In-depth Analysis of the Impact of Global Social Media Regulation Tightening on Meta, Snap and Other Platforms

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

-

Australia: The world’s first social media ban for under-16s officially took effect on December 10, 2025, covering major platforms like TikTok, Instagram, Facebook, Snapchat, etc. Non-compliant platforms face fines of up to AUD 49.5 million (about RMB 230 million) [1,2]

-

France: Plans to ban social media use for under-15s starting September 2026; the bill is expected to be submitted to the legislature for review in early January 2026 [1,2]

-

Malaysia: Bans social media use for under-16s starting January 1, 2026, and mandates electronic identity verification [1]

-

Germany: Instructs a committee to study social media restrictions for children; the final report will be submitted in autumn 2026 [1]

-

Brazil: Passed a law in September 2025 requiring age verification for under-16 users and linking to parental accounts; non-compliant platforms face fines of up to 50 million reais [4]

According to Ipsos poll data, four out of five French residents support banning social media use for children under 14 [1]. This reflects the growing global public concern about the impact of social media on adolescents’ mental health. The European Parliament also urged Brussels last month to set a minimum age limit for social media use to address adolescent mental health issues [1].

According to the latest 2025 data from Pew Research Center [5]:

| Platform | Percentage of Teens Using Daily | Percentage of “Nearly Constant” Usage |

|---|---|---|

| YouTube | 76% | 21% |

| TikTok | 61% | 21% |

| 55% | 12% | |

| Snapchat | 46% | 12% |

| 20% | 3% |

- Snapchat: 46% of teens use it daily, with 12% using it “nearly constantly”—it is one of the core platforms for teens

- Instagram: 55% of teens use it daily, with 12% using it “nearly constantly”

- Facebook: Only 20% of teens use it daily, with just 3% using it “nearly constantly”—Meta’s dependence on teen users has decreased significantly

- Europe accounts for 23.3% of Meta’s 2024 revenue (about $38.36 billion) [0]

- Europe accounts for 17.9% of Snap’s revenue (about $957 million) [0]

- If major markets like France, Germany, and the UK implement bans, it will directly affect about 300 million potential teen users

- Asia-Pacific accounts for 27.4% of Meta’s revenue ($45.11 billion) [0]

- Australia’s ban has taken effect, and Malaysia will follow in 2026, potentially affecting about 500 million teen markets

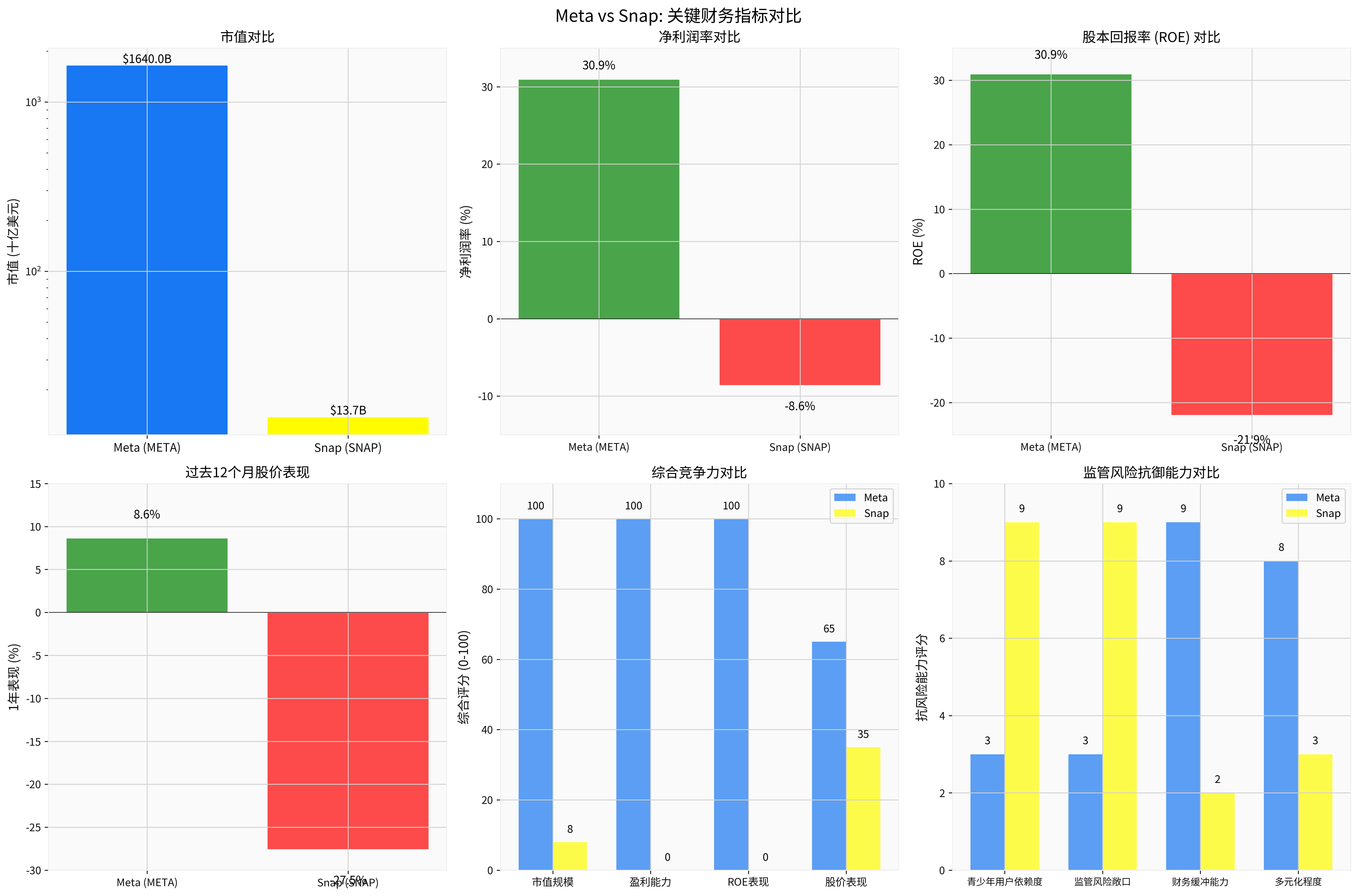

| Indicator | Meta (META) | Snap (SNAP) |

|---|---|---|

| Market Cap | $1.64 trillion | $13.7 billion |

| Net Profit Margin | 30.89% | -8.60% (Loss) |

| ROE | 30.93% | -21.93% (Negative) |

| 1-Year Stock Performance | +8.60% | -27.54% |

| Analyst Consensus | BUY (Target Price $825) | HOLD (Target Price $8.50) |

-

Teen User Proportion Estimation:

- The global 13-17 age group accounts for about 15-20% of internet users

- Assume this group accounts for 15-20% of the platform’s DAU

-

Average Revenue Per User (ARPU) Comparison:

- Meta: ARPU is about $40-50 per quarter

- Snap: ARPU is about $8-10 per quarter (significantly lower than Meta)

-

Revenue Impact Scenario Analysis:Optimistic Scenario(10% teen user attrition, 50% compliance via age verification):

- Meta: Global revenue impact <1% (about $1.6 billion)

- Snap: Global revenue impact 1-2% (about $50 million-$100 million)

Base Scenario(15% teen user attrition, 30% compliance):- Meta: Global revenue impact 1-2% (about $1.6 billion-$3.2 billion)

- Snap: Global revenue impact 2-3% (about $100 million-$150 million)

Pessimistic Scenario(20% teen user attrition, 10% compliance):- Meta: Global revenue impact 2-3% (about $3.2 billion-$4.8 billion)

- Snap: Global revenue impact 3-5% (about $150 million-$250 million)

- Initial Investment: $500 million-$1 billion (global scope)

- Annual Operating Cost: $200 million-$500 million

- Potential Fines: Such as Australia’s AUD 49.5 million, France may have similar

- Combined annual expenditure of Meta and Snap: $500 million-$1 billion

- The U.S. Virgin Islands has sued Meta, accusing it of profiting from fraudulent ads (accounting for 10% of 2024 revenue, about $16 billion) [6]

- Meta: 98.7% of revenue comes from the “Family of Apps” (Facebook, Instagram, WhatsApp, Messenger)

- Snap: 100% of revenue comes from the core platform

- Restrictions on Teen-Targeted Ads: The EU has restricted behavioral advertising targeting children

- Data Collection Restrictions: Stricter privacy protection will reduce advertising precision

- Brand Safety Concerns: Advertisers may worry about their ads appearing next to restricted content

- Loss of the teen “organic growth” engine

- Need for more expensive marketing to attract adult users

- Age verification technology increases per-user acquisition cost

- Teen users usually have the highest engagement and content creation rates

- Losing this group will reduce the overall activity of the platform

- Weakened social network effects

- Strong profitability (30.89% net profit margin) [0] provides a buffer

- Diversified product portfolio (new businesses like Reality Labs)

- Huge cash flow supports compliance investment

- Continuous losses (-8.60% net profit margin) [0], no financial buffer

- High dependence on a single product

- Market cap of only $13.7 billion—any major regulatory fine could pose an existential threat

- Low Dependence on Teens: Facebook’s teen usage rate is only 20% [5], main user group is adult

- Strong Financial Strength: $1.64 trillion market cap [0], 30.89% net profit margin [0]

- Diversified Business: Instagram, WhatsApp, Messenger, Reality Labs

- Technological Leadership: Accelerated AI investment (recently acquired AI agent startup Manus for over $2 billion) [7]

- Instagram More Affected: 55% of teens use it daily [5]

- High Regulatory Costs: Global compliance investment is expected to be $500 million-$1 billion annually

- Legal Risks: The U.S. Virgin Islands lawsuit may lead to major fines [6]

- Important European Market: Accounts for 23.3% of revenue [0], one of the most strictly regulated regions

- Short-term (1-2 years): Revenue impact of 1-3% (about $1.6 billion-$4.8 billion)

- Long-term (3-5 years): If global regulation tightens, cumulative impact could reach 5-10%

- High Dependence on Teens: 46% of teens use it daily [5], it is their core user group

- Financial Fragility: Continuous loss (-8.60% net profit margin) [0], negative ROE (-21.93%) [0]

- Single Product Risk: 100% revenue from Snapchat [0]

- Small Market Cap: $13.7 billion [0]—any major regulatory fine could pose an existential threat

- Poor Stock Performance: Down 27.54% in one year [0], reflecting market concerns

- If core teen users lose 20-30%, Snap may struggle to maintain its current business scale

- Age verification compliance costs may account for 5-10% of its annual revenue

- European fines could be up to tens of millions of dollars, causing significant financial pressure

- Achieve profitability quickly (currently still losing money)

- Expand to adult user markets

- Seek strategic investors or merger partners

- Small platforms cannot bear compliance costs and may be acquired or exit the market

- Giants like Meta and Google further consolidate their positions with financial advantages

- TikTok faces greater regulatory pressure, possibly leaving space for Meta and Snap

- Subscription Model: Reduce dependence on teen advertising

- Enterprise Services: Increase the proportion of B-side revenue

- E-commerce: More transaction commission revenue

- Hardware Ecosystem: Such as Meta’s Reality Labs

- Developed markets (Europe and the U.S.): Strict regulation, limited growth

- Emerging markets (Southeast Asia, Latin America, Africa): Relatively loose regulation, becoming growth engines

- Meta and Snap need to adjust regional strategies and strengthen emerging market layout

- Financial strength sufficient to应对 regulatory challenges

- Relatively low dependence on teen users (only 20% teen usage for Facebook) [5]

- Diversified business

- AI investment may bring new growth points

- Instagram is more affected by regulation

- High regulatory costs

- Legal litigation risks

- High revenue proportion from European market (23.3%) [0]

- High dependence on teen users (46% daily usage) [5]

- Continuous losses (-8.6% net profit margin) [0], limited financial buffer

- Single product risk

- Poor stock performance (-27.54% in one year) [0], reflecting market concerns

- Regulation may lead to stagnant or declining user growth

- Compliance costs may account for 5-10% of revenue

- European fines may pose an existential threat

- May need financing or sale

- Meta: Regulatory uncertainty may suppress stock price, providing buying opportunities

- Snap: High risk, only suitable for investors with extremely high risk tolerance

- Focus on Meta’s business diversification progress

- Focus on Snap’s profitability improvement

- Reassess after regulatory clarity

-

Irreversible Regulatory Trend: Global restrictions on teen social media use will continue to strengthen

-

Differentiated Impact: Meta is significantly less affected than Snap, mainly due to:

- Meta’s low dependence on teen users

- Meta’s strong financial strength

- Meta’s more diversified business

-

Controllable Financial Impact: For Meta, the revenue impact from regulation is expected to be 1-3%, which its strong profitability (30.89% net profit margin) [0] can absorb

-

Snap Faces Challenges: Snap’s fragile financial situation (-8.6% loss) [0] and high teen dependence (46%) [5] make it face severe challenges

- Legislative progress in European countries like France and Germany

- Possible unified legislation at the U.S. federal level

- Maturity and cost of age verification technology

- Progress of business model adjustment for Meta and Snap

- Impact of TikTok regulation on competitive landscape

- Social media regulation will become the “new normal”

- Companies with strong financial strength and diversified businesses will win

- Need to find a balance between teen protection and platform commercial interests

- Technical solutions (age verification, AI content moderation) will become key competitive factors

[0] Gilin API Data - Meta and Snap company profiles, financial indicators, analyst ratings, etc.

[1] DW - France considers legislation to ban under-15s from using social media (https://www.dw.com/zh/法国考虑立法禁止15岁以下未成年人使用网络社交媒体/a-75359792)

[2] People.cn - Following Australia? France酝酿禁止15岁以下群体使用社交媒体 (https://world.people.com.cn/n1/2026/0102/c1002-40637529.html)

[3] CNBETA - Social media regulation related reports (https://www.cnbeta.com.tw/topics/455.htm)

[4] Wikipedia - Social media age verification laws by country (https://en.wikipedia.org/wiki/Social_media_age_verification_laws_by_country)

[5] Pew Research Center - Teens, Social Media and AI Chatbots 2025 (https://www.pewresearch.org/wp-content/uploads/sites/20/2025/12/PI_2025.12.09_Teens-Social-Media-AI_REPORT.pdf)

[6] Sina Finance - Meta sued by U.S. Virgin Islands for profiting from fraudulent ads (https://finance.sina.com.cn/stock/usstock/c/2025-12-31/doc-inherrsy3894510.shtml)

[7] 24/7 Wall St - Meta Just Acquired an Incredibly Impressive AI Startup (https://247wallst.com/investing/2026/01/02/meta-just-acquired-an-incredibly-impressive-ai-startup/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.