Analysis of 5 Stocks Highlighted by Wall Street's Top Analysts (Jan 2026)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Benzinga report published on January 2, 2026 [1], which highlights 5 stocks (HEICO Corporation [HEI], Micron Technology [MU], NVIDIA Corporation [NVDA], TE Connectivity Ltd. [TEL], Tower Semiconductor Ltd. [TSEM]) favored by Wall Street’s most accurate analysts in 2025. The report also provides broader market context from December 31, 2025, when U.S. stocks settled lower: the Dow Jones Industrial Average declined 0.64% to 48,063.28 (falling over 300 points intraday), the S&P 500 dropped 0.77% to 6,845.49 (its fourth consecutive session decline), and the Nasdaq Composite closed down 0.76% at 23,241.99 [0].

All 5 highlighted stocks experienced declines on December 31, 2025, ranging from -1.25% (TEL) to -2.65% (MU) [0]. TSEM’s decline (-1.34%) was compounded by a Wedbush downgrade to Neutral on that day due to valuation concerns [0].

Key details on each stock:

- HEICO Corporation (HEI): Industrials (Aerospace & Defense) sector, $45.00B market cap, current price $323.59 [0]. Analyst consensus is BUY with a $373.00 target (+15.3% upside) [0]. The stock has a high P/E ratio (65.25x), strong ROE (17.01%), and 15.39% net profit margin [0].

- Micron Technology (MU): Technology (Semiconductors) sector, $319.52B market cap, current price $285.41 [0]. Analyst consensus is BUY with a $300.00 target (+5.1% upside) [0]. Morgan Stanley (one of the top-rated analysts) named MU its top semiconductor pick for 2026 [1].

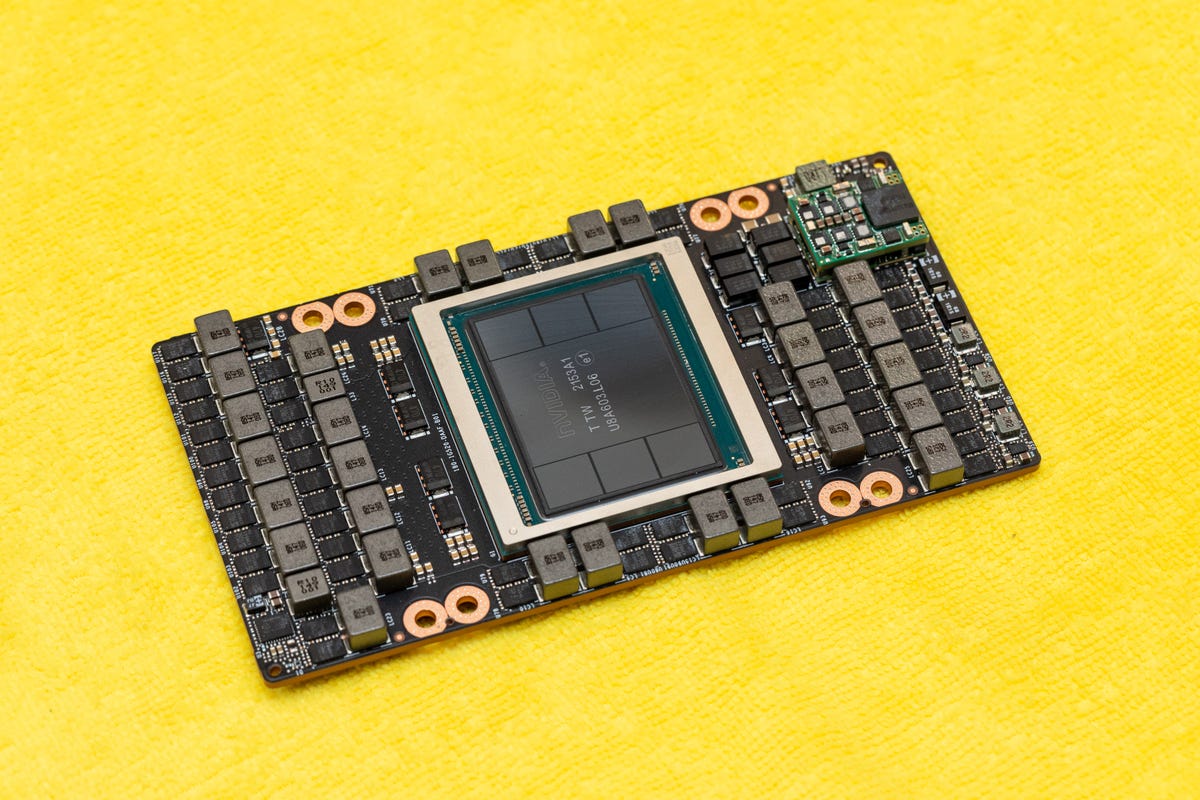

- NVIDIA Corporation (NVDA): Technology (Semiconductors) sector, $4.54T market cap, current price $186.50 [0]. Analyst consensus is BUY with a $257.50 target (+38.1% upside) [0]. Top analysts including BofA, Stifel, and Truist maintained Buy-equivalent ratings [1]. NVDA derives 88.3% of revenue from its Data Center segment [0].

- TE Connectivity Ltd. (TEL): Technology (Hardware, Equipment & Parts) sector, $66.93B market cap, current price $227.51 [0]. Analyst consensus is BUY with a $263.00 target (+15.6% upside) [0].

- Tower Semiconductor Ltd. (TSEM): Technology (Semiconductors) sector, $13.12B market cap, current price $117.42 [0]. While analyst consensus is BUY, the consensus target ($97.00) is 17.4% below current price [0].

- Semiconductor sector emphasis: Three of the 5 stocks (MU, NVDA, TSEM) are in semiconductors, reflecting strong analyst confidence in the sector despite short-term declines [0,1].

- NVDA’s market cap-upside disparity: Despite its $4.54T market cap (one of the largest globally), NVDA has the highest consensus upside (+38.1%), driven by its dominant Data Center segment [0,1].

- TSEM’s valuation mismatch: TSEM is the only stock with a consensus target below current price, aligning with Wedbush’s valuation-based downgrade [0].

- Volatility amid annual gains: The December 31 decline followed four straight S&P 500 declines, but both the S&P 500 (16.39%) and Nasdaq (20.36%) posted strong 2025 gains, indicating short-term volatility in a broadly positive year [0].

- Short-term market volatility: The fourth consecutive S&P 500 decline signals elevated near-term market uncertainty [0].

- Valuation concerns: TSEM’s consensus target below current price and Wedbush downgrade highlight potential overvaluation [0].

- High P/E ratios: HEI (65.25x) and NVDA (45.74x) have above-average P/E ratios that could limit upside in a volatile market [0].

- Top analyst support: All 5 stocks carry BUY consensuses from Wall Street’s most accurate 2025 analysts [1].

- MU’s 2026 outlook: Morgan Stanley’s designation of MU as its top 2026 semiconductor pick signals strong long-term confidence [1].

- NVDA’s growth potential: The company’s 88.3% Data Center revenue and high upside target suggest ongoing growth opportunities [0,1].

- Event Source: Benzinga report (Jan 2, 2026) highlighting 5 stocks from 2025’s top Wall Street analysts: HEI, MU, NVDA, TEL, TSEM [1].

- Market Context: Dec 31, 2025, U.S. indices declined (Dow: -0.64%, S&P 500: -0.77%, Nasdaq: -0.76%); all 5 stocks fell, with TSEM impacted by a Wedbush downgrade [0].

- Stock Key Metrics (as of analysis date):

- HEI: $45B market cap, $373 target (+15.3%), 15.39% net profit margin [0]

- MU: $320B market cap, $300 target (+5.1%), Morgan Stanley 2026 top semiconductor pick [0,1]

- NVDA: $4.54T market cap, $257.50 target (+38.1%), 88.3% Data Center revenue [0,1]

- TEL: $67B market cap, $263 target (+15.6%) [0]

- TSEM: $13B market cap, $97 target (-17.4%), recent valuation downgrade [0]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.