Current Precious Metals Market Situation and Portfolio Adjustment Recommendations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

- Background of Platinum Flash Crash: The precious metals sector saw significant profit-taking, liquidity contraction, and selling pressure driven by a reversal in safe-haven sentiment after earlier sharp gains. Especially amid concentrated year-end capital flows and relatively thin trading, this triggered a single-day drop of over 9% in platinum (spot price fell to $1985.5 per ounce). Silver and palladium also experienced double-digit retracements simultaneously, highlighting the market’s vigilance against high-leverage speculative positions [1][2].

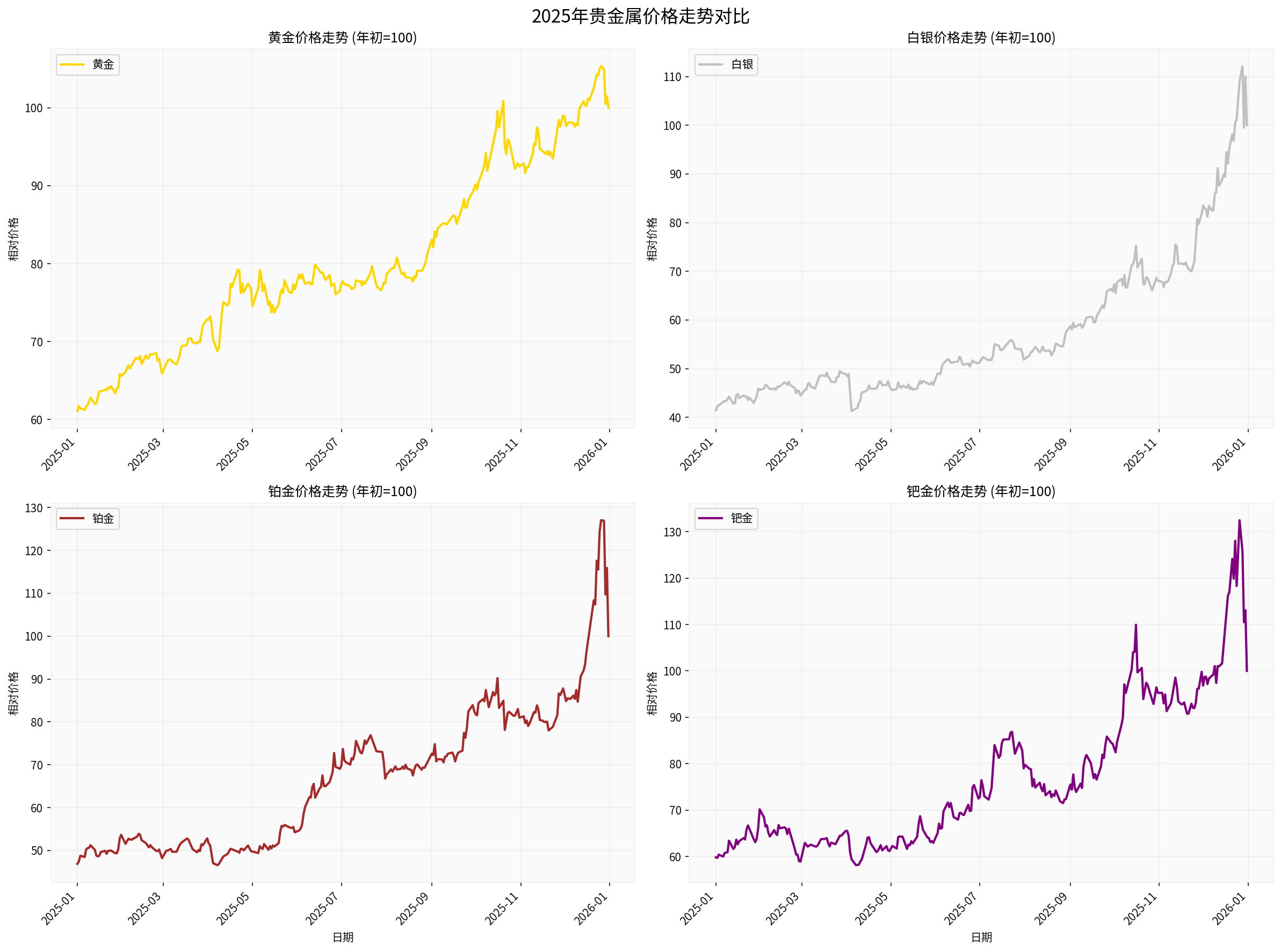

- Performance Characteristics of Precious Metals in 2025: Except for gold, silver, platinum, and palladium each fell by more than 50% during the year, with maximum drawdowns and annualized volatility both above 35%. Among them, platinum had a huge peak-to-trough spread during the year, with an annual return decline of about 53% and a maximum drawdown of over 63%, reflecting extreme market sentiment and uncertainty in structural supply and demand [0].

- Chart Observation: After normalizing the year-to-date prices of precious metals based on the beginning of the year, all showed high volatility followed by a rapid decline, with platinum and palladium falling particularly steeply, indicating that changes in risk appetite have a more intense impact on industrial precious metals [0]. Chart link:

- Safe-Haven Category (Gold/Gold ETFs): Although also affected by liquidity, they generally have deeper secondary markets. Maintaining a moderate defensive exposure (15%-25% of the portfolio) helps hedge against broad risks; focus on monitoring interest rate expectations and the direction of the U.S. Dollar Index. When the dollar continues to strengthen and real interest rates rise, the position can be moderately reduced to the lower limit.

- Industrial/Scarce Category (Platinum, Palladium): The current sharp decline is mainly caused by speculative funds, hedging arbitrage, and liquidity runs; fundamentals (such as demand for automotive exhaust catalysts) have not completely deteriorated. It is recommended to adjust positions in stages:

- Reduce Leverage/Short Risk: If you have participated via futures/leveraged ETFs, immediately reduce the leverage ratio or close part of the short positions;

- Diversified Hedging Strategy: Cross-metal spread strategies using palladium or silver can be utilized to take advantage of arbitrage opportunities from the recovery of the relative spread between palladium and platinum.

- Opportunistically Build Positions on Dips: If macro conditions ease or the dollar pulls back later, and actual inventories tighten again, you can buy in batches to control unit costs.

- Stop-Loss and Drawdown Management: Calculate the current downside risk based on the maximum drawdown indicator (platinum’s maximum annual drawdown is 63%). If the floating loss on positions is close to the historical drawdown high, prioritize liquidating non-essential long positions;

- Liquidity and Hedging Needs: Maintain 10%-15% of cash or short-term liquid assets to replenish margins or seize opportunities when the market fluctuates again; at the same time, consider using tools like gold options to hedge the tail risk of spot platinum/palladium.

- Industry/Macro Hedging: Combine the dollar trend, interest rate expectations (such as the continuation of Fed policy tightening), global industrial data, and auto sales. Appropriate allocation of inversely correlated assets (such as U.S. Dollar Index ETFs, inflation-protected bonds, etc.) can reduce the impact of non-systematic fluctuations.

- Reassess Precious Metals Exposure Limits: It is recommended to control the overall precious metals position between 10% and 20% of the portfolio’s total assets, adjusting dynamically according to the policy cycle and risk appetite.

- Focus on Targets with Higher Fundamental Certainty: For example, gold still has traditional safe-haven attributes; for platinum and palladium, pay attention to whether supply bottlenecks (low inventory, concentrated mining) and alternative demand (new energy catalysts) continue to support medium- to long-term demand.

- Diversified Exposure and Cross-Product Strategies: Combine risk-concentrated assets (platinum/palladium) with more liquid gold/silver, and use metal spreads, option combinations, or multi-asset hedging strategies to improve the overall Sharpe ratio.

The platinum crash reflects the dual superposition of structural risks and liquidity tensions in the precious metals market. It is recommended to improve the resilience and risk resistance of the overall portfolio by diversifying precious metal varieties and using strategy combinations covering safe-haven/industrial attributes, under the premise of reducing high leverage, diversifying hedging, and maintaining liquidity. If the market remains highly volatile, a deep research and investment model can be enabled as appropriate to obtain more detailed position dynamics and exchange data support.

[0] Gilin API Data (Precious Metals Price Statistics, Annual Performance and Charts, 2025).

[1] Yahoo Finance Hong Kong – “〈Precious Metals After-Hours〉 Selling Pressure Unleashed! Gold, Silver, Platinum Plunge Sharply from Historical Highs” (https://hk.finance.yahoo.com/news/貴金屬盤後-賣壓出籠-黃金-白金-白金從歷史高點急殺-222417855.html)

[2] Yahoo Finance Hong Kong – “5-Year Largest Drop! Rumors of International Banks’ Short Positions Collapsing—Silver Price Stabilizes Above $71 This Morning … Platinum and Palladium Continue to Decline” (https://hk.finance.yahoo.com/news/5年最大跌幅-傳國際大行做空爆倉-銀價今早守穩71美元之上-鉑金和鈀金續下行-004544820.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.