Analysis of the Synchronous Rise of Stocks and Precious Metals in Early 2026 and Its Driving Factors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The synchronous rise of stocks and precious metals in early 2026 differs from historical patterns. Below is a summary and verification based on brokerage API data and online search materials:

-

U.S. stock indexes traded near year-end highs (as of 2025-12-31):

- S&P 500 (^GSPC) closed at 6,845.49, with a previous range of approximately 6,775—6,946 [0].

- Nasdaq (^IXIC) closed at 23,241.99, with a previous range of approximately 23,006—23,665 [0].

- Dow Jones (^DJI) closed at 48,063.28, with a previous range of approximately 47,952—48,782 [0].

-

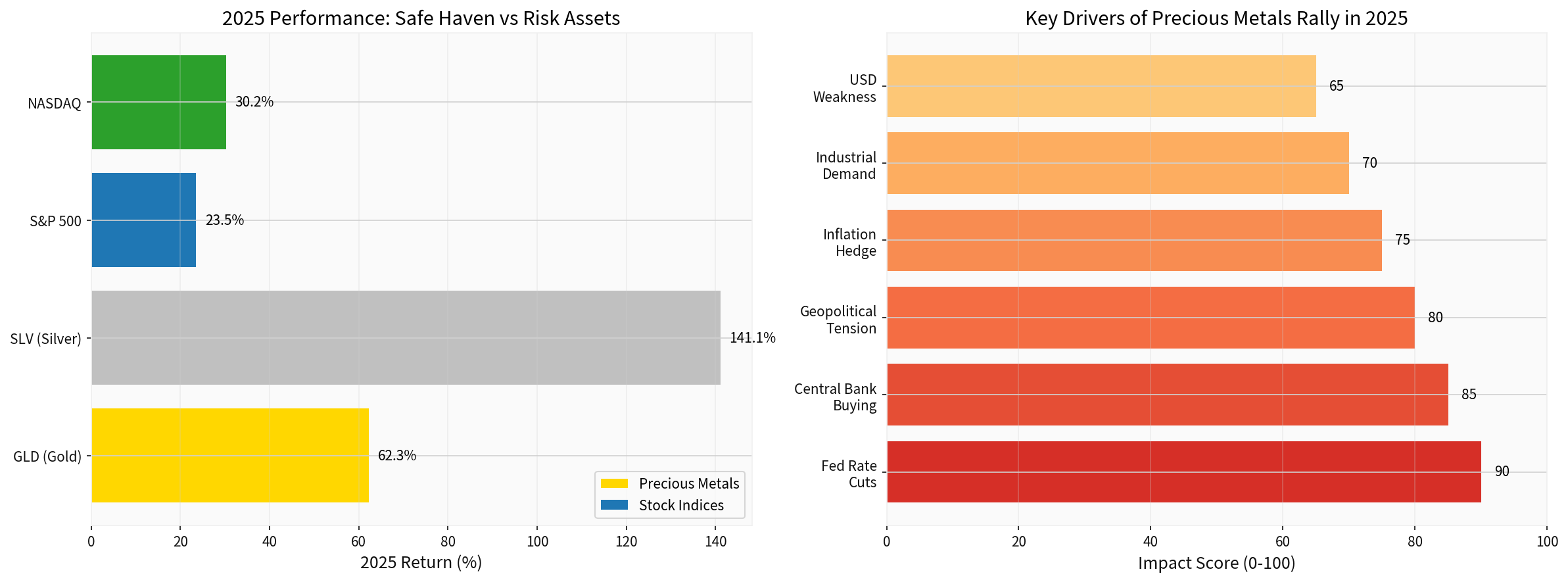

Annual gains of precious metal ETFs (2025 full year):

- GLD (Gold ETF): Opened at 244.22, closed at 396.31 in 2025, with an annual gain of approximately +62.28%; intrayear high of 418.45 [0].

- SLV (Silver ETF): Opened at 26.72, closed at 64.42 in 2025, with an annual gain of approximately +141.09%; intrayear high of 71.22 [0].

-

Real-time quote: The latest price of GLD is $396.31 (down 0.65% from the previous day) [0].

The above price points indicate: At the end of 2025, the three major stock indexes were in a high range; precious metals experienced a strong rise in 2025 (especially silver), and GLD is currently oscillating near its annual high despite a slight pullback.

- Traditionally, risk assets (stocks) and safe-haven assets (precious metals) show a “seesaw effect” in some phases, but their simultaneous rise in specific macro environments is not uncommon. For example:

- When real interest rates tend to fall or the dollar weakens, it benefits gold and silver (reducing holding opportunity costs and enhancing the attractiveness of dollar-denominated assets), while easing expectations or improved liquidity can also support risk assets.

- When safe-haven demand and risk appetite are simultaneously affected by macro factors (such as interest rate cut expectations, geopolitical tensions, and supply chain disruptions) at different levels, different asset classes may strengthen synchronously.

- Online searches indicate that against the backdrop of “Trump tariffs, geopolitical tensions and uncertainties, and rising industrial and institutional demand”, gold and silver hit multiple record highs in 2025 [2]. This coexists with the high U.S. stock environment in the same period, reflecting the layered superposition of macro expectations and capital flows, rather than a simple deviation from historical correlations.

In short: The current “synchronous rise of stocks and gold” more reflects that the macro environment and capital preferences are favorable to both asset classes (interest rate cut expectations combined with safe-haven and industrial demand), which is not contradictory to historical experience but indeed reflects the combined characteristics of macro drivers.

-

Fed Interest Rate Cuts and Easing Expectations

- The Fed implemented three interest rate cuts in 2025, and the market expects further cuts in 2026 (including policy expectations related to potential successors) [2].

- The Fed’s December meeting minutes showed that “most officials expect more rate cuts” [5].

- Rate cuts reduce nominal and real interest rates, lowering the holding cost of precious metals while improving the valuation and financing environment for risk assets.

-

Central Banks’ Continued Gold Purchases

- Many central banks continue to increase their gold reserves, using gold as part of diversified reserve assets [2][4].

- Sustained growth in central bank demand provides structural support for gold prices.

-

Geopolitical and Trade Uncertainties

- Against the background of tariff policies and geopolitical situations, the demand for safe-haven and uncertainty hedging of gold and silver has increased [2][4].

- Safe-haven capital flows into precious metals, while capital reallocation to some risk assets (such as resources, military industry, and beneficiary industries) can also support stock indexes periodically.

-

Inflation Hedging and High Debt Levels

- “Persistent inflation and high debt levels” have prompted investors to view precious metals as a hedge and preservation tool [2].

- Concerns about fiscal sustainability and currency weakening in a high-debt environment are beneficial to precious metals.

-

Silver’s Dual “Safe-Haven + Industrial” Attributes

- Silver has both precious metal and industrial metal attributes, gaining additional momentum amid the energy transition and rising electronic demand [2].

- This explains why silver’s gain in 2025 was significantly higher than that of gold.

-

Weakening Dollar

- The U.S. Dollar Index came under pressure and declined in 2025; some reports stated that the DXY may have fallen by more than 9% for the full year [6].

- A weaker dollar is beneficial to the prices of dollar-denominated precious metals and supports the valuation of U.S. stocks with more overseas earnings.

- Interest rate cut expectations and falling real interest rates: Simultaneously boost risk asset valuations and precious metal attractiveness.

- Safe-haven demand and structural demand: Geopolitical and policy uncertainties drive precious metals; but structural capital preferences for growth and resource sectors also support stock indexes.

- Weakening dollar and capital rotation: A weak dollar benefits precious metals and increases the profits of multinational enterprises, thereby supporting stock indexes.

- Diversification at the asset allocation level: In a complex macro environment, institutions hold both risk and safe-haven assets to build diversified portfolios, which can also lead to “synchronous rises” at the capital level.

- If inflation remains stubborn or the Fed slows down the pace of rate cuts, a rebound in real interest rates may pressure precious metals while U.S. stock valuations come under pressure.

- If geopolitical risks ease or tariff policies become clearer, the safe-haven premium may shrink, leading to increased short-term volatility in precious metals.

- If the liquidity environment tightens significantly, it may affect the valuation and holding costs of both risk and safe-haven assets at the same time.

[0] Gilin API Data

[2] Yahoo Finance — “Gold and Silver in 2025: Multiple Record Highs Amid Trade …” (https://finance.yahoo.com/news/gold-silver-2025-multiple-record-133600639.html)

[4] Bloomberg — “How Gold’s Safe-Haven Appeal Is Fueling Record Prices” (https://www.bloomberg.com/news/articles/2025-12-22/gold-price-record-why-us-rate-cut-bets-safe-haven-appeal-are-fueling-rally)

[4] Bloomberg — “Central Banks Are Hoarding Gold for a Reason” (https://www.bloomberg.com/news/newsletters/2025-12-10/central-banks-have-been-the-biggest-force-in-a-secular-gold-bull-market)

[5] Bloomberg — “Fed Minutes Show Most Officials Expect Additional Rate Cuts” (https://www.bloomberg.com/news/articles/2025-12-30/fed-minutes-show-most-officials-expect-additional-rate-cuts)

[6] WSJ — “The WSJ Dollar Index Falls 6.65% This Year to 95.92” (https://www.wsj.com/articles/dollar-rises-after-fed-minutes-show-caution-over-rate-cuts-bdce1a49)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.