PetroChina-Inner Mongolia Oil & Gas Joint Venture: Strategic Layout and Performance Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

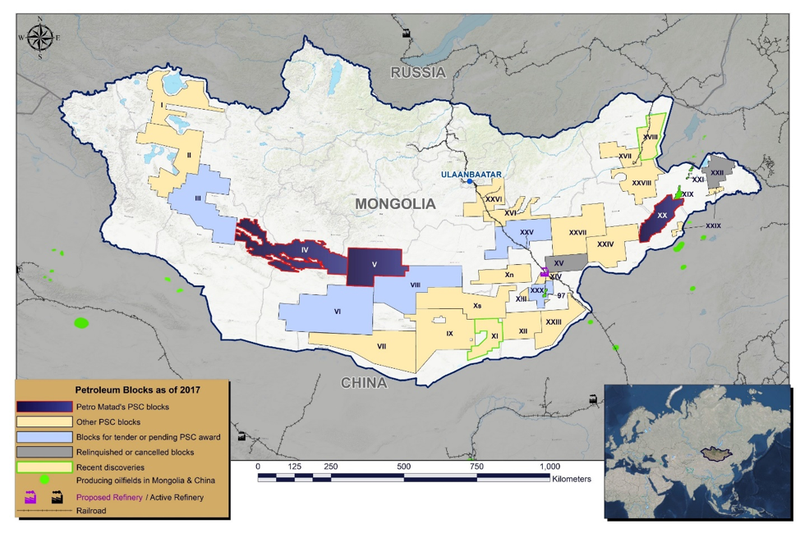

A wholly-owned subsidiary of PetroChina and Inner Mongolia Geological and Mineral Group jointly invested to establish a new oil and gas exploration and development company, indicating that central enterprises and local state-owned enterprises are building a collaborative development mechanism in resource exploration, geological services, and emerging energy fields. The continental deep oil and gas resources in Inner Mongolia’s Hetao Basin and Ordos Basin have achieved large-scale production through technological breakthroughs: According to a report by the People’s Daily Overseas Edition, the cumulative crude oil production of the Bayan Oilfield in Huabei Oilfield has exceeded 5 million tons, and a series of technological breakthroughs have been made in the development of deep continental clastic rock reservoirs, showing that the region has the reserve and technical foundation to expand production capacity and extend field life [1]. This new joint venture can “embed” local resource exploration advantages, ensure mineral rights allocation, and share local geological services and upstream engineering capabilities, providing an institutionalized channel for PetroChina to expand its resources in Inner Mongolia.

-

Resource and Production Increment: Multiple 10-million-ton concentrated resource areas have emerged in Inner Mongolia. The new company’s business scope covers geological exploration, mineral rights evaluation, and technical services, meaning it can identify and monetize reserves more quickly. Collaboration with local groups can reduce mineral rights approval and surface coordination costs, further shortening the commissioning cycle of new wells, and will provide PetroChina with incremental resource and production guarantees in the long term.

-

Technology Validation and Cost Advantages: Combined with existing innovative experiences in the province such as deep development, shale oil/tight gas, and CCUS (e.g., multiple potential tapping technologies and carbon dioxide flooding tests in Changqing Oilfield have shown significant revenue growth effects), the joint venture is expected to promote wider replication of technologies in Inner Mongolia, improve recovery rates, reduce single-well costs, and help PetroChina maintain profit margins and stabilize cash flow in the current oil price cycle [0].

-

Capital and Financial Stability Support: According to the latest financial analysis, PetroChina has a stable free cash flow (recent FCF of approximately RMB 103.88 billion) and a low valuation level (P/E ratio of about 12x), providing room for increasing low-cost capital expenditures [0]. The RMB 80 million equity investment accounts for an extremely low proportion of the overall capital structure, but it can bring considerable returns through the conversion of exploration results in several years, making it a typical “small investment, big return” strategic investment.

-

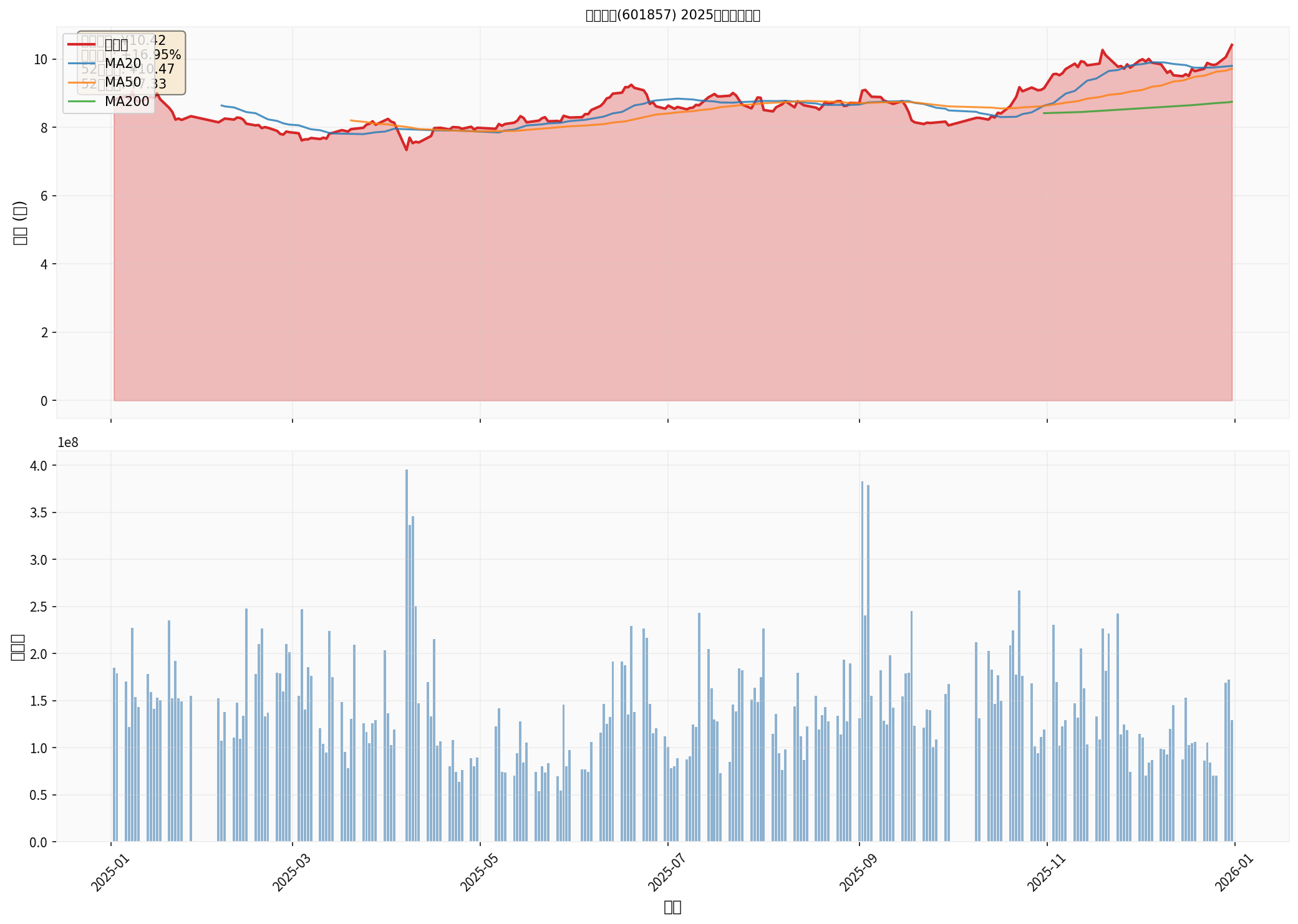

Market Performance and Trend Signals: In 2025, the stock price showed a steady upward trend overall, with an annual increase of about 16.95%, and the stock price continued to run above the 20/50/200-day moving averages, indicating that the market maintains confidence in the sustainability of medium- and long-term profits, and the new resource cooperation is expected to continue to support this trend [0].

-

Execution Cycle and Production Capacity Release: The accumulation conditions of deep continental oil and gas are complex. Although breakthroughs have been made, a continuous rhythm of exploration and production is still needed. It is recommended that PetroChina closely monitor the joint venture’s well location layout, technical pilot results, and resource recoverable reserve certification to avoid single-well concentration risks.

-

Policy and Local Collaboration: This cooperation enhances policy implementation efficiency, but cross-regional coordination and environmental protection requirements still need high attention. It is recommended to establish a joint management and control mechanism, deploy environmental protection and safety standards in advance, and set up export storage and transportation channels to ensure the rapid conversion of resource results into sales revenue.

The joint deep cultivation of oil and gas resources in Inner Mongolia by central enterprises and local state-owned enterprises not only increases the density of PetroChina’s layout in strategic resource belts but also provides important support for its future oil and gas production and conversion of remaining resources. The current collaborative project has the characteristics of low-cost investment and high collaborative returns. Combined with the company’s strong cash flow and stable valuation, it is expected to contribute considerable performance increments in the next few years and become an important grasp for PetroChina to continue to improve quality and efficiency.

[0] Gilin API Data

[1] People’s Daily Overseas Edition - “Bayan Oilfield’s Total Crude Oil Production Exceeds 5 Million Tons” (http://paper.people.com.cn/rmrbhwb/pc/content/202512/24/content_30126695.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.