Agios Pharmaceuticals (AGIO) Insider Stock Sale Investment Signal Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to Quiver Quant’s collation of SEC Form 4, James William Burns, the company’s Chief Legal Officer (CLO), sold 2,932 shares of AGIO on December 30, 2025, with a transaction amount of approximately $79,427; the page does not provide “pre-sale holdings”, so the exact percentage of the sale cannot be calculated. The same page shows that the executive still held 31,718 shares after the sale. Quiver also mentioned that in the quarter, 109 institutions increased their holdings vs. 100 reduced (this only reflects the comparison of the number of buyers and sellers, not net inflow/outflow) [1].

On the same day, according to TradingView’s report on Form4, Brian Goff, the company’s CEO, sold 18,703 shares with a transaction amount of approximately $506,664 to fulfill the tax withholding obligation related to performance share units (PSUs). The report also noted that the CEO still directly held 136,583 shares after the sale [0].

- Commercial Milestone: On December 23, 2025, the U.S. FDA approved the company’s AQVESME™ (mitapivat) for the treatment of anemia in adults caused by alpha/beta thalassemia. This is the world’s first approved therapy for this indication, marking an important progress for the company in the rare disease field [0].

- Financial and Profit Status: The company is still in a loss-making phase. The latest disclosed quarterly report (2025-10-30) shows EPS of -$1.78 and revenue of $12.88 million; the quarter-on-quarter growth was 43.69% (see Quiver’s reference to Q3 2025) [1]. Brokerage API data shows that net margin (-895.86%) and operating margin (-1061.80%) are still negative, but the current ratio (13.82) and quick ratio (13.39) are at very robust levels [0].

- Analyst Consensus: The current stock price is approximately $27.18, with analysts’ consensus target price at $39 (implying an upside potential of about 43.5%). There are 22 ‘Buy’ ratings and 7 ‘Hold’ ratings, leading to a consensus rating of ‘Buy’ [0].

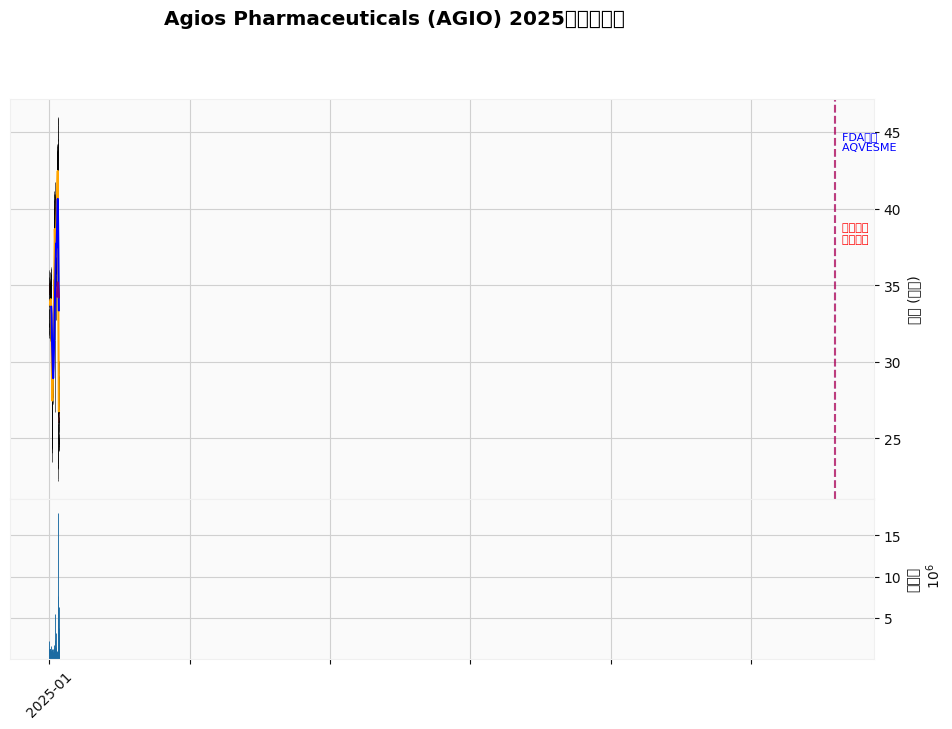

- Trend Positioning: Based on technical analysis from July 1, 2025, to December 31, 2025, the trend is judged as ‘sideways/no clear trend’, with a reference trading range of [$26.39, $28.05] [0].

- Moving Averages: As of December 31, 2025

- Closing price: $27.22

- MA20: $26.78 (slightly below closing price)

- MA50: $33.37 (significantly above closing price)

- MA200: $34.21 (significantly above closing price) [0]

- Implication: The short-term price hovers above the 20-day moving average, but the medium- and long-term moving averages still form a suppression, indicating that the market is more inclined to consolidation.

Chart Description: The chart shows that AGIO started at $31.84 at the beginning of 2025 and ended at $27.22 at the end of the year, a drop of about 14.51% for the year, with a range high of $46.00 and low of $22.24 [0]. The blue dashed line in the chart marks the FDA approval of AQVESME (December 23), and the red dashed line marks the date of insider sales (December 30).

- Nature Classification: Tax-related vs. Voluntary

- CEO’s Sale: Clearly used to fulfill the tax withholding obligation related to performance share unit exercises, usually regarded as a ‘tax-related sale’ and does not directly convey pessimistic judgments about the company’s prospects [0].

- CLO’s Sale: The public disclosure does not explicitly state whether it is tax-related, so from the ‘motivation attribute’ perspective, it is more inclined to ‘voluntary sale’. However, the amount of approximately $79,427 is limited relative to his position and the company’s size, and he still holds a substantial position (31,718 shares) after the reduction [1]. Without other evidence (such as concentrated, large-scale selling by higher-level management, or consecutive multiple sell-offs), it is not appropriate to interpret this alone as a strong negative signal.

-

Shareholding Changes and Decision Weight

After this sale, the CLO still holds 31,718 shares [1]; the CEO still holds 136,583 shares [0]. The ‘remaining equity’ of both in the company is still significant, indicating that the executive team has not made a systematic liquidation-style exit.

At the key node where the company just obtained FDA approval for a major indication, if there were fundamental concerns, we would usually see more extensive and higher-proportion executive sell-offs (and often accompanied by more intensive ‘non-tax’ attributes in Form4). This event does not reach that intensity in terms of scope and attributes. -

Market and Institutional Dimension

Quiver’s page mentions: 109 institutions increased their holdings vs.100 reduced in the quarter. This number only reflects the comparison of the number of buyers and sellers, and cannot be directly equated to net inflow/outflow or ‘institutional capital net inflow’ judgment, but at least it shows that institutions have not shown extreme polarization of bearish divergence [1].

The stock price was in a sideways range before and after the FDA approval, indicating that the market is still in a game over the ‘event-driven valuation repair’ and has not formed a volume breakthrough in a consistent direction.

- Signal Level: Weak Negative/Neutral. The CLO’s voluntary sale is not sufficient to form a strong signal given the amount and remaining holdings; the CEO’s sale is tax-related and clearly neutral in attribute.

- Current Background: The company just obtained FDA approval, marking a milestone on the product side; the financial side is still in loss, but the cash position is robust; analysts are unanimously bullish (target price $39), but the stock price is below the medium- and long-term moving averages and has not formed a trend upward movement, indicating that the market is still waiting for the verification of the pace of commercialization/revenue realization [0][1].

- Comparable Reference: During 2021-2024, the company’s stock price fluctuations and insider transactions (mostly sell-offs at high prices) showed a certain correlation, indicating that ‘concentrated sell-offs at high prices’ in history are indeed worthy of attention; however, this relatively small sell-off after an important catalyst has obvious differences from the historical typical ‘high exit’ scenario (refer to past insider transaction maps) [0].

- Short-term Dimension

- It is not appropriate to regard the single CLO sell-off of $79,000 as a leading negative for the stock price. Combined with the CEO’s tax-related sale on the same day, the nature of the event is more neutral.

- Pay attention to the launch pace of AQVESME and early prescription uptake, as well as the company’s commercial investment and pipeline advancement pace around this product in 2026—these are the core variables driving the stock price.

- Medium- and Long-term Tracking Indicators

- Commercialization Progress: Quarterly revenue growth rate, coverage of key indications and medical insurance access status.

- Cash Runway and Profit Improvement: Although there is a book loss, the cash resources are abundant; it is necessary to pay attention to when the loss will converge and the profit margin will improve.

- Pipeline and Regulation: Subsequent pipeline advancement and supplementary indication expansion.

- Insider Transaction Structure Changes: If multiple ‘non-tax, large-amount, multi-person coordinated’ sell-offs occur in the future, the signal intensity needs to be re-evaluated.

- Recommended Actions

- It is recommended to maintain the judgment framework of ‘focus on fundamental tracking, supplemented by insider transactions’: Under the current sample, the negative signal of this insider sale on investment value is limited, and it should not be used alone as the core basis for increasing or reducing holdings decisions.

- For investors who already hold positions or plan to build positions, they should focus more on the progress of commercialization realization and cash flow improvement, as well as the marginal changes in institutional holdings and analyst expectations, and then make dynamic evaluations combined with the ‘frequency, attributes and scale’ of insider transactions.

[0] Jinling API Data (real-time quotes, company overview, technical analysis, financial analysis, analysts’ consensus target price and ratings, historical prices and statistics)

[1] Quiver Quant - “Insider Sale: Chief Legal Officer of $AGIO Sells 2,932 Shares” (James William Burns sold 2,932 shares on December 30, 2025, for approximately $79,427, and still held 31,718 shares after the sale; the same page mentions 109 institutions increased holdings vs.100 reduced in the quarter, and cites Q3 2025 revenue of $12.9M, up 43.69% year-over-year.)

[2] TradingView - “AGIOS PHARMACEUTICALS CEO Brian Goff Sells Shares” (December 30, 2025: CEO sold 18,703 shares for a total of $506,664 to fulfill the tax withholding obligation related to performance share unit exercises, and still directly held 136,583 shares after the sale.)

[3] BioSpace / Investor Relations - “U.S. FDA Approves Agios’ AQVESME™ (mitapivat) for the Treatment of Anemia in Adults with Alpha- or Beta-Thalassemia” (FDA approval on December 23, 2025; AQVESME becomes the first approved therapy for anemia caused by thalassemia.)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.