Analysis of the Impact of Caribbean Airspace Closure on U.S. Airlines' Operations and Stock Valuations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On January 3, 2026, the U.S. government announced a large-scale military operation against Venezuela, successfully capturing President Maduro and his wife [1]. In response, the U.S. Federal Aviation Administration (FAA) immediately issued an airworthiness notice prohibiting U.S. airlines from flying in parts of the Caribbean airspace [2]. This emergency airspace closure forced hundreds of flights to be canceled that day, mainly affecting routes to and from the Caribbean region (including Puerto Rico, the Dominican Republic, Jamaica, etc.) [3].

According to web search data, the main affected airlines include:

- American Airlines(AAL): Adjusted its Caribbean flight schedule [3]

- JetBlue Airways(JBLU): Canceled more than 200 flights [4]

- Southwest Airlines(LUV): Canceled or diverted flights to Aruba, Dominican Republic, and Puerto Rico [4]

- United Airlines(UAL) andDelta Air Lines(DAL): Also affected to varying degrees

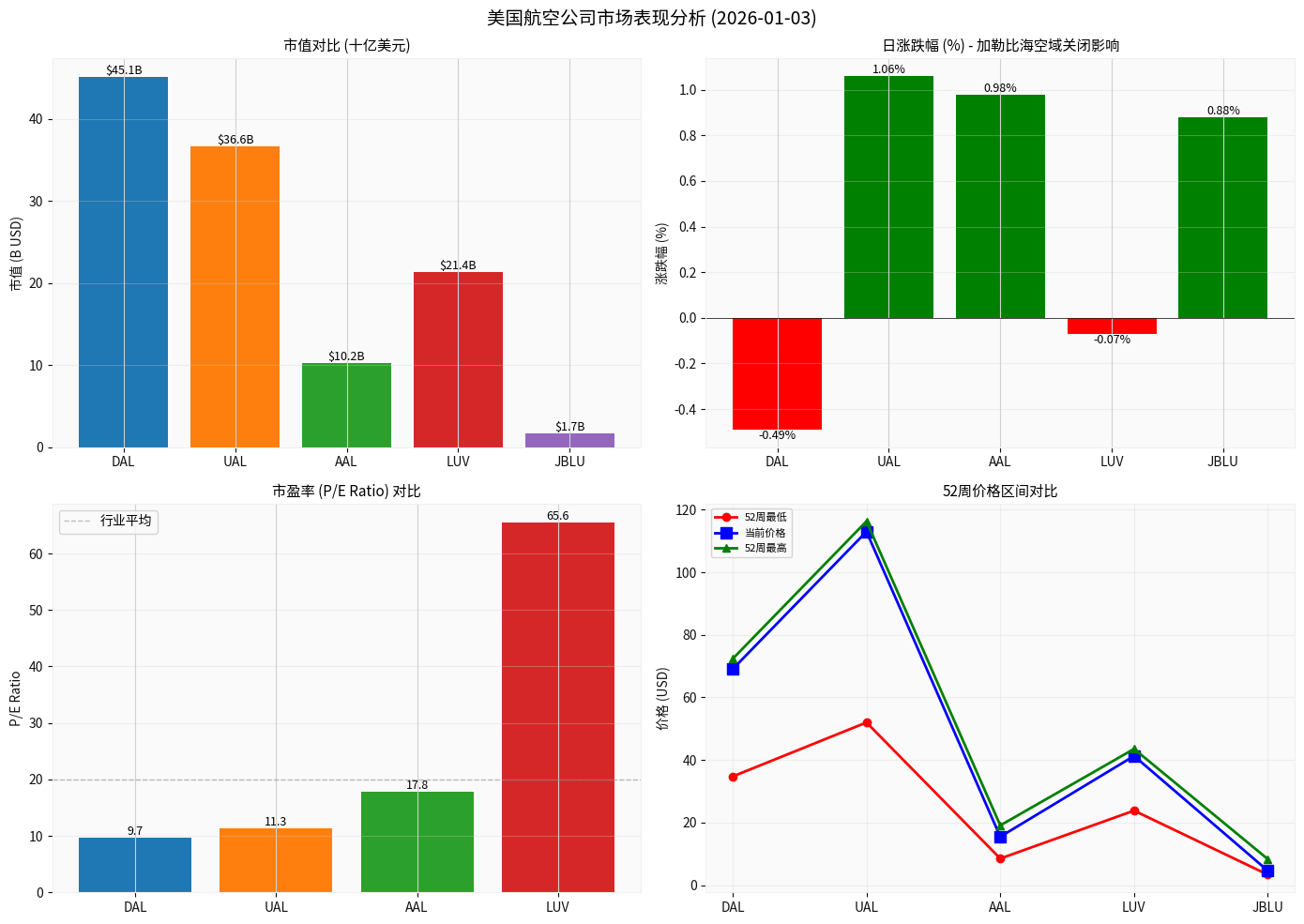

| Airlines | Ticker | Current Price | Daily Change | Market Cap | P/E Ratio |

|---|---|---|---|---|---|

| Delta Air Lines | DAL | $69.06 | -0.49% |

$45.09B | 9.74x |

| United Airlines | UAL | $113.01 | +1.06% |

$36.59B | 11.31x |

| American Airlines | AAL | $15.48 | +0.98% |

$10.22B | 17.79x |

| Southwest Airlines | LUV | $41.30 | -0.07% |

$21.36B | 65.56x |

| JetBlue Airways | JBLU | $4.59 | +0.88% |

$1.67B | -3.53x |

Surprisingly, despite hundreds of flight cancellations, U.S. airlines’ stock prices did not fall sharply; instead, they rose by an average of 0.47% [0]. This unusual phenomenon may stem from:

- Perception of Short-Term Impact: Investors view this as a short-term event that will not affect long-term fundamentals

- Diversified Route Network: Large airlines have extensive route networks, with limited share of Caribbean routes

- Insurance and Compensation: Airlines usually purchase relevant insurance to partially hedge against losses

- Favorable Macroeconomic Conditions: The U.S. stock market performed strongly overall during the same period, with the S&P 500 rising 3.51% in 30 days [0]

The chart shows a comparison of market cap, daily change, P/E ratio, and 52-week price range for the top five U.S. airlines

| Indicator | DAL | UAL | AAL | JBLU |

|---|---|---|---|---|

| ROE (Return on Equity) | 27.64% |

24.87% |

-14.76% | N/A |

| Net Profit Margin | 7.36% |

5.64% |

1.11% | Negative |

| Operating Margin | 9.65% |

8.27% |

4.16% | N/A |

- Delta Air Lines (DAL)andUnited Airlines (UAL)have the healthiest financial conditions, with ROE exceeding 20% and net profit margin above 5%

- American Airlines (AAL)has a net profit margin of only 1.11% and negative ROE, with weak financial risk resistance

- JetBlue Airways (JBLU)has negative EPS (-$1.30) and is in financial distress

From the P/E ratio perspective:

- Delta Air Lines (9.74x)andUnited Airlines (11.31x)have reasonable valuations, below the industry average

- Southwest Airlines (65.56x)is overvalued, mainly due to declining profitability (EPS only $0.63)

- American Airlines (17.79x)has a moderate valuation

- JetBlue Airwayshas negative P/E, with no profit to support valuation

- Trend: Sideways

- Trading Range: $68.24 - $69.88

- MACD: No clear crossover, bearish

- KDJ: Bearish

- Beta:1.38 (high volatility)

- 52-Week Performance: Rose from $34.74 to $72.34, an increase of over 100%

- Trend: Sideways

- Trading Range: $4.50 - $4.79

- KDJ: Oversold, rebound opportunity exists

- Beta:1.76 (very high volatility)

- 52-Week Performance: Rose from $3.34 to $8.31 then pulled back, currently at $4.59

| Airlines | Analyst Consensus | Target Price | Potential Upside | Rating Distribution |

|---|---|---|---|---|

DAL |

Buy |

$74.00 | +7.2% |

75.6% Buy,19.5% Hold |

UAL |

Buy |

$132.50 | +17.2% |

62.8% Buy,37.2% Hold |

AAL |

Buy |

$14.00 | -9.6% |

45.5% Buy,45.5% Hold,9.1% Sell |

According to company financial report data [0]:

| Airlines | Latin America/Caribbean Revenue | % of Total Revenue | Risk Exposure |

|---|---|---|---|

| DAL | $4.56B | 7.4% | Low |

| UAL | $5.44B | 9.5% | Medium-Low |

| AAL | $6.56B | 13.2% | Medium-High |

- American Airlines (AAL)has the highest dependence on Caribbean routes (13.2%) and is most affected by this airspace closure

- Delta Air Lines (DAL)andUnited Airlines (UAL)have higher route diversification and better risk dispersion

-

Increased Operating Costs:

- Flight diversions increase fuel costs

- Passenger compensation and accommodation expenses

- Crew scheduling costs

-

Revenue Loss:

- Ticket refunds and changes

- Expected daily loss of millions of dollars (JetBlue canceled over 200 flights)

-

Stock Price Volatility:

- From current performance, the market has partially priced in negative news

- If the situation worsens, short-term selling pressure may occur

-

Route Network Adjustment:

- Airlines may reduce dependence on Caribbean routes

- Strengthen layout of other international routes

-

Increased Insurance Costs:

- Geopolitical risks increase, aviation insurance premiums may rise

-

Impact on Passenger Confidence:

- If the situation remains unstable, passengers may reduce travel demand to the region

- Reasons:

- Sound financial condition (ROE 24.87%, net profit margin5.64%)

- Analyst target price $132.50, potential upside17.2% [0]

- Caribbean route share only9.5%, risk manageable

- Rose1.06% against the trend today, showing resilience

- Risk Tip: High Beta value, high volatility

- Reasons:

- Best financial health (ROE27.64%)

- Lowest Caribbean route share (7.4%)

- Analyst target price $74, potential upside7.2% [0]

- But fell0.49% today, technicals are bearish

- Operation Suggestion: Consider adding positions when it pulls back to the $68 support level

- Reasons:

- AAL: Weak financial condition (ROE-14.76%), highest Caribbean route share (13.2%), analyst target price lower than current price

- JBLU: In loss (EPS-$1.30), huge cash flow pressure, weakest risk resistance

- Risk Tip: If the situation worsens, these two companies are most likely to face financial crisis

- Escalation of Geopolitical Risks: If U.S.-Venezuela conflict escalates further, airspace closure may be extended

- Fuel Price Volatility: Middle East situation may affect oil prices, increasing aviation operating costs

- Macroeconomic Slowdown: Economic recession may lead to decline in aviation demand

- Regulatory Risk: FAA may strengthen aviation safety regulations, increasing compliance costs

The Caribbean airspace closure event has

- Stock Market: Average stock price rose by0.47% instead, showing investors view it as a short-term event

- Operational Impact: Mainly affected is JetBlue (canceled over200 flights), but large airlines like Delta and United are relatively less affected

- Financial Impact: Estimated daily loss of millions of dollars, but considering insurance coverage, actual impact is limited

- Route Diversification is Core Competitiveness: Delta and United have stronger risk resistance due to extensive route distribution

- Financial Health Determines Resilience: Companies with high ROE and sufficient cash flow can better respond to emergencies

- Market Has Partially Priced In: Investors focus more on long-term fundamentals rather than short-term disruptions

[0] Gilin API Data - Including real-time stock prices, financial indicators, technical analysis and company profiles

[1] Reuters - “US airlines cancel flights after Caribbean airspace closure” (https://www.reuters.com/world/americas/us-airlines-cancel-flights-after-caribbean-airspace-closure-2026-01-03/)

[2] Xinhuanet - “US FAA: US flights banned from parts of Caribbean airspace” (http://www.xinhuanet.com/20260103/828a12fcb28b484b9769cbdd4f0bfe93/c.html)

[3] Fox News - “Airlines cancel slew of Caribbean flights, are ‘closely monitoring’ situation amid Venezuela strikes” (https://www.foxnews.com/travel/airlines-cancel-slew-caribbean-flights-closely-monitoring-situation-amid-venezuela-strikes)

[4] The Hill - “Dozens of Caribbean flights canceled after US strikes Venezuela” (https://thehill.com/policy/transportation/5670934-caribbean-flights-canceled-venezuela-strikes/)

[5] People.com.cn - “News Background丨Timeline of U.S. military threats and strikes against Venezuela” (http://world.people.com.cn/n1/2026/0103/c1002-40637908.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.