Analysis of Hainan Free Trade Port Closure's Effects and Beneficiary Companies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on your question, I will conduct a comprehensive analysis from three dimensions: policy effects, industry impact, and beneficiary companies.

Hainan Free Trade Port officially launched all-island closure operation on December 18, 2025, marking the entry into a substantive phase of building an “inside the territory but outside the customs territory” special tariff zone [1]. The core features of this institutional arrangement include:

- Zero Tariff: Imported equipment, raw materials, and operational transportation vehicles are almost fully duty-free. The number of tax items for goods entering the island under the “zero tariff” policy has been significantly expanded from 1,900 to 6,660, and the proportion of “zero tariff” goods tax items has increased from about 20% before closure to over 70% [1][2]

- Low Tax Rate: Corporate income tax for encouraged industries is reduced to 15% (standard rate is 25%), and personal income tax for high-end and in-demand talents is exempted if the actual tax burden exceeds 15% [2]

- Simplified Tax System: Implement simplified tax systems such as sales tax to optimize the tax structure [1]

- Implement the institutional arrangement of “First line open, second line controlled, free flow within the island”

- Promote models such as “batch exit from the island, centralized declaration” to significantly reduce customs declaration costs and time for enterprises [2]

According to data released by Hainan Province, driven by the closure policy, as of December 28, the province has added nearly 12,000 new business entities and over 110,000 inbound and outbound passengers, showing a strong driving effect of the policy on market vitality.

After the closure operation, the duty-free consumption market showed a strong rebound:

- The number of visitors to Sanya International Duty-Free City exceeded 36,000, an increase of over 60% year-on-year

- Duty-free sales in Sanya City increased by 85% year-on-year, exceeding 100 million yuan for multiple consecutive days [3]

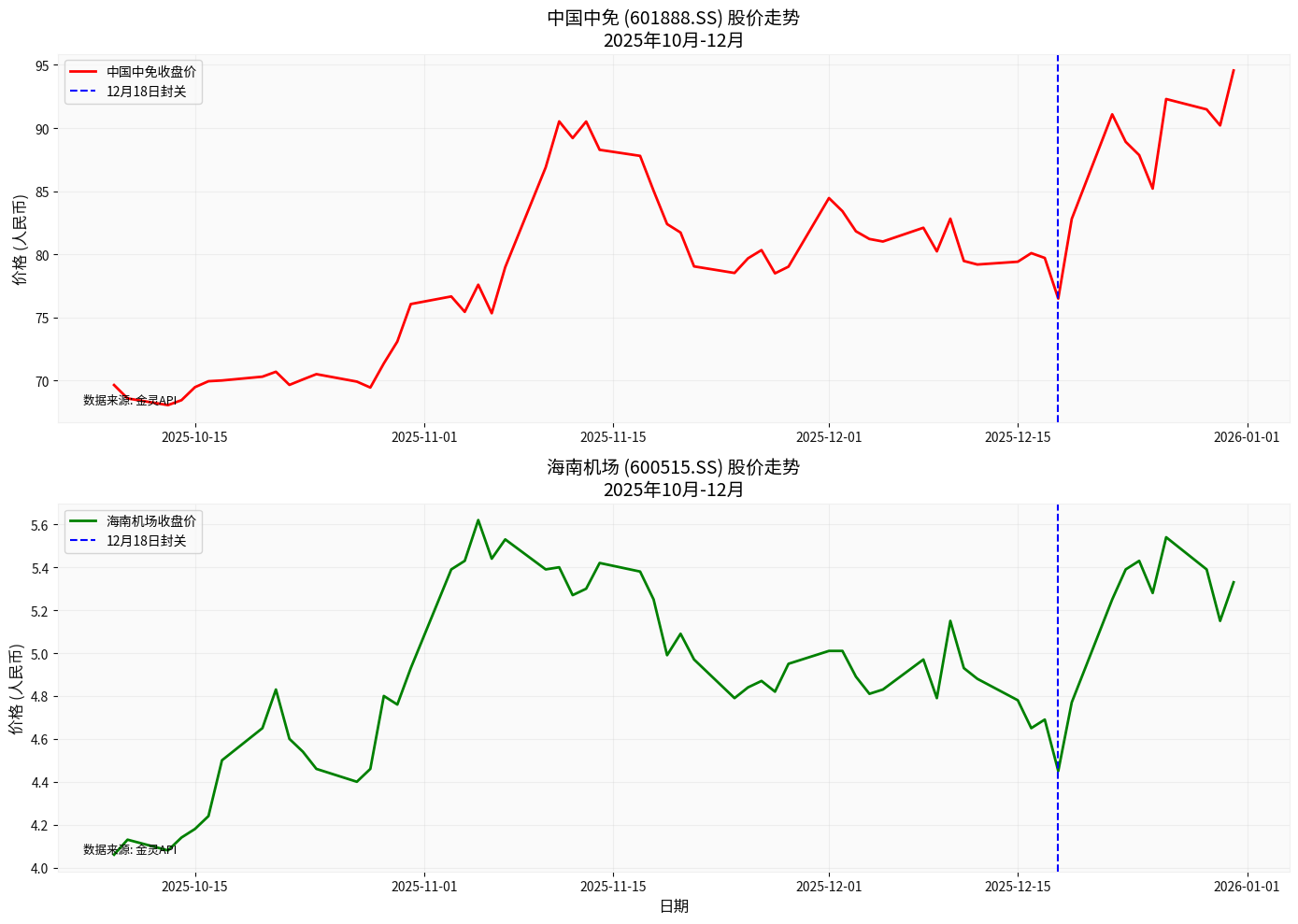

- China Duty Free’s stock price rose by 19.67% in December alone, with a market capitalization reaching 184.6 billion US dollars [0]

-

Continuous Release of Policy Dividends:

- Personal offshore duty-free quota increased to 100,000 yuan per year [1]

- The scope of “zero tariff” goods has been significantly expanded, from 1,900 to 6,660 types [1]

- Hainan’s offshore duty-free sales exceeded 20 billion yuan in 2024 [3]

-

Diversification of Consumption Scenarios: China Duty Free has implemented the “Duty-Free +” strategy, adding tourism, health care and other experience formats to retail to increase customer unit price and repurchase rate [4]

-

Construction of International Consumption Center: Hainan Free Trade Port aligns with high-standard rules such as CPTPP and RCEP, creates an international consumption environment, and attracts international luxury brands to settle in [2]

-

Outbound Tourism Competition Pressure:

- In the first quarter of 2025, outbound hotel and air ticket bookings reached 120% of the same period in 2019 [4]

- Hainan’s duty-free consumption fell by nearly 30% in 2024, and China Duty Free’s Hainan regional revenue dropped by 27% year-on-year [4]

- China Duty Free’s revenue contribution from Hainan dropped sharply from 70% in 2023 to 51.4% [4]

-

Change in Consumption Habits:

- Domestic consumers prefer overseas consumption

- Merchants in other regions offer deep discounts on popular duty-free products, weakening Hainan’s attractiveness [4]

-

Intensified Market Competition:

- China’s duty-free industry is re-opened to foreign operators

- Although China Duty Free accounts for 78.7% of the market share, it will face more intense competition in the future [4]

- As a major beneficiary, Hainan Airport (600515.SS) saw its stock price rise by 31.28% in the fourth quarter of 2025 and 46.83% for the full year of 2025 [0]

- Industries such as aviation, hotels, and scenic spots will benefit from passenger flow growth

- Attract tourists through internationally competitive tax systems and relaxed visa policies

- Optimize entry tourism facilitation measures

- Headquarters Economy: The 15% corporate income tax preference attracts enterprise groups to establish regional headquarters in Hainan

- Financial Services: Cross-border trade facilitation, offshore finance and other businesses usher in development opportunities

- Medical and Health Care Industry: The policy advantages of Boao Lecheng International Medical Tourism Pilot Zone are strengthened

- Convention and Exhibition Industry: The increase in international conferences and exhibitions drives demand for related services

- Logistics and Shipping Industry: The “first line open” policy reduces international trade costs

- China’s largest duty-free operator, with a market share of about 78.7% [4]

- Has the world’s largest duty-free store in Haikou and the world’s second-largest duty-free mall in Sanya [4]

- Successfully won the right to operate 10 domestic port duty-free shops, including Guangzhou Baiyun International Airport and Kunming Changshui International Airport [4]

- Current stock price is 94.56 yuan, P/E ratio is 57.31 times, market capitalization is 184.6 billion US dollars [0]

- Rose by 19.67% in December 2025 alone, showing the market’s positive response to the closure policy [0]

- Recently opened overseas stores in popular destinations for Chinese tourists such as Singapore and Japan to layout for the recovery of outbound tourism [4]

- Policy dividends brought by the closure operation of Hainan Free Trade Port

- Expansion opportunities for urban duty-free shops

- Acquisition of direct operation rights for airport duty-free shops (e.g., Shanghai Pudong International Airport) [4]

- Hainan regional revenue accounted for 51.4%, but it is still highly dependent [4]

- Revenue in 2024 decreased by 16% year-on-year to 56.5 billion yuan, and net profit dropped by 36% to 4.32 billion yuan [4]

- Intensified market competition, foreign duty-free operators re-enter the market [4]

- Core airport infrastructure operator in Hainan Province

- Directly benefits from the growth of passengers entering and exiting the island

- Current stock price is 5.33 yuan, up 7.03% in Q4 2025 and 46.83% for the full year 2025 [0]

- P/E ratio is 196.45 times, reflecting the market’s high expectations for its growth [0]

- 52-week price range is 1.27-1.93 yuan, current stock price is at the high end of the range [0]

- Recent quarterly revenue is 913 million yuan, net profit margin is 6.89% [0]

- Current ratio is 2.22, financial structure is stable [0]

- Major airline operator in Hainan Province

- Benefits from the growth of Hainan Airlines passenger flow

- Current stock price is 1.81 yuan, performance in 2025 is relatively stable [0]

- Market capitalization is 7.828 billion US dollars, leading among local airlines in Hainan [0]

- The company is currently in a loss state, with a negative P/E ratio [0]

- Need to pay attention to the overall recovery of the aviation industry

- Medical and Health Care: Pay attention to listed companies related to Boao Medical

- Financial Opening: Cross-border trade financial service providers

- Logistics and Shipping: Ports and shipping enterprises benefit from trade facilitation

- Hotel and Catering: Local hotels and catering chain enterprises in Hainan

- Scenic Spot Operation: Tourism scenic spots and theme park operators

- Tourism Services: Online travel platforms and travel agencies

- Pay attention to market sentiment reactions after policy implementation

- Focus on direct beneficiary targets such as China Duty Free and Hainan Airport

- Be alert to callback risks after short-term speculation

- Pay attention to high-frequency indicators such as duty-free sales data and passenger throughput

- Evaluate the actual realization of policy dividends

- Layout leading enterprises with high certainty of performance improvement

- Pay attention to the continuous progress of Hainan Free Trade Port construction

- Focus on enterprises with core competitiveness and moats

- Pay attention to changes in industry structure brought by foreign investment entry

- Policy Execution Risk: Uncertainty exists in the effect and implementation intensity of policy landing

- Macroeconomic Risk: Domestic consumption recovery is weaker than expected

- Market Competition Risk: Intensified industry competition may compress profit margins

- Valuation Risk: Some targets have high valuations, need to be alert to callback pressure

- Geopolitical Risk: Changes in international relations may affect the development of the tourism industry

The closure operation of Hainan Free Trade Port is a major measure for China to promote high-level opening up, which will have a significant long-term boosting effect on duty-free consumption, tourism, and modern services. China Duty Free (601888.SH) and Hainan Airport (600515.SS) are the most directly benefited A-share listed companies. Investors should pay attention to data verification after policy implementation and substantial improvement in corporate performance, while noting valuation risks and changes in competition patterns.

Chart shows: The stock price trends of China Duty Free (601888.SS) and Hainan Airport (600515.SS) from October to December 2025. After the official closure of Hainan Free Trade Port on December 18, both stocks showed an upward trend, with China Duty Free rising by 35.75% and Hainan Airport by 31.28% during this period [0]

[0] 金灵API数据

[1] 雅虎财经 - “海南自贸港12.18推全新关税政策打造国家’特殊关税区’” (https://hk.finance.yahoo.com/news/海南自貿港12-18推全新關稅政策-打造國家-特殊關稅區-021548544.html)

[2] 雅虎财经 - “封关效应显现!海南掀起南下掏金潮中产、资本涌入卡位” (https://hk.finance.yahoo.com/news/封關效應顯現-海南掀南下掏金潮-中產-資本湧入卡位-031321799.html)

[3] 雅虎财经 - “三亚市免税销售额连日破亿中免(01880.HK)股价涨逾12%” (https://hk.finance.yahoo.com/news/三亞市免稅銷售額連日破億-中免-01880-hk-股價漲逾12-054345836.html)

[4] 雅虎财经 - “海南免税销售降温中国中免收入盈利双降” (https://hk.finance.yahoo.com/news/海南免稅銷售降溫-中國中免收入盈利雙降-014116073.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.