Analysis of Benchmarking Opportunities for Kunlun Chip 30,000-Card Cluster Supercomputing Centers

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on search results, I systematically analyze the

- Deployment Scale: The cumulative deployment of Kunlun Chip’s 3rd-generation P800 series has reached tens of thousands of units, with a single cluster scale exceeding 30,000 cards

- Completed Projects: Launched a 32,000-card domestic computing power cluster

- Technological Breakthrough: The model computing utilization rate (MFU) of Baidu’s self-developed XPU 10,000-card cluster can match the effect of GPU 1,000-card clusters

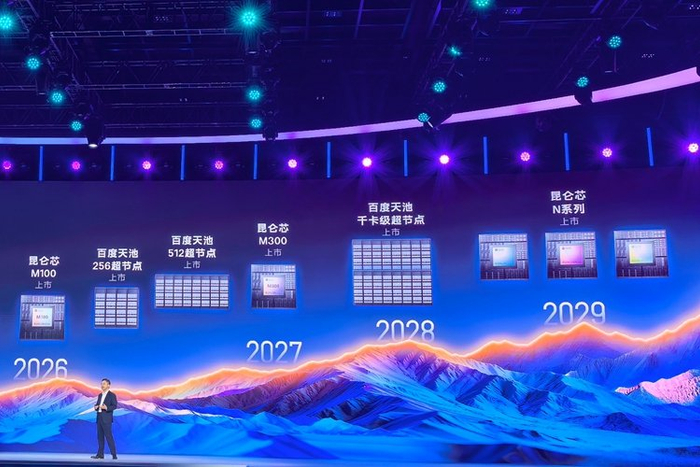

- Product Roadmap: Launch M100 chip in 2026, M300 chip in 2027, and target million-level chip clusters by 2030

- Benchmarking Advantages: Deployed the “Tianhe-1” petaflop supercomputer and has exascale computing power experience

- Cooperation Opportunities: Can connect to government digital projects such as “Smart Tax Services”; Kunlun Chip has been recognized in government-led data center projects [0]

- Technological Synergy: The HPC technology of Tianjin Supercomputing can be combined with Kunlun Chip’s AI acceleration capabilities

- Benchmarking Advantages: Supercomputing application scenarios such as marine science and climate simulation require AI + supercomputing integration capabilities

- Cooperation Opportunities: Kunlun Chip’s multimodal model training capabilities can support AI4Science applications

- Benchmarking Advantages: Core node of the Guangdong-Hong Kong-Macao Greater Bay Area with a rich AI industry ecosystem

- Cooperation Opportunities: Connect with ecological partners such as Tencent and Huawei to strengthen chip-application collaboration

- Benchmarking Position: Kunlun Chip and Ascend form the “dual-engine” of domestic AI chips and are in the first tier of the domestic AI chip market [0]

- Competitive Advantage: Kunlun Chip P800 is the first domestic chip supporting full-version deployment of DeepSeek V3/R1 large models on a single machine [0]

- Differentiation: Deeply synergized with Baidu PaddlePaddle, optimizing inference efficiency by more than 30%

- Benchmarking Scenarios: Cloud-based AI training and inference services

- Technical Path: Kunlun Chip’s XPU scalable architecture achieves higher energy efficiency than traditional GPUs [0]

- Customer Expansion: Has obtained external customers such as China Merchants Bank, China Southern Power Grid, and Geely Auto [1]

- Benchmarking Breakthrough: Kunlun Chip has won a server procurement order of nearly 1 billion yuan from China Mobile [1]

- Expansion Opportunities: Data center upgrade needs of China Telecom and China Unicom

- Benchmarking Customers: Financial institutions such as China Merchants Bank have adopted Kunlun Chip solutions [1]

- Expansion Scenarios: Quantitative trading and risk management AI systems in the securities and insurance industries

- Benchmarking Cases: Energy central enterprises such as China Southern Power Grid have deployed Kunlun Chip [1]

- Expansion Directions: Scenarios such as power dispatch, new energy grid connection, and intelligent oilfields

- TOP500 Gap: Due to not participating in the HPL benchmark test update, China’s supercomputer Sunway TaihuLight has dropped to the 21st place [2]

- Breakthrough Path: Kunlun Chip’s strategy of “using system engineering ideas to make up for insufficient single-chip performance through cluster computing” [3]

- Deepen Government Cooperation: Consolidate state-owned enterprises and government-led projects; P800 chip has been recognized by the market [0]

- Expand Operator Share: Replicate the successful experience of China Mobile’s 1 billion yuan order

- Activate AI Native: Support deployment of domestic large models such as DeepSeek

- Launch M100 Chip: Optimize for large-scale inference scenarios and compete with international AI accelerators

- Build 10,000-Card Level Training Clusters: Support ultra-large-scale MoE model training

- Expand Industry Customers: Extend from the Internet to industries such as manufacturing, medical care, and education

- Million-Card Cluster Target: Benchmark against international top AI supercomputing centers

- Improve Software and Hardware Ecosystem: Strengthen the construction of “soft power” such as system software, compilers, and interconnection technologies [3]

- International Expansion: Enhance international influence through Hong Kong IPO

| Dimension | Kunlun Chip Advantages | Benchmarking Opportunities |

|---|---|---|

Cluster Scale |

Experience in deploying single clusters of 30,000 cards | Leading domestic AI chip manufacturers |

Energy Efficiency Performance |

Higher energy efficiency of XPU architecture | Matching international GPU performance |

Software Ecosystem |

Deep collaboration with PaddlePaddle | 30% improvement in inference efficiency |

Market Position |

69,000 units shipped in 2024, ranking second among domestic brands | 2.65 times that of Cambricon |

Customer Base |

Over 100 customers, 10,000-card level delivery | Full coverage of operators, finance, and energy sectors |

The

- Replace International: Fill the gap left by international chips such as Nvidia in the domestic substitution process

- System Innovation: Make up for single-chip performance gaps through cluster computing and take the path of “system-level innovation”

- Industry Deepening: Establish a position in computing infrastructure in key industries such as telecommunications, finance, and energy

- Ecological Synergy: Form integrated competitiveness of “chip-framework-cloud service” with Baidu Cloud and PaddlePaddle framework

As Kunlun Chip plans to go public in Hong Kong, its valuation is expected to exceed 80 billion yuan [0], which will provide stronger capital support for supercomputing center benchmarking cooperation.

[0] Sina Finance - Baidu Announces Kunlun Chip’s Hong Kong IPO (https://finance.sina.cn/hkstock/gggd/2026-01-02/detail-inhewqnt3774662.d.html)

[1] Yicai - Kunlun Chip Plans Hong Kong IPO (https://www.yicai.com/news/102943332.html)

[2] Guancha.cn - Global Supercomputing Rankings (https://www.guancha.cn/economy/2025_06_12_779109.shtml)

[3] People’s Daily - Efficient Supply of Domestic Computing Power (http://paper.people.com.cn/rmlt/pc/content/202512/02/content_30125634.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.