Analysis on Whether Fujitsu Can Break Samsung and SK Hynix's Monopoly in the HBM Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the information I have gathered, regarding whether Fujitsu’s new memory technology can break Samsung and SK Hynix’s monopoly in the HBM market, I provide the following analysis:

The current HBM market shows a

- SK Hynix: Holds a dominant position as the main supplier of Nvidia’s HBM3E chips. It has recently passed the quality certification for 12-layer HBM3E chips, becoming the second supplier to meet this standard [1][2]

- Samsung Electronics: Is catching up aggressively. In October 2025, it stated that it is “closely discussing” supplying HBM4 chips to Nvidia, with customers giving positive feedback on its competitiveness—some even saying “Samsung is back” [3][4]

- Micron Technology: As the third-largest player, its HBM inventory has been completely sold out until 2026. The HBM market is expected to grow from approximately $35 billion in 2025 to $100 billion in 2028 [5][6]

From the search results,

- SK Hynix (technology leader)

- Samsung Electronics (accelerating catch-up)

- Micron Technology (rapidly rising)

- Building new HBM capacity takes at least 2 years

- OpenAI’s Stargate project will require 900,000 wafers per month by 2029, roughly twice the current global monthly HBM capacity [7]

- SK Hynix has announced that its 2026 chips are fully sold out [8]

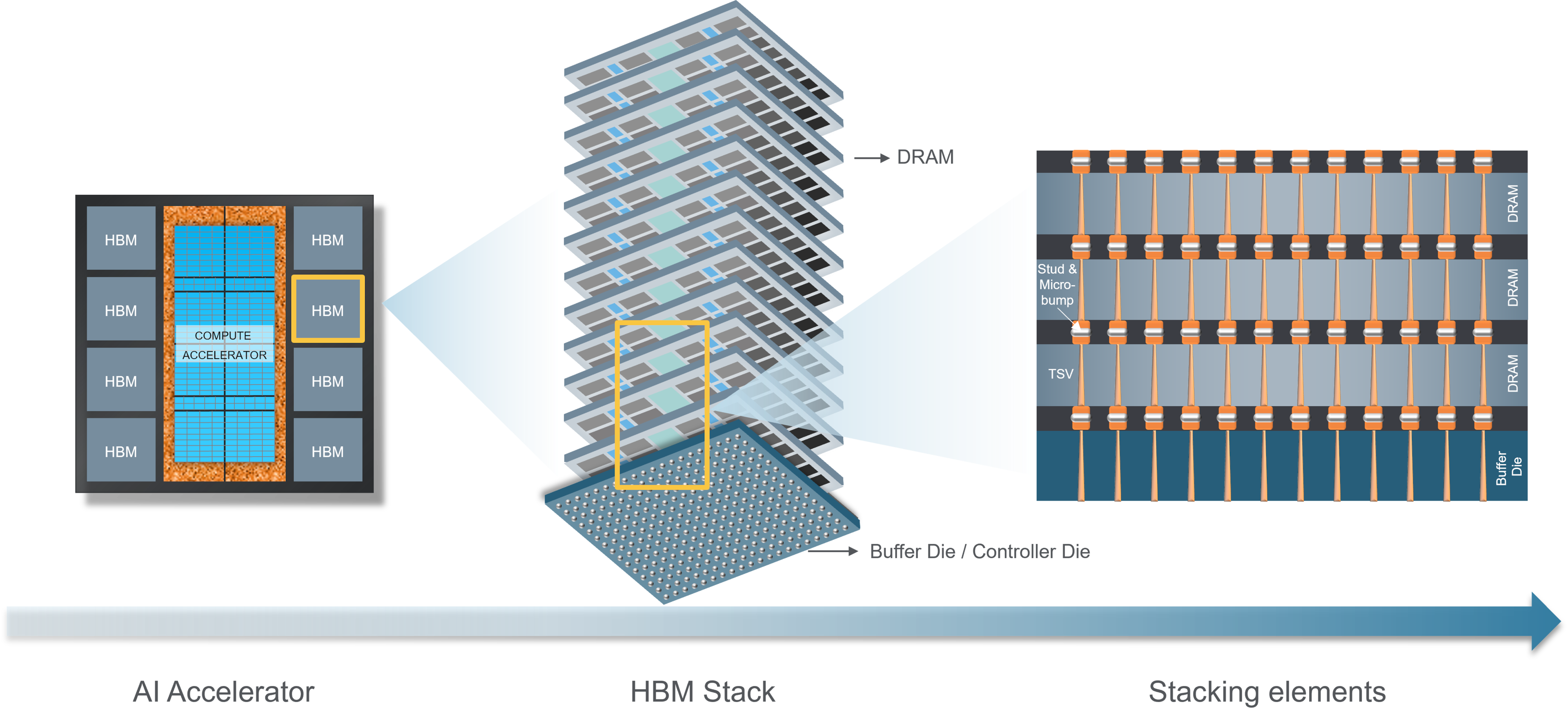

HBM manufacturing involves complex 3D stacking processes, with extremely high requirements for equipment, materials, and process technology. SK Hynix and Samsung have accumulated years of experience in this field.

- Huge Market Share Gap: Samsung and SK Hynix together hold about two-thirds of the global DRAM market share [9]

- Solidified Customer Relationships: AI chip giants like Nvidia have established deep partnerships with existing suppliers

- Lagging Capacity Expansion: New entrants struggle to quickly build sufficient capacity to meet AI demand

- Technological Innovation Opportunities: If Fujitsu can develop breakthrough memory architectures (such as new technologies like HBF high-bandwidth flash memory), it may open up new competitive tracks

- Market Expansion: The global HBM market is expected to exceed $400 billion by 2036 [10], and the huge market may provide opportunities for new entrants

- Geopolitical Factors: South Korean prosecutors’ charges of leaking technology to Chinese companies may affect the market pattern [11]

- Whether Fujitsu is developing differentiated technologies

- HBM4/HBM4E technology iteration progress

- Customer certification progress

[1] Yahoo Finance - Micron Technology Earnings (https://finance.yahoo.com/news/micron-technology-stakes-wednesday-earnings-140700703.html)

[2] Reuters - Samsung HBM4 Progress (https://www.reuters.com/world/asia-pacific/samsung-electronics-highlights-progress-hbm4-chip-supply-2026-01-02/)

[3] Yahoo Finance - Samsung Electronics HBM4 Supply (https://finance.yahoo.com/news/samsung-electronics-highlights-progress-hbm4-000428574.html)

[4] Forbes - AI Infrastructure Scarcity (https://www.forbes.com/sites/jonmarkman/2025/12/19/3-stocks-positioned-to-win-the-ai-infrastructure-scarcity-trade/)

[5] Seeking Alpha - Micron HBM Market Forecast (https://seekingalpha.com/news/4532757-micron-forecasts-100b-hbm-market-by-2028-supply-tightness-persists-through-2026)

[6] Global Village Space - AI Supply Chain Crisis (https://www.globalvillagespace.com/the-ai-frenzy-is-driving-a-new-global-supply-chain-crisis/)

[7] Reuters - AI Memory Chip Supply (https://www.reuters.com/world/china/ai-frenzy-is-driving-new-global-supply-chain-crisis-2025-12-03/)

[8] Reuters - South Korea Chip Technology Leak (https://www.reuters.com/world/asia-pacific/south-korea-charges-10-over-alleged-chip-technology-leak-chinas-cxmt-2025-12-26/)

[9] Global Village Space - Memory Market Competition (https://www.globalvillagespace.com/the-ai-frenzy-is-driving-a-new-global-supply-chain-crisis/)

[10] Yahoo Finance - Memory Technology Research Report (https://finance.yahoo.com/news/memory-storage-technology-research-report-081200557.html)

[11] Forbes - Digital Storage Projections (https://www.forbes.com/sites/tomcoughlin/2026/01/02/digital-storage-and-memory-projections-for-2026-part-2/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.