Industry Comparison Analysis of Single-Hospital Output Efficiency of Aier Eye Hospital Group Under Its Tiered Chain Model

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data, I have completed this industry comparison analysis report on the single-hospital output efficiency of Aier Eye Hospital Group under its tiered chain model.

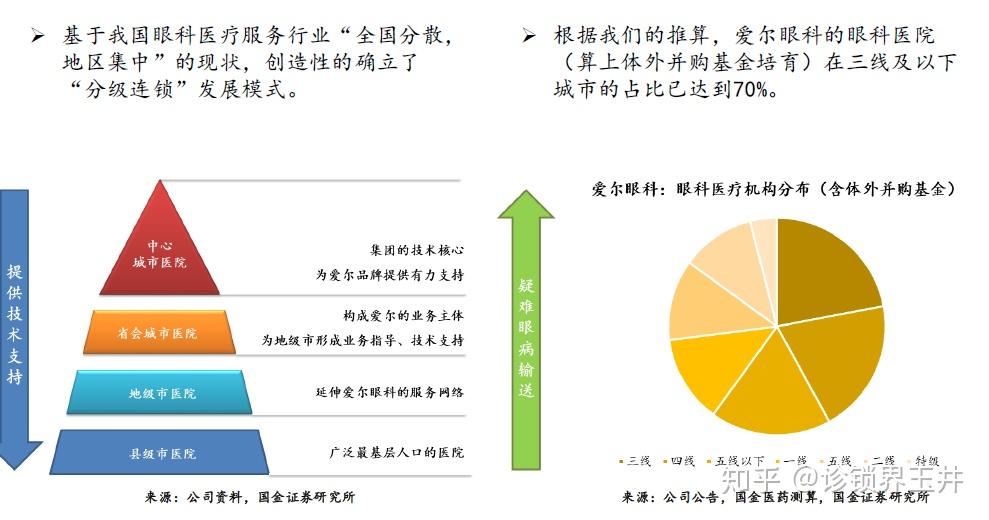

Aier Eye Hospital Group Co., Ltd. (300015.SZ), as a professional ophthalmology chain medical institution, has built a global medical service network covering mainland China, Hong Kong China, Europe, the United States, and Southeast Asia. The company’s unique “Tiered Chain” development model is the core of its business model innovation [1][2].

- First Level: Flagship hospitals in central cities (1 world-class ophthalmology medical center - Changsha Aier)

- Second Level: Provincial capital city hospitals (8 national and regional ophthalmology medical centers: Beijing, Shanghai, Guangzhou, Shenzhen, Chengdu, Chongqing, Wuhan, Shenyang)

- Third Level: Prefecture-level city hospitals

- Fourth Level: County-level hospitals

This model constructs a hierarchical diagnosis and treatment system through the functional positioning of hospitals at different levels, realizing the optimal allocation of medical resources [3]. Higher-level hospitals provide technical support to lower-level hospitals, and lower-level hospitals refer patients with complex eye diseases to higher-level hospitals, forming an efficient ophthalmology diagnosis and treatment service network.

Based on historical data analysis, Aier Eye Hospital’s single-hospital output efficiency shows the following characteristics:

| Indicator | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | Trend |

|---|---|---|---|---|---|---|---|

| Number of Hospitals (units) | 166 | 183 | 203 | 215 | 256 | 280 | ↑ |

| Single-Hospital Revenue (100 million yuan) | 0.60 | 0.65 | 0.74 | 0.75 | 0.72 | 0.71 | → |

| Single-Hospital Outpatient Visits (10,000 person-times) | 3.99 | 4.12 | 5.01 | 5.24 | 5.90 | 6.05 | ↑ |

| Single-Hospital Surgeries (10,000 cases) | 0.36 | 0.38 | 0.40 | 0.41 | 0.45 | 0.46 | ↑ |

-

Expansion Speed and Efficiency Divergence

- Annual compound growth rate (CAGR) of the number of hospitals reaches 11.02%

- Annual compound growth rate of single-hospital revenue is only 3.49%

- Single-hospital revenue growth rate was -1.16%in 2024, showing negative growth

- Annual compound growth rate (CAGR) of the number of hospitals reaches

-

Business Volume Growth but Benefit Decline

- Single-hospital outpatient visits increased from 39,900 person-times in 2019 to 60,500 person-times in 2024 (up 51.6%)

- Single-hospital surgeries increased from 3,600 cases to 4,600 cases (up 27.8%)

- However, single-hospital net profit dropped sharply from 8.3 million yuan to 3.2 million yuan, a decrease of 61.4%

-

Significant Scale Dilution Effect

- Single-hospital output efficiency continued to improve from 2019 to 2021

- After 2022, with rapid expansion, single-hospital revenue efficiency began to weaken

- The cultivation cycle of new hospitals has been prolonged, and the contribution of mature hospitals has been diluted

Based on public data, C-MER Eye Care Holdings and Pro-Eye Hospital Group are selected for comparison:

| Indicator | Aier Eye Hospital | C-MER Eye Care | Pro-Eye Hospital | Industry Benchmark Level |

|---|---|---|---|---|

| Number of Hospitals (2023) | 256 units | 57 units | 27 units | - |

| Revenue Scale (2023) | 18.5 billion yuan | ~3.8 billion yuan | ~2.1 billion yuan | - |

| Single-Hospital Revenue | 0.72 billion yuan | 0.67 billion yuan | 0.78 billion yuan | 0.75 billion yuan |

| Net Profit Margin | 14.3% | ~12% | ~8% | 12-15% |

| ROE | 14.86% | ~10% | ~8% | 12-15% |

-

Scale Leadership but Narrowing Efficiency Advantage

- Aier Eye Hospital leads far ahead in absolute scale, nearly 5 times that of C-MER Eye Care, the second place in the industry

- Single-hospital revenue (0.72 billion yuan) is basically the same as the industry benchmark level (0.75 billion yuan)

- However, the leading advantage is no longer obvious; Pro-Eye Hospital’s single-hospital revenue (0.78 billion yuan) is even higher

-

Profitability Comparison

- Aier Eye Hospital’s net profit margin (14.52%) maintains an industry-leading level

- ROE (14.86%) is significantly higher than that of comparable companies

- This indicates that existing hospitals still have competitive advantages in operational efficiency

-

Expansion Quality Evaluation

- Aier Eye Hospital’s rapid expansion has led to weakening of single-hospital efficiency indicators

- C-MER and Pro-Eye Hospital have relatively stable expansion rhythms, maintaining good single-hospital efficiency

Aier Eye Hospital faced greater operational pressure in 2024, with a significant decline in single-hospital output efficiency:

- Insufficient consumer demand, slowing growth of the ophthalmology industry [1]

- Changes in the external environment affect patients’ willingness to seek medical treatment

- Continuous rapid expansion leads to expanded management radius

- Newly built hospitals are in the cultivation period, contributing limitedly

- Increased investment in digital transformation and talent training

- Outpatient visits: 16.9407 million person-times, a year-on-year increase of 12.14% (可观 growth rate)

- Surgeries: 1.2947 million cases (a year-on-year increase of ~12%)

- Net profit attributable to parent company: 899 million yuan, a significant year-on-year decrease (affected by one-time factors)

-

Single-Hospital Output Efficiency Evaluation: Aier Eye Hospital’s single-hospital output efficiency isclose to but not yet exceedingthe industry benchmark level

- Leading in absolute scale, but the single-hospital efficiency advantage is not prominent

- Affected by the external environment in 2024, single-hospital efficiency declined

-

Tiered Chain Model Evaluation:

- ✅ Innovative model, effective resource sinking

- ✅ Extensive coverage network, significant brand effect

- ⚠️ Rapid expansion leads to efficiency dilution

- ⚠️ New hospital cultivation cycle affects short-term performance

-

Efficiency Improvement Space:

- Improve operational efficiency of existing hospitals

- Optimize new hospital cultivation strategies

- Accelerate the implementation of the “1+8+N” strategy (Changsha Aier has achieved more than 1 million surgeries)

- Intensified industry competition

- Changes in medical insurance policies

- Management challenges from rapid expansion

- Medical dispute risks

[1] Aier Eye Hospital Group Co., Ltd. 2024 Annual Report Summary (https://file.finance.qq.com/finance/hs/pdf/2025/04/25/1223271173.PDF)

[2] Innovation Casts Soul to Move Toward “New” Path, Aier Eye Hospital Wins “2024-2025 Most Respected Enterprise” (https://www.aierchina.com/jituanxinwen/1111.html)

[3] Kaiyuan Securities Research Report - Global Leader in Ophthalmology Medical Service Market (https://aigc.idigital.com.cn/djyanbao/【开源证券、公子顶点领袖】眼科医疗服务市场领导者,品牌影响力持续增强-2024-11-23.pdf)

[4] Jinling AI Financial Database - Aier Eye Hospital’s Financial Data and Operational Indicators

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.