Analysis of the Merger Transaction Between Mercantile Bank and Eastern Michigan Financial

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Total Transaction Value:Approximately $95.8 million

- Transaction Structure:Mixed cash and stock transaction

- Consideration Arrangement:EFIN shareholders receive $32.32 cash per share + 0.7116 shares of MBWM

- Post-Merger Asset Size:Total assets of $6.7 billion, loans of $4.9 billion, deposits of $5.2 billion

- Market Position:Becomes the largest bank in Michigan by assets after the merger

- July 22, 2025:Both parties announce a definitive merger agreement

- December 31, 2025:Transaction completed and announced

- Q1 2027:Plan to complete the integration of Eastern Michigan Bank and Mercantile Bank

This transaction reflects the significant recovery of the regional bank M&A market in 2025:

- Surge in Transaction Volume:In Q3 2025, there were 52 bank M&A transactions alone, with a total value of $16.6 billion, the highest level in recent years

- Shorter Approval Time:The new government regulatory agency accelerated the approval process from approximately 7 months previously to about 4 months, the fastest in over three decades

- Favorable Regulatory Environment:Regulatory agencies have shifted their attitude towards bank mergers from “micromanagement” to focusing on substantive financial risks, recognizing that consolidation can create a stronger, more efficient, and more stable industry

- P/TBV Premium Increase:The average price-to-tangible book value ratio of bank transactions in 2025 reached 148% of tangible book value, significantly higher than 124% in 2024

- Valuations Remain Attractive:Despite the rebound in premiums, industry valuations are still at historical lows relative to historical levels and the broader stock market

Regional banks actively seek consolidation mainly based on:

- Economies of Scale Demand:Rising compliance costs and technology investment needs force small banks to seek scale

- Risk Diversification:Enhance risk resistance by expanding deposit bases and loan portfolios

- Digital Transformation:Integrate resources to invest in digital banking platforms and technical infrastructure

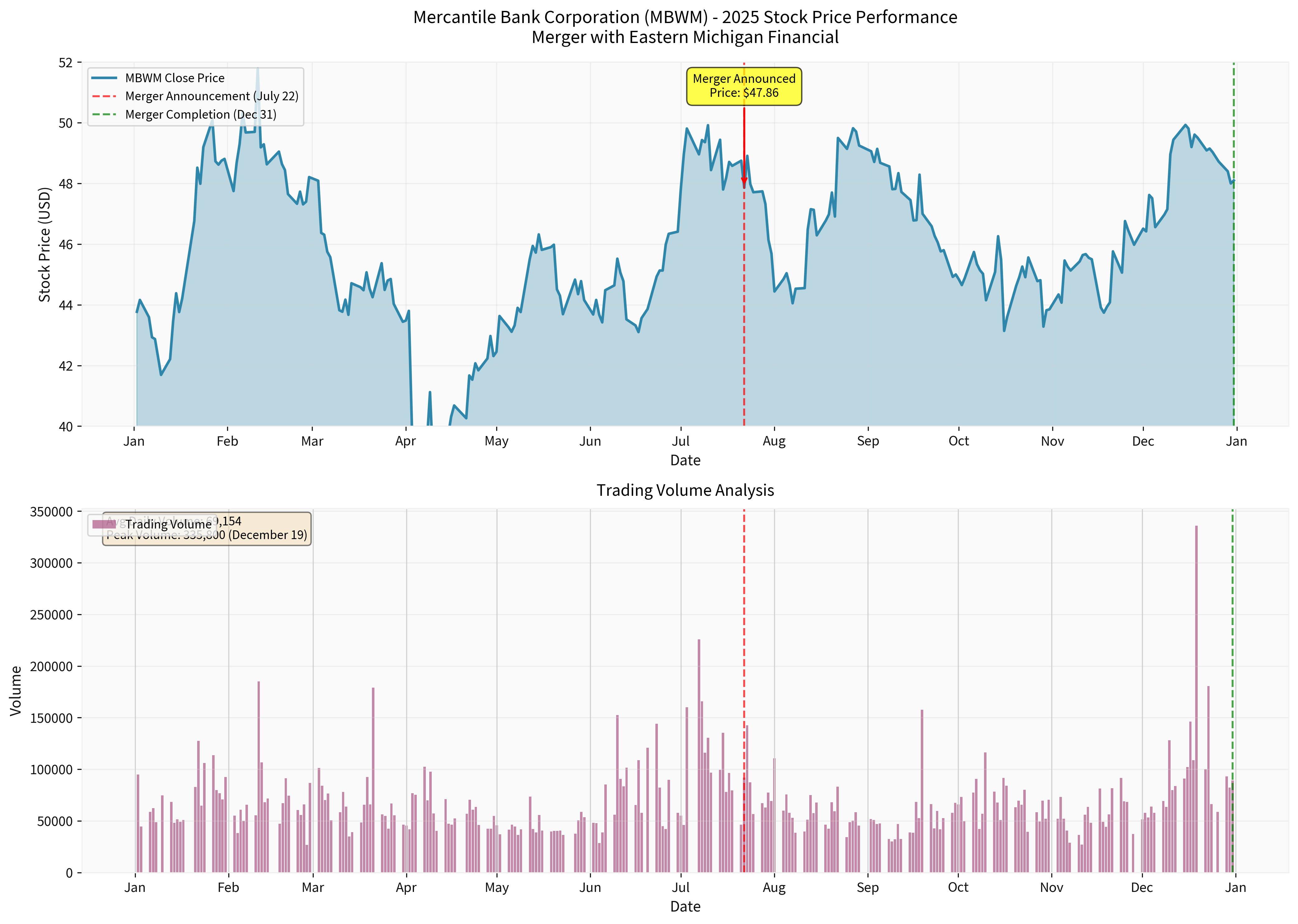

- X-axis:Months in 2025

- Y-axis (Top Chart):Stock Price (USD)

- Y-axis (Bottom Chart):Trading Volume

- Key Events:Red dashed line marks the merger announcement date on July 22, 2025; green dashed line marks the closing date on December 31, 2025

- YTD Return:+9.89%

- 1-Year Return:+8.11%

- 3-Year Return:+42.94%

- 5-Year Return:+77.03%

Comparison with同期 market indices (mid-April to late December 2025):

- S&P 500:+26.49%

- Dow Jones Industrial Average:+18.75%

Key financial indicator improvements from the merger:

- EPS Accretion:The transaction is expected to accret EPS by approximately 11% after cost savings are fully implemented

- Tangible Book Value Dilution:Expected to dilute by approximately 5.8% at closing, but expected to recover in about 3.6 years

- Capital Adequacy Ratio:Capital ratios are expected to exceed the “well-capitalized” regulatory requirement after closing

- Operational Efficiency:Improve loan-to-deposit ratio, expand deposit base, and reduce funding costs

For arbitrage investors, this transaction offers typical risk-return characteristics:

- Regulatory Approval Certainty:The supportive regulatory environment accelerates approval, reducing transaction failure risk

- Faster Capital Turnover:Shorter approval time means arbitrage funds can turn over faster, increasing annualized returns

- Reduced Idiosyncratic Risk:Reduced regulatory pressure lowers transaction risk, supporting narrower spreads

This transaction and the rebound in overall M&A activity in 2025 indicate:

- Bottom Has Been Reached:After the 2023 regional bank liquidity crisis, industry valuations have bottomed out and rebounded

- M&A Repricing:P/TBV has rebounded from its 2023 low to 147%, but still below the 2022 peak of 154%

- Continuous Consolidation Space:There are still thousands of small community banks in the US, with huge consolidation space

- Focus on mid-sized regional banks with strong balance sheets and stable deposit bases

- Prioritize institutions capable of scale expansion through acquisitions

- Closely track the impact of regulatory policy changes on M&A approval节奏

- Look for bank targets with transaction multiples below the industry average but with consolidation potential

- Focus on high-quality small banks that may become acquisition targets

- Evaluate banks’ core deposit franchises and market positions

- Accelerated regulatory approval shortens the arbitrage cycle, increasing potential annualized returns

- Focus on transactions with reasonable premiums and strong strategic synergies

- Pay attention to risk diversification, as the M&A cycle may fluctuate due to macro environment changes

The merger between Mercantile Bank and Eastern Michigan Financial is a typical case of the 2025 regional bank consolidation wave, reflecting several key trends:

- Supportive Regulatory Environment:Accelerated approval processes create a more favorable environment for bank M&A

- Strategic Necessity:Banks need scale to cope with rising compliance costs and technology investment needs

- Valuation Recovery:The rebound in transaction premiums indicates that investor confidence in regional banks’ prospects is recovering

- Shareholder Value Creation:Through synergies and efficiency improvements, the merger is expected to create long-term value for both shareholders

For investors, this transaction highlights structural opportunities in the regional banking sector—whether as a growth story for potential acquirers or a value realization opportunity for acquisition targets. As consolidation trends continue, banks with strong franchises, sound financial conditions, and clear strategies are best positioned to create excess returns for shareholders in this consolidation cycle.

[0] Gilin API Data

[1] PR Newswire - “Mercantile Bank Corporation and Eastern Michigan Financial Corporation Announce Definitive Merger Agreement” (July 22, 2025) - https://www.prnewswire.com/news-releases/mercantile-bank-corporation-and-eastern-michigan-financial-corporation-announce-definitive-merger-agreement-302510148.html

[2] Eastern Michigan Bank - “2025 Financial Corporation News” - https://www.emb.bank/about/financial-corporation-news-2025

[3] LinkedIn - Marie Zimmerman CPA - “Q3 2025 FS M&A: Resilience, strategic shifts, and digital trends” - https://www.linkedin.com/posts/marie-zimmerman-cpa-9132189_q3-2025-fs-ma-resilience-strategic-shifts-activity-7406779973664985088-FYUh

[4] LinkedIn - KPMG US - “Q3 2025 M&A Report: Banking, Capital Markets, and Insurance Deals” - https://www.linkedin.com/posts/kpmg-us_q3-2025-marked-a-turning-point-for-financial-activity-7403161361477742592-cMLG

[5] Harvard Law School Blog - “Mergers and Acquisitions — Reviewing 2025 and Looking Ahead to 2026” - https://corpgov.law.harvard.edu/2025/12/20/mergers-and-acquisitions-reviewing-2025-and-looking-ahead-to-2026/

[6] PR Newswire - “Mercantile Bank Corporation Announces Completion of Merger with Eastern Michigan Financial Corporation” (December 31, 2025) - https://www.prnewswire.com/news-releases/mercantile-bank-corporation-announces-completion-of-merger-with-eastern-michigan-financial-corporation-302651327.html

[7] Pender Fund - “Pender Alternative Arbitrage Fund - October 2025” - https://penderfund.com/commentaries/pender-alternative-arbitrage-fund-october-2025/

[8] Forvis Mazars - “Regional Financial Services Mergers & Acquisitions – Q3 2025” - https://www.forvismazars.us/forsights/2025/10/regional-financial-services-mergers-acquisitions-–-q3-2025

[9] Amundi Research Center - “Merger Arbitrage Rally 2025” - https://research-center.amundi.com/article/tailwinds-merger-arbitrage-europe-fast-lane

[10] Yahoo Finance - “Regional Bank Rebound: 3 Overlooked Banks to Watch in 2026” - https://finance.yahoo.com/news/regional-bank-rebound-3-overlooked-165400393.html

[11] Cherry Bekaert - “Bank M&A Trends and 2025 Outlook” - https://www.cbh.com/insights/reports/bank-ma-trends-and-2025-outlook/

[12] OneStream - “Banking on Scale: How M&A and Market Shifts Reveal Finance’s…” - https://www.onestream.com/blog/banking-on-scale-how-finance-builds-resilience/

[13] StockTitan - “Mercantile Bank (MBWM) completes merger with Eastern…” - https://www.stocktitan.net/news/MBWM/mercantile-bank-corporation-announces-completion-of-merger-with-putc665z9io3.html

[14] Angel Oak Capital - “The M&A Rebound Is Here” - https://angeloakcapital.com/the-ma-rebound-is-here/

[15] Yahoo Finance - Eastern Michigan Financial Corporation (EFIN) Quote - https://finance.yahoo.com/quote/EFIN/

[16] Crowe LLP - “Bank M&A Update - Quarterly Report 2Q25” - https://www.crowe.com/-/media/crowe/llp/folio-pdf-hidden/banking-ma-campaign---quarterly-report-2q25.pdf

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.