezuela

- China’s response: Whether it will take military or tough economic countermeasures [1]

- Global economic growth: If the global economy slows in 2026, the upside space for oil prices will be limited

- Venezuela’s production is already at an extremely low level (900 thousand barrels/day), with limited direct impact on the global market

- Geopolitical risk premium has been factored into oil prices; about $3-5 per barrel in WTI’s $58/barrel

- Long-term view: If sanctions are lifted and international oil companies return, Venezuela’s production capacity may gradually recover over the next 3-5 years, reshaping the global crude oil trade pattern

- China faces strategic dilemmas: $60 billion in investments and 76% oil import share are at risk [1]

- Latin American emerging markets are under overall pressure: Even countries with good fundamentals may face “contagion effect”

- Non-Latin American emerging markets benefit: India, Southeast Asia may attract safe-haven capital inflows

- Do not bet on event outcomes alone: Geopolitical news often has reversals, and market volatility may exceed fundamental expectations [9]

- Diversified allocation is crucial: Maintain balance between safe-haven assets (gold, dollar) and risky assets (energy stocks, selected emerging markets)

- Dynamically adjust strategies: Timely adjust allocation ratios as events develop

- Strict stop-loss discipline: Geopolitical risks are often rapid and unpredictable

⚠️

- Conflict expands to other Latin American countries

- China takes military or tough economic countermeasures

- Global energy supply chain fully restructured

- Oil prices exceed $100/barrel, triggering global inflation out of control

⚠️

- Local conflict persists but does not expand

- Venezuela’s production remains low

- Oil prices remain in the range of $55-70/barrel

- Emerging markets show differentiated trends

⚠️

- New government stabilizes the situation quickly after taking office

- Sanctions are gradually lifted, and international capital returns

- Venezuela’s production starts to recover slowly

- Latin American markets rebound overall

[1] Xinhua News Agency - “Trump says he has ordered a blockade of all sanctioned oil tankers entering or leaving Venezuela” (December 17, 2025)

https://www.news.cn/world/20251217/d1d8ff7e517f43d689835f3c6ebfb7e8/c.html

[2] BBC Chinese - “Trump approves military operation to blockade Venezuela: Will cleaning up the Latin American backyard endanger China’s oil supply?” (December 2025)

https://www.bbc.com/zhongwen/articles/cy47zx35lx1o/simp

[3] Wood Mackenzie - “What could change in Venezuela mean for oil production?” (December 2025)

https://www.woodmac.com/blogs/energy-pulse/what-could-change-in-venezuela-mean-for-oil-production/

[4] Bloomberg - “Raid Months in the Making Captured Venezuela’s Maduro in Just Hours, US Says” (January 3, 2026)

https://www.bloomberg.com/news/articles/2026-01-03/strike-against-venezuela-how-us-took-maduro

[5] S&P Global - “Venezuelan oil production, exports fall as US ramps up sanctions enforcement” (December 30, 2025)

https://www.spglobal.com/energy/en/news-research/latest-news/crude-oil/123025-venezuelan-oil-production-exports-fall-as-us-ramps-up-sanctions-enforcement

[6] AINVEST - “Assessing Geopolitical Risk and Commodity Market Volatility in the Wake of U.S.-Venezuela Escalation” (January 3, 2026)

https://www.ainvest.com/news/assessing-geopolitical-risk-commodity-market-volatility-wake-venezuela-escalation-2601/

[7] ION Analytics - “Latin America’s infrastructure faces a year of contrasts” (December 22, 2025)

https://ionanalytics.com/insights/infralogic/latin-americas-infrastructure-faces-a-year-of-contrasts/

[8] FastBull - “Geopolitical risks reignite, oil prices rise at the start of the year” (January 2, 2026)

https://m.fastbull.com/cn/news-detail/4362977_1

[9] FastBull - “Full Analysis of 2026 Investment Logic for Emerging Markets” (December 2025)

https://m.fastbull.com/cn/news-detail/4362973_1

[10] Vocus - “Global Market Earthquake: Financial Risk Assessment and Asset Trend Analysis After U.S. Bombing of Venezuela” (January 2026)

https://vocus.cc/article/amp/6958dd68fd89780001fe036f

[0] Gilin API Data (Broker API Data)

- Market indices: S&P 500, Nasdaq, Dow Jones, Russell 2000 (October 8, 2025 - January 2, 2026)

- Sector performance: Energy, Utilities, Basic Materials, etc. (December 20, 2025)

- Real-time quotes: USO, XLE, EEM, GEX ETF (January 3, 2026)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.