ADL and JLens Opposition to Alphabet Anti-Israel Shareholder Proposal - Governance Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis examines the May 13, 2025 joint opposition by ADL (Anti-Defamation League) and JLens to a shareholder proposal targeting Alphabet Inc. (NASDAQ: GOOG) regarding its business ties with Israel. The proposal was overwhelmingly rejected by shareholders with 95.5% voting against at the June 6, 2025 annual meeting [0]. While representing significant geopolitical and corporate governance considerations, the event poses limited immediate financial impact to Alphabet.

The controversy centered on “Proposal 9,” a shareholder resolution requesting Alphabet to commission an independent third-party report assessing whether its products and services contribute to human rights harms in “conflict-affected and high-risk areas” (CAHRA), specifically focusing on Project Nimbus with Israel [1][2]. ADL and JLens argued the proposal was politically motivated and aligned with the BDS movement, potentially harming Israel’s national security [1].

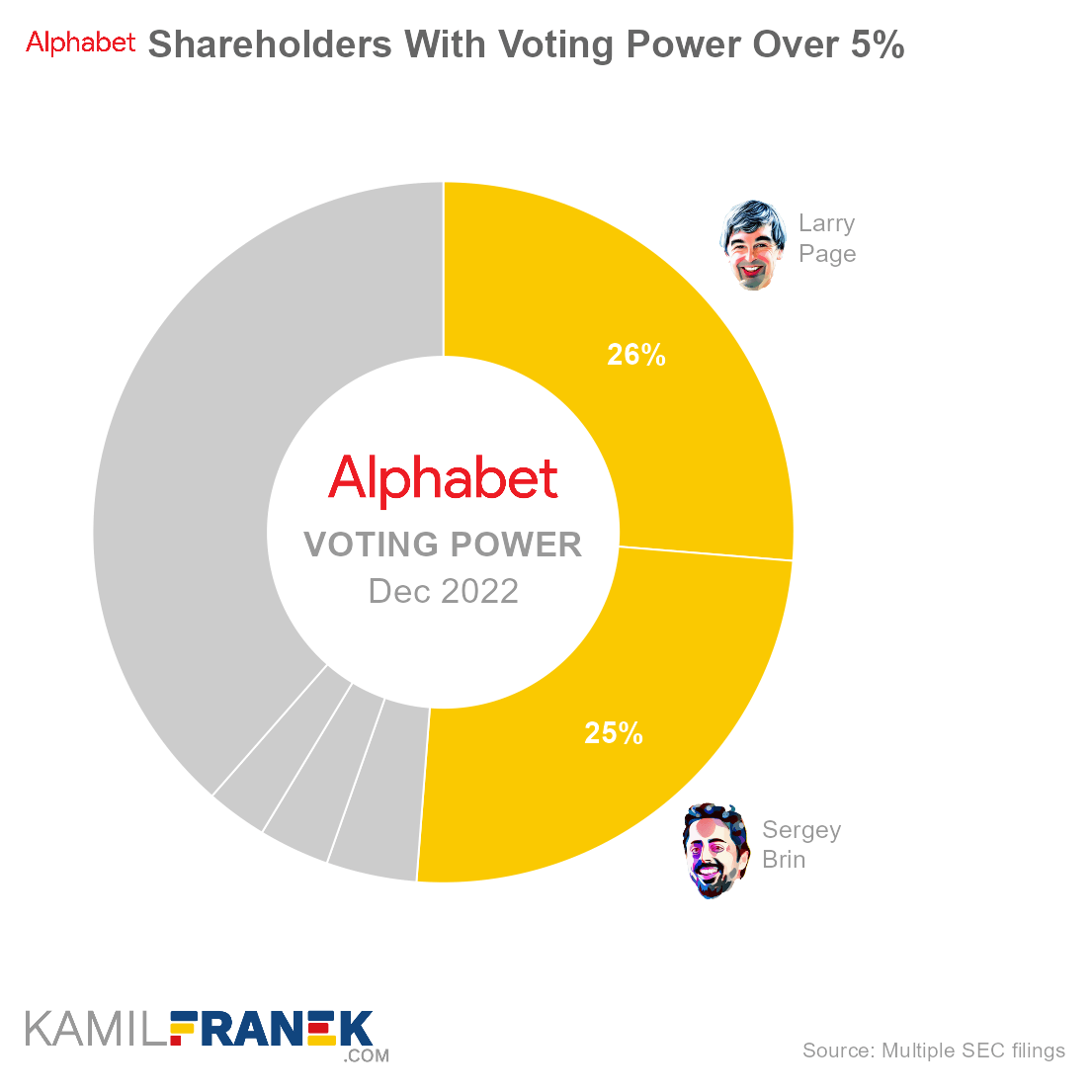

The resolution was decisively rejected with 562,088,943 votes for (4.5%) and 11,908,869,697 votes against (95.5%) [0]. Alphabet’s board of directors had also recommended voting against the proposal [1], aligning with standard corporate governance practices.

Central to this debate is Project Nimbus, a $1.2 billion joint cloud project between Alphabet and Amazon serving both civilian and military applications in Israel [1]. The contract serves multiple Israeli civilian ministries including healthcare, finance, education, and transportation, in addition to military applications [1]. Notably, The Intercept reports that Israel “can extend the contract up to 23 years, with limited ability for Google to walk away” from the agreement [3].

GOOG stock currently trades at $281.82 with normal market behavior [0]. The overwhelming shareholder rejection suggests investor confidence in Alphabet’s current approach to geopolitical contracts. The $1.2 billion Project Nimbus represents a relatively small portion of Alphabet’s overall revenue, limiting immediate financial exposure.

This event establishes an important precedent for how technology companies handle geopolitical shareholder activism. The decisive 95.5% rejection indicates strong shareholder support for management’s approach to international contracts, even when involving sensitive geopolitical situations.

Alphabet previously fired 28 employees in April 2024 following internal protests over Project Nimbus [1], indicating ongoing workplace tensions. The company has demonstrated willingness to enforce workplace policies while maintaining controversial contracts, suggesting a balanced approach to stakeholder management.

Legal experts note potential civil liability if technology is used in violations of international humanitarian law, though criminal liability remains less likely [3]. This creates a nuanced risk environment where Alphabet must balance contractual obligations with potential legal exposure.

The ADL and JLens opposition to Proposal 9 represents a standard corporate governance dispute with clear resolution through the shareholder voting process. The overwhelming 95.5% rejection indicates strong investor confidence in Alphabet’s current approach to international contracts [0]. While Project Nimbus involves geopolitical sensitivities and potential legal considerations [3], the immediate financial impact appears limited given the contract’s size relative to Alphabet’s overall operations and the decisive shareholder support for management’s position.

The event underscores the complex landscape technology companies navigate when operating in geopolitically sensitive regions, balancing contractual obligations, stakeholder interests, and potential reputational risks. However, the clear shareholder mandate suggests current strategies align with investor expectations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.