Tesla's Sales Surpassed by BYD for the First Time: In-depth Analysis of Valuation Impact and Global Electric Vehicle Market Landscape

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

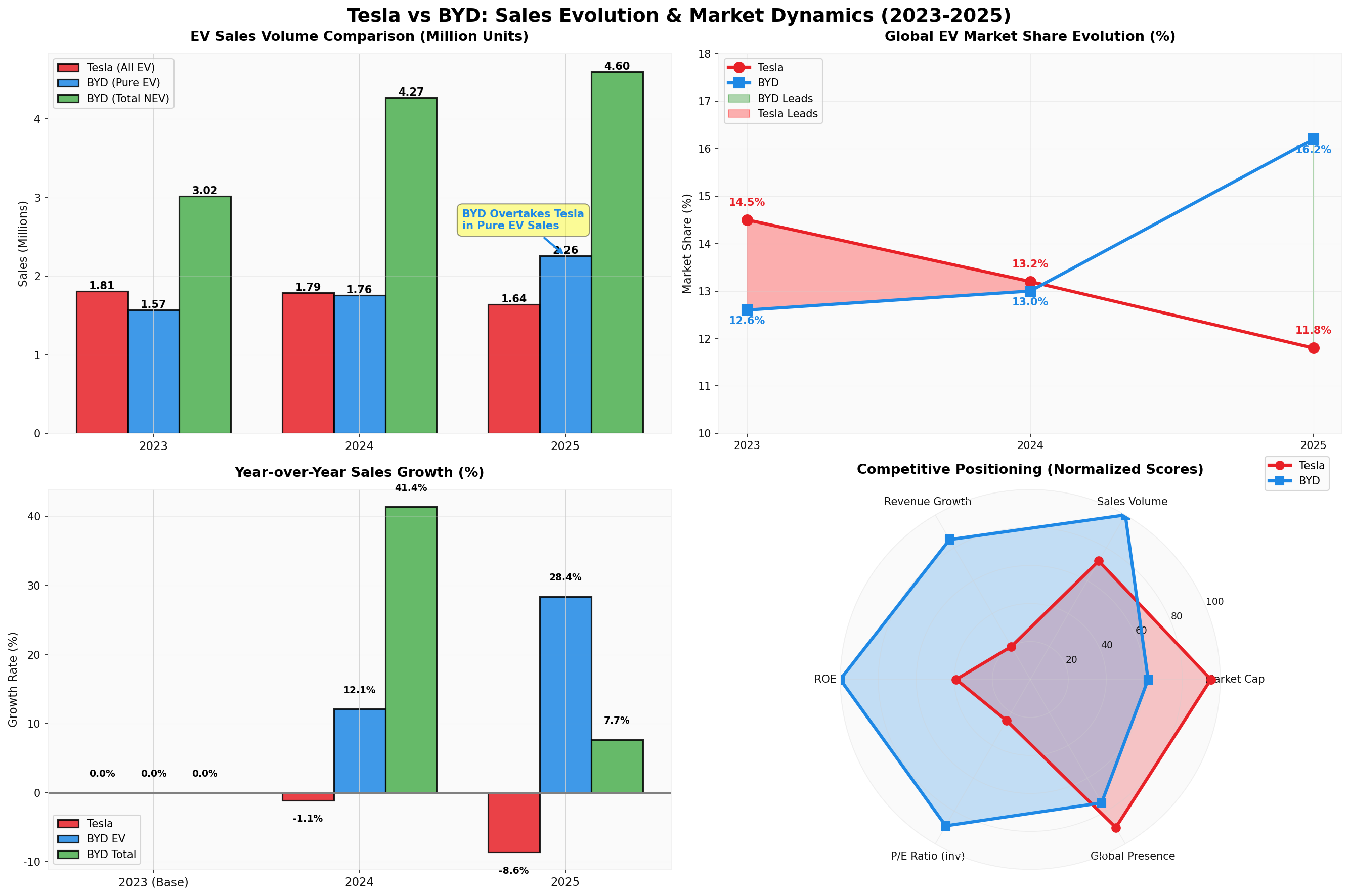

On January 2, 2025, Tesla released its full-year delivery data, delivering 1.636 million vehicles globally, a year-on-year decrease of approximately 8.6%. Meanwhile, BYD’s pure electric vehicle sales reached 2.26 million units in 2025, a year-on-year increase of 28%, and total sales (including plug-in hybrids) reached 4.6 million units, a year-on-year increase of 7.7% [1][2][3]. This marks the first time BYD has surpassed Tesla in annual pure electric vehicle sales, ending Tesla’s over-decade-long leadership in the global electric vehicle market.

- Stock Price: $438.07 (closing on January 3, 2026) [0]

- Market Capitalization: $1.41 trillion [0]

- P/E Ratio: 230.56x (extremely high valuation) [0]

- P/B Ratio:17.68x [0]

-

DCF Intrinsic Value Analysisshows that even in the most optimistic scenario, Tesla’s fair value is only $188.20, which is still a 57% downside from the current stock price [0]. In the conservative and base scenarios, the fair values are $141.11 and $147.25 respectively, meaning the current valuation is overestimated by 63-67% [0].

-

Direct Impact of Sales Decline on Valuation:

- 2025 sales decreased by 8.6%, marking the second consecutive year of negative growth [2][3]

- Severe setbacks in the European market: December sales in France plummeted by 66%, and annual sales in Sweden dropped by 67% [2]

- Market share fell from 14.5% in 2023 to 11.8% in 2025 [4]

-

Analyst Opinion Divide:

- Median Target Price: $483.00 (+10.3% upside potential) [0]

- Rating Distribution: 38.8% Buy, 40.0% Hold, 21.2% Sell [0]

- Recent Analyst Actions: Multiple institutions maintained “Hold” ratings, reflecting concerns about growth prospects [0]

- High P/E Ratio (230.56x)requires strong growth support, but negative sales growth challenges this logic [0]

- Free Cash Flow: $3.581 billion (2024), positive but with weak growth [0]

- ROE only 6.91%, far lower than BYD’s 17.62% [0]

- Hong Kong Stock Price: HK$98.75 [0]

- Market Capitalization: HK$930.8 billion (approx. $119.3 billion) [0]

- P/E Ratio:63.71x (relatively reasonable) [0]

- P/B Ratio:4.05x [0]

-

DCF Valuation Shows Significant Upside: In the base scenario, fair value is HK$3,073.67, representing a 3,012% upside from the current stock price; even in the conservative scenario, fair value reaches HK$2,335.46, with a 2,265% upside [0].

-

Strong Sales Growth:

- Pure electric vehicle sales of 2.26 million units, up 28% year-on-year [2][3]

- Total sales of 4.6 million units, growing for four consecutive years [2]

- Overseas sales surged by 150.7% to 1.0461 million units [2]

-

Better Financial Fundamentals:

- ROE of 17.62%, 2.5x that of Tesla [0]

- Net Profit Margin of 4.56%, close to Tesla’s 5.51% [0]

- Revenue Growth of 49.3%(5-year average), far exceeding Tesla [0]

- P/E Ratio of 63.71x is not cheap, but considering 28% sales growth and strong profitability, the valuation is relatively reasonable [0]

- P/S Ratio of only 1.05x, far lower than Tesla’s 14.75x [0]

- Technical analysis shows a sideways consolidation, with bullish KDJ and MACD indicators [0]

-

Dominance in the Chinese Market:

- BYD holds an absolute advantage in China’s new energy vehicle market

- China’s new energy vehicle penetration rate exceeded 50% in 2025, with BYD being the biggest beneficiary [4]

- Tesla faces fierce competition in China from local brands like BYD, NIO, Li Auto, and Xiaomi [4]

-

Differences in Product Strategy:

- BYD: “Two-Legged Walking” strategy - pure electric + plug-in hybrid, covering a wider price range and market segments

- Tesla: Pure electric route with a relatively single product line, where Model Y/Model 3 account for too high a proportion

- BYD has a richer product matrix, covering from entry-level to luxury segments

-

Supply Chain and Cost Advantages:

- BYD has a high degree of vertical integration, producing core components like batteries and chips independently

- Blade Battery technology leads the industry, combining cost advantages and safety

- Tesla faces supply chain challenges and production capacity bottlenecks

-

Geopolitical and Brand Factors:

- Tesla faced consumer boycotts in the European market due to Musk’s political stance, leading to plummeting sales in France and Sweden [2]

- BYD expanded rapidly in Europe, Southeast Asia, and Latin America, avoiding Sino-US trade frictions [2][3]

- BYD’s overseas sales reached 1.0461 million units in 2025, up 150.7% year-on-year [2]

- Growth Pressure: Analysts generally expect sales to remain under pressure in 2026

- FSD Commercialization: Whether the Full Self-Driving system can obtain regulatory approval in Europe and China is a key variable

- New Product Cycle: Whether new models like Model YL can stimulate demand remains to be seen [4]

- Valuation Restructuring: If sales continue to be weak, high valuations will be difficult to maintain

- Overseas Expansion: Targeting overseas sales of 1.5-1.6 million units in 2026 [3]

- Total Sales Target: Analysts expect total sales to reach 5.3 million units in 2026 [3]

- Technological Leadership: Continuous investment in batteries, intelligence, and other areas

- Brand Upward Movement: High-end brands like Yangwang and Denza are gradually gaining market recognition

- Multipolar Competition: Chinese brands (BYD, NIO, Li Auto, etc.) are rising, and Tesla is no longer the only leader

- Price War Continues: Severe “involution” in the Chinese market may spread to the global market

- Diversification of Technical Routes: Coexistence of multiple technical routes such as pure electric, plug-in hybrid, and extended-range

- Regional Characteristics:

- China: BYD’s absolute leadership

- Europe: Tesla’s setbacks and rapid penetration of Chinese brands

- US: Tesla is still favored but faces competition from local brands

⚠️

- Two consecutive years of sales decline, weakening growth momentum

- Brand damage in the European market, difficult to recover in the short term

- High P/E (230x) requires strong growth support, but current fundamentals do not support it

- Musk’s political stance has a negative impact on the brand

- Breakthrough in FSD technology and global regulatory approval

- Success of new models (Model 2, Cybertruck production ramp-up)

- Rapid growth of energy storage business

✓

✓

✓

- Intensified competition in the Chinese market, leading to price wars due to “involution”

- Overseas expansion faces trade barriers and geopolitical risks

- Growth slowdown: 2025 total sales growth rate of only 7.7%, the lowest in nearly 5 years [2]

- Four consecutive months of monthly sales decline, with a 18.2% year-on-year plummet in December [2]

- Continuous expansion of overseas markets

- Breakthrough in high-end brands

- New growth points from battery technology supply to external parties

Tesla’s sales being surpassed by BYD marks the

-

Valuation Restructuring: Tesla’s high valuation faces severe challenges and needs to prove the rationality of its premium with performance; BYD’s valuation is relatively reasonable and has long-term investment value.

-

Competition Landscape: From “Tesla’s dominance” to “Sino-US dual hegemony”, the collective rise of Chinese brands has changed the global competition landscape.

-

Investment Logic:

- Short-term: Tesla faces valuation adjustment pressure, while BYD has stronger fundamentals

- Long-term: Tesla’s FSD technology and brand value are still core assets; BYD’s scale effect and cost advantages will drive sustained growth

-

Market Insights: The electric vehicle industry has entered a comprehensive competition stage of“Product Strength + Cost Control + Brand Strength”, and a single advantage is difficult to maintain long-term leadership.

For investors, it is necessary to re-evaluate Tesla’s valuation logic and closely monitor the execution of BYD’s overseas expansion and the sustainability of profitability. The competition in the global electric vehicle market has just begun, and 2026 will be a critical year.

[0] Gilin API Data - Includes real-time quotes, financial data, DCF valuation, technical analysis for TSLA and 1211.HK

[1] Yahoo Finance - “Tesla is officially smaller than China’s BYD in EV sales” (https://finance.yahoo.com/news/tesla-officially-smaller-china-byd-153000113.html)

[2] Yahoo Finance Hong Kong - “BYD’s Electric Vehicle Sales Surpass Tesla, Selling 2.25 Million Units in 2025 with 28% Growth” (https://hk.finance.yahoo.com/news/比亞迪電車銷量拋離特斯拉-2025年賣225萬輛-上升28-183100046.html)

[3] Yahoo Finance - “China’s BYD electric cars beat Tesla deliveries in 2025” (https://ca.finance.yahoo.com/news/chinas-byd-electric-cars-beat-193748131.html)

[4] Wall Street Journal Chinese Edition - “BYD’s 2025 Sales Growth Slows, But Still Expected to Surpass Tesla” (https://cn.wsj.com/articles/比亚迪2025年銷量增长放緩-但仍料將超越特斯拉-dd35c5c5)

[5] Yahoo Finance - “Tesla loses EV crown to China’s BYD in 2025 as sales slip” (https://uk.finance.yahoo.com/news/tesla-sales-slip-loses-ev-144645117.html)

[6] Yahoo Finance - “BYD sells 4.6 mil vehicles in 2025, meets revised sales goal” (https://sg.finance.yahoo.com/news/byd-sells-4-6-mil-044129189.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.