AI-Driven Market Fragmentation: Concentration Risk and Sector Divergence Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

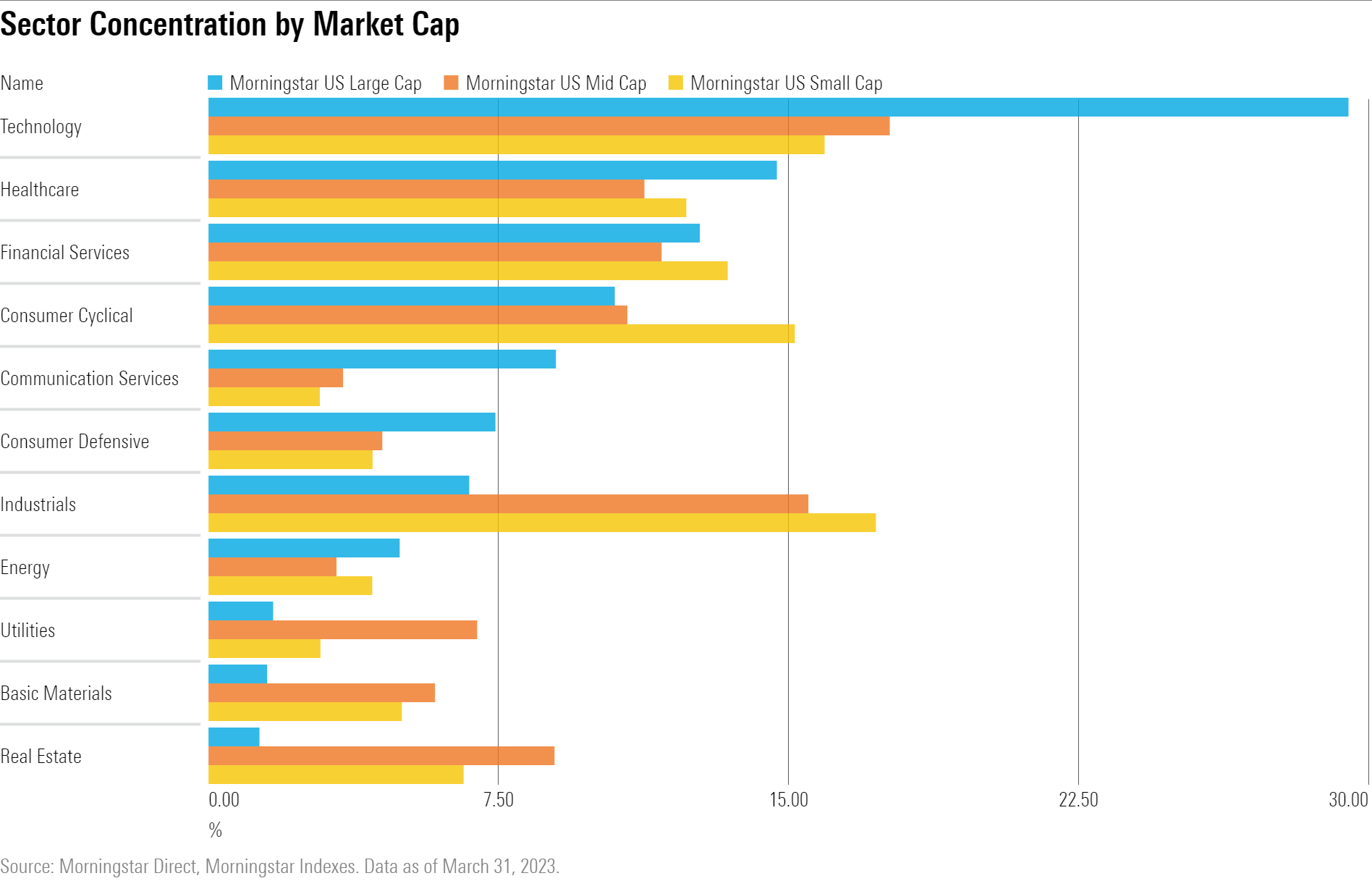

This analysis is based on the Seeking Alpha report [1] published on November 10, 2025, by Leo Nelissen, which presents a stark assessment of current market conditions as the “toughest market call in 14 years.” The report identifies a “high-risk, high-reward environment” characterized by AI-driven market fragmentation, dangerous concentration in mega-cap stocks, and emerging earnings recession in cyclical sectors. Recent market data [0] validates these concerns, showing significant sector divergence and heightened vulnerability in the market structure.

The current market exhibits unprecedented concentration risk, with mega-cap AI stocks dominating market performance while broader sectors struggle. Market data reveals extreme valuations among AI leaders, with NVIDIA trading at P/E of 54.53 and AMD at 136.36 [0], indicating elevated investor expectations and potential vulnerability. This concentration creates a fragile market structure where disappointments in key AI stocks could trigger broad market dislocation.

The analysis identifies a critical bifurcation in market performance: AI hyperscalers and related sectors continue to attract capital flows, while cyclical sectors and consumer stocks face earnings recession. Recent sector performance data confirms this divergence, with Healthcare (+1.12%) and Financial Services (+0.79%) outperforming, while Consumer Cyclical (-0.20%) and Energy (-0.38%) show weakness [0].

AI disruption has emerged as the primary market driver, but recent performance suggests the narrative is becoming more selective. While AMD demonstrated exceptional performance (+9.08%) on positive projections [2], other AI leaders including NVIDIA (-0.62%), Microsoft (-0.64%), and Apple (-0.75%) showed recent weakness [0]. This selective performance indicates that AI capital flows are becoming more discriminating, favoring companies with demonstrable AI execution capabilities.

The technology sector’s underperformance (-0.87%) despite AI enthusiasm [0] suggests that broader tech exposure may not capture the AI opportunity effectively, requiring more targeted investment approaches.

The report highlights weakening labor demand affecting broad economic fundamentals, though specific employment metrics were not provided. The analysis anticipates Fed policy shifts toward “stimulating cyclical growth” with potential balance sheet expansion and lower rates despite persistent inflation [1]. This policy expectation creates significant market dependency on monetary policy support, increasing vulnerability if policy shifts don’t materialize as anticipated.

The market’s top-heavy structure represents the most significant systemic risk. With NVIDIA ($4.67T), Microsoft ($3.76T), and Apple ($4.04T) representing massive market weight [0], any major disappointment in these stocks could trigger cascading effects throughout the market. This concentration makes traditional diversification strategies less effective, as noted in the original analysis [1].

The divergence in AI stock performance reveals that the AI disruption thesis is becoming more nuanced. AMD’s strong performance suggests that companies with clear AI execution and demonstrable results continue to attract capital, while broader AI exposure may face headwinds. This selectivity requires more sophisticated analysis of AI investment opportunities.

Recent market rotation toward defensive sectors (Healthcare, Financial Services) [0] indicates investor awareness of market fragility. This defensive positioning, combined with the underperformance of cyclical sectors, suggests that market participants are increasingly risk-averse despite the high-reward potential in AI.

-

Valuation Risk: Extreme multiples in AI stocks create vulnerability to earnings disappointments and sentiment shifts [0]

-

Concentration Risk: Market dominance by few mega-cap stocks increases systemic risk and reduces diversification effectiveness [1]

-

Policy Transition Risk: Heavy market dependency on anticipated Fed policy support creates vulnerability if policy shifts don’t materialize [1]

-

Narrative Risk: The AI disruption thesis faces significant execution risk - if AI investments fail to generate expected returns, the entire market structure could be affected

-

Selective AI Exposure: Companies with demonstrated AI execution capabilities like AMD may continue to outperform [2]

-

Defensive Positioning: Healthcare and Financial Services show resilience amid market volatility [0]

-

Contrarian Cyclicals: The analysis suggests long-term opportunities in unloved cyclical sectors for patient investors [1]

The market is experiencing unprecedented structural change driven by AI disruption, creating significant divergence between winners and losers. Current conditions feature:

- Market Concentration: Extreme concentration in mega-cap AI stocks creates systemic risk

- Sector Divergence: AI hyperscalers outperform while cyclical sectors face earnings recession

- Valuation Extremes: AI leaders trading at elevated multiples increase vulnerability

- Policy Dependency: Market expectations heavily dependent on anticipated Fed policy support

- Selective Performance: AI capital flows becoming more discriminating, favoring execution over narrative

This environment challenges traditional investment approaches and requires careful risk management, selective exposure to AI opportunities, and awareness of the market’s structural fragility. The high-risk, high-reward dynamics demand sophisticated analysis and disciplined portfolio management approaches.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.