In-Depth Analysis of Samsung SDI's Competitive Position and Loss Turnaround Capability

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

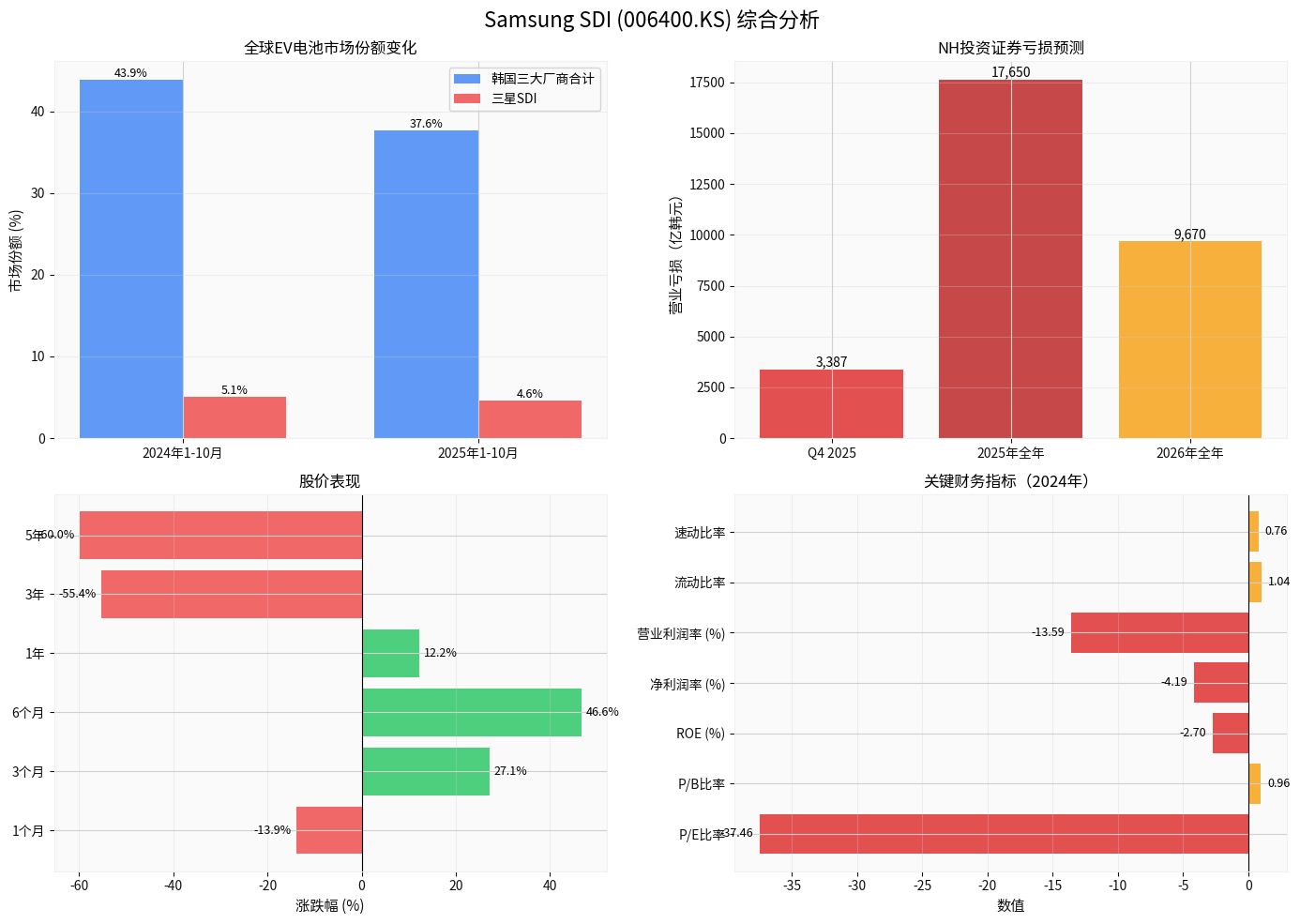

According to SNE Research data [1][2], Samsung SDI’s global EV battery installations reached 25.1 GWh in January-October 2025, a year-on-year decrease of 4.6%, with its market share dropping to only 2.7%. This performance makes it the

- Combined share of South Korea’s three major manufacturers: Plummeted from 43.9% in the same period of 2024 to 37.6% in 2025, a decrease of 6.3 percentage points

- Samsung SDI’s standalone performance: Dropped from about 5.1% in the same period last year to 4.6%, the worst performer among the three South Korean companies

- Competitor Comparison:

- LG Energy Solution: 86.5 GWh (+11.4%, market share 9.3%)

- SK On:37.7 GWh (+19.0%, market share4.0%)

- Samsung SDI:25.1 GWh (-4.6%, market share2.7%) [2]

- EU pure electric vehicle sales decreased by 5.9% year-on-year in 2024, and market demand cooled significantly

- Sales of BMW’s core model i4 declined, directly affecting Samsung SDI’s battery installations

- Audi Q6 e-tron performed moderately well, but it needs to share orders with CATL [2]

- US EV demand is weak, with growth far below the global average

- Rivian, a key customer, switched its new standard range version to LFP batteries from Gotion High-Tech, significantly reducing Samsung SDI’s supply chain share[1][2]

- Rivian’s overall sales slowed down, further dragging down Samsung SDI’s shipments

Samsung SDI has long focused on ternary lithium battery technology, but against the backdrop of the rapid explosion in global demand for LFP batteries, its transformation progress is slow:

- In Q1 2025, the global installation share of LFP power batteries exceeded 51% for the first time, becoming the market mainstream [2]

- Chinese battery enterprises (BYD, Gotion High-Tech, etc.) are rapidly expanding in overseas markets relying on their LFP technology advantages

- Samsung SDI lacks technical accumulation in the LFP field, missing this key growth opportunity[2]

To meet the localized production requirements of European and American markets, Samsung SDI has built multiple new factories in Europe and America, but:

- Surge in fixed costs: High operating costs of new factories

- Significant drop in capacity utilization: For reference, peer SK On’s capacity utilization plummeted from 95% in 2023 to 46% in 2024

- Loss of scale effect: Low capacity utilization leads to a sharp increase in unit costs, further weakening profitability [2]

According to forecasts from NH Investment & Securities analysts [3]:

| Forecast Period | Operating Loss (100 million KRW) | Market Expectation |

|---|---|---|

Q4 2025 |

3,387 | 2,690 |

Full Year 2025 |

17,650 | - |

Full Year 2026 |

9,670 | - |

- Q4 loss exceeded market expectations by 26%

- Although the loss in 2026 is expected to narrow by 45%, it still cannot turn losses into profits

- This means two consecutive years of huge losses, with enormous cash flow pressure

| Indicator | Value | Assessment |

|---|---|---|

P/E Ratio |

-37.46x | Negative value, severe loss |

P/B Ratio |

0.96x | Below book value, pessimistic market expectations |

ROE |

-2.70% | Negative shareholder equity |

Net Profit Margin |

-4.19% | Sustained loss |

Operating Profit Margin |

-13.59% | Severe loss in core business |

Current Ratio |

1.04 | Barely maintaining liquidity |

Quick Ratio |

0.76 | Insufficient short-term solvency |

- 1 month: Down 13.93%

-3 months: Up27.12% (market expectation of narrowed losses in2026)

-6 months: Up46.65%

-3-year cumulative decline:

-5-year cumulative decline:

- Current price (262,500 KRW) is far below the 52-week high (354,500 KRW) [0]

##3. Loss Turnaround Capability Assessment: Numerous Challenges, Gloomy Prospects

###1. Positive Factors

- Expansion in Energy Storage System (ESS) Field: Recently signed an agreement with a U.S. customer to supply LFP batteries over three years starting from 2027, with a contract value exceeding 2 trillion KRW (approximately 9.6 billion RMB)

- U.S. Factory Transformation: Convert part of the electric vehicle production lines to ESS battery production lines to meet local demand

- Solid-State Battery R&D: Plans to achieve mass production in2027, with a19.5% share in the solid-state battery electrolyte market [1]

- BMW (i4, i5, i7, iX) remains a major customer

- Audi Q6 e-tron performs well in the European market

- These high-end brand customers have a certain degree of stickiness [1][2]

###2. Core Challenges

- Market Demand Side: The recovery of the European and American EV markets is far from sight, and growth expectations for2025-2026 have been generally lowered

- Lagging Technology Transformation: Slow layout of LFP technology, huge gap with Chinese enterprises, unable to form competitiveness in the short term

- Difficult Capacity Structure Adjustment: The capacity utilization rate of European and American factories with huge investments is low, and the cost of transformation or closure is enormous

- Cash Flow Pressure: Two consecutive years of losses will severely consume cash reserves, affecting R&D investment and capacity expansion

- Intensified Competitive Pressure: Chinese battery enterprises (BYD, Gotion High-Tech, CALB, etc.) are rapidly expanding in the global market, with a combined share exceeding65% [2]

###3. A Turnaround May Only Be Seen After2027

- 2025-2026: Sustained losses, difficult to reverse

- 2027: Solid-state batteries may be mass-produced, and ESS business starts to contribute revenue

- 2028 and Beyond: Only then may real profit turnaround be achieved

##4. Investment Recommendations and Risk Assessment

###1. Competitive Position Rating:

Samsung SDI’s competitive position in the global EV battery market has fallen from “second-tier leader” to “marginalization risk”, and its main threats come from:

- The full rise of Chinese battery enterprises (market share over65%)

- Missed market opportunities due to wrong technology route selection

- Structural weakness in demand in European and American markets

###2. Loss Turnaround Probability Assessment:

- Loss narrowing in2026 exceeds expectations

- ESS business volume grows rapidly

- Solid-state batteries are successfully mass-produced and receive orders

- Achieve break-even in2027

- Loss narrows to967 billion KRW as scheduled in2026

- Continues to have small losses in2027

- May achieve small profits only in2028

- European and American markets further deteriorate

- Order loss from major customers accelerates

- Losses continue to expand, cash flow crisis

- Needs capital injection from parent company Samsung Group

###3. Key Observation Indicators

Investors should pay close attention to:

- Changes in Capacity Utilization: Especially the recovery of utilization rates of European and American factories

- Progress of ESS Business: Contract execution with U.S. customers

- Changes in Customer Orders: Order volume and share of BMW, Audi, and Rivian

- LFP Technology Breakthrough: Whether there are product launches and commercialization progress

- Cash Flow Status: Quarterly operating cash flow and free cash flow

##5. Conclusion

Samsung SDI is facing the most severe challenges since its establishment. Multiple negative factors such as

Although the company has laid out in the ESS business and solid-state battery field, the contribution of these businesses will not be reflected until after2027. Before that, Samsung SDI will have to continue to rely on its existing business in the traditional ternary lithium battery field, which is facing unprecedented competitive pressure.

[0] Jinling API Data

[1] SNE Research - “From Jan to Oct 2025, Non-Chinese Global EV Battery Usage…” (https://www.sneresearch.com/en/insight/release_view/548/page/0)

[2] Sina Finance - “SNE Research Heavyweight Report: Chinese Battery Enterprises Lead Strongly, Market Share of South Korea’s Three Giants…” (https://finance.sina.com.cn/roll/2025-12-03/doc-infznqyq9692032.shtml)

[3] News18a - “Samsung SDI May Continue to Lose Money Until End of2026; Weakness in U.S. and European Markets is Main Cause” (http://www.news18a.com/news/storys_221420.html)

[4] Battery Tech Online - “Top 5 Insights into the 2025 EV Battery Market” (https://www.batterytechonline.com/ev-batteries/top-5-insights-into-the-2025-ev-battery-market)

[5] Gasgoo Auto - “Top 10 International News in Battery New Energy Industry in2025: Overseas Shuffle Intensifies, Rise of Chinese Power” (https://auto.gasgoo.com/news/202601/1I70440741C501.shtml)

[6] DCF Modeling - “Breaking Down SAMSUNG SDI CO LTD Financial Health” (https://dcfmodeling.com/blogs/health/0l2tl-financial-health)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.