Analysis of the Impact Mechanism of Stock Dividends on Investors' Actual Returns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

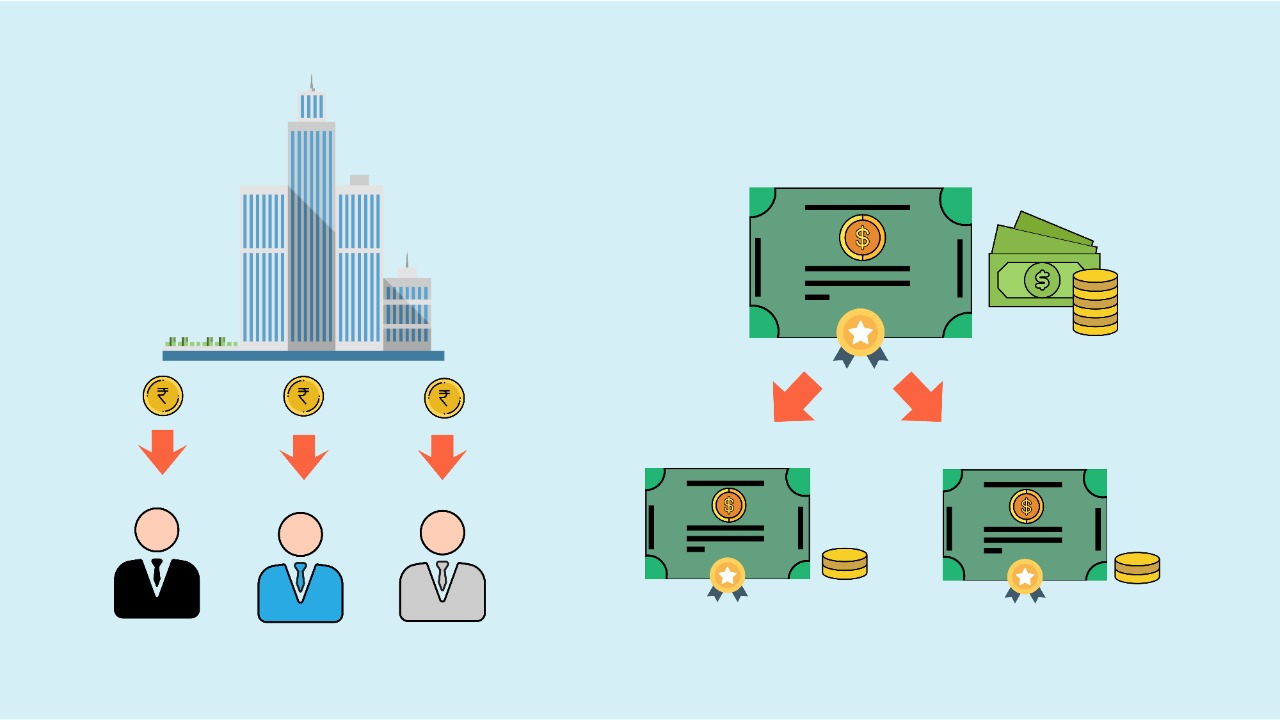

Stock dividends are essentially a

- Stock Price: 20 yuan/share

- Shares Held: 1000 shares

- Total Market Value: 20,000 yuan

- Ex-Dividend Price: 19 yuan/share (20-1)

- Stock Market Value: 19,000 yuan (19×1000)

- Cash Dividend: 1,000 yuan

- Total Assets: 20,000 yuan(19,000 + 1,000)

It can be seen that the total value of the investor’s account remains unchanged before and after the dividend [2]; the dividend only transfers part of the value from the stock market value to the cash account.

The ex-rights and ex-dividend system is based on the

- Investors holding the stock are entitled to the dividend

- Newly buying investors are not entitled to this dividend

If the stock price is not adjusted, investors who buy after the dividend will face double losses: they cannot enjoy the dividend, and may also suffer losses from the natural decline of the stock price.

After dividends are distributed, the company’s net assets per share and profitability decrease, and the stock price should reflect this change [3]. Ex-rights and ex-dividend keep the stock price consistent with the company’s actual value, avoiding market chaos.

Major securities markets such as the United States, Japan, Hong Kong, and Taiwan all adopt the ex-rights and ex-dividend system [1], which is a globally accepted practice.

| Item | Before Dividend | After Dividend |

|---|---|---|

| Stock Market Value | 100% | Decrease by Dividend Amount |

| Cash Account | 0 | Increase by Dividend Amount |

Total Assets |

Unchanged | Unchanged |

-

Dividend Tax Burden

- Holding period less than 1 month: Tax rate 20%

- Holding period 1 month to 1 year: Tax rate 10%

- Holding period over 1 year: Tax-free

Example:Holding period less than 1 month: a dividend of 1000 yuan requires a tax payment of 200 yuan, so the actual total assets will decrease to 19,800 yuan [2]. -

Rights Filling and Rights Discount

- Rights Filling: Stock price rises above ex-rights price, total assets increase

- Rights Discount: Stock price is lower than ex-rights price, total assets decrease

-

Reinvestment Income

- Long-term investors can reinvest dividends to enjoy the compound interest effect

- Dividends of high-quality companies are often accompanied by long-term stock price increases

Although dividends do not directly create wealth, high-dividend strategies are still of great significance to long-term investors:

-

Proof of Healthy Cash Flow

Companies that can distribute stable dividends usually have sufficient cash flow and sound financial conditions. -

Tool for Screening High-Quality Companies

Companies with high dividends for consecutive years (such as banks and leading liquor companies) often have sustained profitability. -

Umbrella in Bear Markets

When the market falls, dividends provide stable returns and reduce volatility. -

Accelerator for Compound Growth

Reinvesting dividends can amplify long-term returns.

-

Dividends themselves do not change the investor’s total wealth; they only convert the form of value (stock → cash).

-

Ex-rights and ex-dividend are necessary institutional arrangementsto ensure market fairness and price authenticity.

-

The true value of dividend investment lies in:

- Identifying high-quality companies

- Obtaining stable cash flow

- Long-term compound growth

- Reducing investment volatility

-

Recommendations:

- Long-term investors should focus on companies with sustainable dividends

- Avoid short-term speculation on dividend stocks (high tax burden)

- Prefer high-quality targets with “dividends + stock price growth”

Dividends are a way for listed companies to share operating results with shareholders, not a zero-sum game of “moving from left pocket to right pocket”. Only when dividends from high-quality companies are combined with long-term stock price increases can they create real excess returns for investors.

[1] Caifu Zhidao - Comprehensive Understanding of Stock Dividend, Tax Deduction, Ex-Rights and Ex-Dividend Rules: XD, XR, DR

https://www.caifuzhidao.com/104.html

[2] CSDN Blog - Why Does Stock Price Fall After Dividends? Does the Total Account Asset Really Increase?

https://blog.csdn.net/liuyun12139/article/details/147263856

[3] Morgan Stanley Securities - Investor Education Q&A: Dividends of Listed Companies

https://www.morganstanleysecurities.com.cn/investor/education-dividendpolicy.html

[4] Caifuhao - Can Arbitrage Be Done Without Ex-Dividend for Dividends?

https://caifuhao.eastmoney.com/news/20251228061555528517650

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.