Risk Warning Significance of Key Monitoring on Jiamei Packaging and Jiamei Convertible Bond for Convertible Bond Investment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the regulatory weekly report released by Shenzhen Stock Exchange [1], from December 29 to 31, 2025, Shenzhen Stock Exchange took self-regulatory supervision measures against

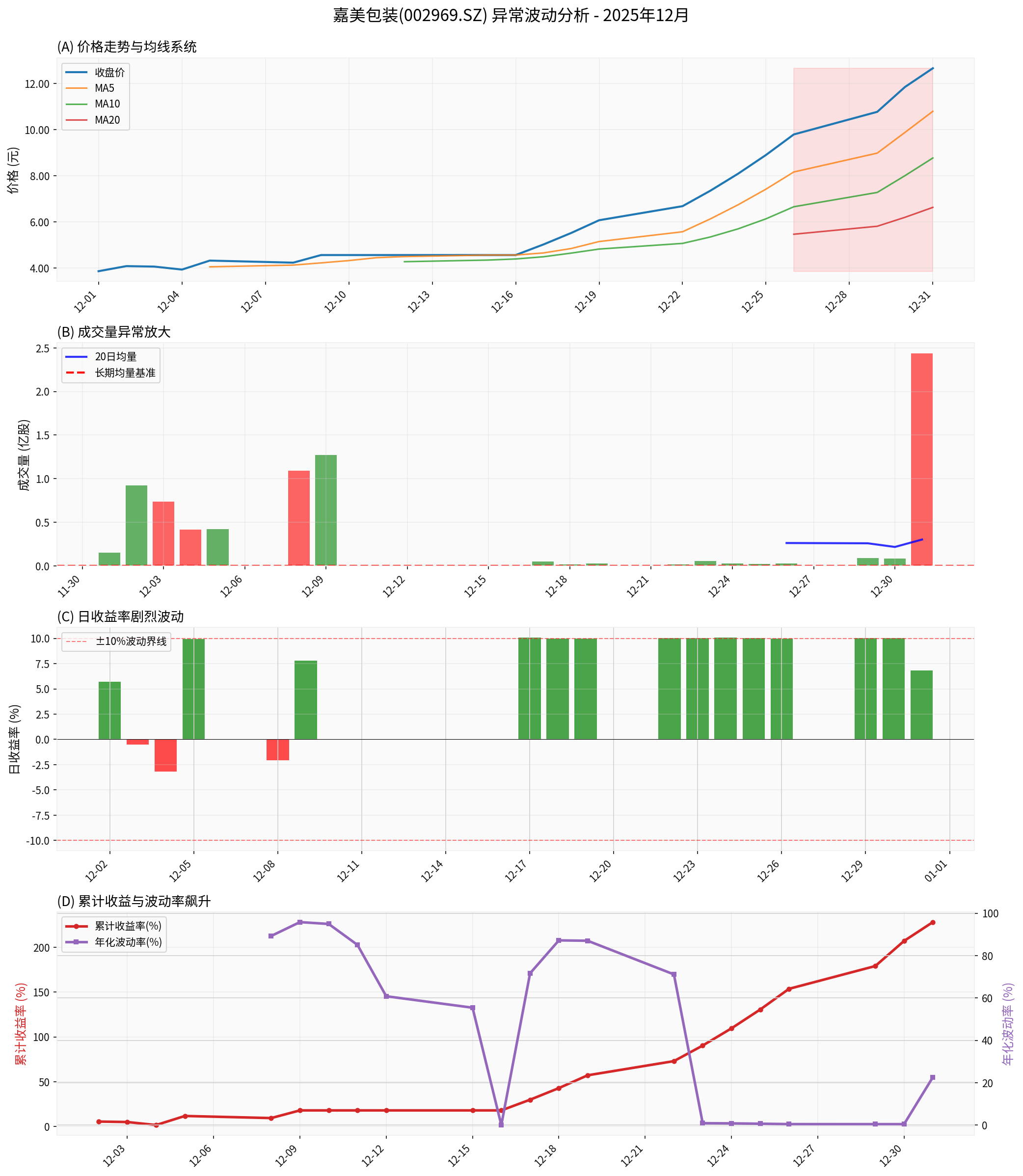

According to brokerage API data, Jiamei Packaging showed extreme abnormal fluctuation characteristics in December 2025 [0]:

| Indicator | Value | Explanation |

|---|---|---|

| December Opening Price | 3.86 CNY | Price at the beginning of the month |

| December Closing Price | 12.66 CNY | Price at the end of the month |

| December Price Change | +227.98% | Monthly increase of over 2x |

| Highest Price During Period | 13.04 CNY | Hit 52-week high |

| Lowest Price During Period | 3.82 CNY | Close to 52-week low (2.76 CNY) |

| Trading Volume on Dec 31 | 243.69 million shares | More than 13x the long-term average volume |

| Daily Average Volume | 34.22 million shares | 1.8x the normal level |

| Annualized Volatility During Period | 45.79% | Far exceeding normal market levels |

| Price-to-Earnings Ratio (P/E) | 79-80x | Severely overvalued [0] |

| Turnover Rate (Estimated) | Abnormally high | May exceed 100% in a single day [0] |

- Maintained oscillation in the range of 3.8-4.5 CNY in the first two weeks of December

- Started continuous sharp rise on December 16, soaring from 4.46 CNY to 12.66 CNY in 7 trading days

- Maximum single-day increase reached 10.09%, showing a typical short squeeze trend

- Trading volume surged to 243.69 million shares on December 31, far exceeding the long-term average level [0]

According to Shenzhen Stock Exchange disclosure, key monitoring targets the following abnormal trading behaviors [1]:

- Intraday lifting and suppressing: Artificially pushing up or suppressing stock prices through large buy or sell declarations in a short period of time

- False declarations: Quickly canceling declarations after applying to buy or sell, creating a false illusion of active trading

- Suspected market manipulation: Manipulating securities trading prices through capital advantages, shareholding advantages, or information advantages

From regulatory developments, it can be seen that regulatory measures show a stepwise upgrade [1]:

| Regulatory Level | Specific Measures | Applicable Scenarios |

|---|---|---|

| Self-regulatory supervision measures | Oral warnings, written warnings | General abnormal trading behaviors |

| Key monitoring | Included in key monitoring accounts | Securities with severe abnormal fluctuations |

| Self-regulatory management measures | Suspension of account trading, restriction of account trading | Repeated violations or serious circumstances |

| Administrative penalties | Fines, market access bans | Suspected violations of laws and regulations, transferred to CSRC |

Huabao Securities has issued a risk warning announcement to investors, clearly stating that the exchange will

The simultaneous key monitoring of “Jiamei Convertible Bond” and “Jiamei Packaging” reveals the risk of linked speculation between convertible bonds and underlying stocks:

- Convertible bonds have both bond and stock attributes

- T+0 trading mechanism makes intraday trading of convertible bonds more frequent

- Convertible bond prices often follow the fluctuations of underlying stocks, but the volatility may be greater

- Hot money may achieve “dual-wheel drive” by speculating on both underlying stocks and convertible bonds simultaneously

The current P/E ratio of Jiamei Packaging reaches

- Severely deviated from fundamentals: Company financial data shows that the EPS in Q3 2025 was only 0.02 CNY, and the annual net profit margin was only 4.7% [0]

- Price bubble: Short-term increase of over 227%, completely deviating from the company’s actual operating conditions

- Huge correction risk: Once speculation subsides, stock prices may face a cliff-like drop

Obvious liquidity risk signals can be seen from the trading data [0]:

- Abnormal surge in trading volume: Trading volume reached 243.69 million shares on December 31, more than 13x the long-term average level

- Extremely high turnover rate: Estimated daily turnover rate may exceed 100%, indicating highly dispersed chips and a strong speculative atmosphere

- Liquidity exhaustion risk: Once regulation becomes stricter or market sentiment turns, investors may face difficulties in selling

Investors participating in such abnormal fluctuation convertible bond transactions may face the following regulatory risks:

- Account monitoring: Being included in key monitoring accounts, and trading behaviors being strictly monitored

- Trading restrictions: Those with serious circumstances may have their accounts suspended or restricted from trading

- Administrative penalties: Investors suspected of market manipulation will face administrative penalties from the CSRC

- Civil liability for compensation: If market manipulation is confirmed, they may need to bear civil liability for compensation

The Jiamei Packaging case highlights the “double high” risks in the convertible bond market:

- High premium: Convertible bond prices are significantly higher than conversion value, with excessive premium rates

- High turnover: Daily turnover rate exceeds 100%, funds enter and exit quickly, lacking long-term holders

- Decoupling from underlying stocks: Convertible bond price trends are severely decoupled from the fundamentals of underlying stocks

- Delisting risk: After the implementation of the new convertible bond delisting rules, the delisting risk linked to underlying stocks increases

According to public information, regulation of the convertible bond market has continued to escalate in recent years:

- March 2025: Shanghai Stock Exchange revised the “Implementation Rules for Trading of Convertible Corporate Bonds”, improving the regulatory standards for abnormal trading [2]

- 2023: CSRC annual report shows that 18 market manipulation cases were filed for investigation throughout the year, severely cracking down on cases where controlling shareholders, executives of listed companies collude with hot money inside and outside to manipulate the company’s stock price [1]

- Convertible bond delisting system implemented: Clarified rules related to convertible bond delisting, achieved smooth delisting of ST Landun, and the first case of bankruptcy reorganization during the existence of convertible bonds occurred [1]

Historical cases of convertible bond speculation being investigated include:

- ST Zhengbang, ST Quanzhu: Bankruptcy reorganization implemented during the existence of convertible bonds, investors faced significant losses [1]

- Landun Convertible Bond: The first convertible bond delisting case, with both the convertible bond and underlying stock delisted simultaneously [1]

- Multiple “demon bonds”: Amazing increases but lack of fundamental support, eventually returning to rationality

It can be seen from the Shenzhen Stock Exchange’s centralized adoption of regulatory measures against 119 abnormal trading behaviors [1]:

- Regulatory authorities maintain a “zero tolerance” attitude towards market manipulation behaviors

- Technical monitoring capabilities continue to improve, making abnormal trading easier to detect

- Inter-departmental collaboration is strengthened, with exchanges, CSRC, and public security organs forming a regulatory synergy

- Investor protection efforts are increased, and the penalties for illegal and irregular behaviors are significantly enhanced

Investors should be alert to the following abnormal fluctuation signals:

| Risk Signal | Specific Performance |

|---|---|

| Abnormal price | Short-term increase of over 50%, continuous limit-up or sharp rise |

| Abnormal trading volume | Trading volume suddenly increases several times or even dozens of times |

| Excessively high turnover rate | Daily turnover rate exceeds 50%, or even 100% |

| Deviation from fundamentals | Extremely high P/E ratio, but mediocre or even loss-making performance |

| Regulatory announcements | Issuing abnormal fluctuation announcements, risk warning announcements, or being under key monitoring |

Based on the warning from the Jiamei Packaging case, convertible bond investment should follow the following principles:

- Fundamentals first: Focus on the fundamental quality of underlying stocks, select companies with stable profitability and good financial conditions

- Reasonable valuation: Avoid participating in convertible bonds with excessively high premium rates and severely overdrawn future expectations

- Diversified investment: Do not concentrate funds on a few convertible bonds, avoid single bond risks

- Long-term holding: Convertible bonds are suitable for medium- to long-term holding, not short-term speculative炒作

- Risk awareness: Fully understand the various terms of convertible bonds, including conversion price, redemption clause, put clause, etc.

- Set profit-taking and stop-loss: When participating in convertible bond transactions with large fluctuations, set profit-taking and stop-loss levels in advance

- Control position size: Strictly control the position size for convertible bonds with abnormal fluctuations, avoid heavy positions

- Pay attention to regulatory developments: Closely follow regulatory announcements and risk warnings issued by exchanges

- Avoid following the trend to speculate: Do not blindly chase rises and kill falls, make investment decisions after rational analysis

- Understand delisting rules: Familiarize yourself with the new convertible bond delisting rules, prevent delisting risks

The key monitoring event of Jiamei Packaging and Jiamei Convertible Bond sends a clear risk warning signal to investors in the convertible bond market:

- High-pressure regulatory situation will continue: Regulatory authorities maintain a high-pressure stance on market manipulation behaviors, and abnormal trading will face strict regulation

- Huge risk of speculative炒作: Speculation deviating from fundamentals will eventually return to rationality, and investors chasing highs may face significant losses

- Convertible bond market is becoming more mature: With the improvement of regulatory systems and the maturity of market participants, the convertible bond market will become more rational

- Increased investor protection: Regulatory authorities will pay more attention to protecting the interests of small and medium investors, and strictly investigate market manipulation behaviors

It is expected that convertible bond regulation will be further strengthened in the future:

- Technical monitoring upgrade: Use big data, artificial intelligence and other technologies to improve the ability to identify abnormal trading

- Strengthened cross-market regulation: Strengthen linked regulation between convertible bonds and underlying stocks, and between convertible bond markets and stock markets

- Deepened investor education: Strengthen investor risk education, guide rational investment concepts

- Improvement of delisting system: Further improve the convertible bond delisting system to achieve market-oriented exit

Under the current regulatory environment, convertible bond investors should:

- Establish value investment concept: Start from fundamentals, select high-quality targets

- Enhance risk awareness: Fully understand the various terms of convertible bonds, prevent delisting risks

- Pay attention to regulatory developments: Timely understand changes in regulatory policies, avoid crossing regulatory red lines

- Rationally participate in the market: Do not blindly follow the trend to speculate, adhere to independent judgment

- Seek professional advice: Seek investment advice from professional institutions when necessary

The Jiamei Packaging case is a typical epitome of speculative risks in the convertible bond market. Investors should learn lessons from it, adhere to rational investment, and avoid becoming “bag holders” of market speculation. Under the “zero tolerance” regulatory background, only by returning to the origin of value investment can long-term stable returns be achieved in the convertible bond market.

[0] Gilin API Data - Real-time quotes, historical price data, company overview and technical analysis of Jiamei Packaging (002969.SZ)

[1] Sina Finance - Shenzhen Stock Exchange: Conduct key monitoring on “Jiamei Packaging” and “Jiamei Convertible Bond” with severe abnormal fluctuations recently (https://finance.sina.com.cn/jjxw/2025-12-31/doc-inhesxnh9023786.shtml)

[2] Huabao Securities - Risk Warning Announcement on “Jiamei Packaging, Jiamei Convertible Bond” (https://www.cnhbstock.com/detail/614352)

[3] Eastmoney - Shenzhen Stock Exchange: This week, conduct key monitoring on “Jiamei Packaging” and “Jiamei Convertible Bond” with severe abnormal fluctuations recently (https://finance.eastmoney.com/a/202512313607114792.html)

[4] China Securities Regulatory Commission Annual Report (2023) - Steadily resolving convertible bond risks, filling institutional gaps (https://www.csrc.gov.cn/csrc/c100024/c7523280/7523280/files/中国证券监督管理委员会年报(2023年).pdf)

[5] Shanghai Stock Exchange - Implementation Rules for Trading of Convertible Corporate Bonds (Revised in March 2025) (http://www.sse.com.cn/lawandrules/sselawsrules2025/bond/trading/currency/c/c_20250606_10781040.shtml)

[6] CSRC - Decision on Amending Some Securities and Futures Regulations - Convertible Bond Related Provisions (http://www.csrc.gov.cn/csrc/c101953/c7547341/7547341/files/附件1:《关于修改部分证券期货规章的决定》.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.