Analysis of Sichuan Changhong's AI Transformation and Current Low Gross Margin Situation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

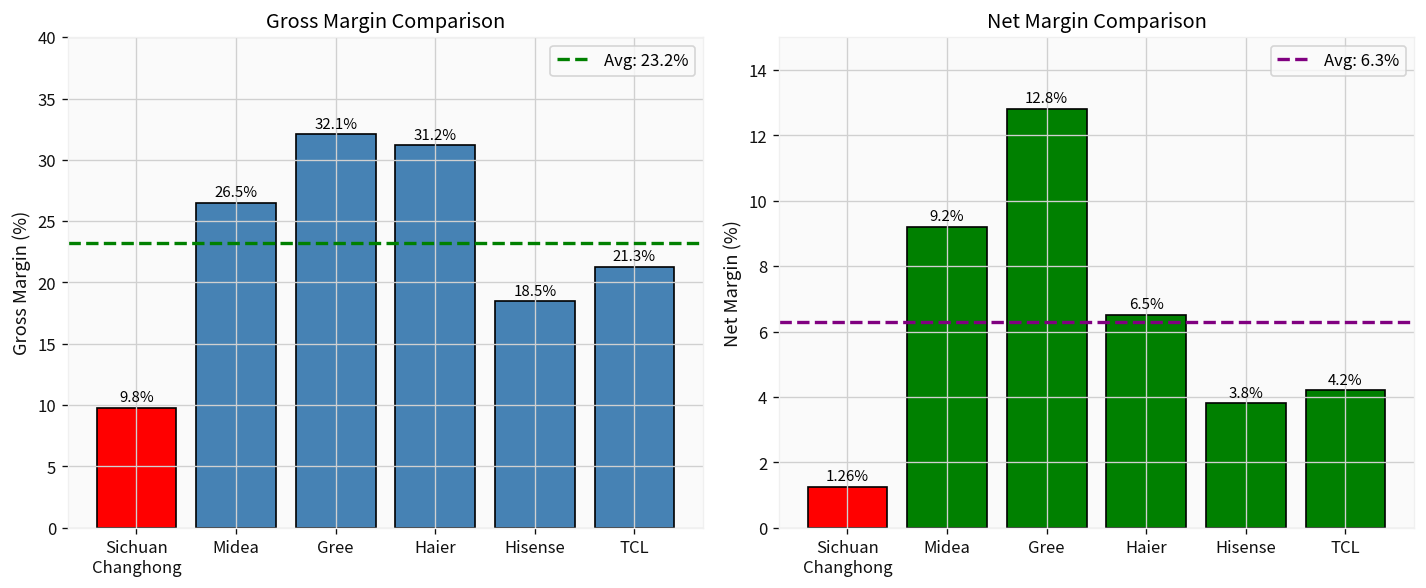

According to the latest financial data [0], Sichuan Changhong faces significant profitability challenges:

| Indicator | Sichuan Changhong | Industry Average | Gap |

|---|---|---|---|

Gross Margin |

9.8% | 23.2% | -13.4 percentage points |

Net Margin |

1.26% | 6.3% | -5.0 percentage points |

ROE |

9.1% | 18.0% | -8.9 percentage points |

Compared with industry leaders such as Midea Group (gross margin 26.5%) and Gree Electric (gross margin 32.1%), Sichuan Changhong’s gross margin gap is obvious, only about one-third of Gree Electric’s [0].

According to public information [1], Sichuan Changhong has made active布局 in intelligent manufacturing and AI fields in recent years:

- Deploy AI-driven “factory brain” systems on production lines to achieve intelligent control of production processes

- Introduce automated equipment and robot technology to improve production efficiency

- Build digital factories to achieve full-process data management

- Launch new-generation products such as AI TVs, smart refrigerators, and smart air conditioners

- Layout 5G ecosystem and smart home interconnection systems

- Develop terminal products with AI functions such as voice interaction and image recognition

- Increase R&D efforts in artificial intelligence, Internet of Things, big data and other fields

- Carry out industry-university-research cooperation with universities and research institutions

| Impact Factor | Mechanism | Expected Effect |

|---|---|---|

Production Efficiency Improvement |

AI optimizes production processes, reduces waste, lowers unit costs | Cost side improvement of 2-3% |

Product High-endization |

AI functions empower high-end products, increase price increase space | Revenue side increase of 1-2% |

Quality Improvement |

AI quality inspection reduces defect rate, reduces rework costs | Profit margin increase of 0.5-1% |

Supply Chain Optimization |

AI predicts demand, optimizes inventory management | Operational efficiency improvement |

-

Fierce competition in the home appliance industry: Leading enterprises such as Midea and Haier are also accelerating AI transformation, and Sichuan Changhong faces pressure to catch up technologically [1]

-

Long input-output cycle: Intelligent manufacturing transformation requires a lot of capital investment, which may erode profits in the short term

-

Limited brand premium capability: Compared with high-end brands, Sichuan Changhong has a weak “high-end” positioning in consumers’ minds, and AI functions are difficult to support significant premiums

-

Excessively large gross margin gap: The 13.4 percentage point gap with industry leaders is difficult to close in the short term relying solely on AI transformation

| Scenario | Gross Margin Improvement Range | Achievement Time | Key Assumptions |

|---|---|---|---|

Optimistic Scenario |

+3-5% | 3-5 years | AI products account for over 30%, successful high-endization |

Neutral Scenario |

+1-2% | 3-5 years | Mainly production efficiency improvement, slow product upgrade |

Conservative Scenario |

+0.5% | Over 5 years | Increased competition, limited effect of AI transformation |

- Sichuan Changhong’s AI transformation can improve gross margin in the medium to long term, but the improvement range is limited

- In the short term (1-2 years), the direct contribution of AI transformation to gross margin may be less than 2 percentage points

- To achieve a substantial breakthrough in gross margin (reaching more than 15%), it needs:

- Breakthrough in high-end product structure

- Improvement of brand premium capability

- Establish differentiated competitive advantages in segmented markets

- The overall growth rate of the home appliance industry slows down, and competition intensifies

- AI transformation investment may affect short-term performance periodically

- Impact of raw material price fluctuations on the cost side

- Change in revenue proportion of AI products

- Quarterly sequential trend of gross margin

- R&D expense ratio and capital expenditure intensity

[0] Gilin AI Financial Database - Sichuan Changhong Financial Data (https://www.gilin-ai.com)

[1] Sichuan News Network - Sichuan Changhong Intelligent Manufacturing Transformation Report (https://www.sc.chinanews.com.cn)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.