Analysis of the Strong Performance of Feiwo Technology (301232)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Feiwo Technology (301232) entered the strong stock pool mainly driven by two catalysts:

- Commercial aerospace concept heating up: The company established a commercial aerospace department, received policy support, and cooperated with German aerospace enterprise Heggemann. Although the revenue share of aerospace business is less than 1%, the concept heat still boosted investor sentiment [3].

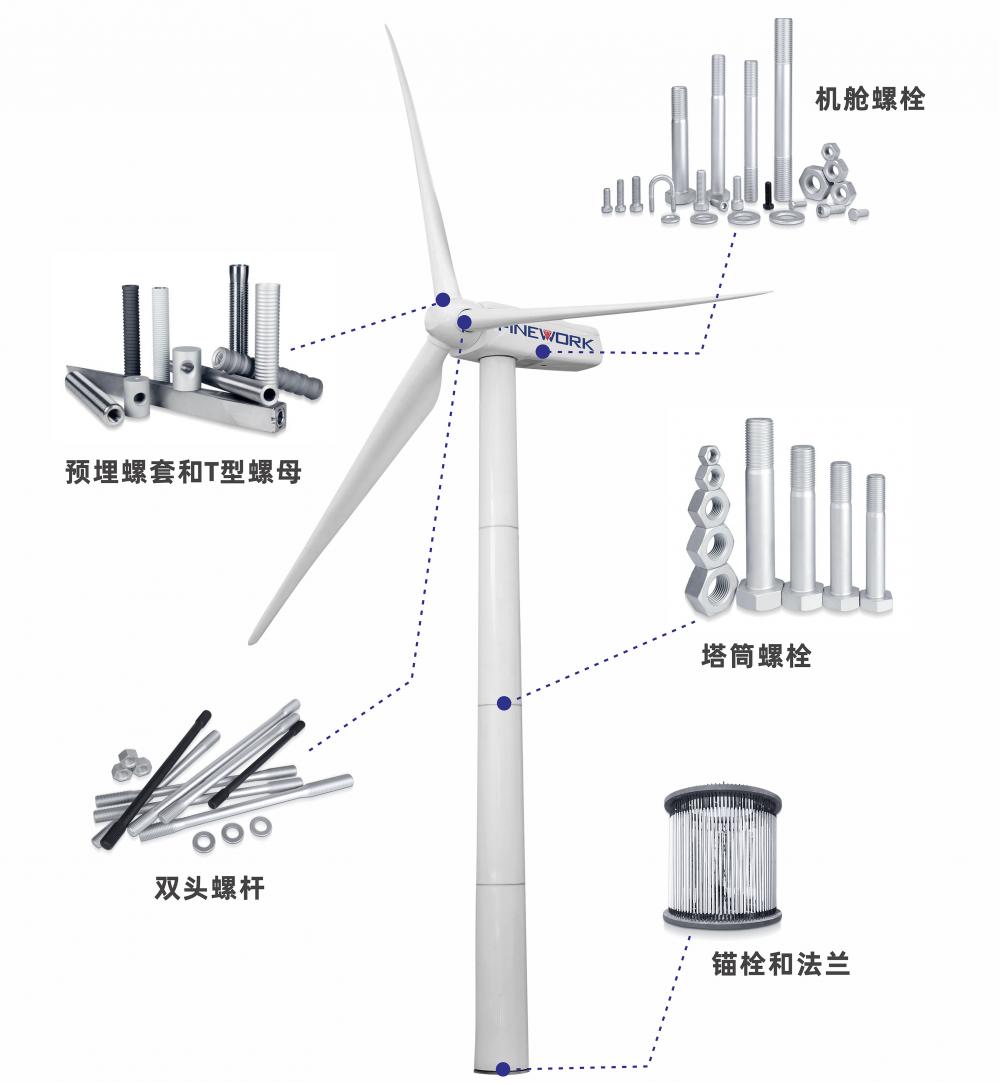

- Strong support from wind power main business: As the leader in wind turbine blade embedded nuts, the company has a 70% market share and benefits from the recovery of the wind power sector [5].

Technical aspects: On December 31, the stock price closed at 168.37 yuan, with an increase of 17.91%, a turnover rate of 28.45%, and a transaction volume of 2.013 billion yuan, showing active trading [1]. It hit a new high 14 times in the past month, with a year-to-date increase of 581.66% [2].

Fundamental aspects: The wind power main business has a solid position, and the layout in the commercial aerospace field enhances long-term imagination space. At the same time, it is included in the holdings of Xinhua Small and Medium Market Value Preferred Fund [3].

- Resonance of concept and performance: Although the aerospace business share is low, policy support and international cooperation increase valuation flexibility, coupled with stable growth of the wind power main business, forming a dual drive.

- Overheating trading signal: A high turnover rate of 28.45% indicates obvious involvement of short-term speculative funds, and attention should be paid to volatility risks.

- Overvaluation: Since April, the increase has exceeded 410%, and the valuation may have deviated from fundamentals [2].

- Uncertainty of aerospace business: The share is less than 1%, and the implementation effect needs to be verified [3].

- Volatility of wind power industry: Dependent on a single wind power track, industry policies or demand changes have a greater impact [5].

- Sustained recovery of wind power demand: Industry growth is expected to support the performance of the main business [5].

- Layout in commercial aerospace: If the business is implemented, it can bring new growth points for performance [3].

The recent strong performance of Feiwo Technology (301232) is driven by both concept and performance. Technically, it continues to hit new highs, and fundamentally, it relies on the wind power main business. However, attention should be paid to the risks of overvaluation, low aerospace business share, and industry volatility. Sustainability needs to observe wind power demand and aerospace business progress.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.