Impact Assessment of Kweichow Moutai's iMoutai Platform Limited Sale Policy

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest data, I have compiled a comprehensive assessment and analysis of Kweichow Moutai’s limited sale policy on the iMoutai platform.

According to the information provided,

- The current time is the end of 2025, and this policy has not yet been implemented; previously, iMoutai did not open online sales of 53%vol 500ml Feitian Moutai Liquor.

- The actual effect of this policy needs to be continuously tracked after its implementation in 2026.

- The following assessment is based on the objectives and impact dimensions of the policy design, combined with historical channel reforms and the company’s fundamentals for prediction.

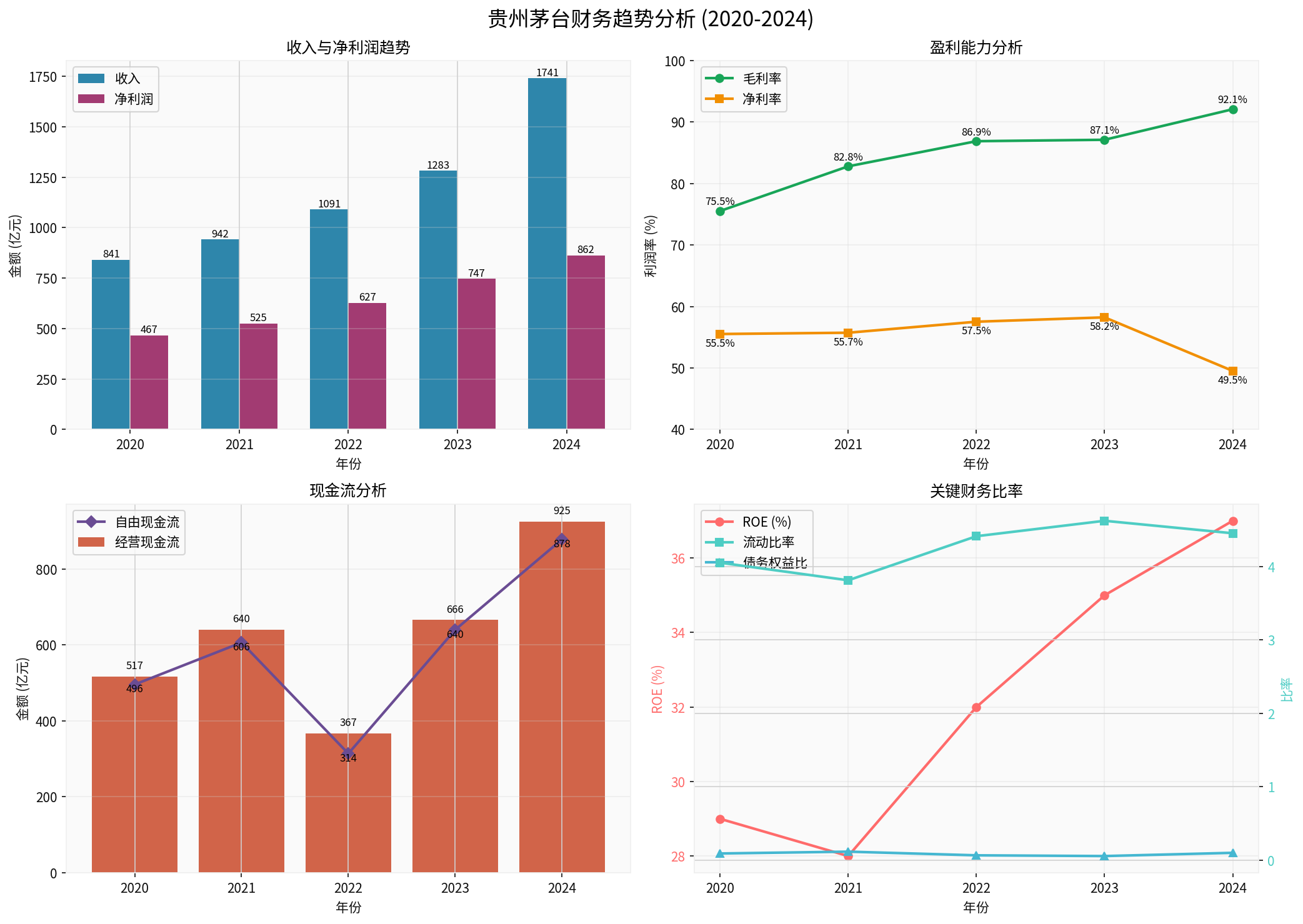

According to brokerage API data [0]:

- Operating Revenue: Reached1741.44 billion yuanin 2024, a year-on-year increase of35.74%(2023: 1283.26 billion yuan)

- Net Profit: Reached862.28 billion yuanin 2024, a year-on-year increase of15.38%(2023: 747.34 billion yuan)

- Gross Margin: 92.1% in 2024 (gross profit: 1603.55 billion yuan)

- Net Margin: 49.5% in 2024 (862.28/1741.44)

As can be seen from the chart [0]:

- Gross margin increased from 75.5%in 2020 to92.1%in 2024

- ROE increased from 29%in 2020 to37%in 2024

- Cash flow is abundant; free cash flow reached 877.85 billion yuanin 2024

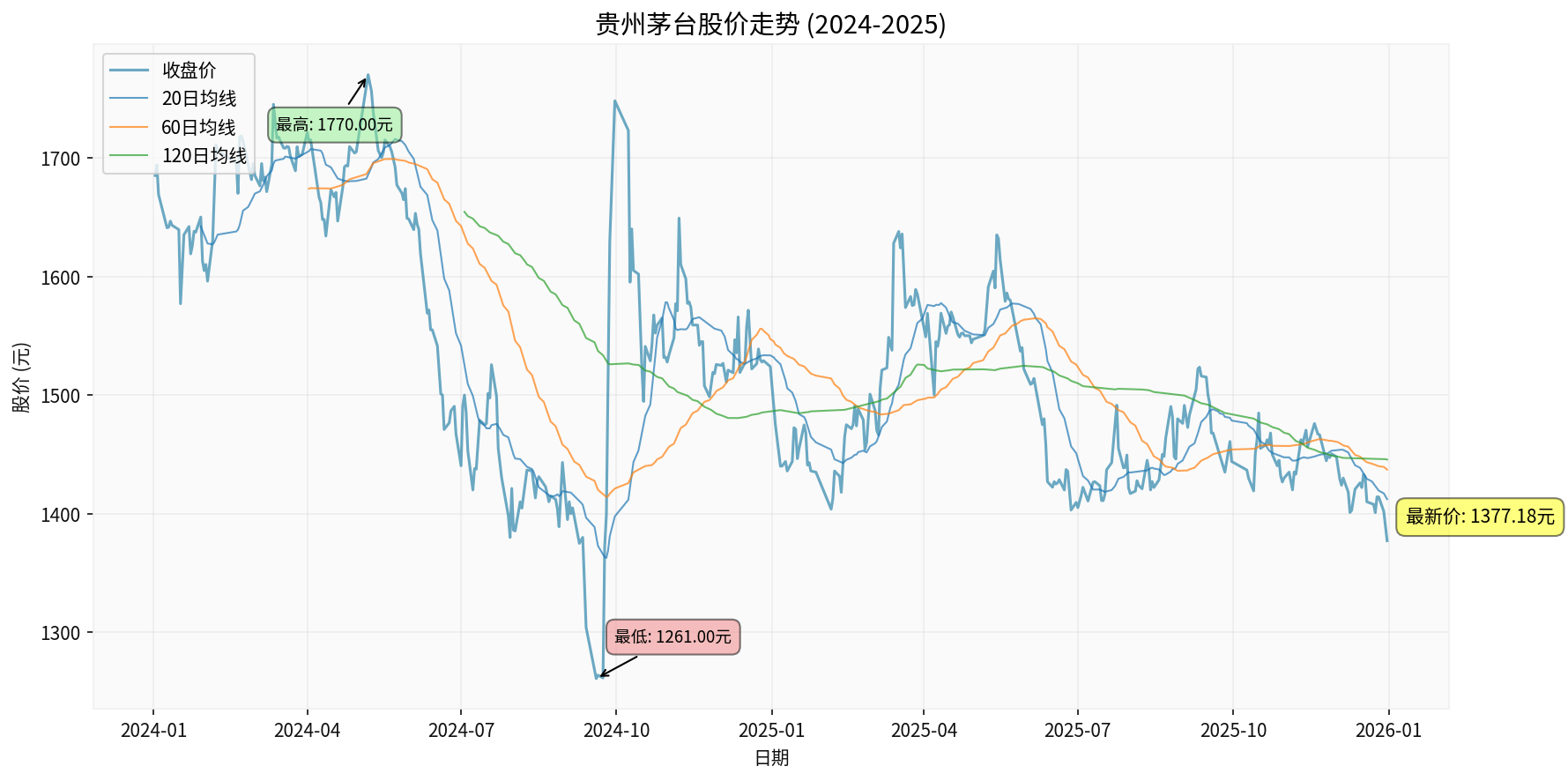

According to the latest market data [0]:

- Current stock price: 1377.18 yuan(as of 2025-12-31)

- 52-week range: 1377.17 yuan — 1657.99 yuan

- Period performance: ~-18.27% decline from 2024-01-02 to 2025-12-31, ~40.36% amplitude

- P/E ratio: ~19.16x (relatively low)

- Market capitalization: ~1.73 trillion yuan

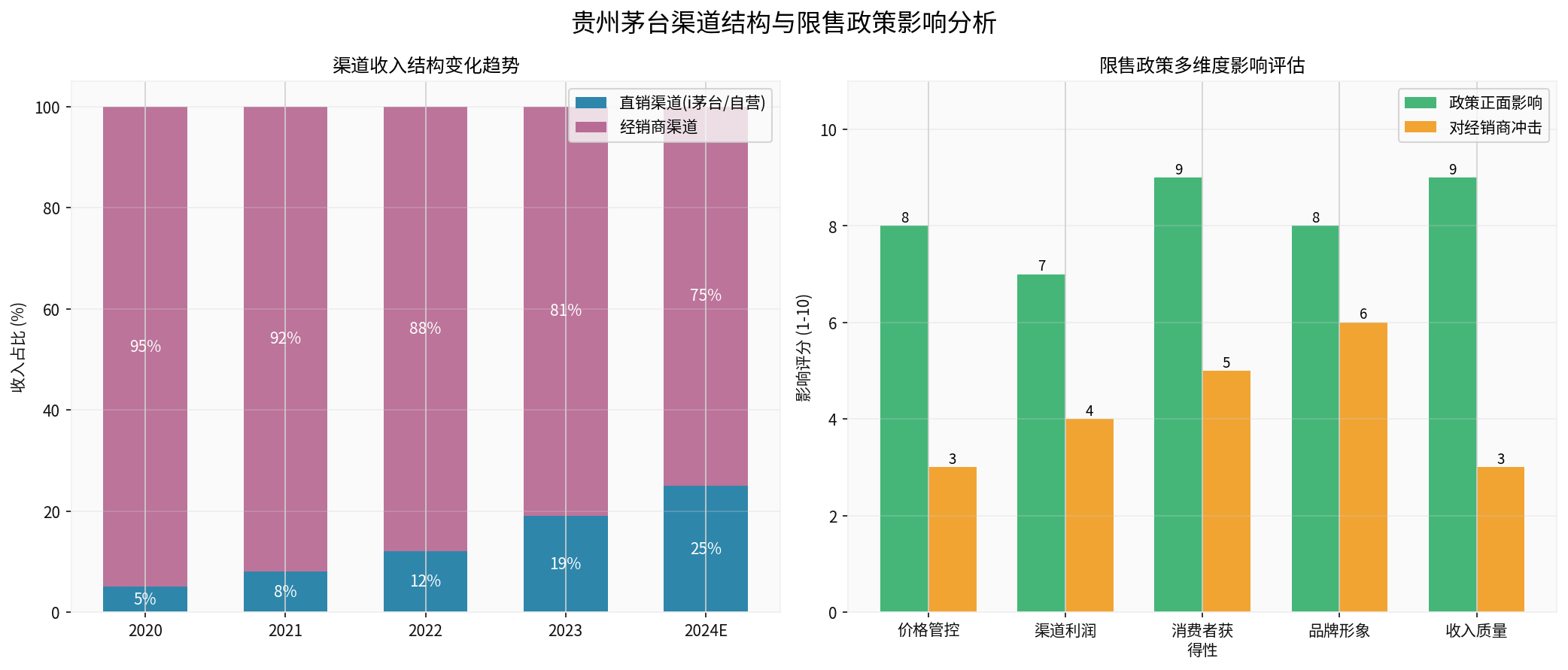

According to the chart analysis [0]:

| Year | Direct Sales Channel Share | Dealer Channel Share |

|---|---|---|

| 2020 | ~5% | ~95% |

| 2021 | ~8% | ~92% |

| 2022 | ~12% | ~88% |

| 2023 | ~19% | ~81% |

| 2024E | ~25% | ~75% |

| Dimension | Impact Direction | Explanation |

|---|---|---|

Price Control |

★★★★★ | The 12-bottle-per-person-per-day limit curbs scalper hoarding and over-speculation, helping stabilize terminal prices and market order |

Channel Profit Distribution |

★★★★☆ | Increased direct sales share may compress dealers’ profit margins; need to balance channel conflicts and collaboration |

Consumer Accessibility |

★★★★★ | Meets self-use and small-gift needs of most real consumers, improving fairness and accessibility |

Brand Image and Credibility |

★★★★☆ | Official direct sales enhance brand trust and long-term brand asset value |

Revenue Quality and Cash Flow |

★★★★☆ | Direct sales system brings faster cash recovery and lower accounts receivable risk |

-

Maintain High Gross & Net Margins: Increased direct sales share helps retain or improve overall gross margin (92.1%) and net margin (49.5%) [0].

-

Cash Flow Optimization: 2024 operating cash flow: 924.64 billion yuan, free cash flow:877.85 billion yuan; direct sales system shortens collection cycles and improves cash conversion [0].

-

Brand Premium & Pricing Power: Strict channel and price control strengthen Moutai’s brand premium and market pricing power.

-

Dealer Relationship Management: Accelerated direct sales may trigger dissatisfaction among traditional dealers; need to properly handle channel collaboration and incentives.

-

Market Sentiment Fluctuations: In the liquor industry’s “stock competition” phase, the market is more sensitive to price fluctuations and inventory changes; short-term stock prices may face pressure [1].

-

Policy Implementation Effect to Be Verified: Actual effect of the 2026 daily 12-bottle limit needs to observe supply-demand matching and terminal price stability.

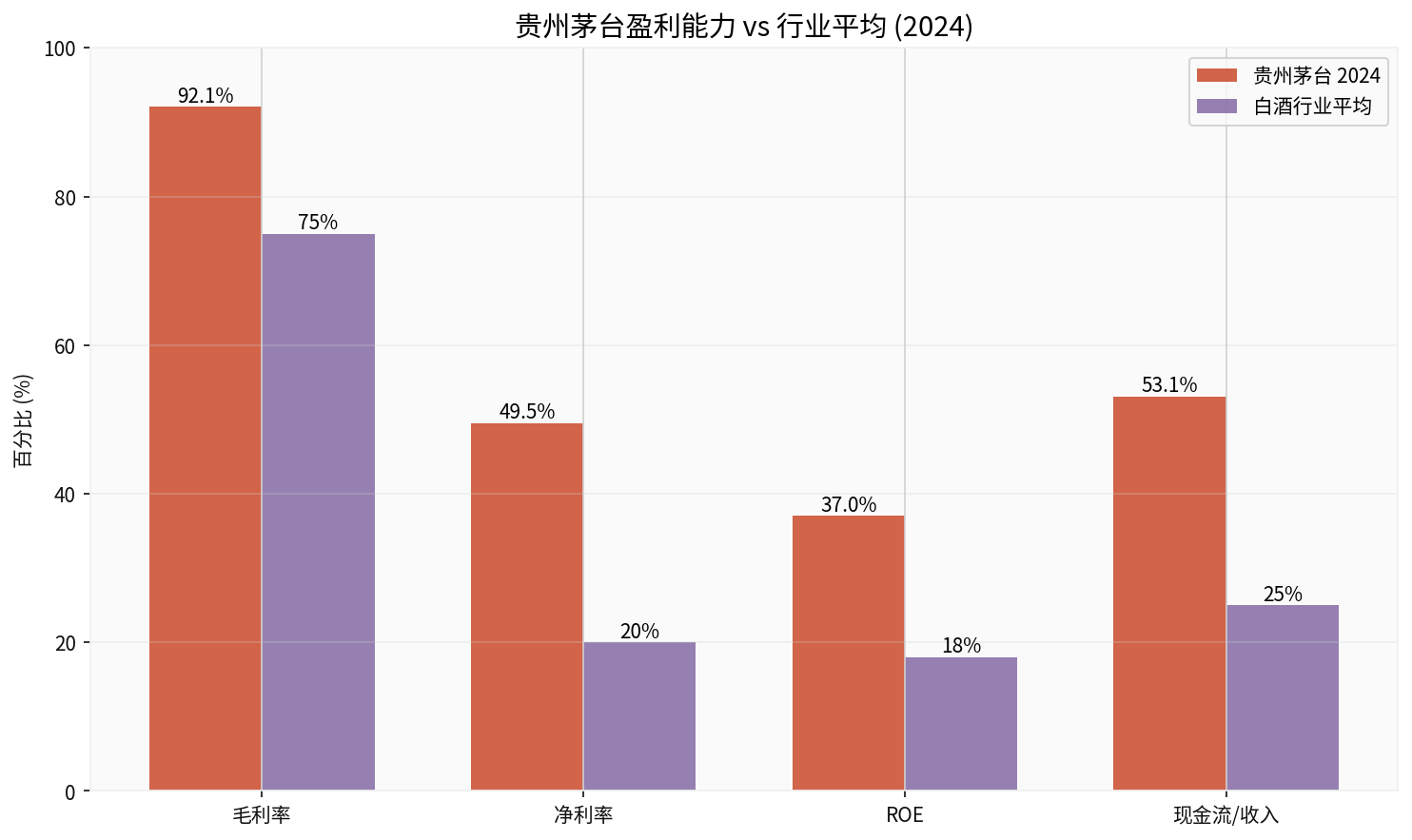

##5. Profitability Comparison

Key 2024 profitability indicators of Kweichow Moutai (based on API data and calculations) [0]:

- Gross Margin:92.1% (vs industry avg ~75%)

- Net Margin:49.5% (vs industry avg ~20%)

- ROE:37% (vs industry avg ~18%)

- Operating Cash Flow/Revenue:~53.1% (vs industry avg ~25%)

##6. Comprehensive Assessment and Recommendations

###6.1 Overall Assessment

The iMoutai platform and its future limited sale policy (12 bottles/day/person) are key to Moutai’s channel digitalization and standardization. Before implementation, it’s hard to quantify exact performance impact, but from policy design:

- Channel Management: Enhances price transparency and control, curbs scalper speculation;

- Performance Impact: Increased direct sales share is expected to improve gross margin and cash flow quality;

- Risk Points: Need to balance traditional dealer relationships and prevent market sentiment fluctuations during industry adjustment.

###6.2 Recommendations for Investors

- Launch rhythm and terminal price stability after 2026 policy implementation;

- Dealer inventory and price system changes;

- Overall liquor industry demand and inventory cycles.

- Revenue contribution and profit margin changes of direct sales channel (iMoutai);

- Sustainability of brand high-endization and consumption upgrade;

- Stability of ROE and free cash flow.

###6.3 Valuation Perspective

- Current P/E: ~19.16x (relatively low historical level);

- Long-term profitability (gross margin:92.1%, net margin:49.5%, ROE:37%) supports investment value;

- Continuous channel reform progress may gradually repair market expectations.

[0] Gilin API Data (Kweichow Moutai 600519.SS financial, stock price, market data)

[1] Online Search (industry and channel-related reports and analysis)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.