In-Depth Strategic and Shareholder Value Analysis of Vodafone's Early 2025 Form 6-K Disclosures

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On January 2, 2025, Vodafone Group submitted Form 6-K to the SEC, officially announcing the completion of the major transaction to sell its Italian business (Vodafone Italy) to Swiss telecom operator Swisscom [1]. This is one of Vodafone’s most important strategic restructuring initiatives in recent years.

- Transaction Value: €8 billion in cash [1]

- Valuation Multiples: The transaction was concluded at a valuation of 7.6x adjusted EBITDAaL and approximately 26x operating free cash flow (OpFCF) [1]

- Historical Significance: This is the highest OpFCF multiple transaction for Vodafone in the past 10 years, highlighting the quality of the asset and the precise timing of the sale [0]

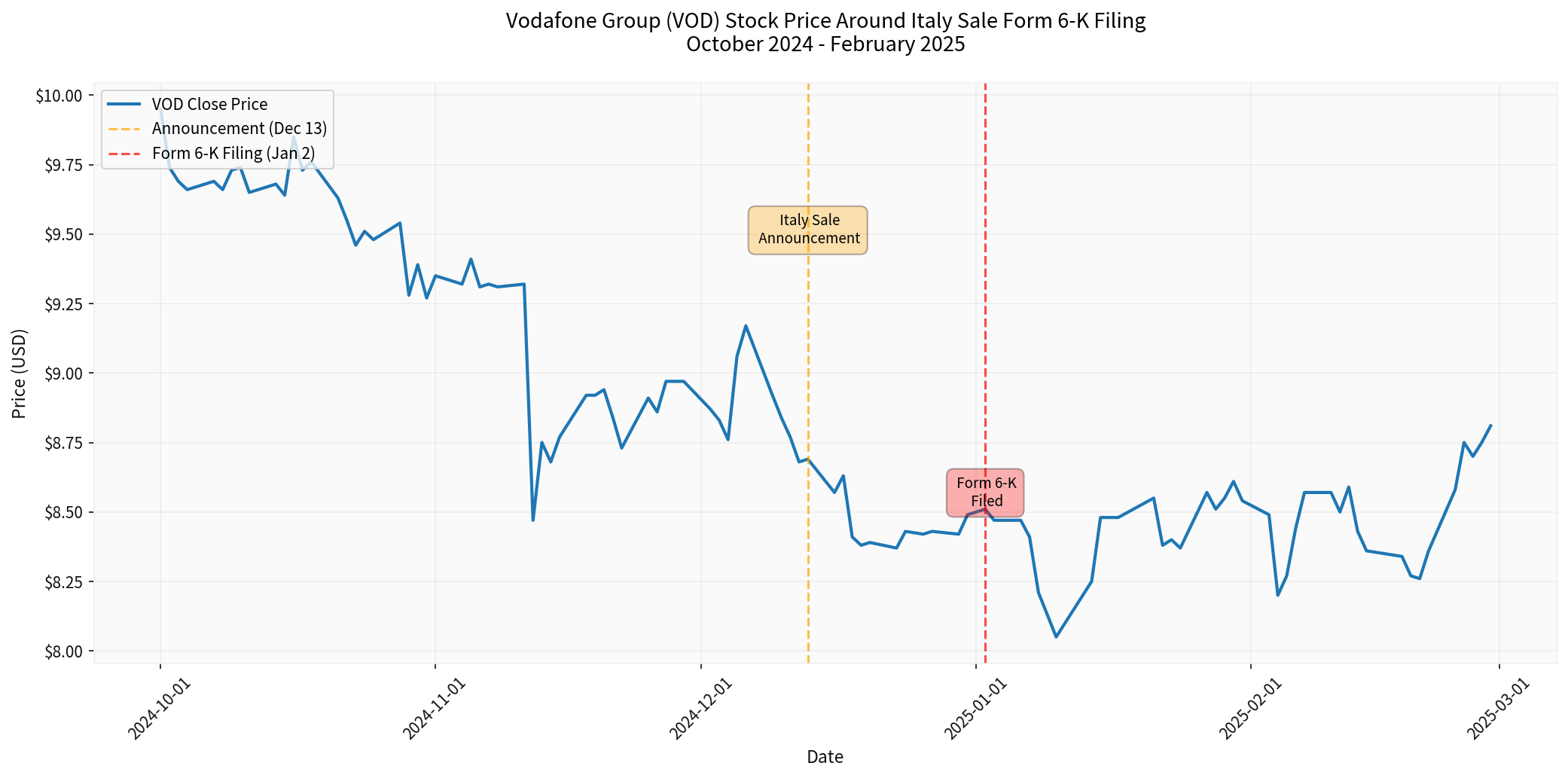

Chart shows: VOD stock price fluctuations before and after the December 13, 2024 announcement and January 2, 2025 Form 6-K submission. The stock price slightly declined from $8.68 before the announcement to $8.51 after completion, a drop of approximately 2% [0].

This asset sale is a core component of Vodafone’s large-scale asset portfolio restructuring strategy. According to the company’s FY25 performance presentation, through continuous asset divestment and portfolio optimization, Vodafone is shifting its business focus from mature but highly competitive markets to markets with higher growth potential [2].

- Growth Market Share: Growth markets (e.g., UK, Turkey, South Africa, Spain) currently account for 67% of the Group’s adjusted free cash flow [2]

- Transformation Market Focus: Transformation markets such as Germany account for 33% of adjusted free cash flow, and the company is implementing operational improvement plans [2]

- Simplified Geographic Footprint: Exiting Italy allows Vodafone to concentrate management resources and capital more on core advantage markets

Italy is one of the most competitive telecom markets in Europe, with ongoing price wars and pressure on profit margins. By selling its Italian business, Vodafone has achieved:

- Risk Diversification: Reduced reliance on highly competitive markets

- Resource Reallocation: Redeployed capital to markets with higher returns

- Operational Simplification: Reduced group-level complexity and improved decision-making efficiency

Notably, Vodafone and Swisscom have reached an agreement that Vodafone will continue to provide certain services to Vodafone Italy for up to 5 years after the transaction is completed [1]. This ensures Vodafone can continue to derive partial benefits from the Italian market while reserving space for potential long-term business cooperation.

After the completion of this transaction:

- Italian Market: Swisscom, through the merger of Fastweb and Vodafone Italy, creates Italy’s second-largest telecom operator with approximately 23.4 million customers (3.4 million from Fastweb + 20 million from Vodafone) [3]

- European Landscape: Vodafone retains core markets such as the UK, Germany, and Spain while optimizing overall asset quality

- Africa Focus: Vodafone maintains influence in African markets through Vodacom, seeking opportunities in high-growth markets like Kenya and Ethiopia

- €8 billion in cash is equivalent to approximately 24.5% of Vodafone’s current market capitalization ($32.61 billion) [0][1]

- This fund can be used for:

- Reducing debt burden

- Increasing shareholder returns (dividends and share repurchases)

- Investing in capital expenditures in growth markets

- Addressing investment needs in transformation markets like Germany

- Leverage Optimization: Cash flow can significantly reduce the net debt/EBITDA ratio

- Credit Rating Upgrade: A stronger balance sheet may receive positive evaluations from rating agencies

- Increased Financial Flexibility: More strategic options, including potential M&A activities

The valuation multiples of this transaction (7.6x EBITDAaL, 26x OpFCF) are significantly higher than Vodafone Group’s transaction multiples, indicating:

- Asset Quality Recognition: The market highly recognizes the asset quality of Vodafone Italy

- Timing Grasp: Selling at a relatively high point of European telecom asset valuation

- Negotiation Capability: Vodafone demonstrates excellent transaction execution capability

- Before announcement (around December 13): $8.68

- After completion (January 2): $8.51

- Change: -1.96% [0]

- 20-day volatility before announcement: 1.66%

- Volatility after completion: 1.11%

- Interpretation: Reduced volatility indicates that market uncertainty about strategic transformation has decreased, and there is more optimism about long-term prospects [0]

- The moderate decline in stock price may reflect market concerns about:

- Future revenue losses in the Italian market

- Concerns about execution risks in Germany’s transformation market

- Pressure from the overall macroeconomic environment

- However, from a long-term perspective, the financial flexibility and strategic focus brought by the asset sale may create greater value

Through this asset sale, Vodafone demonstrates to shareholders:

- Strategic Clarity: Clear development path focusing on advantage markets

- Capital Allocation Discipline: Selling non-core assets to strengthen the balance sheet

- Execution Capability: Successful completion of large transactions proves management capability

- After debt reduction, cash flow can be released for shareholder returns

- Stable and potentially growing dividend policy

- Increased possibility of share repurchase plans

- Investing in 5G network infrastructure

- Expanding B2B and enterprise services

- Seeking opportunities in growth markets (e.g., Africa)

Although this transaction is generally positive, investors need to pay attention to:

- Execution Risk: The success of Germany’s transformation market is crucial to overall performance

- Competitive Pressure: Competitive态势 in retained markets may intensify

- Currency Risk: Volatility of the euro affects shareholder returns reported in US dollars

- Regulatory Environment: The European regulatory environment may affect profitability

- Stock price fluctuations are normal reactions, and transaction valuation is excellent

- Focus on management’s plan for using the €8 billion

- Closely track the progress of Germany’s market transformation

- Correct strategic restructuring direction, improving operational quality

- A more simplified asset portfolio should bring higher efficiency

- Debt reduction creates conditions for future shareholder returns

- Free cash flow conversion rate

- Adjusted EBITDAaL margin

- Improvement in net debt/EBITDA ratio

- Customer churn rate and ARPU (Average Revenue Per User) in core markets

The sale of the Italian business disclosed in Vodafone’s Form 6-K submitted in early 2025 is a key milestone in the company’s strategic restructuring. Although the short-term stock price reaction is flat, from a long-term perspective, this transaction:

- Strategic Level: Accelerates Vodafone’s transformation to a high-quality asset portfolio, focusing on growth and transformation markets

- Financial Level: Brings substantial cash injection, significantly improves the balance sheet, and enhances financial flexibility

- Shareholder Value: Lays the foundation for future sustainable growth and shareholder returns, although value realization takes time

For long-term investors, Vodafone’s strategic direction is clear, management’s execution capability has been verified, and this asset sale creates opportunities for the company to reallocate capital and enhance overall competitiveness. It is recommended that investors pay attention to subsequent fund use announcements and operational improvement progress in core markets.

[0] Gilin API Data - Stock prices, financial indicators, market data, Python calculation results

[1] Vodafone Official Website - “Sale of Vodafone Italy for €8 billion completes” (January 2, 2025)

https://www.vodafone.com/news/newsroom/corporate-and-financial/sale-of-vodafone-italy-for-e8-billion-completes

[2] Investing.com - “Vodafone FY25 presentation: Service revenue grows 5.1% amid portfolio restructuring”

https://www.investing.com/news/company-news/vodafone-fy25-presentation-service-revenue-grows-51-amid-portfolio-restructuring-93CH-4053969

[3] Mergersight - “Swisscom’s €8bn Acquisition of Vodafone Italia”

https://www.mergersight.com/post/swisscom-s-8bn-acquisition-of-vodafone-italia

[4] Ecofin Agency - “Vodacom on Track to Acquire Majority Control in Safaricom With a $2.1 billion Paycheck”

https://www.ecofinagency.com/news-finances/0412-51099-vodacom-on-track-to-acquire-majority-control-in-safaricom-with-a-2-1-billion-payckeck

[5] Yahoo Finance - “Vodafone to gain control of and fully consolidate Safaricom”

https://finance.yahoo.com/news/vodafone-gain-control-fully-consolidate-070200971.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.