Samsung HBM4 Chip Competitiveness Enhancement: Analysis of Market Share and Valuation Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Now let’s provide you with a comprehensive analysis of the impact of Samsung HBM4’s enhanced competitiveness on AI memory market share and valuation:

According to the latest data, Samsung has shown a significant rebound in the HBM market [1,4]:

- Q2 2025: 15% (3rd place in the market)

- Q3 2025: 22% (surpassed Micron to rank 2nd)

- 2026 Forecast: 29% (gap with SK Hynix significantly narrowed)

Current Competitive Landscape:

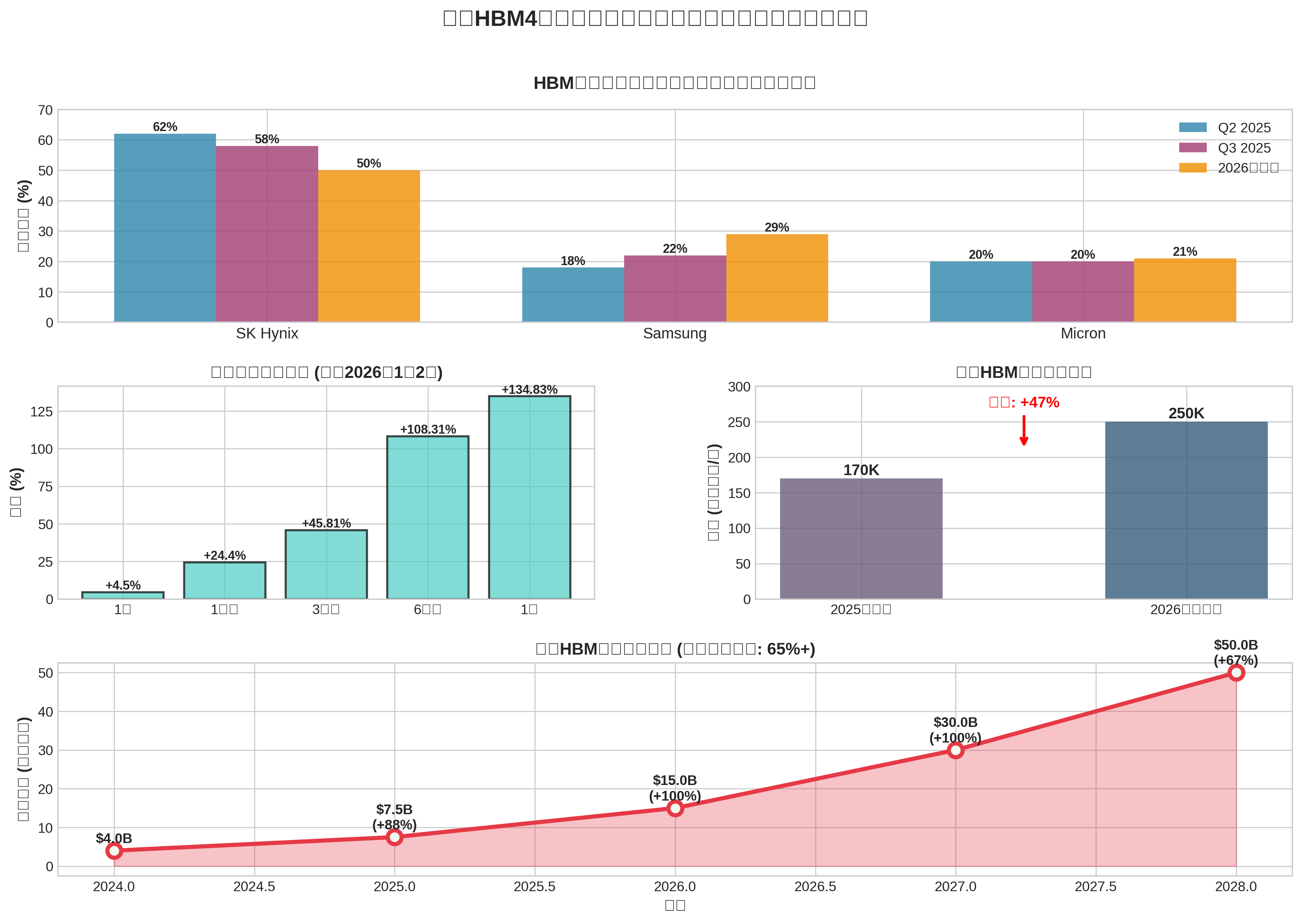

Chart Description: The top-left chart shows the share evolution of the three major HBM market players, with Samsung quickly climbing from 18% in Q2 to a forecasted 29% in 2026; the top-right chart shows Samsung’s stock price rising by 134.83% over the past year, reflecting market recognition of its HBM4 competitiveness; the bottom-left chart shows capacity expansion plans; the bottom-right chart shows the global HBM market size is expected to reach $50 billion by 2028, with a compound annual growth rate exceeding 65%.

Samsung HBM4 has achieved key breakthroughs [1,5,9]:

- Hybrid Bonding Technology: Adopts copper-copper direct bonding, eliminates traditional micro-bumps, and significantly reduces stack height

- 16-Layer Stack Architecture: Provides higher bandwidth density compared to SK Hynix’s 12-layer solution

- Transmission Speed: Reaches 11.7Gbps, outperforming competitors

- Top Rating in NVIDIA SiP Testing: Excellent performance in core indicators such as operating speed and power efficiency

- NVIDIA team informed Samsung after SiP testing: “Samsung is back”

- Samsung received a “green light” for HBM4 supply, expected to formally sign the contract in Q1 2026 and start delivery in Q2 [9]

- NVIDIA’s required HBM4 supply volume in 2026 “far exceeds Samsung’s internal expectations” [9]

- Current Capacity: 170,000 wafers/month

- Target by End of 2026: 250,000 wafers/month

- Growth Rate: +47% [2,5]

- 2026 HBM Shipment Volume: Expected to grow by140%compared to 2025 [4]

- KB Securities Forecast: Samsung’s total HBM shipment volume in 2026 will reach 11.1 billion Gb, a3x surgefrom 2025 [10]

- Expected to account for 55%of Samsung’s total HBM revenue in 2026, quickly taking over HBM3E demand [10]

With enhanced HBM competitiveness, Samsung is reshaping its position in the global DRAM market [4]:

- Q3 2025: Samsung’s share in the overall DRAM market is only 1 percentage point behind SK Hynix (Samsung ~33%, SK Hynix 34%)

- LPDDR Advantage: As SK Hynix prioritizes HBM production, Samsung occupies a larger share in the mobile LPDDR market with the world’s largest memory semiconductor capacity

Based on current data calculations:

- 2025 Market Size: Approximately $7.5 billion

- 2026 Forecast: $15 billion (100% growth)

- 2028 Forecast: $50-100 billion (CAGR 40%+)

- Calculated by 29% market share in 2026: Approximately $4.35 billion

- Calculated by conservative 30% share in 2028 (market size $50 billion): $15 billion

- This will be a significant increment to Samsung’s current DRAM business (Q3 2025 revenue ~29 trillion KRW, ~$20 billion)

Samsung’s stock price has already reflected expectations of HBM4 breakthroughs in advance [0]:

| Period | Growth Rate | Key Events |

|---|---|---|

| 1 Month | +24.40% | HBM4 test progress reported |

| 3 Months | +45.81% | NVIDIA SiP test success |

| 6 Months | +108.31% | HBM competitiveness recovery |

| 1 Year | +134.83% | Full AI storage cycle |

- P/E Ratio: 25.76x (in a reasonable range, reflecting growth expectations)

- P/B Ratio: 2.17x

- ROE: 8.39% (room for improvement)

- Net Profit Margin: 10.38%

-

Increased Certainty of Revenue Growth

- NVIDIA HBM4 order finalization: Expected to account for 60-70% of 2026 HBM revenue

- ASIC customer demand: KB Securities predicts a surge in ASIC demand from customers like Google and Amazon [10]

-

Profit Margin Improvement

- Gross margin of HBM is significantly higher than traditional DRAM products

- Increased share of Samsung’s HBM business will boost overall profit margin

- Scale effect of hybrid bonding technology will emerge in H2 2026

-

Establishment of Technical Moat

- Leading position of 16-layer HBM4 will last at least until 2027

- Customer stickiness from deep cooperation with NVIDIA

Compared to peer valuation (Micron’s P/E 27.10x), Samsung’s current P/E of 25.76x is relatively conservative. If Samsung successfully achieves the target of 29% HBM market share in 2026, the market may give a higher premium:

- Optimistic Scenario: P/E rises to 28-30x, corresponding to a further 15-20% increase in stock price

- Base Scenario: P/E remains at 26-27x, stock price rises in line with performance growth

- Risk Scenario: If there are technical issues in HBM4 mass production, P/E may fall back to 22-24x

- Hybrid Bonding Yield: Yield ramp-up of 16-layer stack may be slower than expected

- SK Hynix Competition: SK Hynix plans to mass produce 12-layer HBM4 in Q4 2026, which may seize some market share [9]

- AI Infrastructure Investment Cycle: If data center capital expenditure slows in H2 2026, HBM demand may fall short of expectations

- Customer Concentration: Over-reliance on NVIDIA (expected to account for 60%+ of HBM revenue)

- 47% capacity expansion plan requires huge capital expenditure (semiconductor capital expenditure in 2026 is expected to exceed 50 trillion KRW)

- Uncertainty in the construction and equipment debugging progress of Pyeongtaek P4 factory

- Q1: Formally sign NVIDIA HBM4 supply contract

- Q2: Start mass supply of HBM4

- Q3: HBM4 quickly takes over HBM3E demand (accounting for 55% of revenue)

- Q4: Yield of 16-layer HBM4 exceeds 80%

The enhanced competitiveness of Samsung HBM4 is not only a short-term revenue driver but also has long-term strategic significance:

- Reshape Samsung’s Position in AI Chip Ecosystem: From follower to top-tier supplier alongside SK Hynix

- Successful Technical Route Validation: Hybrid bonding technology lays the foundation for future HBM5 and HBM6

- Customer Diversification: In addition to NVIDIA, Samsung is actively expanding to customers like Google TPU and Broadcom ASIC [2]

Based on HBM4 technical breakthroughs, rapid market share growth, and NVIDIA order confirmation, Samsung’s HBM business will become the core growth engine in the next 2-3 years. Although the current stock price has partially reflected expectations, considering:

- Feasibility of 140% growth in HBM shipment volume in 2026

- Profit margin improvement brought by 55% share of HBM4 in total HBM revenue

- Long-term market space of $50-100 billion for global HBM by 2028

[0] Jinling API Data - Real-time quotes, financial data and technical analysis of Samsung Electronics

[1] TrendForce - “Samsung Reportedly Plans 50% HBM Capacity Surge in 2026” (https://www.trendforce.com/news/2025/12/30/news-samsung-reportedly-plans-50-hbm-capacity-surge-in-2026-spotlight-on-hbm4/)

[2] TrendForce - “Samsung HBM4 Reportedly Beats Expectations in Broadcom Test” (https://www.trendforce.com/news/2025/12/03/news-samsung-hbm4-reportedly-beats-expectations-in-broadcom-test-set-to-lead-2026-google-tpu-supply/)

[3] The Chosun - “Samsung Set to Reclaim DRAM Leadership with HBM Edge” (https://www.chosun.com/english/industry-en/2025/12/30/B6LZXS3MKFFO7D2ZCK4CEQT3HE/)

[4] Financial Content - “The Battle for AI’s Brain: SK Hynix and Samsung Clash Over Next-Gen HBM4 Dominance” (https://markets.financialcontent.com/wral/article/tokenring-2026-1-1-the-battle-for-ais-brain-sk-hynix-and-samsung-clash-over-next-gen-hbm4-dominance)

[5] AInvest - “Samsung Advances HBM4 Chip Supply for 2026 AI Expansion” (https://www.ainvest.com/news/samsung-advances-hbm4-chip-supply-2026-ai-expansion-2601/)

[6] NAND Research - “Call Notes: Memory & NAND Market Situation (Dec 2025)” (https://nand-research.com/call-notes-memory-nand-market-situation-dec-2025/)

[7] Financial Content - “How Micron’s HBM Boom Redefined the AI Landscape in 2025” (https://markets.financialcontent.com/wral/article/marketminute-2025-12-25-the-memory-wall-crumbles-how-microns-hbm-boom-redefined-the-ai-landscape-in-2025)

[8] AInvest - “Micron’s AI-Driven Momentum: 30%-80% Upside in 2026” (https://www.ainvest.com/news/micron-ai-driven-momentum-30-80-upside-2026-memory-market-booms-2512/)

[9] Yahoo Finance HK - “Memory Giants Battle for HBM4 Dominance! SK Hynix Advances Mass Production, Samsung Gets NVIDIA Green Light, Micron Joins the Fray in 2026”

[10] Sina Finance - “Market Surges as Memory Chip Giants Raise Prices”

— tags (codes, translate to display labels) —

HBM4, Samsung, AI Memory, Market Share, Valuation, Semiconductor, DRAM

— event_type (code, translate to display label) —

Social Media

— sentiment (code, translate to display label) —

Mixed

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.