2026 U.S. Stock Market In-Depth Analysis: Comprehensive Impact of Three Core Drivers

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

In 2026, the U.S. stock market will face a

2025 was a landmark year for AI capital expenditure. Data shows:

- Global AI capital expenditure is expected to reach $571 billion in 2026[3], a significant increase from 2025

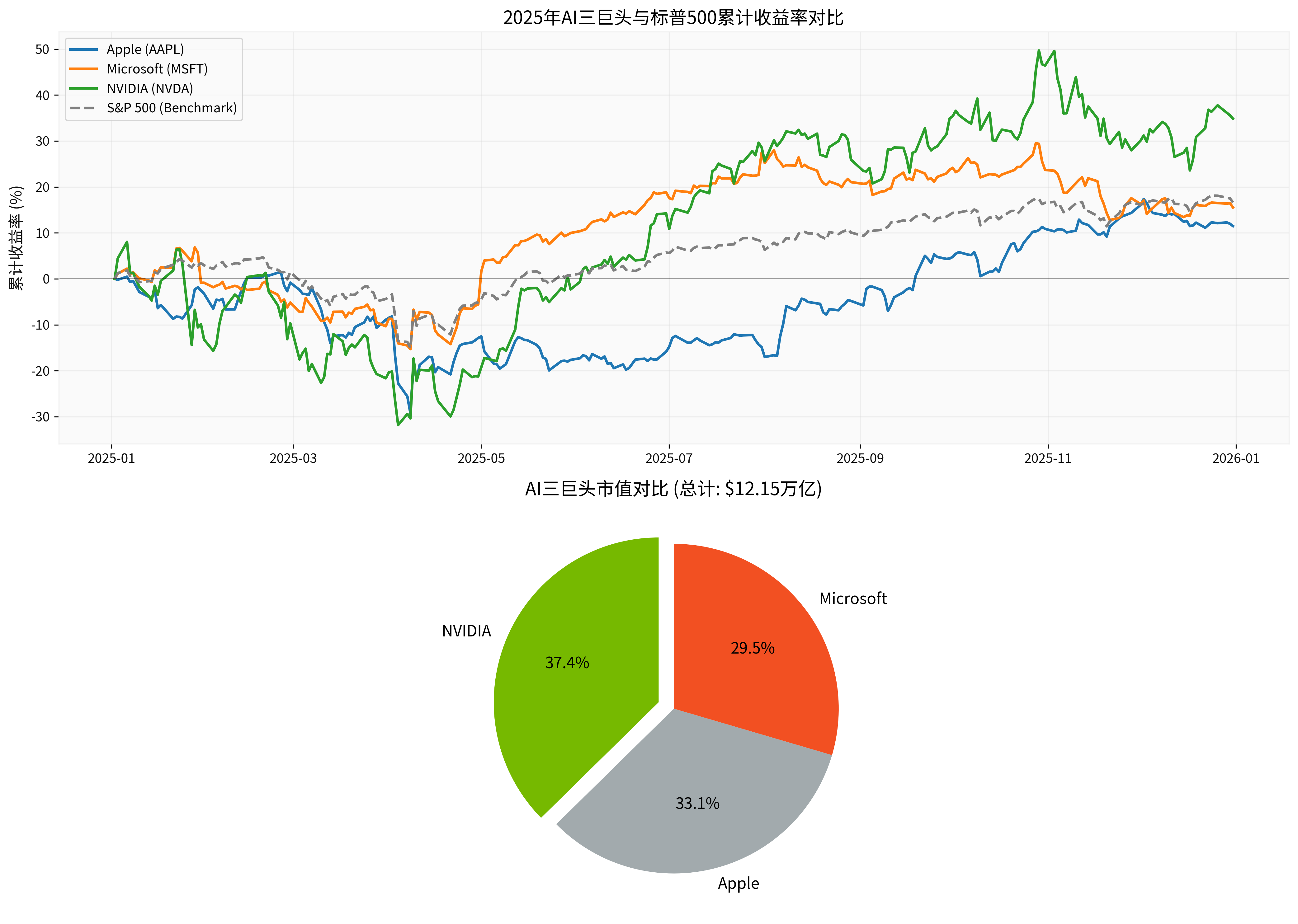

- The combined market capitalization of the three AI giants reached $12.15 trillion, accounting for a significantly higher proportion of the total U.S. stock market capitalization [0]

- NVIDIA rose 34.84% in 2025, significantly outperforming the S&P 500’s 16.65% [0]

The chart shows that NVIDIA performed the most prominently in 2025 but also had the highest volatility (maximum drawdown of -36.89%), Microsoft performed steadily, and Apple was relatively moderate

Based on the latest market research and corporate investment plans:

- Corporate AI budgets continue to increase: Venture capital surveys show that most enterprises will increase their AI budgets in 2026, but they will be more concentrated and rational [4]

- From experiment to production: Enterprises will cut experimental budgets and concentrate resources on AI technologies that have proven value [4]

- Sustained demand for infrastructure: Investment in infrastructure such as data centers, AI chips, and cloud computing will remain strong

- Rising project failure rate: Gartner predicts that more than 40% of agentic AI projects will be canceled by the end of 2027 [7], meaning the first wave of failures may start in 2026

- Pressure on investment returns: Investors are starting to demand actual returns from AI investments, not just conceptual hype

- Valuation pressure: Some AI concept stocks are overvalued (e.g., Palantir’s price-to-sales ratio exceeds 120x) [8]

- AI Infrastructure: NVIDIA, Broadcom, Data Center REITs

- AI Application Implementation: Enterprise software companies that can demonstrate real ROI

- AI Security and Governance: As enterprise AI deployment accelerates, demand for security and compliance increases

The current valuation levels of AI-related companies show obvious differentiation:

- NVIDIA: P/E 46.28x, Analyst Target Price $257.50 (+38.1%) [0]

- Microsoft: P/E 34.45x, Analyst Target Price $640.00 (+32.3%) [0]

- Apple: P/E 36.39x, Analyst Target Price $312.50 (+14.9%) [0]

According to FactSet data:

- S&P 500 earnings grew by approximately 12% in 2025, higher than the 10-year average of 8.6% [5]

- Technology sector led the gain: Benefited from demand for AI chips and cloud services

- Improved earnings quality: Many companies expanded profit margins through cost control and operational efficiency improvements

- S&P 500 2026 EPS Expectation: $300-$320, YoY growth of 11-19% [9]

- Overall Earnings Growth: FactSet expects 15% growth in 2026, higher than 2025’s 12% [5]

- Industry Differentiation:

- Technology Sector: Continues to lead, but the gap with the broader market narrows

- Cyclical Sectors: Benefit from economic recovery and falling interest rates

- Defensive Sectors: Relatively moderate growth

- Operating Leverage: Revenue growth plus cost control leads to margin expansion

- Accelerated AI Monetization: 2026 will be a key year for large-scale AI commercialization

- Tax Incentives: Corporate tax policies may remain favorable

- Buyback Support: Strong cash flow will continue to support share repurchases

- Rising Labor Costs: Despite rising unemployment, skilled talent remains scarce

- Geopolitical Risks: Tariffs and trade policies may affect multinational companies’ profits

- Uncertainty in AI Investment Returns: If AI monetization falls short of expectations, earnings forecasts may be revised downward

The latest FOMC meeting shows:

- Three rate cuts in 2025, 25 basis points each [10]

- One more rate cut expected in 2026, policy rate may drop to 3.0-3.25% [10,11]

- Decision Divergence: 7 FOMC members believe no more rate cuts should occur in 2026 [10]

- Valuation Support: Lower discount rate increases the present value of future cash flows

- Lower Credit Costs: Reduced corporate financing costs, beneficial for investment and buybacks

- Improved Economic Expectations: Rate cuts usually signal an economic soft landing

- Limited Rate Cut幅度: Only one 25bp cut, marginal effect diminishes

- Long-term Rates May Remain High: Inflation expectations and fiscal deficits may push up long-term yields

- Yield Curve Steepening: May compress bank net interest margins

| Scenario | Probability | Fed Funds Rate | 10-Year Treasury Yield | Impact on Stock Market |

|---|---|---|---|---|

| Base Case | 50% | 3.00-3.25% | 3.5-4.0% | Neutral to Positive |

| Optimistic Case | 30% | 2.75-3.00% | 3.0-3.5% | Significantly Positive |

| Pessimistic Case | 20% | 3.25-3.50% | 4.0-4.5% | Negative |

- S&P 500 Forward P/E: ~20x (2026 EPS $310, Index 6,845)

- Shiller P/E:40.74, Second Highest in History [9]

- Tech Stock Valuations: Significantly higher than the broader market, but some rationality has emerged

- Historical Highs: Current valuations are in the historical high range, limited room for expansion

- Rates Are Falling But Still Not Low: The 3-3.25% rate level is still higher than the zero rates in 2020-2021

- Earnings Growth Is the Main Driver: 2026 returns will rely more on EPS growth than P/E expansion

- Strong Earnings Growth:15% EPS growth can offset some P/E contraction

- Decline in Risk-Free Rate: Even if limited, it can provide marginal support

- Long-term Value of Tech Stocks: Long-term productivity gains from AI deserve a certain premium

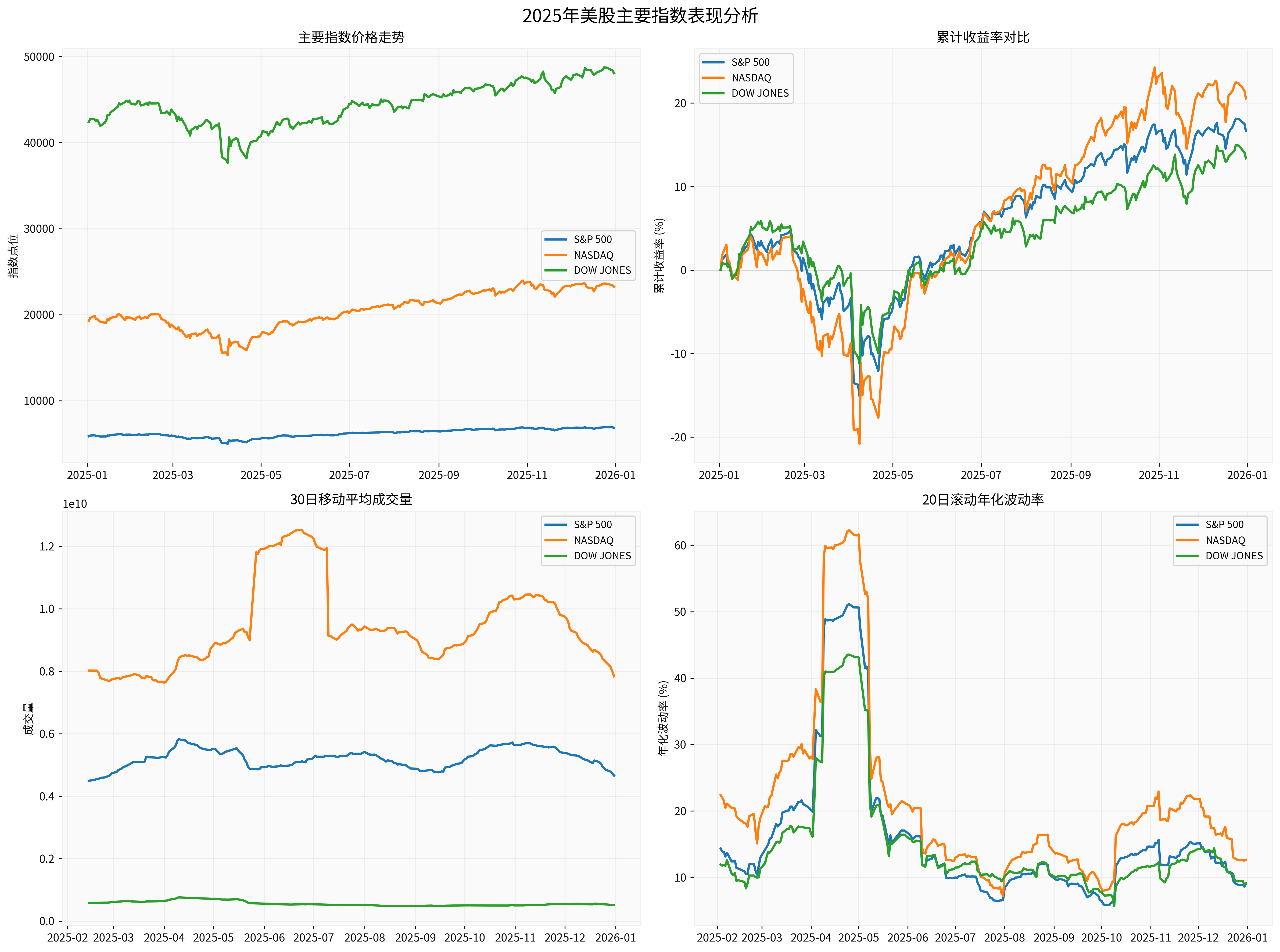

The chart shows that the Nasdaq led with a 20.54% gain in 2025 and also had the highest volatility (24.42%), reflecting the high-beta characteristics of tech stocks

| Institution | S&P500 Target Price | Upside Potential | Core Logic |

|---|---|---|---|

| BofA | 7,100 | ~3.7% | Valuation Expansion + Earnings Growth [12] |

| Barclays | 7,400 | ~8.1% | AI Story Continuation + Rate Cuts [12] |

| Oppenheimer | 8,100 | ~18.3% | Most Optimistic Scenario [13] |

- S&P500 Range:6,800-7,500 points

- Total Return:5-15% (mainly from earnings growth)

- Characteristics: Volatile upward trend, accelerated sector rotation

- Downside Risk: Valuation contraction + earnings miss expectations, index may fall to6,000-6,500 points

- Upside Risk: AI monetization exceeds expectations + more aggressive rate cuts, index may break 8,000 points

- Logic: AI capital expenditure continues to grow, but shifts from hardware to software and applications

- Key Focus:

- NVIDIA: AI chip leader, high valuation but strong profitability [0]

- Microsoft: AI office application (AI Copilot) monetization leader [0]

- Cloud Service Providers: AWS, Azure, Google Cloud

- Risks: Intensified competition, pressure on capital expenditure returns

- Logic: Economic soft landing + rate cuts benefit cyclical stocks

- Key Focus:

- Financials: Banks and insurance benefit from yield curve steepening

- Industrials: Infrastructure investment and manufacturing reshoring

- Energy: Traditional energy has low valuation and high dividends

- Risks: Economic slowdown, policy uncertainty

- Logic: High earnings certainty, reasonable valuation

- Key Focus:

- Apple: Service business proportion increases (26.2%), relatively reasonable valuation [0]

- High-Quality Consumer Brands: Strong pricing power, abundant cash flow

- Risks: Slowdown in consumer spending, intensified competition

- Logic: Valuation at historical lows, benefits from economic recovery and rate cuts

- Key Focus: Small and mid-cap value stocks with solid fundamentals

- Risks: Insufficient liquidity, tightening financing environment

- Overvalued AI Concept Stocks Without Earnings: e.g., Palantir (P/S ratio >120x) [8]

- Interest Rate Sensitive Sectors: Real Estate REITs, Utilities (unless deep recession occurs)

- Companies With High Geopolitical Risk Exposure: Enterprises with high proportion of business in China and Russia

- Growth Stocks (Including AI):50-60%

- Value Stocks (Including Cyclicals):25-35%

- Cash/Defensive Assets:10-20%

- Dollar-Cost Averaging: Avoid full position at once due to possible market volatility

- Dynamic Rebalancing: Gradually reduce AI weight and increase cyclical and value allocations as the market rises

- Focus on Earnings Realization: Pay close attention to AI monetization progress during quarterly earnings seasons

- Use Volatility: Deep corrections (10-15%) may be opportunities to add positions

- AI Investment Return Rate: Can enterprises prove the ROI of AI investments?

- Inflation Rebound: Will service sector inflation reemerge?

- Deterioration of the Job Market: Will rising unemployment trigger consumption concerns?

- Earnings Warnings: Will enterprises issue earnings warnings?

- Geopolitical Conflicts: Will situations in the Middle East, Russia-Ukraine, etc., worsen?

- Fed Communication: Will there be an unexpected shift in the FOMC dot plot?

In 2026, the U.S. stock market will operate under the complex interaction of

- AI Capital Expenditureshifts from explosive period to rational period, investment opportunities move from hardware to software and applications

- Corporate Earningsshow strong resilience, growth is expected to accelerate to15% in2026

- Fed Rate Cutsprovide liquidity support, but space is limited

[0] 金灵API数据 - 股票价格、财务数据、技术指标、市场指数、公司概况

[1] Yahoo Finance - “3 Leading AI Stocks Investors Can Buy for 2026” (https://finance.yahoo.com/news/3-leading-ai-stocks-investors-185800576.html)

[2] Yahoo Finance - “VCs predict enterprises will spend more on AI in 2026” (https://finance.yahoo.com/news/vcs-predict-enterprises-spend-more-153024453.html)

[3] Yahoo Finance - “Federal Reserve cuts interest rates by 25 basis points” (https://finance.yahoo.com/news/federal-reserve-cuts-interest-rates-by-25-basis-points-signals-1-cut-ahead-150046493.html)

[4] Investopedia - “Wall Street Expects a Solid 2026 for Stocks” (https://www.investopedia.com/wall-street-expects-a-solid-2026-for-stocks-but-the-risks-are-growing-spx-11874698)

[5] Forbes - “Agentic AI Takes Over 11 Shocking 2026 Predictions” (https://www.forbes.com/sites/markminevich/2025/12/31/agentic-ai-takes-over-11-shocking-2026-predictions/)

[6] Yahoo Finance - “Wall Street’s 2026 outlook for stocks” (https://finance.yahoo.com/news/wall-streets-2026-outlook-for-stocks-150650909.html)

[7] Yahoo Finance - “Wall Street strategists are divided over valuations” (https://finance.yahoo.com/news/wall-street-strategists-are-divided-over-valuations-165910618.html)

[8] Yahoo Finance - “Every major analyst’s S&P 500 price target for 2026” (https://finance.yahoo.com/news/traders-discussing-markets-170711079.html)

[9] Yahoo Finance - “Big Changes Are Coming to the Federal Reserve in 2026” (https://finance.yahoo.com/news/big-changes-coming-federal-2026-110000843.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.