Analysis of the Global Energy and Market Impact of U.S. Law Enforcement Actions Against Venezuela

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest reports, the U.S. government has implemented large-scale law enforcement actions against Venezuela and its leadership. Specific measures include:

- Expanded Sanctions: Sanctioned three nephews of Venezuelan President Maduro’s wife, as well as six crude oil tankers and shipping companies related to Venezuelan oil [1,2]

- Escalation of Military Actions: Conducted a large-scale military buildup in the Caribbean region and seized a sanctioned Venezuelan oil tanker [2,6]

- Key Event Timeline:

- December 10, 2025: U.S. seizes Venezuelan oil tanker

- December 11, 2025: New sanctions imposed on Maduro family

- December 29, 2025: Venezuela begins shutting down oil wells in the Orinoco Belt [3]

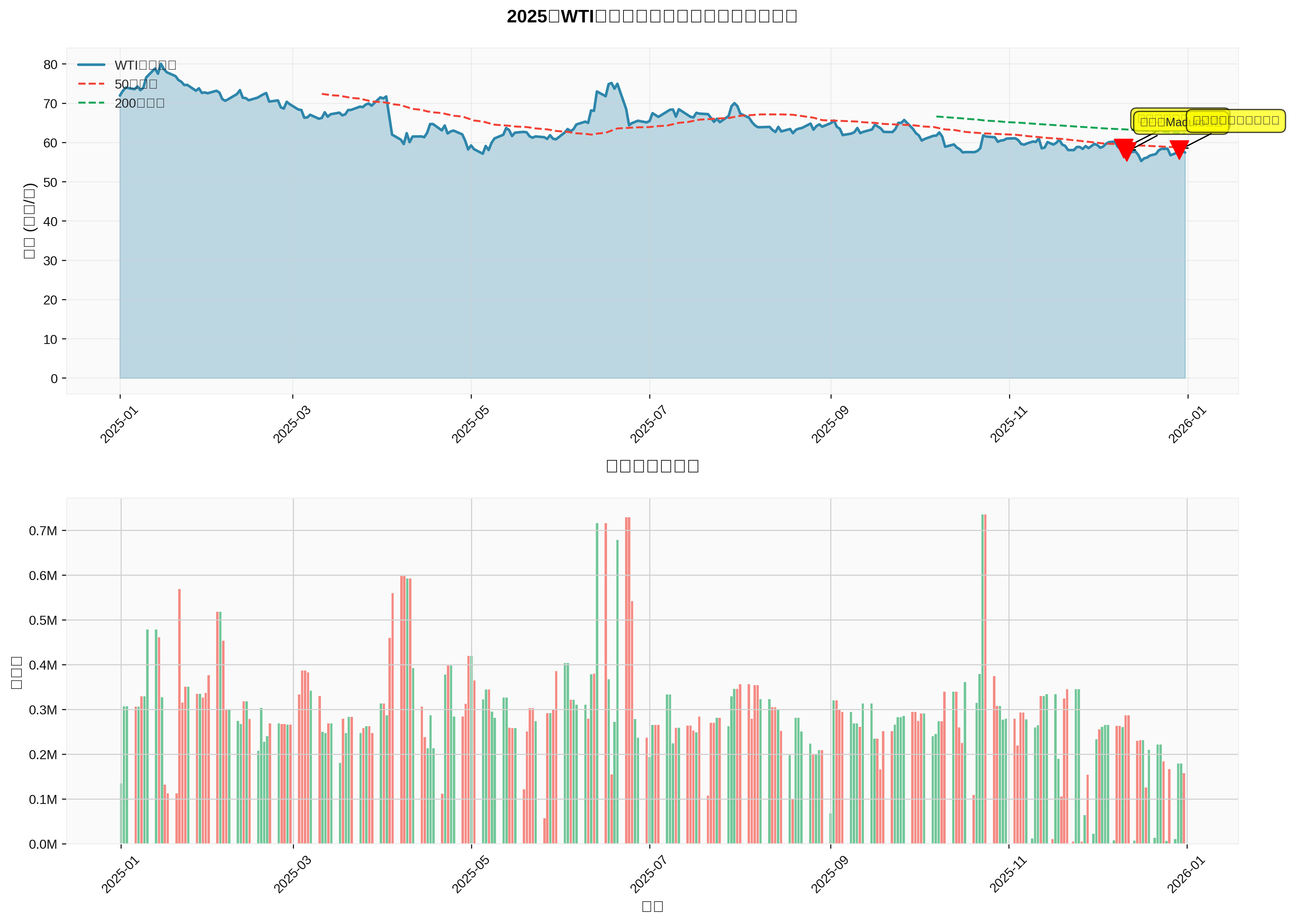

- Start-of-year price: $71.93/barrel → End-of-year price: $57.42/barrel

- Annual decline: -20.17% [0]

- Annual volatility: 1.91% [0]

- Price range: $54.98 - $80.77/barrel [0]

- Venezuela’s Orinoco Belt production dropped by approximately 25% (specifically to about 498,000 barrels per day), accounting for a significant contraction in its domestic high-yield production areas [3]

- Venezuela’s overall production target may be cut by 15% (to about 1.1 million barrels per day), exacerbating supply pressures [3]

- Blockades and sanctions have increased the risk of export discounts and transportation disruptions [3,4]

Despite geopolitical tensions, crude oil prices still declined significantly in 2025, possibly reflecting demand-side pressure, shale oil supply elasticity, and production increases from other oil-producing countries offsetting some of the disturbances. If sanctions are further strengthened and lead to larger-scale export disruptions, the market still faces potential upside risks.

- Exchange Rate Shock: Venezuela’s official exchange rate rose from 52.02 bolivars per dollar at the start of the year to 301.37 bolivars per dollar (official口径), an appreciation of approximately 480% within 12 months; the black market exchange rate is close to 560 bolivars per dollar [4]

- Inflation Expectations: The annual inflation rate is expected to exceed 400% by the end of 2025 [4]

- Impact on Regional Financial Stability: Continuous seizures and blockades will significantly weaken Venezuela’s import capacity and foreign exchange inflows, increase financial and debt pressures, and form spillover risks to neighboring countries and regional supply chains [4]

- Transportation and Logistics: Some flights in the Caribbean region were canceled, and regional travel and logistics were disrupted [6,7]

- Geopolitical Diffusion Risk: Tensions have escalated in the region, potentially triggering greater policy uncertainty

- Current Stock Price: $122.65

- Market Capitalization: $517.24 billion [0]

- Analyst Target Price: $143.00 (+16.6% upside), Rating: HOLD [0]

- Financial Health: ROE 11.42%, Net Profit Margin 9.03%, P/E 17.73x, Stable Liquidity (Current Ratio:1.14) [0]

- Risks/Opportunities: Limited exposure to Latin America, limited geopolitical premium; but stable oil prices or supply shocks help improve its pricing environment

- Current Stock Price: $155.87

- Market Capitalization: $311.64 billion [0]

- Analyst Target Price: $169.00 (+8.4% upside), Rating: BUY [0]

- Financial Health: ROE 8.01%, Net Profit Margin6.78%, P/E21.97x, Stable Liquidity (Current Ratio:1.15) [0]

- Risks/Opportunities: More upstream and Latin American business distribution; if the situation eases or sanctions are lifted, it has elasticity; but short-term operational and compliance risks increase

####3.

- Current Stock Price: $96.70

- Market Capitalization: $120.47 billion [0]

- Analyst Target Price: $118.00 (+22.0% upside), Rating: BUY [0]

- Financial Health: ROE13.56%, Net Profit Margin14.67%, P/E13.64x, Stable Liquidity (Current Ratio:1.32) [0]

- Risks/Opportunities: Core exposure to North America, low direct risk exposure to the Venezuelan situation; structural support for oil prices is more favorable to its profit margins

####4.

- Current Stock Price: $40.20

- Market Capitalization: $60.06 billion [0]

- Analyst Target Price: $50.50 (+25.6% upside), Rating: BUY [0]

- Financial Health: ROE16.84%, Net Profit Margin10.34%, P/E16.22x, Stable Liquidity (Current Ratio:1.39) [0]

- Latin America Revenue Share: Approximately18.6% (FY2024) [0]

- Risks/Opportunities: Service and equipment demand is affected by regional production activities; if sanctions lead to well shutdowns or delays, short-term orders are under pressure; medium-to-long term, if regional situation eases and production capacity recovers, there is room for repair

- XLE (Energy Select Sector): Year-to-date (as of year-end) +3.54%, obvious range-bound fluctuations [0]

| Risk Category | Impact Level | Duration (Qualitative) | Response Strategy |

|---|---|---|---|

Supply Disruption Risk |

Medium-High | Weeks to months (depending on the extent of sanctions and export受阻) | Increase weight of integrated energy companies with large exposure to North America and the Middle East |

Price Volatility Risk |

Medium | Months | Focus on targets with strong balance sheets and stable dividends |

Geopolitical Diffusion Risk |

Medium-High | Months or longer | Conduct scenario analysis and hedging arrangements for companies with high exposure to Latin America |

Compliance and Operational Risk |

High | Months | Strengthen due diligence on enterprises with operational and logistics exposure in Venezuela/Caribbean |

- Oil Prices: Supply disturbances bring potential upside risks, but global demand and OPEC+ policies remain key variables

- Latin American Markets: Increased currency and capital market volatility, tighter financing conditions

- Energy Stocks: North America-focused integrated and exploration companies relatively benefit; service companies and those with high Latin America exposure are under pressure

- Market Restructuring: Sanctions will accelerate the rebalancing of trade flows and supply chains

- Energy Company Strategic Adjustments: Enterprises will re-evaluate regional risk exposure and supply chain resilience

- Geopolitical Pattern Changes: U.S.-Latin America relations may undergo a long period of repositioning

- Focus: North America-focused integrated energy companies (e.g., XOM, COP)

- Reason: Low geopolitical exposure, sound financials, relatively stable dividends and cash flow [0]

- Allocation Ratio: Maintain standard to slightly underweight allocation in the energy sector

- Focus: Diversified portfolio combining integrated and service companies (e.g., CVX, SLB)

- Reason:兼具 defense and elasticity, but need to dynamically assess regional risk exposure and compliance costs [0]

- Allocation Ratio: Standard allocation in the energy sector, moderately overweight low-volatility targets

- Focus: Latin American production and service companies, pay attention to event-driven and policy reversal opportunities

- Reason: If the sanction path or situation eases, there is great elasticity in valuation repair

- Allocation Ratio: Moderately overweight, but strict stop-loss and scenario testing are required

- Short-Term (1-3 Months): Maintain moderate defensive positions, focus on North America-focused companies such as XOM and COP; remain prudent on high Latin America exposure [0]

- Medium-Term (3-12 Months): Dynamically track sanction implementation, export data and regional policy changes, optimize portfolio structure

- Long-Term (12+ Months): According to the trend of regional geopolitical pattern rebalancing, select opportunities to lay out energy and service enterprises with cost advantages and channel resilience [0]

[0] 金灵AI Data - Crude Oil Prices, Energy Company Overview and Financial Indicators, XLE Performance

[1] Marine News Magazine - US Administration Targets President Maduro’s Family with New Sanctions (https://www.marinelink.com/news/us-administration-targets-president-533435)

[2] The Jerusalem Post - Trump designates Venezuelan ‘regime’ foreign terrorist organization (https://www.jpost.com/international/article-880507)

[3] Bloomberg - Venezuela Oil Output Slows 25% in Orinoco Belt Under US Pressure (https://www.bloomberg.com/news/articles/2025-12-31/venezuela-oil-output-slows-25-in-orinoco-belt-under-us-pressure)

[4] Bloomberg - US Seizure of Venezuela Oil Tanker Risks Amping Up Economic Pain (https://www.bloomberg.com/news/articles/2025-12-12/us-seizure-of-venezuela-oil-tanker-risks-amping-up-economic-pain)

[5] Yahoo Finance - Holiday Markets Eye War Risks but Oil Refuses to Break Out (https://finance.yahoo.com/news/holiday-markets-eye-war-risks-153000144.html)

[6] Bloomberg - Flights Canceled Across Caribbean After US Raid in Venezuela (https://www.bloomberg.com/news/articles/2026-01-03/flights-canceled-across-caribbean-after-us-raid-in-venezuela)

[7] New York Times - A Timeline of Rising Tension Between the U.S. and Venezuela (https://www.nytimes.com/2026/01/03/world/americas/us-venezuela-tensions-timeline.html)

[8] Yahoo Finance - Venezuelan bolívar–dollar rate jumps to nearly 480% (https://ca.finance.yahoo.com/news/venezuelan-bol-var-dollar-rate-135049714.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.