2026 Quantum Computing Industry and Investment Research Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

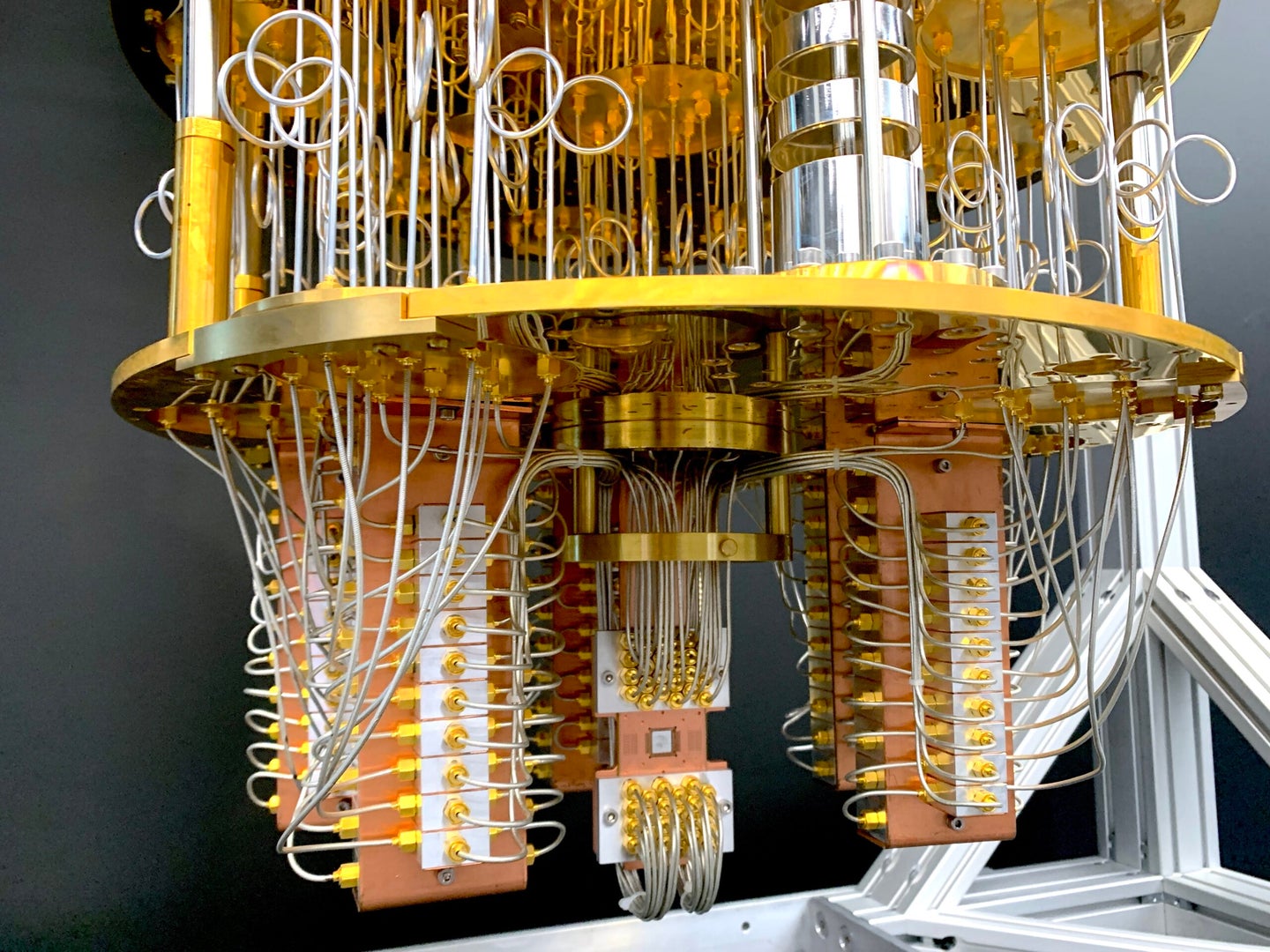

- Upstream: Hardware, qubit implementations (superconducting, neutral atom, ion trap), dilution refrigeration, control electronics, quantum error correction, etc. This segment is relatively mature, with multiple technical routes entering the engineering and iterative optimization phase.

- Midstream: Quantum software, compilation and development toolchains, hybrid computing platforms (e.g., quantum integrated with GPU/classical computing), cloud services (QaaS). The ecosystem is expanding as open-source platforms like NVIDIA CUDA-Q and collaborations with national computing centers progress.

- Downstream: Industry applications and scenarios, including AI and machine learning acceleration, complex optimization, pharmaceutical and materials science, financial modeling and risk management, logistics and supply chain, cybersecurity (quantum security and post-quantum cryptography). Currently in the early pilot and proof-of-concept (PoC) stage; large-scale deployment still requires time.

- The global quantum computing market is expected to grow from approximately $800 million in 2025 to about $1.08 billion in 2026, with a CAGR of around 35.2% from 2025 to 2035 (Source: Global Growth Insights report, cited via web search results).

- According to data from PhotonBox Research Institute quoted in CITIC Securities Research Report: The overall industry size is expected to grow from approximately $5 billion in 2024 to about $800 billion in 2035; the downstream market size will increase from around $270 million in 2024 to approximately $202.67 billion in 2035. Upstream is relatively mature, while downstream has a small base but huge growth potential.

- Pure Quantum Concept Stocks: During 2024-2025, pure quantum targets like Rigetti Computing (RGTI) and D-Wave Quantum (QBTS) experienced short-term sharp rises but subsequent volatility; IonQ (IONQ) had fast revenue growth but expanding losses, showing industry uncertainty before scale profitability.

- Large Tech Companies: IBM, NVIDIA, Amazon layout quantum via hybrid and cloud service models. 2025 reports indicate that large tech companies’ quantum businesses are embedded in diversified and profitable core operations, favored by investors (e.g., positive stock performance of IBM and Amazon since October 2025).

- Chinese Market: More detailed information is available for overseas targets in public market data; public information on quantum-related companies in A-shares/H-shares is limited. For systematic sorting and screening of Chinese listed companies, it is recommended to use professional research databases (deep research mode).

- Upstream

- Advantages: Clear technical iteration path, definite engineering route, strong synergy with global hardware supply chains (semiconductor, precision manufacturing, cryogenic equipment); some segments have entered delivery and customer trial stages.

- Challenges: High capital expenditure, long iteration cycles, competing technical routes (superconducting vs. neutral atom vs. ion trap, etc.).

- Investment Attributes: Closer to “infrastructure type”, suitable for funds that can bear high capital input and long payback periods, focusing on platform and route positioning.

- Downstream

- Advantages: Once technology matures and the ecosystem is完善, wide application scenarios, large potential market size, customer willingness to pay depends on quantifiable benefits; deep integration with AI, big data, pharmaceuticals, finance, etc.

- Challenges: Currently in early deployment stage, uncertain commercialization timeline, highly dependent on hardware performance and stability.

- Investment Attributes: More oriented to “scenario and model innovation”, with high growth elasticity but higher risk.

- Technical Milestones: Progress of neutral atom routes (QuEra, Atom Computing, etc.), improvement of error correction and reliable qubit count, engineering pace of hybrid and fault-tolerant systems.

- Industry Policies and Big Company Investment: Support from major global economies for quantum research and industrialization, as well as investment pace and commercialization routes of large tech companies.

- Capital Market Sentiment: Valuation volatility of pure quantum targets and value revaluation of big tech-related businesses.

- Diversified Allocation: Balance “upstream hardware/infrastructure” and “downstream applications/ecosystem”, avoid single-track bets.

- Prioritize Platform-Type and Cash Flow-Supported Entities: Large tech companies’ quantum businesses have synergy and cash flow support, with relatively stable business progress and commercialization pace; pure quantum targets are more volatile, requiring continuous tracking of technical routes and order progress.

- Focus on Quantifiable Progress: Track hardware parameters (qubit count, fidelity, error correction schemes), cloud service customer numbers, industry pilot project counts, and commercial contract amounts.

- Dynamic Adjustment and Stop-Loss/Take-Profit: Pure quantum concept stocks are volatile; it is recommended to set strict risk management and rebalancing mechanisms.

- Thematic Investment and Long-Term Perspective: Quantum computing is a medium-to-long-term theme, suitable as a strategic position; short-term volatility should not be over-amplified.

- Technical Path and Engineering Risks: Multiple technical routes are parallel, with uncertainty of route iteration and elimination.

- Commercialization Timeline Risks: Uncertainty in downstream large-scale deployment time and form, generally long profit timelines.

- Valuation and Liquidity Risks: Pure quantum targets are volatile; liquidity may be highly correlated with market capitalization.

- Geopolitical and Compliance Risks: Supply chain, export controls, intellectual property, and other factors may affect the industry structure.

- Current public information mostly covers the overall industry size and performance of some overseas targets; for:

- Systematic sorting of quantum-related stocks in A-shares/H-shares;

- Competitiveness comparison of upstream sub-segments (materials, equipment, manufacturing) and key companies;

- Quantitative analysis of pilot progress, cooperation models, and market size of downstream application scenarios;

- Horizontal comparison and retrospective verification of financial and valuation indicators.

- It is recommended to enable the deep research mode, which can use professional brokerage databases for deeper industry chain mapping, target screening, and investment value assessment to provide more systematic data and case support for investment decisions.

[1] Yahoo Finance - Quantum Investing in 2026: Hit the Jackpot With the Best 3 Stocks (https://finance.yahoo.com/news/quantum-investing-2026-hit-jackpot-200000939.html) (Report on global market forecasts and targets, 2025-2035 CAGR 35.2%, market from $800 million in 2025 to $1.08 billion in 2026; mentions IonQ, IBM, NVIDIA, etc.)

[2] Yahoo Finance - 2026 Big Tech Quantum Bets: IBM and Amazon’s Edge (https://finance.yahoo.com/news/2026-big-tech-quantum-bets-200000979.html) (Discusses volatility of pure quantum targets in 2025 and progress of large tech companies’ quantum businesses)

[3] Yahoo Finance - 3 Incredible Growth Stocks to Buy Now (Case introduction of Rigetti Computing, showing volatility of pure quantum targets)

[4] Forbes - 7 Quantum Computing Trends That Will Shape Every Industry in 2026 (https://www.forbes.com/sites/bernardmarr/2025/12/11/7-quantum-computing-trends-that-will-shape-every-industry-in-2026/) (Industry trends and commercialization nodes)

[5] Forbes - Quantum Computing Mega-Rounds Continue As Quantum Art Raises $100 Million (https://www.forbes.com/sites/johnkoetsier/2025/12/11/quantum-computing-mega-rounds-continue-as-quantum-art-raises-100-million/) (Industry financing and capital investment dynamics)

[6] Yahoo Finance - How QUBT Prioritizes Long-term Scalability Over Near-term Sales (https://finance.yahoo.com/news/qubt-prioritizes-long-term-scalability-123200798.html) (Reflects the industry’s trade-off between long-cycle investment and short-term commercialization)

[7] Hong Kong Yahoo Finance - IonQ是能讓人一夕致富的股票嗎? (https://hk.finance.yahoo.com/news/ionq是能讓人-夕致富的股票嗎-111500031.html) (Introduces IonQ’s ion trap route, revenue growth and loss expansion, comparing volatility and risks of pure quantum targets)

Note: Market size and industry chain structure descriptions also refer to CITIC Securities Research Report and PhotonBox Research Institute data provided by users; global overall forecasts and specific company market performance are based on web search results.

注:Market scale及产业链结构描述亦参考用户提供的中信建投研报与光子盒研究院数据,全球总体预测与具体公司市场表现以网络搜索结果为依据。

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.