Investment Value Analysis of Xiamen Airports Xiang'an New Airport

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the data and information I have collected, the following is a detailed analysis of the expected doubling of passenger throughput at Xiamen Airports Xiang’an New Airport:

- Annual passenger throughput: 45 million

- Cargo and mail throughput: 750,000 tons

- Aircraft takeoffs and landings: 380,000 sorties

This means that after relocating from the existing Xiamen Gaoqi International Airport (with an annual passenger throughput of approximately 29 million) to the new airport, the passenger throughput will achieve an increase of approximately

| Indicator | 2025 Data | Design Target | Growth Rate |

|---|---|---|---|

| Passenger Throughput | 29.19 million | 45 million | +54% |

| Cargo & Mail Throughput | ~400,000 tons | 750,000 tons | +87.5% |

| Aircraft Movements | ~210,000 sorties | 380,000 sorties | +81% |

From the data comparison, the design capacity of the new airport is indeed significantly higher than the existing operational capacity, but this expansion scale is a

According to the latest financial data of Xiamen Airports (600897.SS)[0]:

- Earnings Per Share (EPS): 1.03 yuan (2024), up 21% year-on-year

- Return on Equity (ROE): 9.65%, an increase from 8.54% in 2023

- Price-to-Earnings Ratio (P/E): 14.79x, within a reasonable range for the industry

- Extremely low asset-liability ratio, with a debt-to-equity ratio of only 4.3%

- Current ratio as high as 3.49, with abundant liquidity

- Sufficient operating cash flow, with good quality of free cash flow

- Price-to-Book Ratio (P/B): 1.43x

- EV/EBITDA: 7.37x

The company’s financial status shows that it

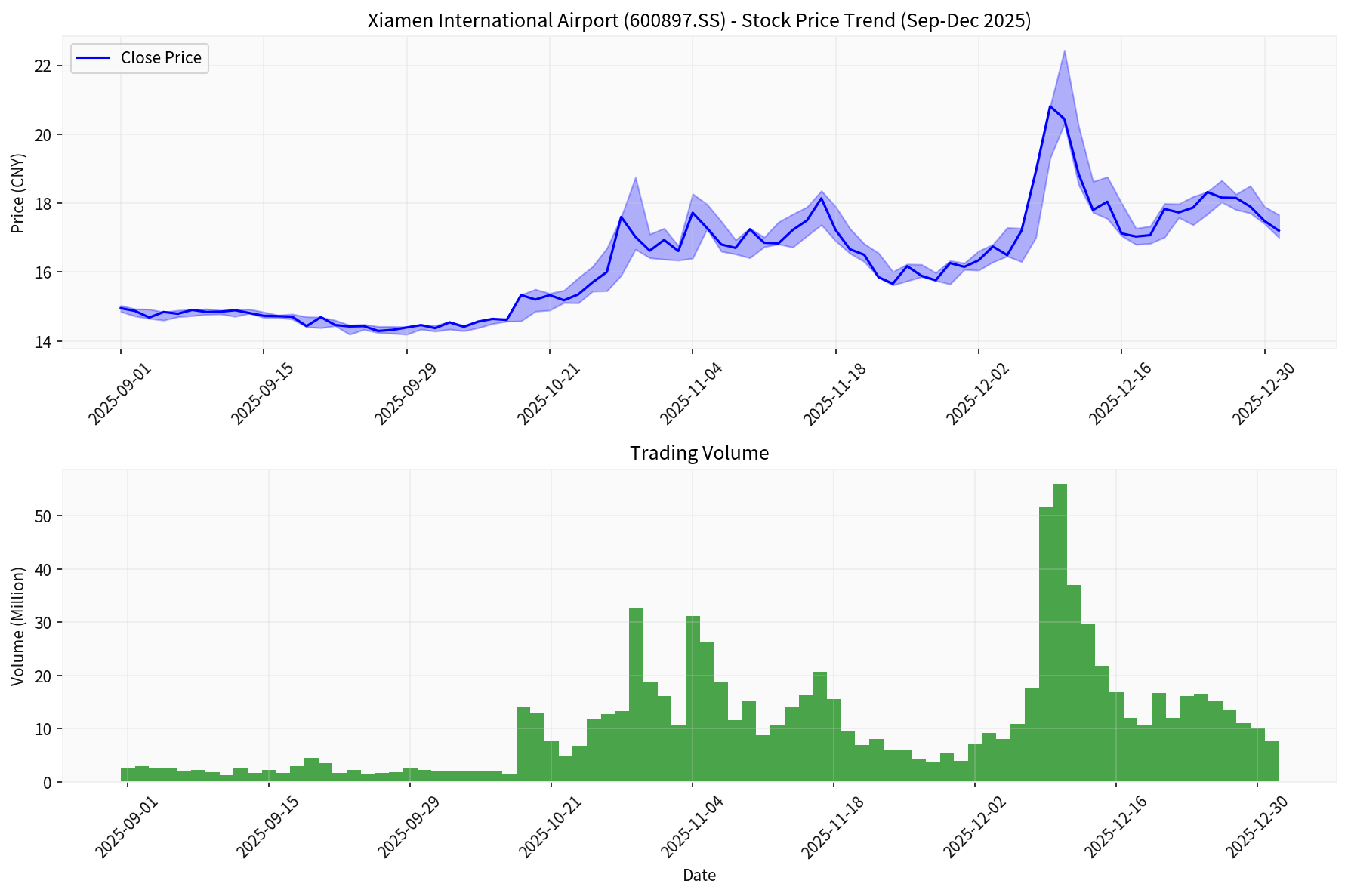

From the perspective of technical analysis[0]:

- Current Price: 17.20 yuan (December 31, 2025)

- Price Range: 16.80-18.02 yuan (sideways consolidation range)

- Trend Judgment: Sideways consolidation, no clear direction

- Beta Coefficient: 0.42 (low correlation with the broader market)

From the trend from September to December 2025, the share price fluctuated widely in the range of

- Significant Location Advantages: As a core city in the southeast coast and a hub for cross-strait exchanges, Xiamen has a stable customer base

- Clear Policy Support: Xiamen has been included in the regional aviation hub of the “3+7+N” international aviation hub functional system[1]

- Recovery of International Routes: The civil aviation industry recovered significantly in 2025, with the three major airlines turning profitable in the first three quarters[2]

- Regional Economic Driving: The development plan for the Xiamen-Zhangzhou-Quanzhou metropolitan area has been approved and implemented, which will form a larger aviation demand market

- Capacity Ramp-up Period: It usually takes 2-3 years for a new airport to reach 70-80% of its design capacity after operation

- Market Competition Pressure: Surrounding cities such as Fuzhou and Quanzhou have airports competing

- Macroeconomic Fluctuations: Air travel demand is highly correlated with the economic cycle

- Diversion Effect: Short-term passenger flow fluctuations may occur during the transition from Gaoqi Airport to the new airport

- The construction progress of the new airport may be affected by engineering factors

- Fluctuations in jet fuel prices may affect airlines’ operating costs

- Macroeconomic downward pressure may suppress air travel demand

- Intensified regional competition may affect market share

[1] The Paper - “Aiming for an International Aviation Hub! Xiamen is Rising as an ‘Airport City’” (https://m.thepaper.cn/newsDetail_forward_32135998)

[2] Sina Finance - “These Airports’ Passenger Throughput Hit Records! Civil Aviation Industry Recovery Accelerates Again” (https://finance.sina.com.cn/jjxw/2025-12-22/doc-inhcsrpa9076272.shtml)

[3] Wikipedia - “Xiamen Gaoqi International Airport” (https://zh.wikipedia.org/wiki/厦门高崎国际机场)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.