2026 U.S. Minimum Wage Increases: 19 States Raise Pay, Impacting 8.3M Workers

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the Forbes report [5] published on January 2, 2026, which announced that 19 U.S. states raised their minimum wages on January 1, 2026, affecting over 8.3 million workers with an estimated $5 billion in additional earnings nationwide [0][4]. The states implementing increases include Arizona, California, Colorado, Connecticut, Hawaii, Maine, Michigan, Minnesota, Missouri, Montana, Nebraska, New Jersey, New York, Ohio, Rhode Island, South Dakota, Vermont, Virginia, and Washington [1][3][4]. These changes come amid ongoing federal inaction, where the federal minimum wage has remained stagnant at $7.25 due to congressional gridlock [1].

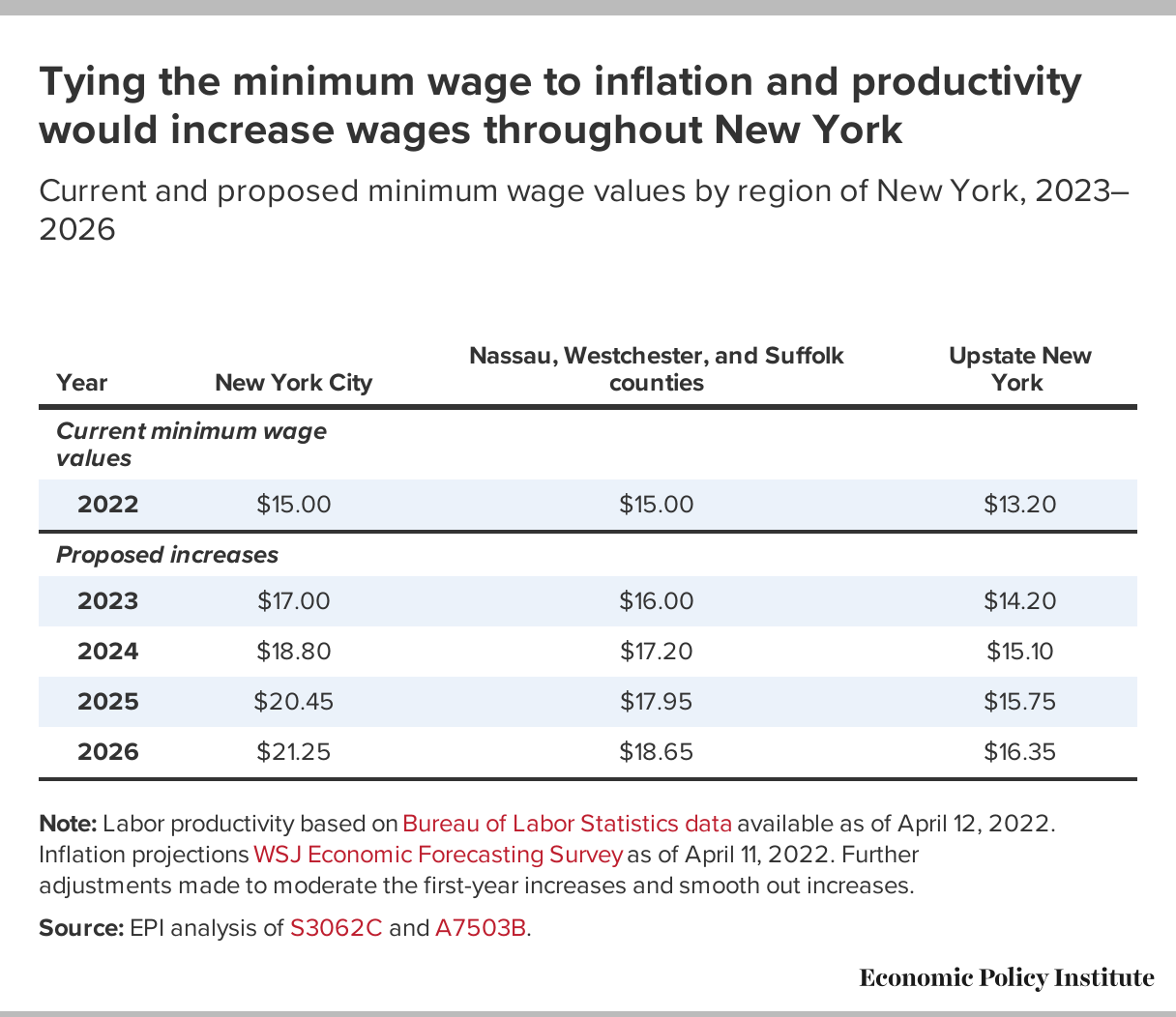

The magnitude of the increases varies by state. For example, Hawaii saw a 14.3% rise from $14 to $16, while Missouri and Nebraska both increased their minimum wages to $15 per hour, representing 9.1% and 11.1% hikes respectively [1][3][4]. Many states, including California, Colorado, and New York, index their minimum wages to inflation, ensuring gradual adjustments that maintain purchasing power over time [1][3]. New York also implemented tiered increases, with a $17 minimum wage in the NYC metro area and $16 upstate [3].

- Federal Gridlock Drives State-Level Action: The stagnant federal minimum wage has led states to take independent action, highlighting a growing divergence in labor policies across the U.S. This trend reflects changing political priorities regarding income inequality at the state level [1].

- Inflation Indexing as a Long-Term Strategy: The adoption of inflation indexing by several states indicates a shift towards sustainable wage growth, aiming to prevent the erosion of low-wage workers’ purchasing power over time [3].

- Ripple Effect on Wages: Beyond minimum wage workers, the hikes are expected to drive up wages for those earning slightly above the minimum to maintain wage differentials, potentially benefiting a broader segment of the low-wage workforce [4].

- Increased Labor Costs for Small Businesses: Higher minimum wages may strain operational budgets of small enterprises, potentially leading to price adjustments for goods/services or reduced hiring [3].

- Industry-Specific Challenges: Labor-intensive sectors like retail, hospitality, and food service may face disproportionate impacts due to reliance on low-wage workers [0].

- Enhanced Purchasing Power: Additional earnings for low-wage workers are likely to be spent locally, boosting consumer demand and supporting small businesses in the long run [0].

- Improved Worker Outcomes: Higher wages may reduce financial strain, lower poverty rates, and improve worker productivity/retention by increasing job satisfaction [0].

- 19 U.S. states raised minimum wages on January 1, 2026, affecting over 8.3 million workers with ~$5 billion in additional earnings [5][0].

- States acted independently due to federal minimum wage stagnation at $7.25 [1].

- Increases ranged from moderate to significant (Hawaii +14.3%, Missouri +9.1%), with inflation indexing in some states [1][3].

- Further hikes: Alaska ($14 in July), Florida ($15 in September), Oregon (TBD) [1][3][4].

- Impacts are mixed: positive for workers/economic stimulus, challenging for small businesses [0][3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.