In-depth Analysis of Netflix's Shortening of Warner Bros.' Theatrical Window to 17 Days and Its Impact on AMC and the Industry Competitive Landscape

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to media reports, in the process of advancing its acquisition of Warner Bros. (WBD), Netflix plans to shorten the exclusive theatrical window from the industry’s usual approximately 45 days to 17 days. This news is regarded by the industry as a radical strategic shift that may “crush the theater business” [1][2]. Meanwhile, public information shows that Netflix officially stated that it will respect existing theatrical distribution contracts until 2029 after completing the acquisition [1]. Currently, the transaction is still in the process of advancement and regulatory review, and no official announcement of the completed merger has been seen; the following analysis is based on the premise of “if this window strategy is implemented” and uses public data for deduction.

-

Netflix (NFLX): Current stock price is approximately $90.99, market capitalization is about $38.547 billion, 2025 stock price was relatively stable overall (about $89.55 at the start of the year, $93.76 at the end, with an interval increase of +4.7%); TTM net profit margin is approximately 24.05%, operating profit margin about 29.14%, ROE around 41.86%, current ratio about 1.33—profitability and liquidity are robust [0][6]. The median analyst consensus target price is approximately $136.50 (still has significant upside potential from current levels), with ratings mostly leaning towards “Buy” [0][6].

-

AMC (AMC): Current stock price is approximately $1.61, market capitalization about $826 million; 2025 stock price was significantly under pressure (about $4.00 at the start of the year, $1.56 at the end, with an interval drop of approximately -61.0%), and volatility (daily standard deviation) is higher than NFLX (about 3.46% vs. 2.14%) [0][7]. TTM net profit margin is approximately -13.16%, operating profit margin about -0.26%, current ratio around 0.39—indicating heavy cash flow pressure and debt burden [0][7].

-

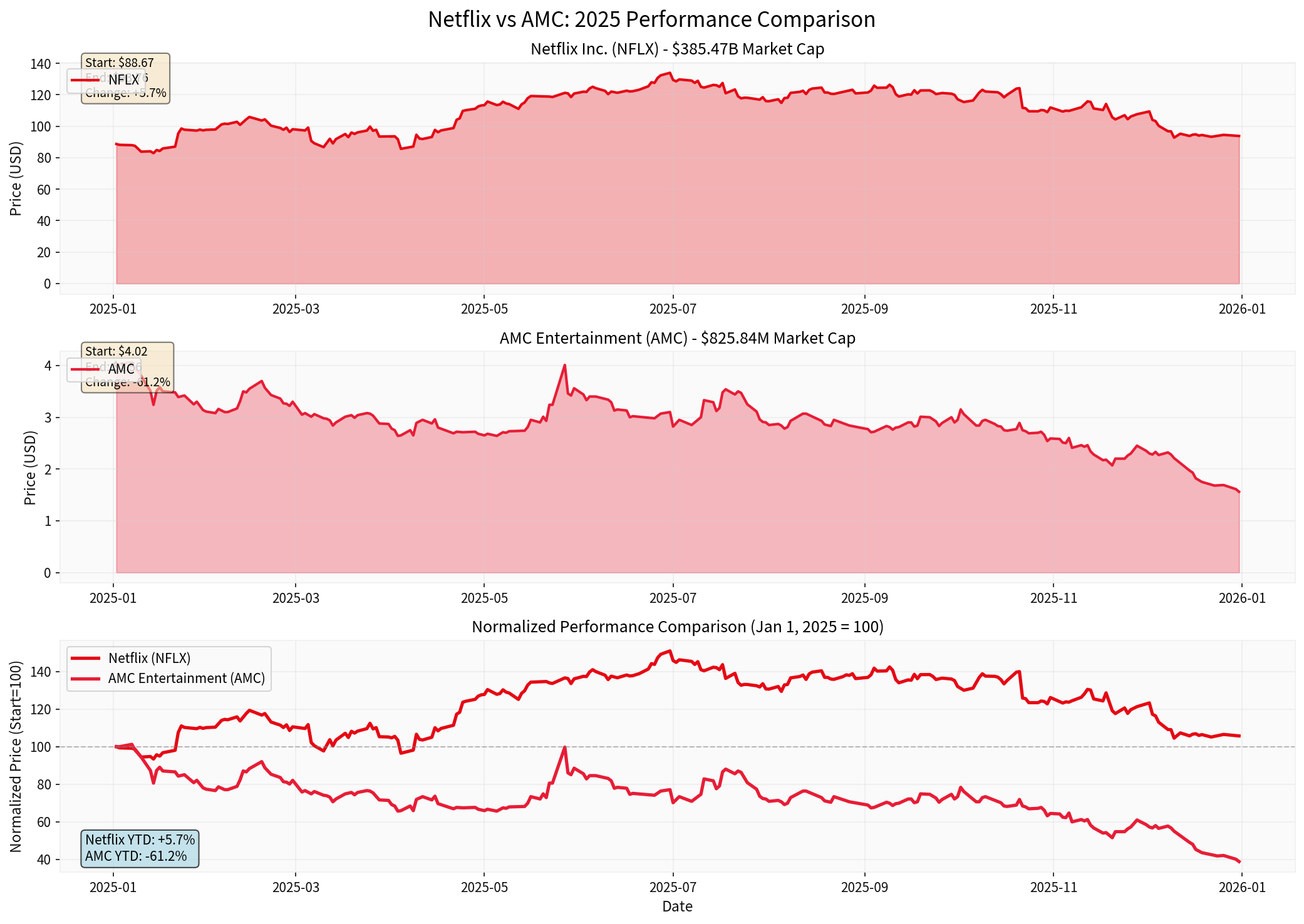

Trend comparison see the following chart (2025 daily data and normalized comparison):

- X-axis: Date (2025-01-01 to 2025-12-31)

- Y-axis: USD price (top two charts) and normalized price=100 (bottom chart)

- Legend and key notes: NFLX was relatively stable throughout the year; AMC declined throughout the year and significantly underperformed; the normalized chart clearly shows the divergence in performance between the two companies in 2025 [0][6][7].

-

AMC’s latest quarter (as of 2025-11-05) revenue was approximately $1.3 billion, net loss expanded; 2025Q1 revenue decreased by 9.3% YoY to $862.5 million, with significant cash flow and debt management pressure [0][5].

- The significant compression of the window (from 45 days to 17 days) means a shorter “exclusive theatrical period”, which may accelerate the migration of audiences to home platforms, weaken the word-of-mouth fermentation in the opening weekend, and reduce the long-tail screening cycle [1][3].

- The industry and media generally believe that a shorter window will have a greater impact on non-serialized, original, and medium-small budget films, possibly leading to “more film failures”, pushing up theater elimination and average ticket price pressure [3].

- AMC’s revenue is highly dependent on box office and on-site consumption: 2024 fiscal year ticket revenue accounted for approximately 55.2%, catering about 35.0%, other theater-related about 6.9%, and screen advertising about 2.9% [0][7]. The shortening of the window will directly weaken the peak and sustainability of ticket sales and high-frequency on-site consumption (food and beverages), putting pressure on core revenue.

- AMC currently has heavy liabilities: as of the end of Q3 2025, cash was approximately $366 million and debt about $4 billion (from public sources) [5]; in July 2025, the company carried out debt restructuring, extending the maturity date of about $2.4 billion in debt to 2029-2030 and converting part of it into equity, alleviating the 2026 “debt wall”, but further contraction of box office revenue under high leverage will squeeze its interest coverage and free cash flow [5].

- Existing financial health indicators are weak (e.g., current ratio of 0.39) [0][7]; if key studios (such as WB) adopt a shorter window, it may weaken theaters’ bargaining power in box office revenue sharing and scheduling negotiations, thereby affecting cash flow expectations and refinancing costs.

- To cope with the diversion pressure brought by the “shortening of the window”, AMC needs to focus more on differentiated experiences such as large visual effects, high-end formats like IMAX/Dolby, live events, and concert films to enhance “must-see” appeal and irreplaceability. Industry media also emphasize the necessity of improving customer experience and equipment upgrades [5].

- Netflix’s strategic focus is “prioritizing member services”; in the short term, theaters serve more as marketing and word-of-mouth amplifiers [1][2]. Integrating WB’s massive film library and content IP into the global streaming system will strengthen its control over content distribution channels and member stickiness [2].

- For theaters: If the 17-day window becomes a new paradigm for top studios, it will further compress the “exclusive theater dividend”, forcing theaters to transform from “screening venues” to “social and experience destinations” [1][3].

- For content ecosystem and regulation: Industry organizations and studios call on regulators to closely monitor the long-term impact of this transaction on the distribution ecosystem [2]. If the window is significantly shortened, it may reshape the film tiered distribution strategy (e.g., blockbusters still adhere to longer windows, while medium-small films use shorter ones), promoting a re-negotiation between studios, platforms, and theaters.

- If Netflix-WB’s window shortening to 17 days is implemented, it will put additional pressure on AMC’s profit model, especially a greater impact on the business model that relies on long-tail screenings and on-site consumption [0][7][3]. Current financial data (negative profit margin, low liquidity, high leverage) shows its limited ability to withstand pressure; any box office loss will amplify debt and cash flow risks [0][7].

- The 2025 stock price and fundamental comparison already reflect the divergence trend between the two companies: NFLX’s stable profitability and strong cash flow support its “content + membership subscription” model; AMC is in a downward channel and needs to rely on debt restructuring and experience upgrades to gain “survival time” [0][6][7][5].

- For the industry landscape, the transaction itself may mean another milestone in “content value concentration to streaming”; the shortening of the window will strengthen the “online-first” distribution tendency, and traditional theaters need to accelerate the transition to high-end formats and composite experiences to maintain differentiated value [1][3].

- The transaction and window strategy are subject to regulatory and contractual constraints (including existing theater contracts until 2029) [1]; the actual implementation time and conditions still have uncertainties.

- AMC’s survival and development still highly depend on its subsequent financing and cost control capabilities, as well as the results of negotiations with studios [0][7][5].

- Streaming growth and global macroeconomic/consumption changes also have an impact on both companies.

- [0] Gilin API Data (NFLX/AMC real-time quotes, company overview, 2025 daily data and volatility)

- [1] Exclaim / Deadline Report (Netflix’s proposed 17-day window and industry impact) https://exclaim.ca/film/article/netflix-eyeing-17-day-theatrical-window-after-it-buys-warner-bros-new-report-claims

- [2] CNBC (Netflix-WB transaction and theater window discussion) https://www.cnbc.com/2025/12/05/netflix-warner-bros-deal-theater-industry-upheaval.html

- [3] Deadline (2026 box office outlook and window discussion) https://deadline.com/2025/12/box-office-2026-preview-1236657116/

- [4] TheStreet (2025 box office and impact of Netflix-WB transaction) https://www.thestreet.com/entertainment/box-office-is-booming-in-2025-but-netflixs-82-7-billion-surprise-raises-alarms

- [5] MatrixBCG (2025Q1 AMC operation and debt pressure) https://matrixbcg.com/blogs/how-it-works/amctheatres

- [6] Netflix Inc. Company Overview and 2025 Stock Price Data (Gilin API)

- [7] AMC Entertainment Holdings, Inc. Company Overview and 2025 Stock Price Data (Gilin API)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.