Analysis of Travis Perkins' New CEO Appointment: Strategic Direction, Performance Expectations, and Investor Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now that I have collected comprehensive information, let me provide you with a detailed analysis report.

- Merchanting: Includes Travis Perkins Builders’ Merchants, Keyline (civil engineering), BSS (HVAC), CCF (drywall and insulation) and other professional businesses

- Toolstation: Tool and equipment retail business

| Company | Position | Period | Main Achievements |

|---|---|---|---|

SIG plc |

CEO | 2023-2025 | Drove strategic and operational changes, accelerated improvement in operating margins |

Grafton Group |

CEO | Before 2022 | Successfully led business transformation |

Based on Gavin Slark’s experience at SIG, his strategic philosophy includes [2]:

- Simplify strategy: Keep strategy simple to improve execution success rate

- Local insights: Flexibly adjust strategy based on local market conditions

- Cost and financial discipline: Strengthened cost control and financial management during his tenure at SIG

- Cultural emphasis: Emphasize building a genuine and open corporate culture

During his tenure as CEO at SIG, Slark demonstrated the following capabilities [2]:

- Achieved steady sales performance relative to the market despite challenging market conditions

- Outstanding performance in UK roofing business, German and Irish operations

- Drove strategic and operational changes to accelerate sustainable improvement in operating margins

| Indicator | Value | Analysis |

|---|---|---|

Market Capitalization |

$1.35 billion | FTSE 250 constituent, mid-cap company |

Current Stock Price |

638 pence | - |

Price-to-Earnings Ratio (P/E) |

-24.23x | Negative value, indicating profitability pressure |

Price-to-Book Ratio (P/B) |

0.68x | Below book value, possibly undervalued |

Return on Equity (ROE) |

-2.81% | Negative value, unsatisfactory shareholder return |

Net Profit Margin |

-1.23% | Slight loss status, needs improvement |

Operating Margin |

2.68% | Positive but low |

Current Ratio |

1.49 | Good liquidity |

Free Cash Flow |

Approximately £150 million | Strong cash generation capacity [0] |

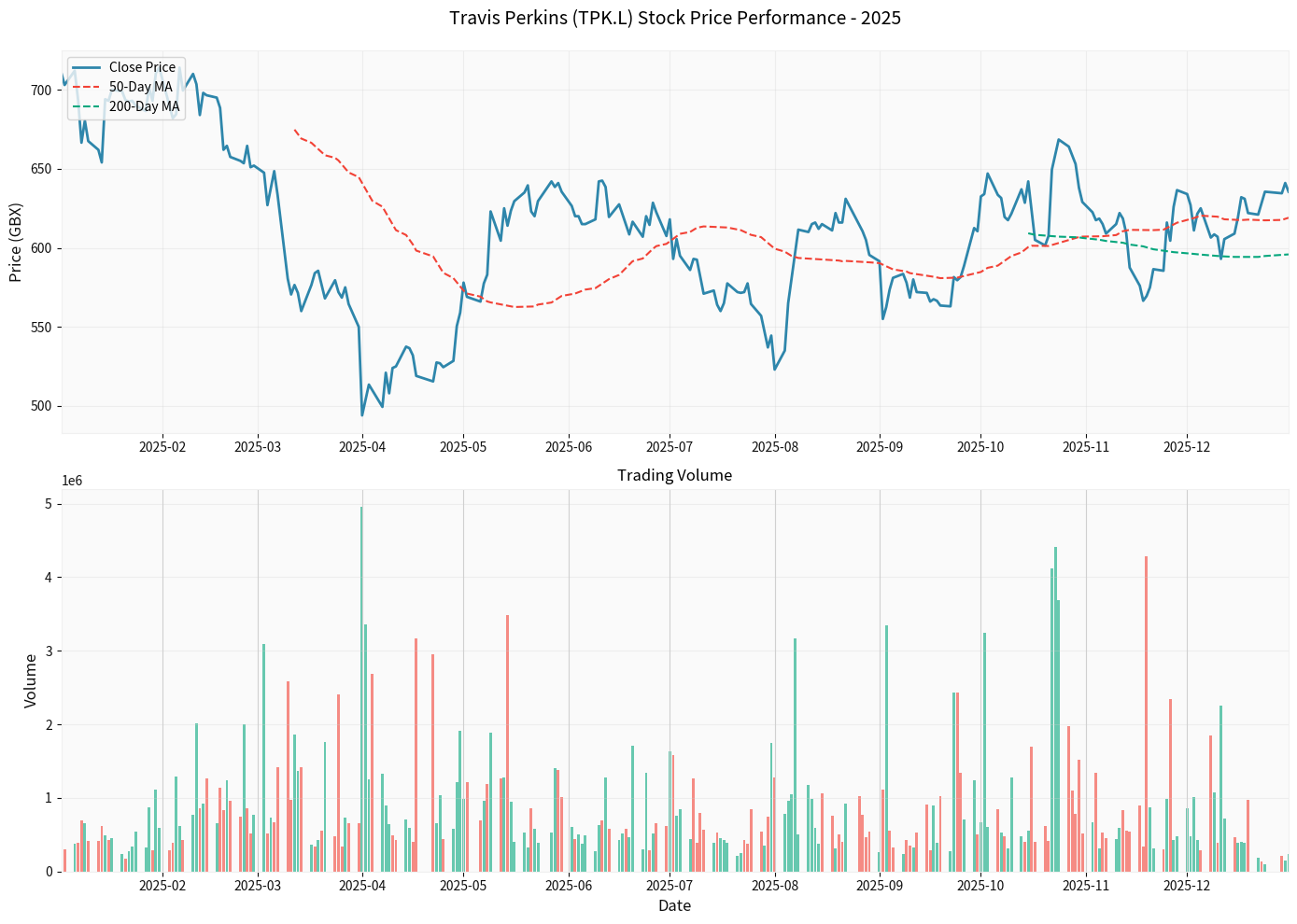

The chart shows Travis Perkins’ price performance and volume changes in 2025, including the 50-day and 200-day moving averages

| Period | Performance | Analysis |

|---|---|---|

1 Month |

+1.75% | Short-term stabilization |

3 Months |

+0.63% | Sideways consolidation |

6 Months |

+7.59% | Mid-term rebound |

1 Year |

-10.27% | Annual decline |

3 Years |

-32.00% | Long-term pressure |

5 Years |

-58.44% | Significant long-term value shrinkage |

- Stock price is above the 50-day moving average (620.73 pence) and 200-day moving average (595.85 pence)

- Short-term technical indicators show a buy signal, but mid-term MACD indicates a sell signal

- Technical score tends to “Hold/Accumulate”

According to the latest investor relations materials, the company’s current strategic focus includes [3]:

- Restore revenue growth momentum: Increase market share

- Stabilize operational performance: Improve operating margins

- Continue pricing investments and targeted promotions: Maintain competitiveness

- Capital allocation discipline: Manage costs and investment expenditures

Based on Slark’s experience and management style at SIG, the following strategic adjustments are expected:

| Aspect | Expected Change | Impact |

|---|---|---|

Strategy Simplification |

Streamline strategic focus, concentrate on core businesses | Improve execution efficiency |

Cost Management |

Strengthen cost control and operational efficiency | Improve profit margins |

Management Assessment |

Evaluate existing team and capability structure | Possible personnel adjustments |

Business Diagnosis |

In-depth analysis of performance of each business segment | Prepare for subsequent restructuring |

-

Merchanting Business Restructuring

- Background: This business had 1.7% same-store revenue growth in Q3 2025, but total revenue decreased by 0.3% due to network optimization [3]

- Expectation: May continue to optimize branch network, close or integrate underperforming outlets

- Reference: Slark conducted similar network optimization at SIG

-

Accelerated Toolstation Expansion

- Background: Toolstation is a growth engine with 2.3% same-store revenue growth and 3.0% total revenue growth in Q3 [3]

- Expectation: May increase investment to expand market share

- Strategy: Leverage SIG’s multi-country operation experience to accelerate international expansion

-

Professional Business Integration

- Background: Specialist Merchants market remains weak [3]

- Expectation: May consider spinning off or integrating professional businesses (Keyline, BSS, CCF)

-

Digital Transformation

- Expectation: Strengthen online business and digital capabilities

- Reference: Slark promoted digital transformation projects at SIG

- Sustainable Development Strategy: Strengthen ESG and carbon reduction goals

- Diversification: May consider entering new product categories or geographic markets

- M&A Opportunities: Use strong cash flow for strategic acquisitions

According to the latest UK government data [4]:

| Indicator | 2025 Forecast | 2026 Forecast | 2027 Forecast |

|---|---|---|---|

Total Construction Output Growth |

+1.1% | +2.8% | +4.2% |

Private Residential New Builds |

+2.0% | +4.0% | +8.8% |

Private Residential RM&I |

Flat | +2.0% | - |

Infrastructure New Builds |

+3.9% | +2.4% | +4.6% |

- Mild recovery of UK construction industry in 2025

- Expected strong growth of private residential market in 2026-2027

- Differentiated material prices: Imported sawn timber prices up 12.5%, but some material prices down [4]

| Scenario | Probability | 2026 Revenue Growth Expectation | 2026 Margin Expectation | Main Drivers |

|---|---|---|---|---|

Optimistic |

30% | +3-5% | Operating margin: 3.5-4.0% | Strong recovery of residential market, successful strategic execution |

Baseline |

50% | +1-2% | Operating margin:2.8-3.2% | Mild market recovery, gradual improvement |

Pessimistic |

20% | -1% to +1% | Operating margin:2.3-2.7% | Macro economic headwinds, delayed execution |

Based on current trends and possible changes by Slark, expected changes in key indicators:

| Indicator | Current Level | 2026 End Expectation | Improvement Range |

|---|---|---|---|

Net Profit Margin |

-1.23% | Near break-even or slight profit | +1.2-1.8 percentage points |

Operating Margin |

2.68% | 3.0-3.5% | +0.3-0.8 percentage points |

ROE |

-2.81% | Turn positive or near zero | +2.8-3.5 percentage points |

Free Cash Flow |

Approximately £150 million | Maintain or slightly increase | Keep strong |

-

Undervalued Assets

- P/B ratio of 0.68x, below book value

- Strong free cash flow (approximately £150 million) supports dividends and investments

- Leading market share position

-

New CEO’s Transformation Experience

- Slark’s successful transformation experience at SIG

- Simplify strategy execution, reduce complexity

- Potential for cost discipline and operational efficiency improvement

-

Industry Recovery Expectation

- Expected 4.0% growth in UK private residential market in 2026

- Expected 8.8% growth in 2027 [4]

- Demand for building materials is expected to rebound

-

Toolstation Growth Engine

- This business is a true growth highlight

- Strong digital capabilities, large expansion potential

- May become an independent spin-off or key investment target

-

Macro Economic Headwinds

- UK construction industry still faces challenges in 2025

- 14 listed construction and materials companies issued profit warnings in the first three quarters of 2025 [5]

- High interest rate environment continues to suppress residential market

-

Strategic Execution Risk

- New CEO needs time to evaluate and adjust strategy

- Substantial improvement may take 6-12 months to see

- Management changes may bring uncertainty

-

Profitability Pressure

- Current net profit margin is negative

- Pricing investments and promotions may squeeze profit margins

- Need to balance market share and profit margins

-

Structural Changes

- Intensified online competition

- Long-term slowdown in residential market growth

- Capital expenditure pressure from green building transformation

-

Debt and Capital Structure

- Need to pay attention to debt level and capital allocation

- Dividend policy may need adjustment

| Investor Type | Recommended Strategy | Reason |

|---|---|---|

Value Investors |

Cautious Buy/Hold |

P/B below 1.0x, strong free cash flow, but need patience for turning point |

Growth Investors |

Wait and See |

Lack of strong growth momentum currently, wait for clearer strategy |

Income Investors |

Hold but Be Cautious |

Dividend yield may be under pressure, focus on free cash flow |

Short-term Traders |

Volatility Opportunities |

High stock price volatility, trading opportunities but high risk |

Long-term Investors |

Moderate Allocation |

Industry leader, new CEO has successful transformation experience, suitable for 2-3 year holding |

According to the latest technical analysis [6]:

- Short-term Signal: Buy signal (stock price above major moving averages)

- Mid-term Signal: Sell signal (MACD indicates)

- Comprehensive Recommendation: Hold/Accumulate

- Support Level: 477.37 pence (52-week low)

- Resistance Level: 721.00 pence (52-week high)

- Current Position: 638.00 pence (in the middle range)

- This is not a quick fix story- It will take time (possibly 12-18 months) to see substantial improvement

- Macro environment is a key variable- UK residential market and interest rate levels will directly affect performance

- Execution risk still exists- New strategy needs effective execution to achieve expected goals

Based on current analysis:

| Indicator | Rating/Forecast |

|---|---|

Investment Rating |

Hold/Accumulate |

Time Frame |

Mid-term (12-18 months) |

Target Price Range |

650-750 pence (based on P/B 0.75-0.85x) |

Upside Potential |

Approximately +2% to +18% |

Core Logic |

Undervaluation + New CEO’s transformation potential + Industry recovery expectation |

Investors should closely track the following indicators:

- Q4 2025 performance (released in March 2026)

- New CEO’s strategic announcements and business updates

- Market share recovery status

- Progress of Merchanting business network optimization

- Toolstation’s expansion and profitability

- Operating margin improvement trend

- Stability of free cash flow

- Relative performance in industry cycle

- Progress of digital transformation

- Achievement of ESG and sustainable development goals

For investors who already hold or are considering investing in Travis Perkins:

- Batch Position Building: Considering volatility, consider buying in batches

- Set Stop Loss:建议设置止损位在480-500便士 (接近52周低点) → Recommend setting stop loss at 480-500 pence (near 52-week low)

- Focus on Catalysts: Q4 performance, new strategy details, industry data

- Diversified Investment: Do not over-allocate to a single construction industry stock

Travis Perkins is in a critical transition period. Gavin Slark’s appointment brings clear improvement expectations, but investors need to maintain patience and rational expectations.

The company’s core advantages (leading market position, strong cash flow, Toolstation growth engine) provide a solid foundation for its transformation. The key lies in whether the new CEO can simplify strategy, improve execution, and seize growth opportunities in the context of UK construction industry recovery.

[0] Gilin API Data - Company financial data, stock price performance, technical analysis

[1] Moomoo News - “Travis Perkins PLC: Gavin Slark Joined Bd as CEO Jan 1. Dow Jones” (2025)

https://www.moomoo.com/news/post/20632598/here-s-why-shareholders-may-want-to-be-cautious-with-increasing

[2] LinkedIn - “Gavin Slark on leading SIG plc to growth” (2025)

https://www.linkedin.com/posts/beldenmenkus_keep-strategy-simple-to-stand-a-better-chance-activity-7328675786524102656-D3YP

[3] Quartr - “Travis Perkins (TPK) Investor Relations, Earnings Summary & Outlook” (2025)

https://quartr.com/companies/travis-perkins-plc_13434

[4] UK Government Statistics - “Construction building materials: commentary November 2025”

https://www.gov.uk/government/statistics/building-materials-and-components-statistics-november-2025/construction-building-materials-commentary-november-2025

[5] TMH Group - “UK Construction Sector Report December 2025”

https://www.tmhcc.com/en/news-and-articles/thought-leadership/uk-construction-sector-report-december-2025

[6] StockInvest.us - “Travis Perkins Stock Price Forecast. Should You Buy TPK.L?”

https

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.