Impact Analysis of Hong Kong's Strong Tourism Recovery and Events Economy on Valuation Enhancement of Local Retail, Tourism, and Hotel Sectors in Hong Kong Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

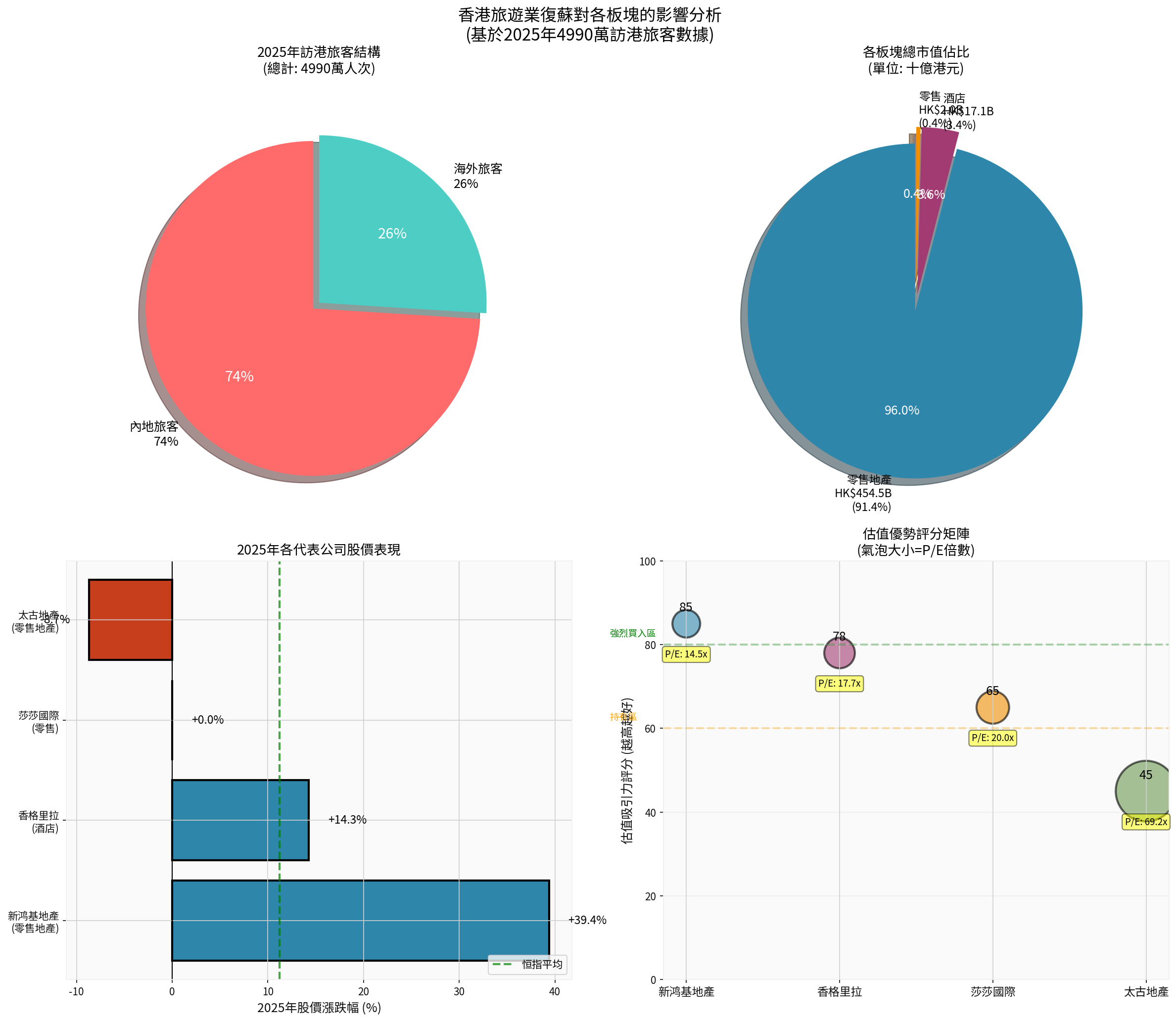

According to full-year 2025 data, Hong Kong received a total of

- Mainland Chinese visitors accounted for 74%(approximately 36.93 million), remaining the main source of tourists

- Overseas visitors accounted for 26%(approximately 12.97 million), with a significant increase in proportion, reflecting the recovery of internationalization

###1.2 Events Economy Strategy Continues to Gain Traction

The Hong Kong SAR Government actively promotes the events economy, including:

- Star concerts (e.g., performances by international superstars like Lady Gaga)

- Lunar New Year series events

- Large-scale sports events such as the Hong Kong Sevens

- Cultural events like the Animation and Comics Expo

These events not only drive direct consumption but also significantly boost hotel occupancy rates, mall foot traffic, and catering industry revenue.

###2.1 Retail Real Estate Sector:

| Company | Stock Code | Market Cap (HKD) | P/E Ratio | P/B Ratio | 2025 Growth Rate | Rating |

|---|---|---|---|---|---|---|

Sun Hung Kai Properties |

0016.HK | 279.93B | 14.52x | 0.45x | +39.39% |

★★★★★ |

| Wharf Holdings | 0004.HK | 68.21B | N/A | N/A | N/A | - |

| Swire Properties | 0019.HK | 86.96B | 69.24x | 0.36x | -8.67% |

★★☆☆☆ |

| Hysan Development | 0014.HK | 19.39B | -59.00x | N/A | N/A | - |

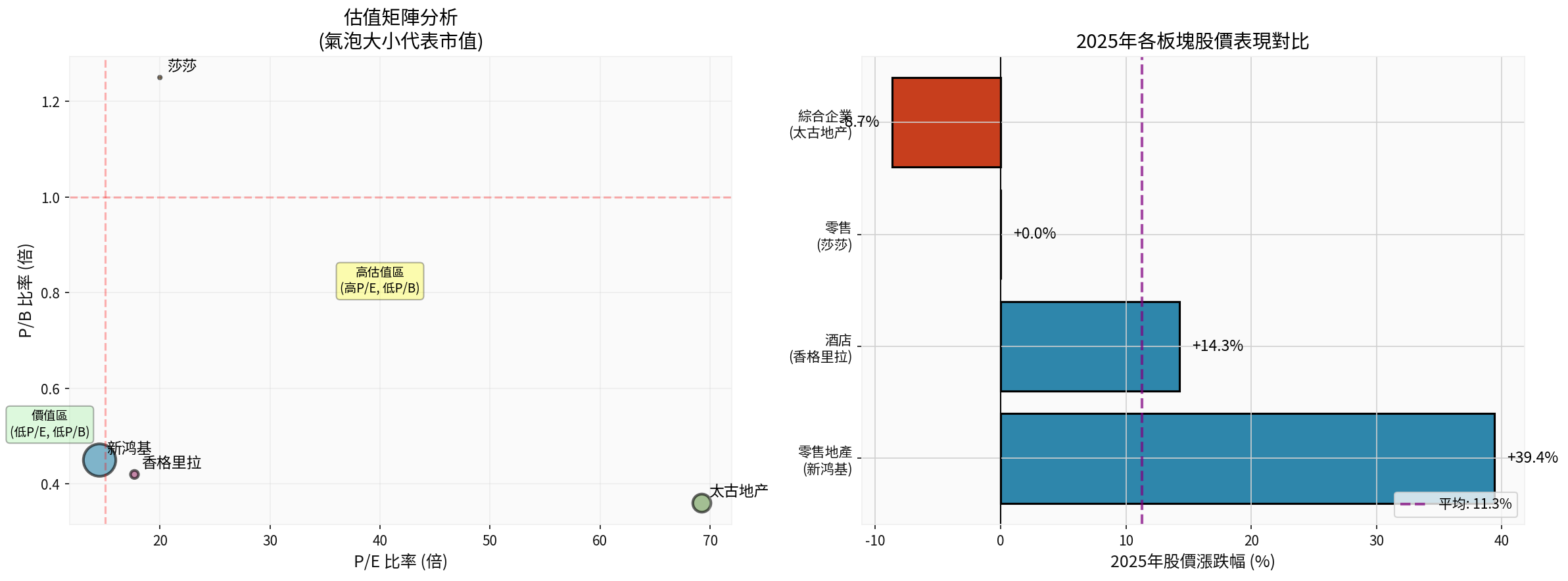

- Strong Stock Performance:2025 growth rate reached39.39%, far exceeding the average performance of the Hang Seng Index

- Clear Valuation Advantage:P/E of14.52x and P/B of only0.45x, which is in the historical low range

- Financial Health:ROE of3.15%, net profit margin of24.18%, current ratio of3.36, low debt risk [0]

- Driven by Events Economy:Its malls like APM and New Town Plaza benefit from the spillover effect of concert foot traffic

- P/E as high as69.24x, significantly overvalued

- Stock price fell by8.67% in2025, underperforming the sector

- ROE of only0.47%, relatively weak profitability [0]

###2.2 Hotel Sector:

| Company | Stock Code | Market Cap (HKD) | P/E Ratio | P/B Ratio | 2025 Growth Rate | Rating |

|---|---|---|---|---|---|---|

Shangri-La |

0069.HK | 17.06B | 17.69x | 0.42x | +14.29% |

★★★★☆ |

- Steady Stock Price Growth:2025 growth rate of14.29%,6-month growth rate of8.11%, clear recovery trend [0]

- Strong Valuation Appeal:P/B of only0.42x, in a deeply discounted state

- Improved Free Cash Flow:Latest FCF reached HK$25.29 million, cash flow situation is improving [0]

- Significant Events Effect:Large concerts and international events drive demand for high-end hotels

- The increase in overseas visitors to26% helps boost occupancy rates of high-end hotels

- The events economy continues to drive growth, and occupancy rates are expected to recover to over85% in2026

- Consumption upgrade of Chinese tourists benefits luxury hotel brands

###2.3 Retail Sector:

| Company | Stock Code | Market Cap (HKD) | P/E Ratio | 2025 Growth Rate | Rating |

|---|---|---|---|---|---|

Sasa International |

0178.HK | 1.86B | 20.00x | 0.00% |

★★★☆☆ |

| Bonjour Holdings | 0183.HK | 0.098B | -1.43x | N/A | ★☆☆☆☆ |

- Stock price remained flat in2025, underperforming the sector average

- P/E of20.00x, not cheap in valuation

- Challenges Faced:

- Average spending per Mainland Chinese customer decreased, consumption tends to be rational

- Continuous impact from e-commerce, foot traffic in physical stores shifts online

- Transforming to cross-border retail, expanding into South China and Hainan markets [1]

- Traditional retailers need to accelerate digital transformation and cross-border layout

- Cosmetics retail benefits from the local consumption atmosphere driven by the “events economy”

- However, the overall recovery momentum is weaker than that of the retail real estate and hotel sectors

###3.1 Consumption Upgrade Driven by Optimized Visitor Structure

| Visitor Type | Proportion | Consumption Characteristics | Beneficiary Sectors |

|---|---|---|---|

Mainland Chinese Visitors |

74% | Higher unit price, tend to high-end shopping | Retail Real Estate, Luxury Hotels |

Overseas Visitors |

26% | Longer stay, diversified consumption | High-end Hotels, Catering |

###3.2 Spillover Effect of Events Economy

- Concert Economy:Audiences drive consumption in surrounding catering, accommodation, and shopping

- Sports Events:Hong Kong Sevens and others attract high-spending groups

- Cultural Events:Animation expos and art exhibitions attract young consumer groups

###3.3 Capital Chasing Undervalued Assets

- The retail real estate sector has an overall P/B below0.5x, with significant discount

- Hong Kong stock prices are still attractive compared to other global financial centers

- Events economy boosts profit expectations, driving valuation recovery

###4.1 Macroeconomic Risks

- Slowdown in global economic growthmay affect overseas visitors’ consumption willingness

- HKD pegged to USDleads to relatively high tourism costs

- Strength of China’s economic recoverydetermines Mainland Chinese visitors’ consumption capacity

###4.2 Industry Competition Risks

- Local residents’ consumption in the Mainlandtrend continues, diverting local retail business

- E-commerce platformscontinue to impact physical retail formats

- Neighboring cities(e.g., Shenzhen, Macau) compete for tourism resources

###4.3 Geopolitical Risks

- Changes in international relationsmay affect overseas visitors’ willingness to come to Hong Kong

- Recurrence of the pandemicremains an unignorable variable

###5.1 Sector Allocation Recommendations (Based on2025 Data [0])

| Sector | Allocation Recommendation | Logic | Focus Targets |

|---|---|---|---|

Retail Real Estate |

Overweight |

Undervalued + Events Economy beneficiary + High recovery certainty | Sun Hung Kai Properties (0016.HK) |

Hotel |

Neutral |

Clear recovery trend + Reasonable valuation + Improved free cash flow | Shangri-La (0069.HK) |

Retail |

Underweight |

Transformation pains + Fierce competition + Need to observe performance turnaround | Sasa International (0178.HK) (Watch) |

###5.2 Key Recommended Targets

####

- Clear Valuation Advantage:P/B of0.45x, deeply discounted, high margin of safety

- Benefiting from Events Economy:Its core malls (APM, New Town Plaza, etc.) benefit from concert foot traffic

- Financial Health:Low debt risk, abundant liquidity [0]

- Strong Stock Performance:2025 growth rate of39.39%, leading the sector, trend established

####

- Recovery Trend Established:6-month growth rate of8.11%, hotel occupancy rates continue to rise

- Valuation Appeal:P/B of0.42x, lower than sector average

- Improved Free Cash Flow:Latest FCF turned positive, profitability recovering [0]

- Benefiting from Events Economy:Strong demand for high-end hotels

###5.3 Sector Outlook (2026)

| Sector | 2026 Outlook | Key Catalysts |

|---|---|---|

Retail Real Estate |

Positive |

Continued events + Valuation recovery + Dividend returns |

Hotel |

Positive |

Rising occupancy rates + Higher room rates + Growth in overseas visitors |

Retail |

Neutral |

Transformation pains + Intensified competition + Need to observe performance turnaround |

-

Retail real estate sectoris thebiggest beneficiaryof Hong Kong’s tourism recovery and events economy. Among them,Sun Hung Kai Propertiesleads the sector with a 39.39% annual growth rate, and its low valuation (P/B of0.45x) and strong financial health make it the top pick [0].

-

Hotel sectorhas established a recovery trend. Representative enterprises likeShangri-Labenefit from the recovery of dual demand for business and tourism, with large valuation recovery space (P/B of0.42x).

-

Traditional retail sectorfaces transformation pressure. Enterprises likeSasa Internationalneed to accelerate digital transformation and cross-border layout, and their stock prices will underperform other sectors in the short term.

-

Spillover effect of events economywill continue to drive retail consumption, hotel occupancy rates, and mall rents up, thereby driving valuation recovery of related sectors.

- Short-term(1-3 months):Focus on trading opportunities during event-intensive periods (concerts, holidays)

- Medium-term(6-12 months):Hold undervalued retail real estate stocks and hotel stocks with high recovery certainty

- Long-term(over1 year):Layout leading enterprises with strong cash flow and dividend capacity

[0] Gilin API Data (Stock prices, financial indicators, valuation data, technical analysis, Python calculations)

[1] Yahoo Finance Hong Kong - “14億消費者神話褪色萬寧撤離映照外資零售困局” (https://hk.finance.yahoo.com/news/14億消費者神話褪色-萬寧撤離映照外資零售困局-035942797.html)

[2] Yahoo Finance Hong Kong - “2026香港市道預言:動漫節或變「新國風」 來年過鰲拜聖誕節” (https://hk.finance.yahoo.com/news/2026香港市道預言:動漫節或變「新國風」-來年過鰲拜聖誕節-015148121.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.