Impact Analysis of the Swiss Bar Fire Incident on Investment Risk Assessment in Europe's Food and Beverage Entertainment Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to public reports, in the early morning of January 1, 2026, a severe fire broke out at the “Le Constellation” bar in the Crans-Montana ski resort in Valais, Switzerland, causing at least 40 deaths and about 119 injuries. The initial investigation suggests the cause may have been a bartender holding a champagne bottle with “firework candles/fairy sticks” too close to the ceiling covered with soundproof foam. Currently, prosecutors are investigating the implementation of the bar’s safety standards, including compliance of escape routes and exits (such as whether it has two escape routes required by Swiss regulations, whether evacuation distance and risk assessment meet standards) [1, 2, 3].

Across Europe, building and fire safety regulations are generally strict and continue to tighten. For example:

- EU EN 54 series standards clearly specify performance, installation, and maintenance requirements for fire detection and alarm systems [4];

- In the UK, the use of external wall materials for buildings is restricted, and this has promoted fire protection renovations for old hotels/accommodation buildings (relevant working groups have released technical guidelines and practical cases) [6];

- At the industry level, the European fire detection and alarm system market is growing driven by regulations, with fire protection upgrades for cultural tourism hotels and catering establishments being one of the key focuses [4].

- Stricter and more frequent compliance inspections may be carried out on fire protection facilities (exits, alarms, automatic sprinklers, evacuation channels, etc.) of high-capacity entertainment venues such as bars, nightclubs, and large restaurants;

- Standards for interior decoration, soundproof materials, electrical and lighting equipment (including flammability and heat source distance) may be further tightened;

- Insurance institutions may adjust premiums/deductibles based on compliance status, promoting the adoption of proactive upgrades and networked monitoring systems;

- Refinement and strengthening of information disclosure requirements and liability determination (including management, equipment suppliers, venue responsible parties, etc.).

- Facility renovation and upgrade: Adding exits, automatic sprinklers, smoke/heat detectors, emergency lighting and indicator systems, evacuation path optimization, etc., will bring one-time or phased capital expenditure increases.

- Labor and operational costs: Cyclical cost increases such as employee training, emergency drills, equipment maintenance, third-party testing and certification.

- Potential rent or structural change costs: To meet evacuation distance and capacity limits, it may be necessary to reduce seats or adjust layouts, affecting per-square-meter efficiency.

- Insurance institutions may implement differentiated pricing and underwriting conditions based on the fire compliance status of venues (such as premium adjustments, deductible optimization, risk monitoring requirements, etc.). Historical and industry information shows that compliant buildings usually get more favorable rate terms or discount incentives [6].

- For non-compliant or poorly performing venues, underwriting thresholds or requirements may increase, raising operational costs and capital occupation.

- In the short term, consumer confidence in dense entertainment venues may be disturbed by emotions, affecting customer flow and consumption willingness;

- If regulation and industry rectification are transparent and effectively implemented, confidence is expected to recover in the medium term;

- High-end hotels and chain brands usually have stronger safety and compliance systems, with better risk resistance than small independent venues [5].

- Regulatory authorities may impose rectification within a time limit, capacity restrictions, or even temporary closure measures on non-compliant venues;

- Small operators with weak cash flow face higher operational disruption and liquidity pressure, and the industry may accelerate consolidation.

- Logic: High customer flow, multi-story and mixed-use buildings have higher fire compliance requirements; resort properties are more sensitive to customer flow elasticity during peak seasons.

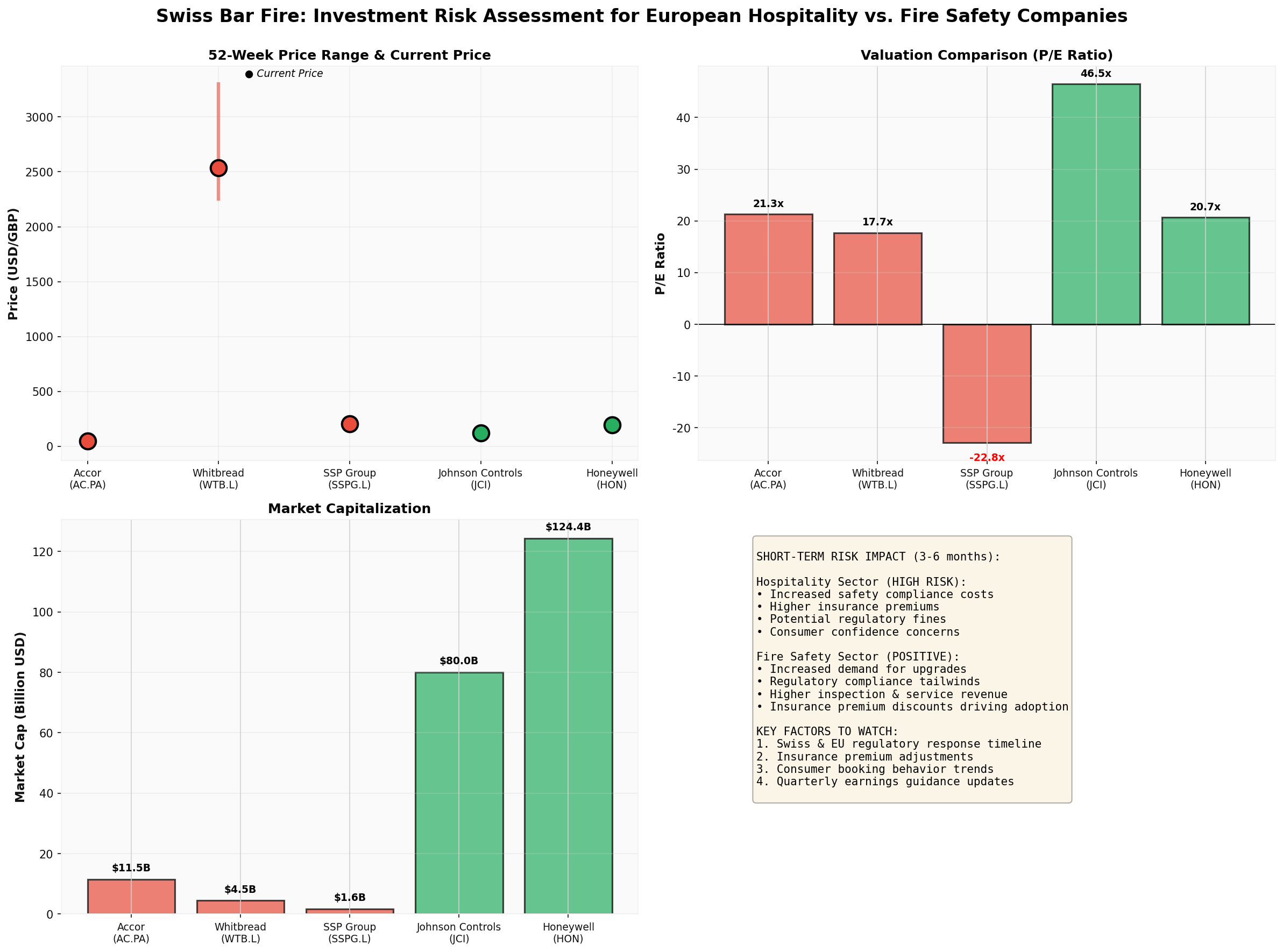

- Representative companies: Accor (AC.PA), Whitbread (WTB.L), etc. In terms of valuation and market capitalization: Accor and Whitbread currently have P/E ratios of 21.34x and 17.74x, with market capitalizations of approximately $11.49 billion and $4.45 billion respectively [0]. Large groups usually have more sufficient safety investment and compliance systems; short-term emotional fluctuations may lead to valuation volatility, but the medium and long term still depend on rectification efforts and brand resilience.

- Logic: High passenger flow and standardized operations make them more likely to be key targets for compliance inspections, but they also have strong safety and internal control systems.

- Representative company: SSP Group (SSPG.L). Current market capitalization is about $1.65 billion, with negative EPS in the past 12 months [0]. Although safety investment may increase, due to high-standard operations and B-side attributes, its emotional disturbance is relatively limited, and it is more affected by macro demand and cost structure.

- Logic: Limited compliance resources, greater pressure from renovation and insurance, and more likely to face operational restrictions due to inspections.

- Theme: The industry may have consolidation opportunities, and chain brands with capital and compliance advantages are expected to gain market share.

- Logic: Safety compliance upgrades directly drive demand for detection, alarm, suppression, and control equipment; insurance incentive policies also promote the popularization of networked monitoring and intelligent systems [6].

- Representative companies (market and financial data from brokerage API [0]):

- Johnson Controls (JCI): Current price is about $122.31, market capitalization is about $80.04 billion, stock price has risen by about 53.04% in the past year, P/E ratio is about 46.51x, median analyst target price is about $133.00, and the general rating is “Buy” [0]. The company provides building and fire safety solutions, and its European business accounts for a significant proportion (EMEA/LA revenue accounts for about 18.7% according to regional segments) [0].

- Honeywell (HON): Current price is about $195.88, market capitalization is about $124.36 billion, P/E ratio is about 20.66x [0]. The company has a global layout in fire alarm, security, and building automation, and is expected to benefit from European compliance upgrades and intelligent transformation needs.

- Industry background: The fire safety system market is expected to continue growing, with regulatory enforcement and insurance incentives being one of the key drivers [6].

- Short term: Rising claims pressure;

- Medium term: Achieve more refined risk management and profit structure optimization through pricing adjustments and risk engineering services (compliance consulting, remote monitoring).

- Food and Beverage Entertainment Sector: Focus on leading companies with strong compliance capabilities (such as large chain hotels and standardized catering groups), avoid high-leverage, small-market-cap independent operators; pay attention to companies’ disclosure and guidance on safety investment and compliance rectification.

- Beneficiary Sector: Focus on industrial/safety companies with European business and fire product portfolios (such as JCI, HON, etc.), and grasp the rhythm based on valuation and order/project progress.

- Be optimistic about industry leaders with capital and compliance capabilities, who are expected to expand their share amid industry consolidation;

- Layout providers of intelligent fire protection and building safety solutions, and track policy implementation and the popularity of insurance incentives;

- Be alert to medium-to-long-term valuation and profit downgrades for targets with opaque compliance or slow rectification progress.

- Uncertainty in regulatory execution intensity and timeline may lead to market expectation gaps;

- Uncertainty in the adjustment range and rhythm of underwriting conditions by insurance companies;

- If similar safety accidents occur again, it may once again impact sector sentiment and trigger a new round of reviews;

- During industry concentration improvement, some small and medium-sized operators may exit the market, so it is necessary to identify the real beneficiaries.

The following chart compares the financial and risk characteristics of representative food and beverage entertainment and fire safety companies from dimensions such as stock price range, valuation (P/E), and market capitalization (data from brokerage API [0]):

- 52-week price range and current position: Helps evaluate the stage and fluctuation range of the stock price;

- P/E ratio: Reflects relative valuation; the negative value of SSP Group reflects profit pressure;

- Market capitalization: Large safety suppliers (JCI, HON) have scale and business diversification advantages;

- Short-term risk impact description: Negative for the food and beverage entertainment sector, positive for the fire safety sector.

- The food and beverage entertainment sector faces short-term risks of rising compliance and insurance costs, demand fluctuations, and operational disruptions; in the medium to long term, leading enterprises with capital and compliance capabilities are expected to benefit from industry consolidation;

- Fire safety and building system providers have structural growth opportunities driven by both regulation and insurance;

- It is recommended to prioritize the allocation of leading enterprises with strong compliance capabilities and stable cash flow, while appropriately laying out global leaders in the intelligent fire protection and building safety field.

[0] Jinling API Data (real-time quotes and company profiles, financial data):

- Accor S.A. (AC.PA) real-time quote & company overview; Whitbread plc (WTB.L) real-time quote; SSP Group plc (SSPG.L) real-time quote; Johnson Controls International plc (JCI) real-time quote & company overview; Honeywell International Inc. (HON) real-time quote.

[1] Central News Agency, “Swiss Fire Probe Initially Blames Fairy Sticks; Bar Owner: Everything Was in Accordance with Regulations”, 2026-01-03, https://www.cna.com.tw/news/aopl/202601030029.aspx

[2] Central News Agency, “Prosecutors Initially Blame Firework Candles for the Disaster; Many Still in Critical Condition in Swiss Bar New Year Fire”, 2026-01-03, https://www.cna.com.tw/news/aopl/202601030002.aspx

[3] DW, “Swiss fire safety under scrutiny after Crans-Montana blaze”, 2026-01-02, https://www.dw.com/en/swiss-fire-safety-under-scrutiny-after-crans-montana-blaze/a-75369716

[4] LinkedIn, “Europe Fire Alarm and Detection Market Demand Key Opportunities”, https://www.linkedin.com/pulse/europe-fire-alarm-detection-market-demand-key-opportunities-tkl0c

[5] NetSuite, “13 Common Challenges in the Hospitality Industry in 2025”, https://www.netsuite.com/portal/resource/articles/erp/hospitality-industry-challenges.shtml

[6] Mordor Intelligence, “Fire Safety Systems Market Size & Share Analysis”, https://www.mordorintelligence.com/industry-reports/fire-safety-systems-market-industry; NFSN UK, “Winter 2025 Newsletter”, https://nfsn.uk/documents/Newsletter-2025.pdf

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.