Analysis of the Impact of Large-Scale Application of Vanadium Flow Battery Energy Storage on Renewable Energy Integration and Profitability of Vanadium Enterprises

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I will comprehensively analyze the impact of large-scale application of vanadium flow battery energy storage on renewable energy integration and profitability improvement of vanadium resource enterprises.

Vanadium flow batteries, with their inherent safety, ultra-long lifespan (over 15,000 cycles), flexible capacity configuration and other characteristics, have become the mainstream technical route for long-duration energy storage. The commissioning and operation of the Xinjiang Jimusar Vanadium Flow Energy Storage Power Station (200MW/1000MWh) have provided an important demonstration for renewable energy integration [1].

This power station is expected to increase the utilization rate of supporting photovoltaic power stations by

In 2025, the vanadium flow battery energy storage industry has pressed the “accelerator button”:

- New grid-connected installed capacity: 3.7 GWh (Jan-Sept)

- New bidding demand:12.78 GWh (Jan-Oct)

- Large-scale base construction: 6 major bases fully put into operation,14 bases partially put into operation [1]

Long-duration energy storage can realize cross-day, cross-month or even cross-season charge-discharge cycles. Its advantages in improving renewable energy integration capacity and enhancing grid flexibility are more obvious, and it is regarded as a key link in building a new-type power system [2].

####3. Strong Policy Support

The National Energy Administration clearly stated in the “2025 Energy Work Guidance Opinions”: “Strengthen technological innovation research and forward-looking layout of long-duration energy storage”, positioning long-duration energy storage as a key pillar for the construction of a new-type power system [1].

Long-duration energy storage is no longer an “option”, but a “must-answer question” to solve the problem of renewable energy integration, ensure power system stability, and support the realization of the “double carbon” goals [1].

####1. Significant Growth in Vanadium Demand

The large-scale application of vanadium flow batteries is significantly driving the growth of vanadium demand:

- Electrolyte demand: Each GWh of vanadium flow battery requires about 10,000 tons of vanadium pentoxide

- 2025 demand increment: Calculated based on3.7 GWh of new grid-connected capacity, the new vanadium demand is about37,000 tons

- Future market space: The global long-duration energy storage market will grow from3.1 billion USD in2024 to8.7 billion USD in2034, with a CAGR of10.6% [3]

This is equivalent to about

####2. Vanadium Prices Stabilize and Rebound

Since November2025, domestic vanadium prices have shown a

####3. Benefit Analysis of Vanadium Resource Enterprises

- Market capitalization:28.79 billion USD

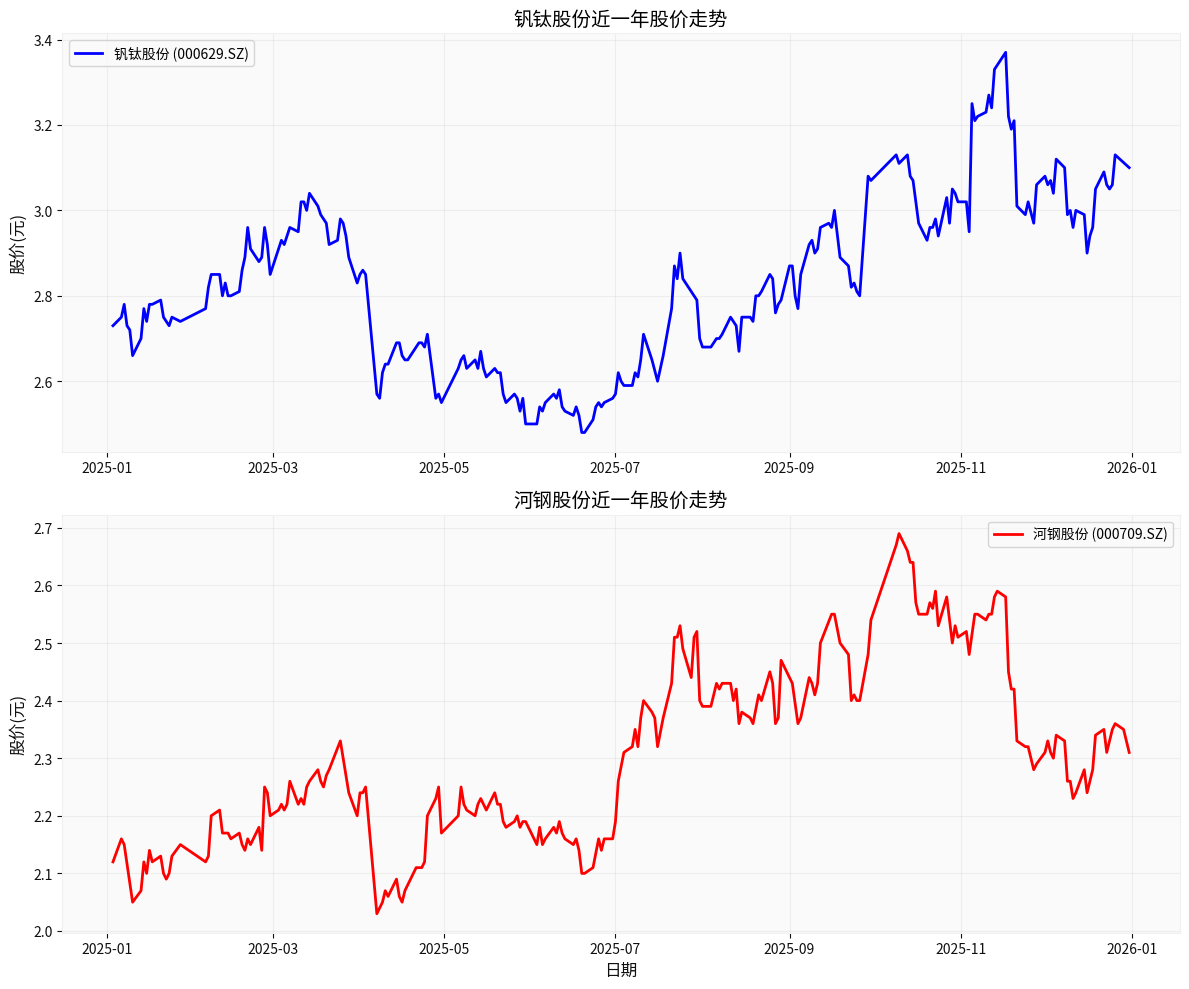

- Stock price performance in the past year: +13.55%(rose from2.73 CNY to3.10 CNY) [6]

- Industry position: Leading enterprise in China’s vanadium pentoxide industry, with a market share of25.56% [4]

- Financial status: Latest quarterly revenue2.28 billion USD, net profit margin-0.50%, ROE-0.38% [6]

- Market capitalization:23.88 billion USD

- Stock price performance in the past year: +8.96%(rose from2.12 CNY to2.31 CNY) [6]

- Financial status: Latest quarterly revenue30.23 billion USD, net profit margin0.75%, ROE1.69% [6]

####4. Profit Improvement Pathways

The growth in vanadium flow battery demand improves the profitability of vanadium resource enterprises through the following pathways:

- Growth in vanadium product sales: The proportion of vanadium demand in the energy storage sector is expected to rise from less than5% currently to15%-20% [1]

- Product structure optimization: Increase in the proportion of high-value-added vanadium electrolyte products

- Price rebound: Supply and demand improvement drives vanadium prices to stabilize and rebound [5]

- Industrial chain extension: Multiple vanadium enterprises actively layout downstream links such as electrolytes and stacks

####1. Quantitative Impact on Renewable Energy Integration

- Short-term(2025-2027): With the commissioning of planned projects, vanadium flow batteries are expected to increase renewable energy integration by5-8 billion kWhannually

- Mid-term(2028-2030): If the15%-20% penetration target is met, it can increase renewable energy integration by20-30 billion kWhannually

- Long-term(after2030): The increase in the proportion of vanadium flow batteries in the long-duration energy storage field is expected to become one of the key technologies to solve the problem of renewable energy integration

####2. Quantitative Impact on Profitability of Vanadium Resource Enterprises

Assuming the installed capacity of vanadium flow batteries reaches10 GWh (approximately80% of the new bidding demand in2025):

- Vanadium demand increment: About100,000 tons of vanadium pentoxide per year

- Impact on Vanadium Titanomagnetite Co., Ltd.: Equivalent to60-80%of its current annual production capacity

- Profit improvement: If vanadium prices rebound by10-20%, the net profit of Vanadium Titanomagnetite Co., Ltd. is expected to improve by100-200 million USD

- Valuation uplift: With the increase in the proportion of energy storage business, the valuation center is expected to move up

- Technological route competition: The cost of lithium battery energy storage continues to decline, and other long-duration energy storage technologies such as compressed air are also developing

- Industrial chain maturity: Breakthroughs are still needed in electrolyte recycling, stack cost reduction, etc.

- Policy dependence: Current development still relies on policy support, and the degree of marketization needs to be improved

- Overcapacity risk: If production capacity is over-expanded in various regions, it may lead to phased supply-demand imbalance

The large-scale application of vanadium flow battery energy storage has a

-

Renewable energy integration: Each GWh of vanadium flow battery can increase photovoltaic utilization by more than10%, generating an additionalover 200 million kWhof clean electricity annually. With the new installed capacity of3.7 GWh in2025, it can increase renewable energy integration by5-8 billion kWhannually.

-

Vanadium resource enterprises: The growth in vanadium demand is equivalent to20-30%of the current annual output, driving vanadium prices to stabilize and rebound. As an industry leader, Vanadium Titanomagnetite Co., Ltd.'s stock price has risen by13.55%in the past year, and there is promising room for profit improvement in the future.

-

Market prospects: The global long-duration energy storage market will grow from3.1 billion USD in2024 to8.7 billion USD in2034. Vanadium flow batteries are expected to occupy an important position due to their safety and long lifespan advantages.

-

Investment suggestions: Pay attention to leading enterprises with vanadium resource advantages and electrolyte production capacity, such as Vanadium Titanomagnetite Co., Ltd. (000629.SZ) and HBIS Group Co., Ltd. (000709.SZ), but need to be aware of risks like technological route competition and policy changes.

[1] Polaris Energy Storage Network - “Cost Drops Below 2 CNY/Wh! The Era of Accelerated Large-Scale Application of Vanadium Flow Battery Industry in2025 is Coming” (https://www.ditan.com/industry/energy-storage/9131.html)

[2] People’s Daily - “Long-Duration Energy Storage Meets Development Opportunities” (http://paper.people.com.cn/zgnyb/pc/content/202501/27/content_30055283.html)

[3] Global Market Insights - “Long-Duration Energy Storage Market Size Forecast (2025-2034)” (https://www.gminsights.com/zh/industry-analysis/long-duration-energy-storage-market)

[4] Huajing Industrial Research Institute - “Analysis of Market Size, Competitive Pattern and Key Enterprises of China’s Vanadium Pentoxide Industry in2025” (https://finance.sina.com.cn/roll/2025-07-29/doc-inficncv4721544.shtml)

[5] Global Ferroalloy Network - “Vanadium Market Trend - Latest Vanadium Price Movement” (https://www.qqthj.com/fan/)

[6] Gilin API Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.