Analysis of the Impact of Sustained Decline in Moutai Wholesale Prices on Kweichow Moutai's Performance and Valuation of the Liquor Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the market data provided, on January 3, 2025, the wholesale price of loose bottles of 2025 Feitian Moutai fell to

As of January 3, 2025, Kweichow Moutai (600519.SS) closed at

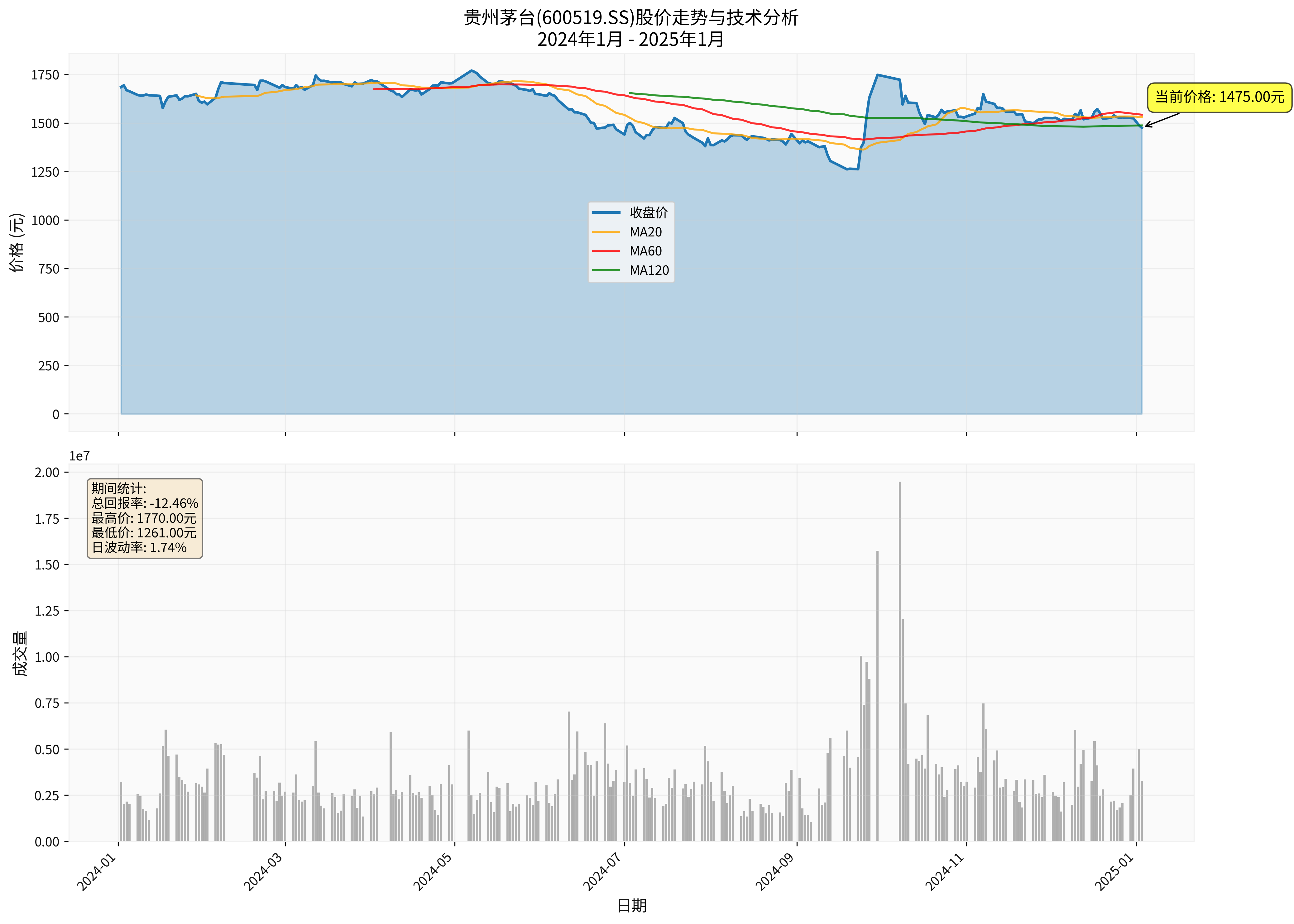

- Annual decline: -12.46% to -13.99% (different statistical calibers)[0]

- 52-week range: 1377.17 - 1657.99 yuan, currently at a 52-week low[0]

- Technical analysis: In a downward trend, MACD shows a bearish signal, KDJ and RSI indicators both show oversold areas[0]

Chart shows: From January 2024 to January 2025, Kweichow Moutai’s stock price was under sustained pressure; the current price is significantly lower than the 20-day and 60-day moving averages, and only barely above the 120-day moving average.

- Profitability: Net profit margin up to51.51%, operating profit margin up to71.37%, ROE up to36.48%[0]

- Financial health: Current ratio6.62, quick ratio5.18, showing extremely strong liquidity[0]

- Valuation level: P/E ratio19.19x, P/B ratio6.71x[0]

The direct impact of wholesale price decline on Moutai is

-

Increased direct sales ratio: Moutai has continued to expand its direct sales channel layout (iMoutai APP, etc.) in recent years, with the direct sales ratio exceeding 40%, and the direct sales channel implements an ex-factory price of 969 yuan, which is not directly affected by wholesale price fluctuations[1]

-

Sufficient profit margin: There is still a price difference of 526 yuan between the ex-factory price of 969 yuan and the wholesale price of 1495 yuan; even if the wholesale price declines, Moutai still maintains extremely high gross profit margin and net profit margin[0][1]

-

Performance resilience verified: In the first three quarters of 2025, among 20 listed liquor companies, only Moutai and Shanxi Fenjiu achieved positive growth in revenue and profit, proving their risk resistance ability[1]

Although the direct impact is limited, sustained decline in wholesale prices may still bring the following indirect impacts:

-

Channel profit compression: Dealer profit margins are compressed, which may lead to reduced enthusiasm of some dealers and affect channel push

-

Risk of brand value damage: Sustained decline in wholesale prices may affect Moutai’s “luxury goods” positioning and brand premium ability

-

Price increase space limited: Sluggish wholesale prices will limit the space and rhythm of future ex-factory price increases

-

Inventory turnover pressure: If the wholesale price continues to be lower than the dealer’s purchase cost, it may trigger channel destocking, thereby affecting the company’s delivery rhythm

According to brokerage API data and online search information, the liquor sector is undergoing

- Liquor index cumulative decline of 13.76%in 2025

- Market value of 19 constituent stocks shrank from 3.37 trillion yuan to 2.96 trillion yuan, shrinking by about 404 billion yuan[1]

- In the first three quarters, 20 A-share liquor listed companies:

- Total revenue 317.779 billion yuan, down5.90%year-on-year

- Total net profit 122.571 billion yuan, down6.93%year-on-year

- Third-quarter revenue down 18.47%year-on-year, net profit down22.22%[1]

- Total revenue

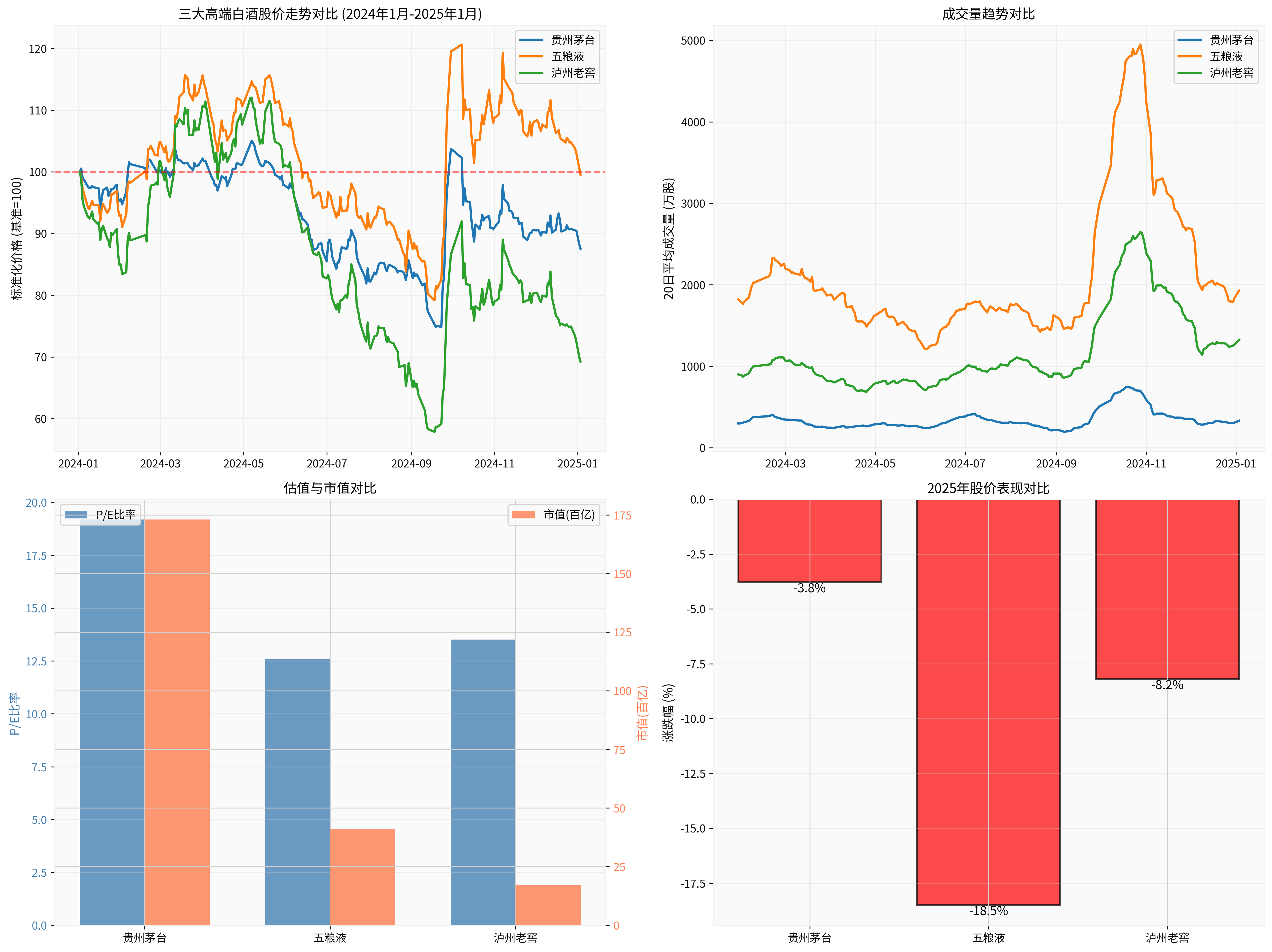

Chart shows: From January 2024 to January 2025, the stock price trends of the three major high-end liquor brands; Kweichow Moutai showed relatively resilient performance (-12.46%), while Wuliangye and Luzhou Laojiao had deeper declines.

| Company | Stock Price (yuan) | Year-to-date Performance | P/E Ratio | Market Value (100 million yuan) | Characteristics |

|---|---|---|---|---|---|

| Kweichow Moutai | 1377.18 | -3.78% |

19.19x | 17,300 | Relatively resilient to decline, highest premium |

| Wuliangye | 105.94 | -18.5% |

12.58x | 4,112 | Under valuation repair |

| Luzhou Laojiao | 116.22 | -8.2% |

13.51x | 1,708 | Between the two |

Data source: [0]

-

Moutai enjoys valuation premium: P/E 19.19x is significantly higher than Wuliangye (12.58x) and Luzhou Laojiao (13.51x), reflecting the market’s premium for leading certainty[0]

-

Industry concentration increases: 6 companies including Moutai, Wuliangye, Luzhou Laojiao, Fenjiu, Yanghe, and Gujing Gongjiu account for 88% of revenue and 95% of net profit, and the trend of head concentration is intensifying[1]

-

Mid-to-high-end and regional liquor are under greater pressure: Jinzhongzi Liquor (-26.09%), Shuijingfang (-25.33%), Yingjia Gongjiu (-23.30%) and others led the decline[1]

-

Business consumption contraction: Under economic downward pressure, the frequency of business banquets has decreased, and demand for high-end liquor has weakened

-

Weakening gift attribute: With continuous anti-corruption efforts and rational consumption, demand for gift-giving has decreased

-

Inventory digestion pressure: High channel inventory and weak terminal sales form a negative feedback loop of “wholesale price decline → reduced willingness to hoard → continued wholesale price decline”

National Bureau of Statistics data shows that China’s liquor production from January to October 2025 was

The Central Economic Work Conference proposed to “clean up unreasonable restrictive measures in the consumption field and release the potential of service consumption”, which is expected to drive the return of rigid demand scenarios for liquor to rationality and restore confidence in the capital market[1].

- Wholesale prices may continue to be under pressure, but the decline space is limited (already close to the cost support area)

- Moutai’s stock price may fluctuate and bottom out in the range of 1300-1500 yuan

- Focus on the sales situation during the spring peak season and the trend of wholesale prices

- Industry’s gradual and hierarchical recovery, high-end liquor is expected to take the lead in achieving stable prices and increasing volume[1]

- Moutai, with its brand moat and channel control, will be the first to benefit from industry recovery

- Target price: 1600-1700 yuan (corresponding to 2025 P/E of about 22-24x)

- The liquor industry has entered the “squeezed competition” stage, and the concentration of leading enterprises continues to increase

- As an absolute leader, Moutai will enjoy the dividend of increased industry concentration

- Significant value for long-term holding

- Wholesale price trend: Focus on whether the loose bottle wholesale price can stabilize in the range of 1450-1500 yuan

- Channel inventory: Pay attention to changes in dealer inventory turnover days

- Peak season sales: Actual sales situation during traditional peak seasons such as Spring Festival and Mid-Autumn Festival

- Policy changes: Implementation and effect of consumption stimulus policies

- Industry competition pattern: De-stocking progress of mid-to-high-end and regional liquor

- Macroeconomic downturn risk: Consumption recovery is less than expected

- Risk of continued decline in wholesale prices: If it falls below 1400 yuan, it may trigger systemic concerns

- Risk of intensified competition: Other high-end liquor companies may adopt more aggressive channel strategies

- Policy uncertainty: Changes in policies such as consumption tax may affect the industry’s profitability

-

On Moutai’s performance: Short-term impact is controllable, and positive growth in revenue and profit is still expected in 2025; long-term attention needs to be paid to the price increase space and channel profit recovery after the wholesale price stabilizes

-

On sector valuation: Sector valuation is already at a historical low, but differentiation is intensifying; leading Moutai enjoys a certainty premium, while mid-to-high-end and regional liquor still need time to digest inventory and repair expectations

-

Industry inflection point: A structural upward inflection point is expected in 2026, but the full recovery will show gradual and hierarchical characteristics, with high-end liquor recovering first, and mid-to-high-end and regional liquor recovering later[1]

[0] Jinling API Data - Kweichow Moutai (600519.SS) real-time quotes, company overview, financial analysis, technical analysis, historical price data

[1] Investing.com - “2025 Liquor Bids Farewell to ‘Lying Win’ Era, Moutai, Wuliangye, Luzhou Laojiao Launch Price Defense War, Dealers Shrink to Survive” (https://cn.investing.com/news/stock-market-news/article-3145146)

[2] Xinhuanet - “2025 Year-end Observation of Liquor Industry: Breaking Through in Deep Water Area, Anchoring New Growth Curve in Reconstruction” (http://www.news.cn/fortune/20251231/598b5722b80a4688922665fd844c0c4c/c.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.