Assessment of the Support Strength of Global Box Office Recovery Trend on Disney (DIS) Valuation Repair

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on comprehensive analysis,

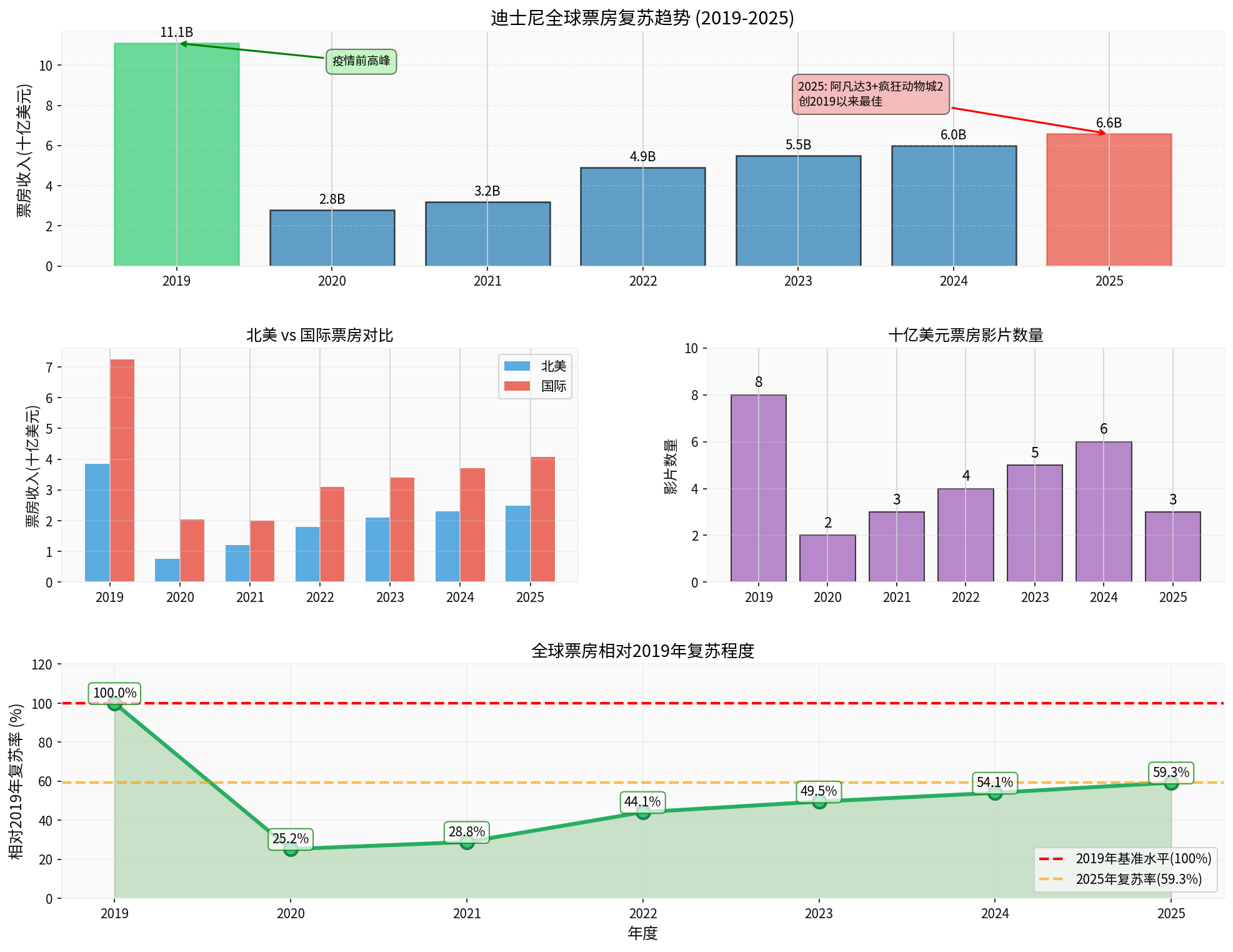

- Short-term Catalyst: Disney’s 2025 global box office reached$6.58 billion, a record high since 2019, up 9.7% from 2024 [1]

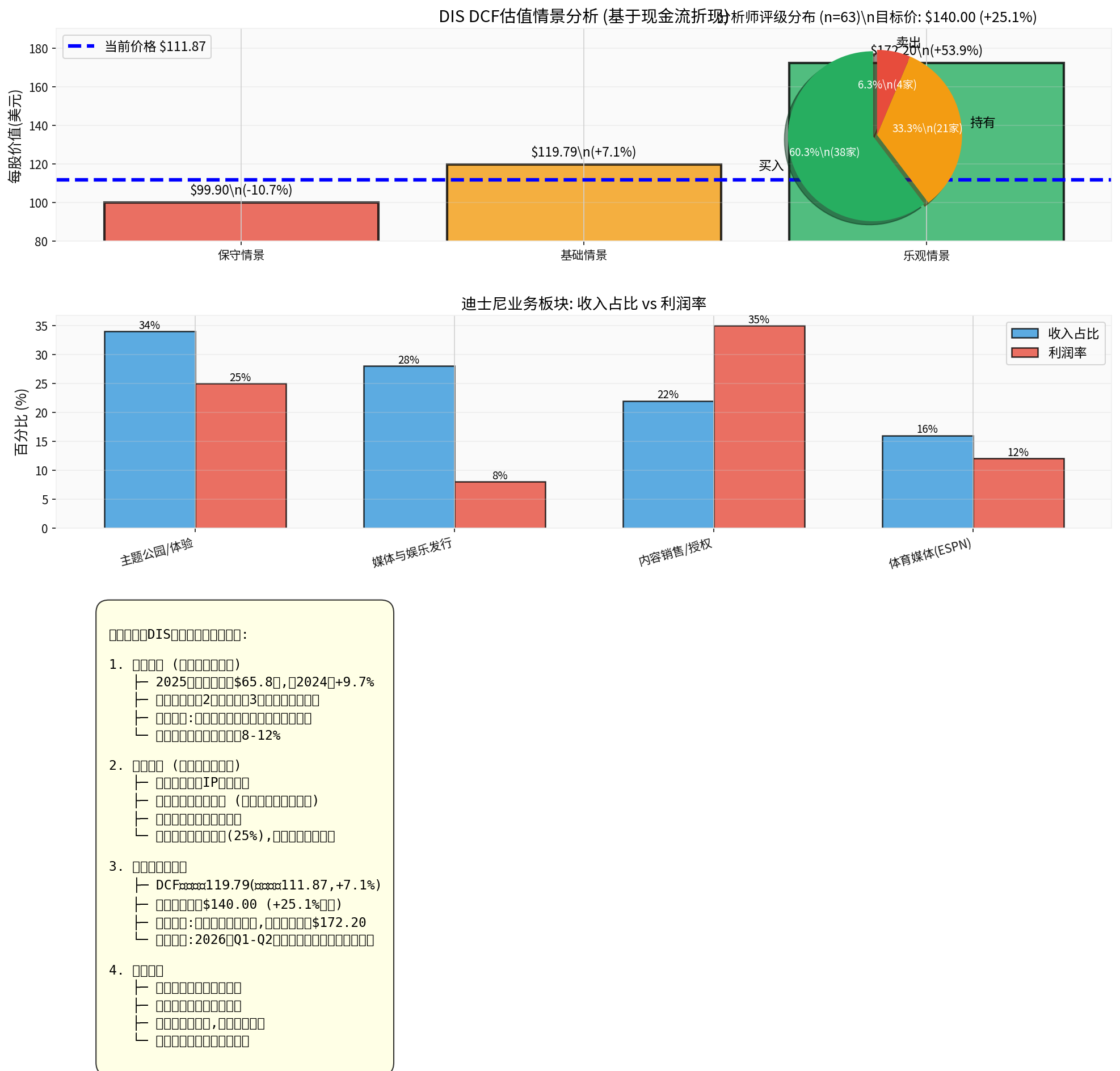

- Valuation Space: Current stock price is $111.87, DCF base valuation is $119.79 (+7.1%), optimistic scenario is $172.20 (+53.9%) [0]

- Analyst Consensus: Target price is $140.00 (+25.1%), with 60% of analysts giving a Buy rating [0]

- Recovery Progress: The recovery rate relative to the 2019 box office peak is59.3%, still with room for continuous repair [0]

Chart shows: DIS stock price fluctuated between $110-$120 in 2025, currently at the midpoint of the trading range

- Global Box Office Total: $6.58 billion (North America: $2.49 billion + International: $4.08 billion)

- Annual Ranking: Disney ranked first in global box office for the 9th consecutive year

- Billion-dollar Blockbusters: 3 films (Zootopia 2, Avatar: Fire and Ash, Lilo & Stitch)

- Number of Viewers: Approximately 700 million globally watched Disney films

- Box office exceeded 700 million RMB

- Zootopia 2 and Avatar 3 ranked among the top three in the period

- Shows continued recovery of audience viewing habits post-pandemic

Chart shows: Disney’s global box office recovered from the 2020 low of $2.8 billion to $6.58 billion in 2025, with a recovery rate of 59.3% relative to the 2019 peak of $11.1 billion

- North American Market: $2.49 billion in 2025, accounting for 37.8% of global box office, with steady recovery

- International Market: $4.08 billion, accounting for 62.0%, becoming the main growth engine

- Asia-Pacific Region: Animated films like Zootopia 2 performed excellently, with significant contributions from the Chinese market

- Animated Films: Zootopia 2 became the highest-grossing film in Disney’s animation history

- Sci-fi Blockbusters: Avatar 3 had a global opening of $347 million, second only to Avatar 2 in 2022

- Family-oriented Content: High-end screenings like IMAX contributed significantly, increasing per-screen ARPU

- Studio entertainment revenue accounts for approximately 22%of total revenue [0]

- Box office revenue (theatrical): Approximately $658 million (direct cash flow)

- Backend Revenue Chain: Streaming licensing (Disney+, Hulu) + Home Entertainment (Blu-ray/DVD) + TV licensing (ABC, ESPN) + Merchandise licensing (accounting for approximately 18% of total revenue)

- Studio segment profit margin is approximately 35%, one of the company’s highest-margin businesses

- Box office blockbusters not only contribute theatrical revenue but also amplify value through IP full-life-cycle monetization

- Studio revenue is expected to grow by 8-12%year-on-year in 2025

- IP Popularity Transmission: Box office blockbusters directly increase tourists’ willingness to visit parks

- New Theme Area Investment: The Zootopia theme area will attract客流 and extend stay time

- Merchandise Sales: Related IP merchandise sales increase (an important part of retail revenue)

- Profit Margin: Experience business profit margin is as high as25%, and box office-driven passenger flow growth has greater profit elasticity

- Box office success increases IP value and improves licensing bargaining power

- Merchandise licensing revenue lags box office by 1-2 quarters, forming a continuous revenue stream

Chart shows: Among Disney’s business segments, theme parks/experiences (34%) and media entertainment (28%) are core pillars; DCF base valuation is $119.79, analyst target price is $140, indicating valuation repair space

- Theatrical blockbusters are launched on Disney+ after the window period, increasing subscription value

- Box office performance verifies content quality, optimizing content investment decisions

- Disney+ content cost yield increased in 2025, narrowing subsidies

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.