2026 A-Share Capital Market Conditions and Structural Investment Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on obtained securities firm data and web search results, a systematic assessment of the 2026 A-share capital flows and structural opportunities is conducted as follows:

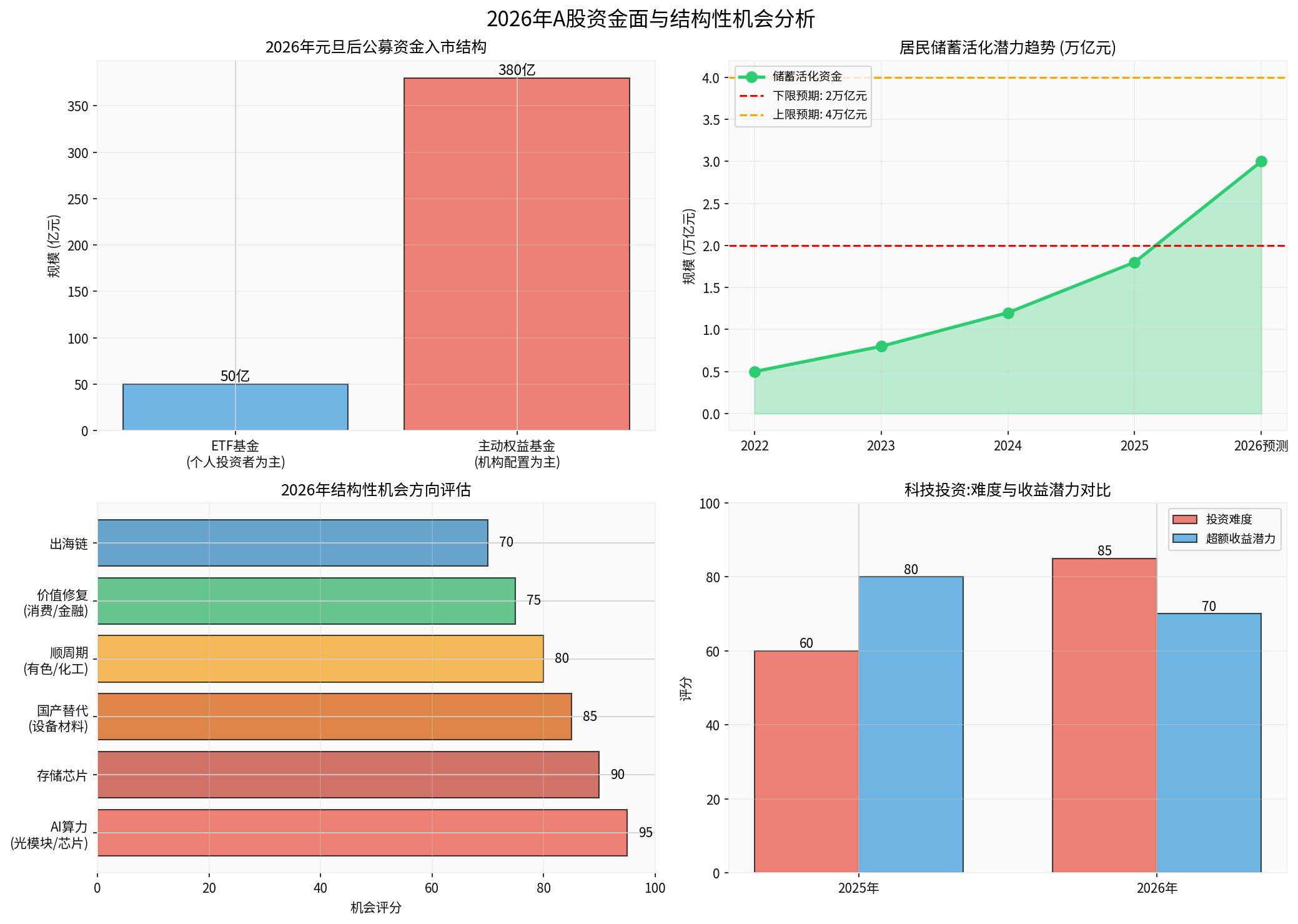

- The scale of public offering funds entering the market after New Year’s Day 2026 has exceeded 430 billion yuan: 16 upcoming ETFs amount to approximately 50 billion yuan (mainly individual investors, accounting for over 90% of shares), and more than 60 newly positioned active equity funds amount to over 380 billion yuan [1][2]. This indicates that off-exchange funds are flowing in an orderly manner, with a structure leaning toward “individuals + funds.”

- Institutional forecast: Driven by “asset shortage” and “wealth effect,” the supply and demand of A-share capital in 2026 is expected to continue a large-scale net inflow, with a scale of approximately 1.56 trillion yuan [1][2][3].

- Potential activation funds from maturing time deposits: In 2026, 20.7 trillion yuan (2-year term), 9.6 trillion yuan (3-year term), and 1.3 trillion yuan (5-year term) of resident time deposits will mature, an increase of approximately 4 trillion yuan compared to 2025 [2]. In a low-interest rate environment, some funds are expected to flow into equity assets through rights-inclusive wealth management, fund fixed investment, ETFs, and other forms.

- Institutional expectation: The non-time deposit investment field is expected to see an additional 2-4 trillion yuan of activated funds in 2026 [2][4] (see the Resident Savings Activation Potential Trend Chart [2] for details).

- Medium- to long-term path: Wealth management institutions are expected to gradually increase their equity positions (estimated to rise to 2.3% in 2026 and 3.5% in 2027), which may bring nearly 1 trillion yuan of incremental funds to the market in total [2].

- Public fund issuance: If the market effectively breaks through the loss-turning resistance level, issuance is expected to recover significantly, while the redemption pressure of active funds may ease [1][3].

- Insurance funds: Under the background of policy encouragement to steadily increase the proportion of equity allocation and lower risk factors, insurance funds are a relatively certain increment [1][3].

- Private equity and foreign capital: The profit-making effect of private equity is expected to continue to attract high-net-worth funds; the appreciation of the RMB and changes in the external interest rate environment may attract foreign capital inflows, but the absolute scale may be less than domestic capital [1][3].

- Condition A (Profit and ROE Repair): A-share revenue and profit growth bottomed out and rebounded in 2025, with ROE stabilizing; if profit growth and ROE continue to repair in 2026, the market will transition from “liquidity + risk preference-driven” to “profit improvement-driven” [5][6].

- Condition B (Valuation and Capital Rhythm): The current overall valuation is in a reasonable range, but the previous gains have been relatively sufficient; if the inflow rhythm of incremental funds is stable and profit improvement continues, the resonance of valuation expansion and profit growth will help the “slow bull” to continue [5][6][8].

- Risk warning: If external shocks, profit fulfillment falling short of expectations, or the inflow rhythm of funds slows down, index fluctuations and style switching may intensify [5][6][7].

- Valuation and game: After a year of growth, the valuations of some high-quality directions have fully reflected the prospects, leading to intensified market games and increased volatility [5][7][8].

- Critical verification period: 2026 will be a critical year for the transition from “valuation driven by capital expenditure expansion” to “performance verification relay”; most links are still in the first stage, and a few have entered the performance fulfillment period. Genuine growth and high-prosperity segments need to be carefully screened [5][7][8][13].

- Strategy shift: From generalized holding in 2025 to in-depth research on industrial rhythm, technical routes, customer stickiness, and business models in 2026 [5][7][13].

- Optical communication and high-speed upgrade: The logic of volume and price increase is clear, and the delivery capacity of leading optical module manufacturers is the key [7][10][13].

- Memory chips: Supply-demand improvement and prosperity cycle, high prosperity is expected to run through the whole year of 2026; HBM (High Bandwidth Memory) is supported by AI demand [7][10][13].

- Domestic computing power breakthrough: Under the logic of autonomy and supply chain security, domestic chip manufacturers are supplementing single-card performance with multi-card clusters, and the demand for supporting components such as liquid cooling, power supplies, PCBs, OCS, and hollow-core optical fibers is increasing [7][10][13].

- AI application landing: Looking for “killer” scenarios, focusing on vertical fields with clear commercialization paths such as intelligent driving, AI+office, and AI+education [5][7][8][13].

- Domestic substitution from “substitution” to “substitution and innovation”: The current overall localization rate of chips is about 25%, with a long-term target of about 70%, which has both space and time dimensions [12].

- Focus directions: Semiconductor equipment, materials, advanced packaging, advanced memory, and the capital expenditure and order landing rhythm related to advanced processes [12][13].

- Pro-cyclical drive: If PPI recovery resonates with the global manufacturing inventory replenishment cycle, directions such as non-ferrous metals, building materials, chemicals, steel, construction machinery, construction, and real estate chains are expected to benefit from price and profit margin repair [5][6][7][8].

- Value repair logic: After the economy enters a steady state, the value sector (traditional brand consumption, high-dividend assets, etc.) is expected to usher in a valuation repair window, characterized by “value return as the main line, superimposed with thematic performance” [5][6][7][8].

- Strategy framework: It is recommended to adopt a “core + satellite” portfolio: core positions focus on genuine growth assets with clear industrial trends and high performance visibility; satellite positions appropriately layout policy-sensitive and transactional opportunities to achieve a balance between risk and return [6].

- Position and rhythm: Attach importance to rhythm control and industry selection sensitivity, balance large and small-cap styles, and dynamically adjust weights between technology and value [5][6][7][8].

- Key monitoring: Profit fulfillment progress, capital inflow rhythm, changes in external macro and industrial policies [5][6][7][8][13].

- 2026 A-share Capital Flows and Structural Opportunities Analysis Chart: The left two sub-charts respectively show the “Post-New Year’s Day 2026 Public Offering Fund Entry Structure” (ETF ≈50 billion yuan / active equity ≈380 billion yuan) and the “Resident Savings Activation Potential Trend” (2-4 trillion yuan range); the lower two sub-charts present the “2026 Structural Opportunity Direction Score” and the “Tech Investment Difficulty / Return Potential Comparison” (investment difficulty increases, excess returns rely more on stock selection). This chart is a framework visualization based on public information collation, used to assist understanding and does not constitute trading advice [1][2][5][6][7][8][10][12][13].

[0] Jinling API Data

[1] Southern Finance / Securities Times - 2026 Public Offering Fund Entry and Savings Activation Overview (https://finance.eastmoney.com/a/202601033607663344.html)

[2] Securities China - 430 Billion Yuan Public Offering Funds Entering the Market in the New Year and Resident Savings Activation Calculation (https://wap.eastmoney.com/a/202601033607656841.html)

[3] The Paper - Shanghai Composite Index Closes with 11 Consecutive Gains, Institutions Look Forward to 2026 Slow Bull (https://m.thepaper.cn/newsDetail_forward_32294048)

[4] Institutional Views - Capital Supply and Demand and Resident Savings Activation (2025-2026) (Charts and calculations are cited from relevant reports in web search results)

[5] East Money - Institutions Analyze 2026: Slow Bull, Tech Main Line and Investment Difficulty (https://finance.eastmoney.com/a/202601023607522332.html)

[6] Tencent News - 2026 A-share Opening: Structural Opportunities Remain the Key to Success (https://news.qq.com/rain/a/20251230A01I1700)

[7] China Energy News Network - Institutions Analyze 2026: Tech Main Line and Investment Difficulty (https://www.cnenergynews.cn/article/4Pn3fL6pI9H)

[8] East Money - Shanghai Composite Index Closes with 11 Consecutive Gains and Capital Flow Outlook (https://www.163.com/dy/article/KI546VGM0519BOCB.html)

[9] East Money - 2026 A-share Upside Potential: Three Institutional Views (https://www.163.com/dy/article/KIBC5FKL0519BOCB.html)

[10] Securities Times - Institutions Are Optimistic About Computing Power Industry Chain Investment Opportunities (https://www.stcn.com/article/detail/3561660.html)

[11] Sina Finance - AI Drives Structural Transition of Semiconductor Industry (https://finance.sina.com.cn/stock/t/2025-12-30/doc-inhequpk4183074.shtml)

[12] NetEase - Tech Track 2026: AI Innovation + Autonomy (https://www.163.com/dy/article/KI48E1NG0552KYAK.html)

[13] Sina Finance - 2025 Computing Power Stocks Doubled Frequently and 2026 Valuation Digest Pressure (https://finance.sina.com.cn/jjxw/2026-01-03/doc-inheyaqf4219171.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.