Innoscience (02577.HK) Hong Kong Hot Stock Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The event occurred at 10:30 on January 1, 2026 (UTC+8). Innoscience (02577.HK) was presumably listed on the Hong Kong Stock Exchange on that day and became a hot stock of market concern.

- Stock Overview

Innoscience’s stock code is 02577.HK, belonging to the semiconductor/power device sector, and may have completed its listing on January 1, 2026 [0]. - Reasons for Popularity

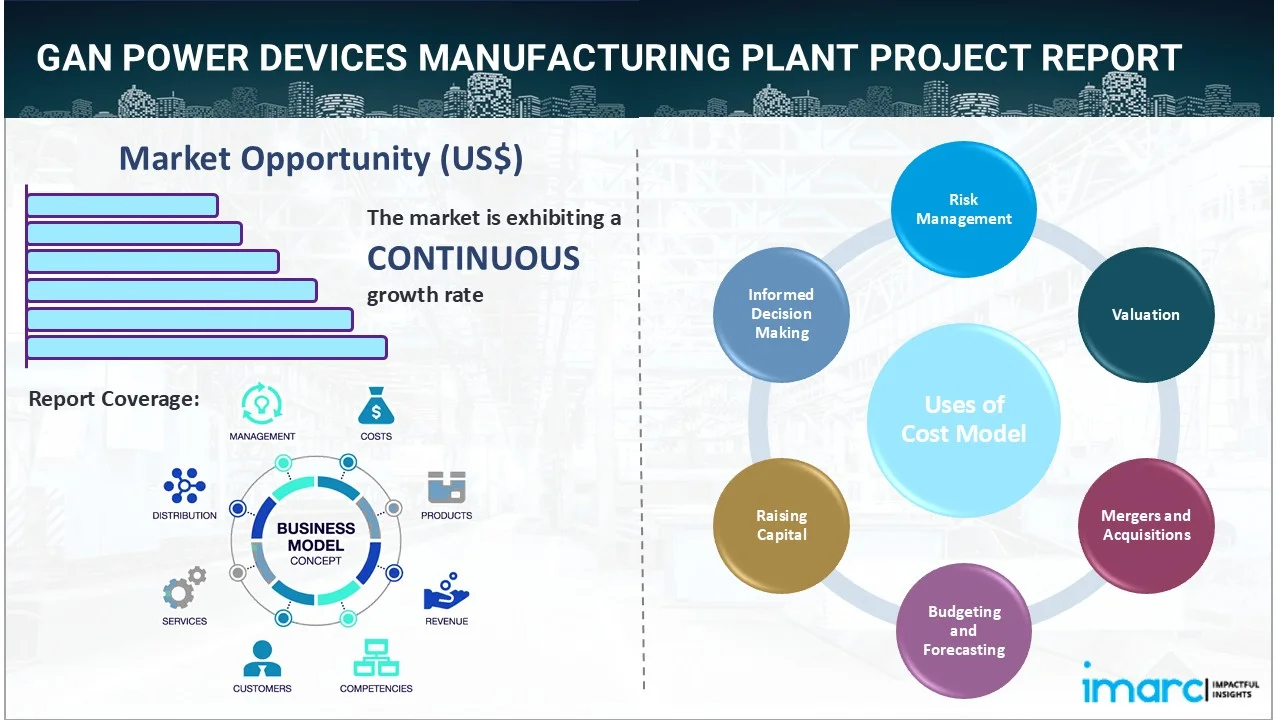

- Industry Position & Technical Advantages: Innoscience is a leading global innovator in 8-inch gallium nitride (GaN) process and power device manufacturing. Its GaN technology covers a wide voltage range from 15V to 1200V, and is widely used in consumer electronics, automotive electronics, data centers and other fields [1].

- Key Partnerships: It has reached a strategic cooperation with semiconductor giant onsemi to jointly accelerate the application of GaN industry, which is expected to bring hundreds of millions of dollars in GaN sales [2][3]; it was selected by NVIDIA as a supplier of 800V DC power architecture for AI data centers, and its technical strength has been recognized internationally [4].

- Market Timing: It coincides with the rebound period of the Hong Kong IPO market. Hong Kong’s IPO financing amount reached 36.5 billion US dollars in 2025, and tech and AI-related companies are favored by investors [5][6].

- Price & Volume

Since the stock has not yet been listed, there is no historical price and volume data [0]. However, based on its industry position, cooperation background and market enthusiasm, it is expected to attract investors’ attention after listing. - Market Sentiment

Cooperation with international giants reflects recognition of Innoscience’s technology and market position [1-4]; the recovery of Hong Kong IPO market makes tech AI companies investment hotspots [5-7]; China’s power semiconductor industry has rapid growth in demand due to new energy vehicles, photovoltaic energy storage and AI data centers [4].

- GaN technology has huge application potential in AI data centers (NVIDIA cooperation) and new energy vehicles. Innoscience’s 8-inch process advantage is expected to help it occupy a leading position in the segmented market.

- Cooperation with onsemi and NVIDIA not only verifies its technical strength, but also provides support for expanding global markets, increasing production capacity and sales, which may affect the competitive pattern of the GaN power device industry.

- The rebound of Hong Kong IPO market provides a good financing environment for tech companies. Innoscience’s listing coincides with the hot period of AI and semiconductor industries, and may become one of the indicators of market sentiment.

- Opportunities: China’s power semiconductor industry demand continues to grow, and the application expansion in AI and new energy fields brings broad market space for GaN devices; the recovery of Hong Kong IPO market improves the financing channels for tech companies.

- Risks: The GaN power device market is highly competitive, and international giants such as onsemi and Infineon are actively deploying [1]; the semiconductor industry has rapid technological iteration, requiring continuous R&D investment to maintain leadership [0]; newly listed stocks have large short-term volatility [0]; the industry is significantly affected by global trade and policies [0].

Innoscience has strong competitiveness in the GaN power device field relying on its technical advantages and cooperation with international giants. Its listing timing aligns with the development trends of the Hong Kong IPO market and the tech industry. Investors need to pay attention to its business progress, market dynamics and industry competition after listing, and make decisions based on their own risk preferences.

[0] Internal analysis database data; [1]-[7] External market reports

This report is for decision support only and does not constitute investment advice. Investors need to independently assess risks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.