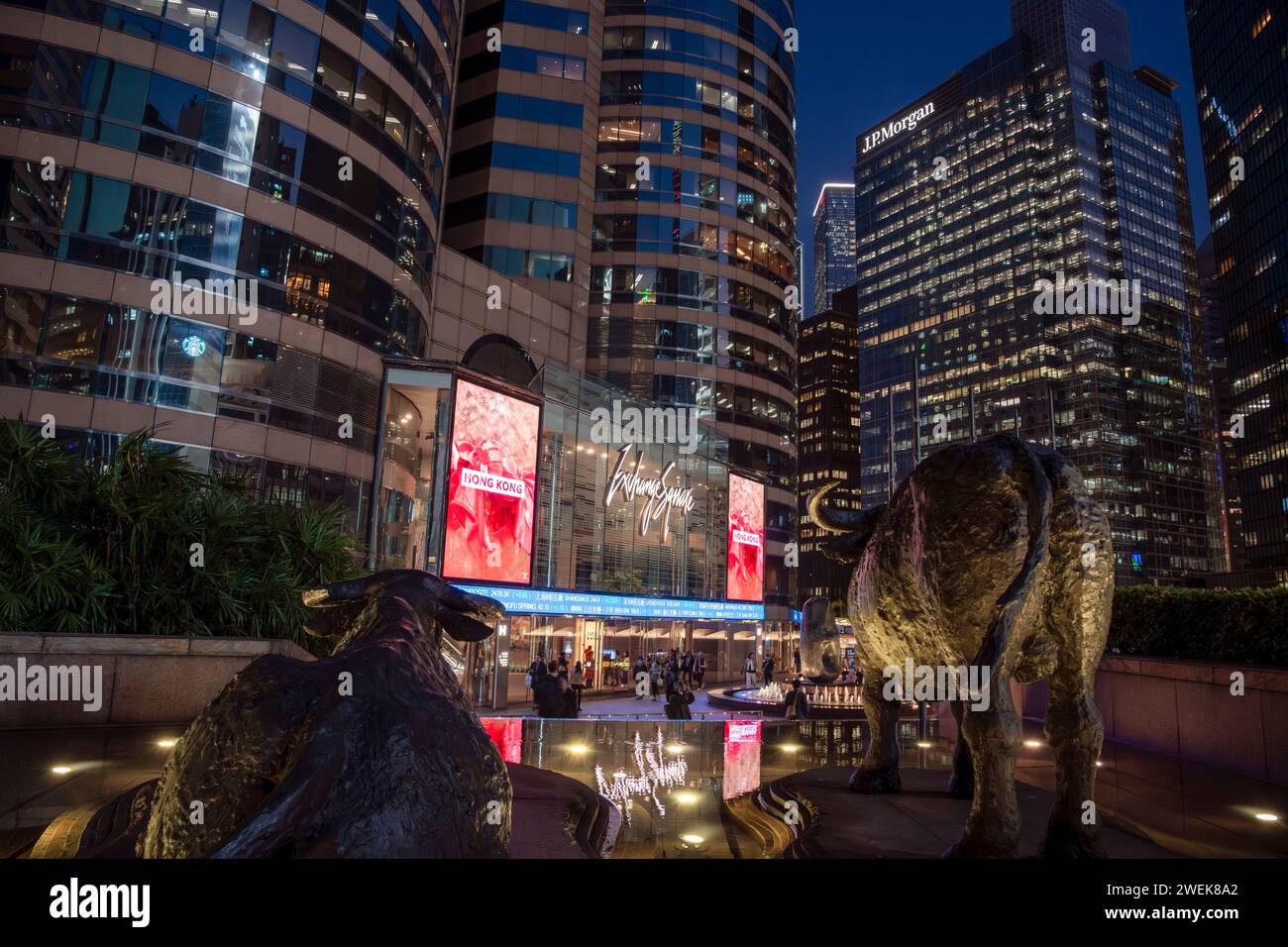

Hong Kong Stocks Post Best Year Since 2017 Driven by AI Tech Rally

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Wall Street Journal report [1] published on December 31, 2025, which highlighted Hong Kong stocks ending the year with their best performance since 2017. The Hang Seng Index (^HSI) recorded a 28.58% annual gain, driven by an AI-fueled tech rally [0]. Tech giants Tencent (00700) and Alibaba (09988) outperformed the broader index, posting gains of 43.41% and 72.94% respectively [0]. A key driver was regulatory reforms under Hong Kong’s Chapter 18C framework, which enabled 12 pre-profit AI and robotics logistics firms to list in 2025, raising capital for AI-driven solutions [3]. Additionally, Hong Kong’s government investment of $128 million in an AI research institute boosted investor confidence in the region’s AI ecosystem [4]. Tech stocks exhibited higher volatility than the broader market, with daily standard deviations of 2.01% for Tencent and 3.28% for Alibaba [0].

- AI as a cross-sector catalyst: The global AI trend lifted both established tech giants and stimulated IPO activity in emerging AI/robotics logistics sectors via the Chapter 18C reforms, demonstrating AI’s broad market impact [3].

- Policy-investment synergy: Supportive listing regulations (Chapter 18C) and government AI research investments worked together to enhance Hong Kong’s appeal as a regional tech hub [3][4].

- Volatility-return tradeoff: While tech stocks delivered significant gains, their higher volatility indicates investor sensitivity to AI-related news and regulatory developments [0].

- Tech hub expansion: The 2025 rally may attract more AI and tech firms to list in Hong Kong, strengthening its status as a regional tech hub.

- AI ecosystem growth: Government investments and regulatory support could drive long-term R&D and innovation in Hong Kong’s AI sector [4].

- Valuation concerns: Analysts warn of “extreme” valuations in AI stocks, raising the risk of a correction if earnings fail to meet optimistic expectations [2].

- Economic growth uncertainty: Natixis has criticized Hong Kong’s government forecast of 2.9% annual growth (2026–2029) as overly optimistic, which could dampen market sentiment [4].

- Regulatory tensions: US export controls on AI chips may disrupt supply chains for Hong Kong’s tech firms, impacting their AI development capabilities [2].

- The Hang Seng Index (^HSI) gained 28.58% in 2025, its best year since 2017 [0].

- Tech giants Tencent (00700) and Alibaba (09988) rose 43.41% and 72.94% respectively [0].

- Regulatory reforms (Chapter 18C) enabled 12 pre-profit AI/robotics logistics firms to list in 2025 [3].

- Hong Kong’s government invested $128 million in an AI research institute [4].

- Risks include stretched AI stock valuations, economic growth concerns, and regulatory tensions [2][4].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.