Geopolitical Shock From Maduro's Capture: Global Oil Market and Energy Sector Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The reported U.S. capture of Nicolás Maduro introduces a high-stakes geopolitical shock to an already tight global oil backdrop. Venezuela remains the largest proven holder of crude reserves within OPEC and still contributes roughly 1.1 million barrels per day (mbd), even after persistent sanctions flows. The resulting uncertainty tends to translate immediately into higher risk premia—particularly for grades linked to the heavy, sour barrels that would be hardest to replace—while advantaging other producers that can absorb supply gaps. [1][2]

- Risk premium surge: The news of a leadership upheaval in Venezuela is a classic supply-side risk event. Historical comparisons show that any potential disruption in a member that already operates well below capacity can trigger a quick re-pricing of oil and related hedges, irrespective of actual physical losses. With WTI still under $60/ barrel but rallied to start 2026, the market may now price in a renewed premium for “geo-risk insurance,” especially if the new regime signals a break from existing production partnerships or accelerates default risk on PDVSA obligations. [0]

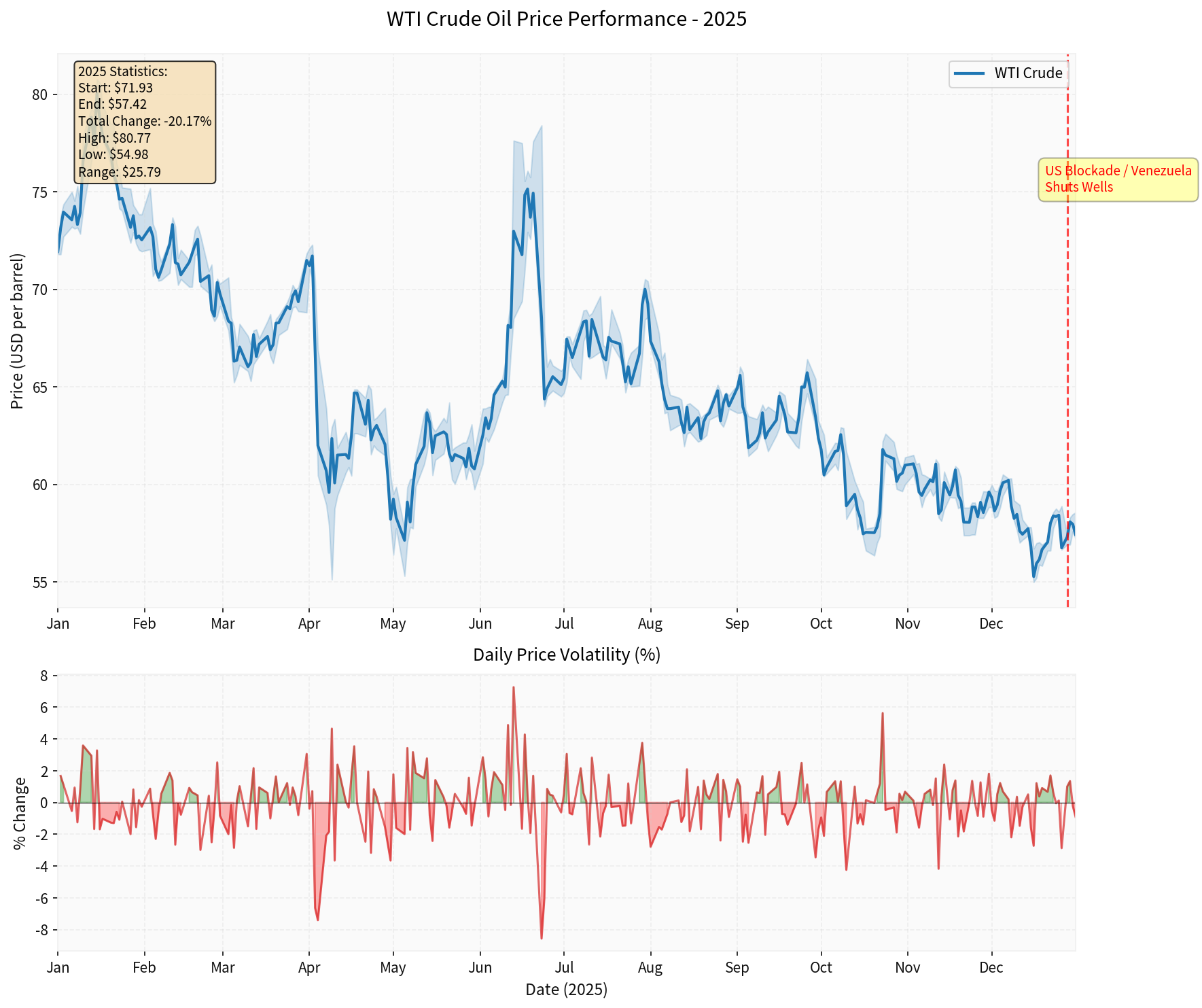

- Volatility persistence: 2025’s oil price record shows 20.08% annual slide from $71.85 to $57.42, but also a wide intra-year band (high $80.77, low $54.98) and daily volatility ~1.9%—illustrations of how quickly price expectations swing on political headlines. The chart highlights these dynamics and flags the December blockade on Orinoco wells, underscoring how actions along Venezuela’s supply chain already sway global trading. [0]

- Brent-WTI spread sensitivity: Brent’s proximity to $60.75 (vs. WTI $57.32) reflects a normal Middle East risk premium, but any Venezuelan disruption may widen the differential further if floating storage and distance to key refineries become even more critical. [0]

Chart description: Dual-panel view with the main panel showing daily WTI price, high/low bands, and highlighted annotations (e.g., U.S. blockade and well shutdowns). The lower panel graphs day-to-day percentage change, with positive/negative fills for quick volatility interpretation. Data spans Jan–Dec 2025; X-axis labeled by month, Y-axis in USD/barrel and % returns. [0]

- OPEC balancing act: Venezuela’s output was already constrained due to sanctions, maintenance issues, and capital scarcity. A leadership transition could either further cut production (if infrastructure is neglected) or, conversely, become a bargaining chip in new deals with friendly buyers. Other OPEC members—including Saudi Arabia and the UAE—may respond by either slightly increasing voluntary compliance to stabilize prices or by delaying planned restarts to protect their own market share.

- U.S. policy influence: Should the new government pledge cooperation with Washington, Washington might lift selective sanctions, unlocking limited volumes. Conversely, a collapse into civil conflict would likely see continued U.S. sanctions and the imposition of production curtailments, amplifying the upside risk for oil prices.

- Strategic stocks & inventories: The U.S. could expedite releases from the Strategic Petroleum Reserve to dampen short-term spikes, but there is a limit to how long such releases can offset supply shocks, especially if buyers hesitate amid policy uncertainty.

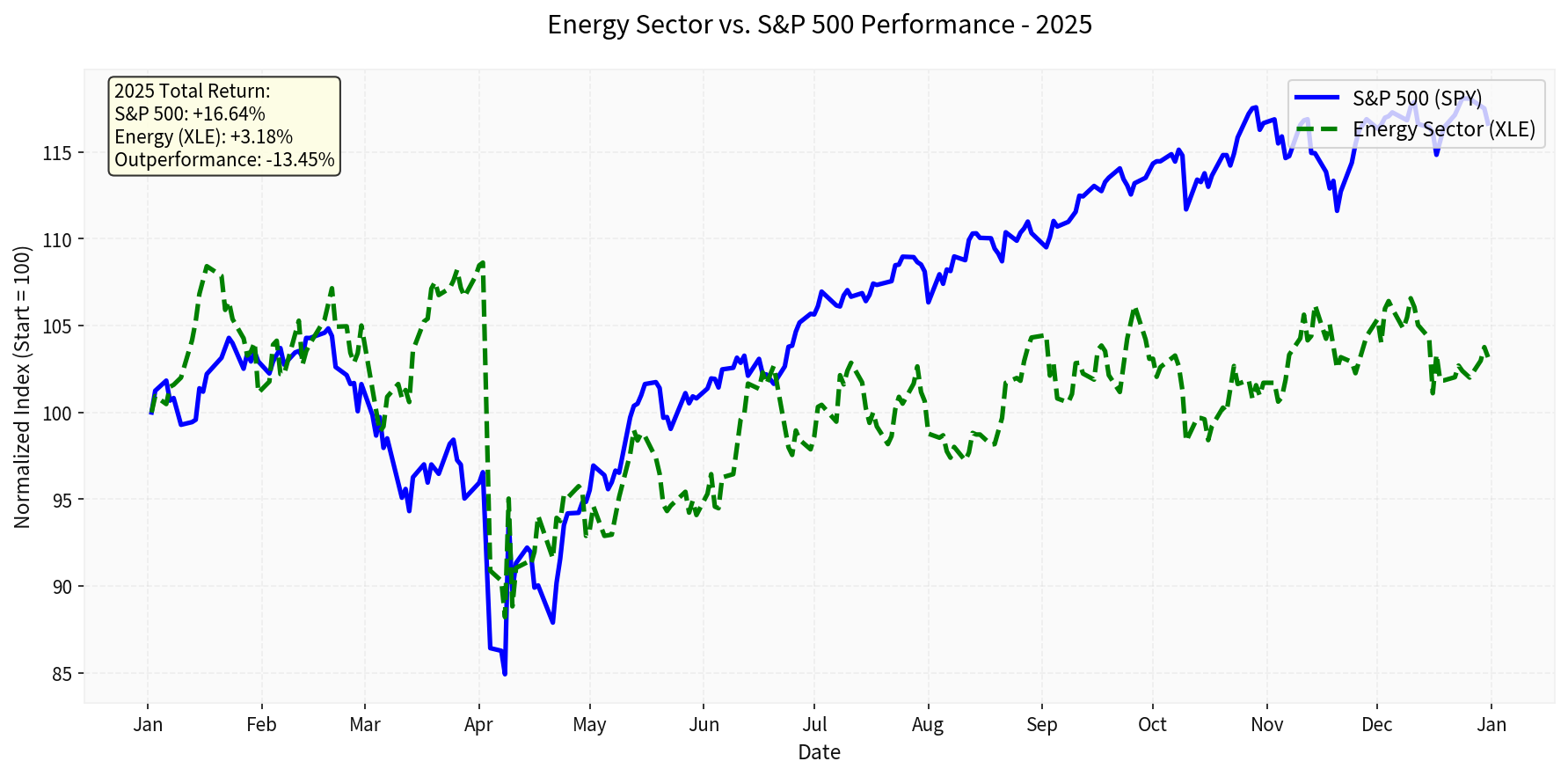

- Relative performance to equities: Energy equities (XLE) outperformed the broader market in 2025, returning ~4.37% vs. S&P 500’s ~0.00%, aided by the lag in equity valuations and higher dividend yields that cushion geopolitical shocks. The sector’s normalized chart shows that energy’s return advantage over SPY persisted even as crude prices slogged lower, reinforcing the defensive/story of cash-flow resilience. [0]

- Oil majors and contractors: Companies with diversified global portfolios, particularly those with shipping, storage, or refining exposure to heavy crude (Chevron, ExxonMobil, TotalEnergies), may benefit from a temporary pricing boost while maintaining long-term hedging discipline. However, cost inflation and stricter capital allocation mean investors should watch guidance for capex changes amid potential disruptions.

- Trading & sentiment: Options and futures traders are likely to price in higher volatility, leading to wider implied volatilities and steepening of curve structures (front-month vs. long). Investors can monitor the crack spreads and rig counts for clues on whether refiners and producers anticipate higher downstream realization or demand softness.

- Energy transition funds: Renewable-centric energy portfolios may face short-term negative sentiment if investors rotate back into traditional oil plays chasing risk premia; yet, the structural transition story remains intact, and any temporary oil rally should be contextualized within a multi-year decarbonization push.

Chart description: Cumulative normalized performance from Jan to Dec 2025 with SPY (blue solid) and XLE (green dashed). Annotations highlight total returns and XLE’s relative outperformance, giving investors clarity on how energy stocks fared amid lasting volatility. Data source: industry ETF prices. [0]

- Monitor tight supply cues: Track Bloomberg, OPEC, and API/EIA monthly reports for Venezuelan exports and any signs of sanctioned recovery. A net drop beyond current shortfalls would validate raising price targets on oil and refining equities.

- Review portfolio energy exposures: Tilt toward integrated majors with strong balance sheets, flexible capex, and regional diversification. Avoid companies too dependent on Venezuela’s infrastructure unless there is clear, credible U.S.-approved stabilization.

- Hedge macro risk with volatility trades: Use structured products or options on energy indices to capture short-term spikes without overcommitting to directional risk.

- Stay alert for policy developments: Central banks and fiscal authorities may respond to higher energy costs through monetary tightening or fuel subsidies—both affect real demand growth.

Given the evolving geopolitical landscape, consider activating

[0] GilinAPI data (commodity prices, ETF performance, charts)

[1] CNBC – “Trump says U.S. operation captured Venezuela president Nicolas Maduro” (https://www.cnbc.com/2026/01/03/trump-us-operation-captured-venezuela-president-nicolas-maduro.html)

[2] MarketWatch – “Trump says U.S. has captured Maduro. What happens next in markets.” (https://www.marketwatch.com/story/trump-says-u-s-has-captured-maduro-what-happens-next-in-markets-46fae56e)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.