Signal Analysis of Insider Stock Sales at Agios Pharmaceuticals

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

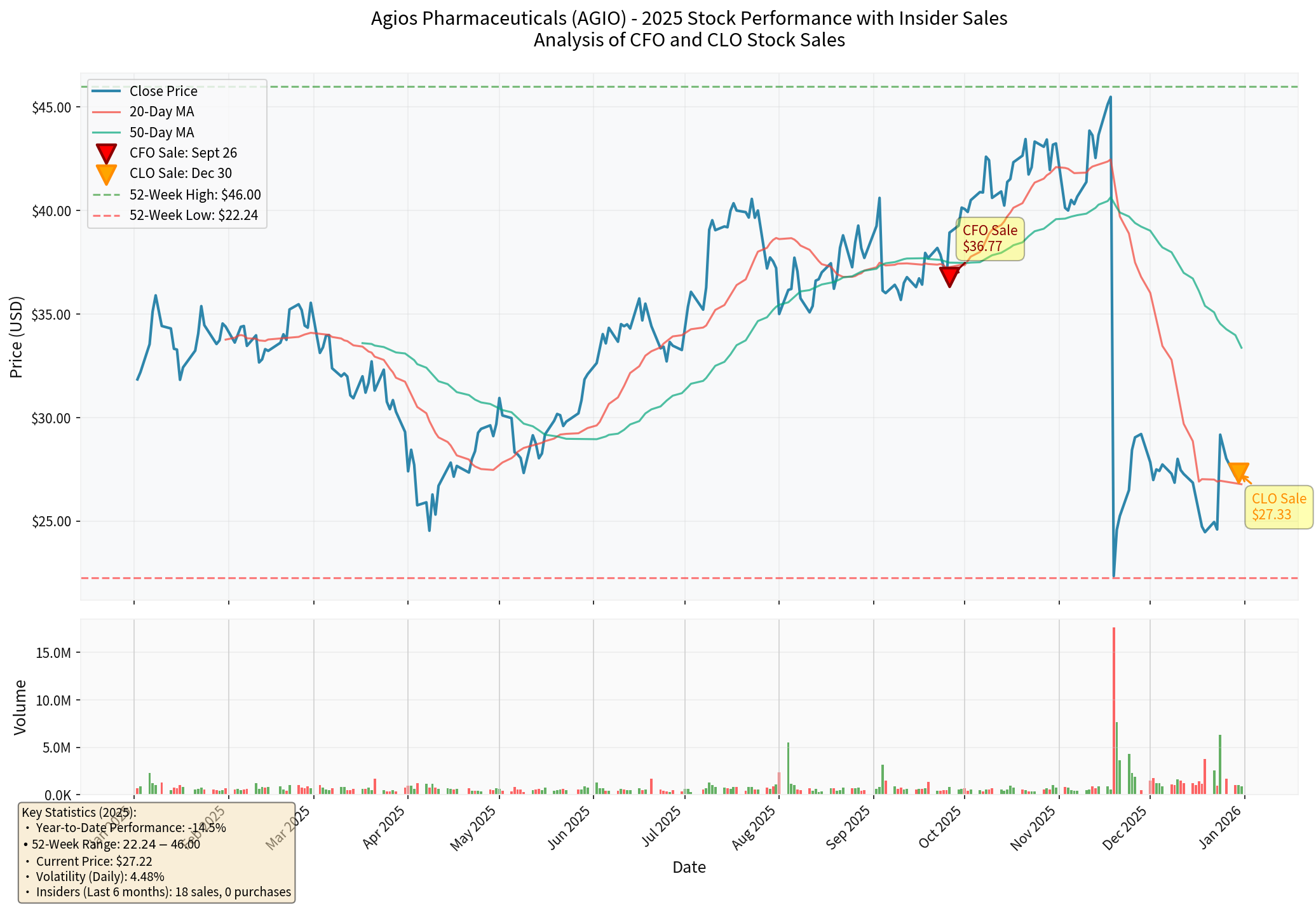

According to SEC disclosure documents, insider transactions involving Agios Pharmaceuticals (AGIO) include:

- CFO Cecilia Jonessold3,651 shares

- Average price: $36.77 per share

- Total value: $134,247

- Remaining shares after sale: 33,870 shares (worth approximately $1.245 million)

- Percentage reduction in holdings: 9.73%

- CLO James William Burnssold2,932 shares

- Value: approximately $79,427(matches the $79,000 you mentioned)

- Remaining shares after sale: 31,718 shares

- Sale percentage: approximately 8.5% of holdings

- Past 6 months: 18 insider sales, 0 purchases[2]

- This indicates insiders are in a net selling position overall

| Indicator | Value | Explanation |

|---|---|---|

| Market Cap | $1.58B | Mid-cap biotech company |

| Current Stock Price | $27.18 | - |

| Current Ratio | 13.82 | Cash-rich, no short-term risk |

| Cash Reserves | ~$1.3B | Sufficient funding for R&D [1] |

- 2025 YTD Performance: -17.06%(dropped from $32.82 to $27.22)

- Past Year: -14.64%

- 52-Week Range: $22.24 - $46.00

- Current Distance from 52-Week High: -40.9%

- Consensus Rating: Buy(22 Buys,7 Holds)

- Consensus Target Price: $39.00(+43.5% upside potential)

- Target Range: $25 - $62

According to web search research, common neutral reasons for insiders to sell stocks include:

- Executive compensation includes significant company stock and options

- Over-concentration riskis a taboo for professional investors

- Regular sales to diversify portfolios are rational wealth management

- Especially for executives about to leave or receive large options grants

- Paying exercise taxes (option exercise requires large tax payments)

- Living expense needs (housing, education expenses, etc.)

- Not all sales mean bearish views on the company’s prospects

- If executives制定了 a sale plan months in advance

- Such sales are fully程序化and do not reflect the latest internal information

- Need to check if there is the term “10b5-1” in SEC documents

Although a single small sale has limited impact, the following situations are worth警惕:

- 18 sales in 6 months, 0 purchases- this is ahighly consistent net selling trend[2]

- When multiple executives sell continuously and frequently, rather than isolated events

- May reflect internal concerns about the company’s short-term prospects or valuation

- The CFO’s September sale price ($36.77) is higher than the current price($27.18)

- This may reflect a judgment that the stock price has peaked

- But it could also be a coincidence or based on personal financial planning

A study from Virginia Tech shows that

insiders tend to sell stocks when public attention is highand buy when attention is low. This means insiders may profit from short-term market sentiment fluctuations rather than based on long-term fundamental judgments.

| Evaluation Dimension | Conclusion |

|---|---|

Amount Size |

$79k-$134k is negligible for a company with a $1.58B market cap |

Sale Percentage |

The sales by CFO and CLO account for 8.5-9.7% of their total holdings, which is a moderate reduction |

Still Holds a Large Amount |

After the sale, the CFO still holds 33,870 shares (worth approximately $920k), indicating continued confidence |

- Pattern > Single Event- Theconsistencyof the18 sales is more important than a single sale

- Lack of Insider Purchases- No executives have increased holdings at current prices, possibly thinking the stock price is not attractive enough

- Weak Stock Performance- The stock price has dropped more than 40% from its high; insiders may think the rebound space is limited

- ✅ Check SEC Form 4 documents to confirm if these sales are part of a 10b5-1 plan

- ✅ Follow the company’s quarterly earnings reports to verify if fundamentals have deteriorated

- ✅ Check recent transactions of other executives (especially the CEO)

- 🔍 If larger-scale and more frequentinsider sales occur → Increase vigilance

- 🔍 If collective selling by executivesoccurs → May be a stronger signal

- 🔍 If company fundamentals deteriorate simultaneously (R&D failure, poor sales) → Consider reducing positions

Insider Sale ($79k-$134k)

│

├─ Is it a 10b5-1 plan?

│ ├─ Yes → Neutral signal, focus on fundamentals

│ └─ No → Continue evaluation

│

├─ Is it an isolated event?

│ ├─ Yes → Limited impact

│ └─ No (this case:18 sales) → Negative signal

│

├─ Have fundamentals deteriorated?

│ ├─ Yes (current: loss but cash-rich) → Cautious

│ └─ No → Neutral to cautious

│

└─ Is the stock price overvalued?

├─ Yes (current: $27 vs target $39) → May be undervalued

└─ No → Continue holding

- Do not panic sell- The $79k-$134k sale is not enough to change the investment thesis

- But should increase vigilance- Treat insider sales as one of therisk management factors

- Closely monitor catalysts- FDA approval decision (September7) and RISE UP trial data are key [1]

-

Weigh bullish and bearish factors:

- Bullish:Cash-rich, unanimous analyst bullishness, FDA approval potential

- Bearish:Sustained insider selling, weak stock price, loss-making status

-

Recommended Strategy:

- If you believe in the company’s long-term prospects → Can buy on dips

- If worried about short-term volatility → Wait for clearer signals

- Set stop-loss- Consider setting a protective stop-loss around $22-$23

- If you believe in the company’s long-term prospects →

The $79k-$134k insider sale

- FDA approval progress of pipeline drugs

- Commercial execution status

- Cash burn rate

- Industry competitive landscape

(https://www.marketbeat.com/instant-alerts/filing-agios-pharmaceuticals-inc-agio-position-boosted-by-boothbay-fund-management-llc-2025-12-13/)

(https://www.quiverquant.com/news/Insider+Sale%3A+Chief+Legal+Officer+of+%24AGIO+Sells+2%2C932+Shares)

(https://seekingalpha.com/article/4855621-agios-pharmaceuticals-inc-agio-discusses-fda-approval-of-aqvesme)

(https://www.tikr.com/blog/how-to-track-whether-insiders-are-selling-their-stock)

(https://news.vt.edu/articles/2025/05/pamplin-investor-attention-insider-trading.html)

(https://finimize.com/content/agio-asset-snapshot)

(https://www.gurufocus.com/news/4087391/agio-analyst-andrew-berens-raises-agios-pharmaceuticals-price-target-agio-stock-news)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.