AI Boom Reshapes Asian Stock Markets: In-Depth Analysis of Investment Patterns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

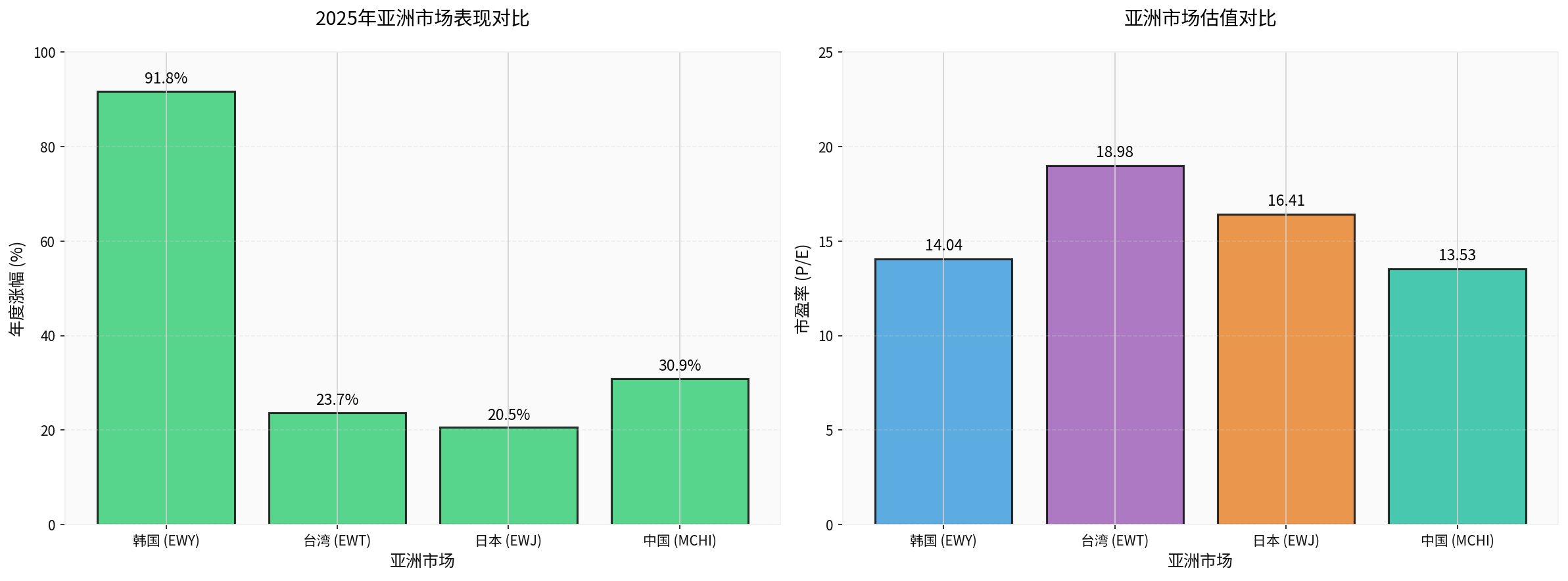

In 2025, Asian stock markets achieved amazing growth driven by the AI wave, with the

| Market | ETF Code | Annual Return | Current P/E Ratio | 52-Week Range |

|---|---|---|---|---|

South Korea |

EWY | +91.76% |

14.04x | $48.49 - $100.79 |

China |

MCHI | +30.93% | 13.53x |

$43.70 - $67.37 |

Taiwan |

EWT | +23.73% | 18.98x | $39.44 - $67.58 |

Japan |

EWJ | +20.54% | 16.41x | $59.84 - $85.31 |

India |

INDA | Valuation Premium | 24.04x | $47.60 - $56.01 |

The strong performance of Asian markets is mainly driven by the following factors:

- Global AI Infrastructure Investment Boom: The Semiconductor ETF (SMH) rose 47.81% over the past year, reflecting strong demand for AI hardware investment [0]

- Asia as Global Tech Manufacturing Hub: In the new AI capital expenditure super cycle, Asia has become an obvious winner [1]

- Weak Dollar Environment: A weaker dollar is beneficial to emerging market economies and their stock market performance [2]

- Monetary Policy Easing: Asian central banks continue to promote monetary easing policies; fiscal policy is expected to play a more important role in 2026 [2]

Despite ongoing trade tensions, the Asian tech sector has shown

- Export Exemption Policy: In 2025, exemptions for key exports such as semiconductors and electronic products significantly reduced effective tariff rates [2]

- Supply Chain Regionalization: Chinese enterprises still play an important role in many key areas (such as power supply, energy storage systems) [3]

- Accelerated Self-Reliance: China’s 15th Five-Year Plan (2026-2030) lists technological self-reliance as a core strategic goal, promoting localization in semiconductors, green energy, quantum computing and other fields [1]

- Semiconductor Equipment: The United States, Japan, and the Netherlands have successively introduced export controls, and the logic of equipment self-reliance continues to strengthen [3]

- AI Computing Chips: Demand for domestic chips such as Huawei Ascend and Cambricon is strong, shifting from “policy-driven” to “market demand” [5]

- Advanced Packaging: TSMC and SK Hynix are competing fiercely in the 2.5D packaging field; SK Hynix announced an investment of 3.87 billion US dollars to build a factory in the United States, which will be put into production in 2028 [4]

- Market Opportunities: AI applications shift from training to inference, requiring access and processing of large amounts of active data at any time, driving surging demand for HBM, GDDR7, LPDDR5 [4]

- Supply-Demand Pattern: DRAM shortages are expected to continue until after 2026, and the supply shortage will last for some time [4]

- Profitability Breakthrough: Samsung Electronics and SK Hynix’s Q4 2025 gross profit margin is expected to reach 63%-67%,surpassing TSMC (about 60%) for the first time in 7 years[4]

- Key Companies:

- SK Hynix(000660.KS): Stock price 651,000 KRW, 52-week increase 300%, market capitalization 449 trillion KRW [0]

- Samsung Electronics(005930.KS): Stock price 119,900 KRW, 52-week increase136%, market capitalization802 trillion KRW [0]

- TSMC’s Position: As the world’s largest wafer foundry, TSMC has become the main foundry for AI chips such as NVIDIA, AMD, and Broadcom with its cutting-edge processes of 3nm and below [4]

- Valuation Pressure: TSMC (ADR) currently has a P/E of 31.11x, which is at a high level [0]

- Competition Situation: SK Hynix enters the 2.5D advanced packaging field, planning to put into production in 2028, directly challenging TSMC’s monopoly position [4]

- Risk Tips: Advanced process capital expenditure is huge, and AI demand fluctuations may affect capacity utilization

- External Environment: NVIDIA’s market share in China plummeted from 95% in 2022 to nearly zero, freeing up huge space for domestic chips [5]

- Technological Breakthroughs:

- Huawei Ascend: Has formed a large-scale intelligent computing system and become the market leader [5]

- Cambricon, Hygon: Continuous iteration in the AI chip field, evolving from “usable” to “easy to use” [5]

- Ecosystem Construction: Enterprises such as SenseTime have completed in-depth adaptation of multiple domestic chips, building a trinity strategy of “large device - large model - application” [5]

- Policy Support: China’s 15th Five-Year Plan clearly takes core technology breakthroughs as the focus, accelerating semiconductor localization investment [1]

- Technical Value: 2.5D packaging technology is the core process for integrating HBM and high-performance system semiconductors (GPU/CPU), which can significantly improve power efficiency and data processing speed [4]

- Competition Pattern:

- TSMC: Leading in CoWoS technology, but capacity is limited

- SK Hynix: Invested 3.87 billion US dollars to build a 2.5D packaging production line in the United States, to be put into production in 2028 [4]

- Domestic Opportunities: Domestic packaging and testing manufacturers such as Changjiang Electronics Technology and Tongfu Microelectronics are accelerating their catch-up in the advanced packaging field, with strong demand for AI computing chips [3]

- Global Competitiveness: Chinese optical module suppliers such as Zhongji Innolight and New H3C occupy an important position in the global high-speed product market [5]

- Double Drivers: Benefit from global AI computing power construction demand and localization process

- Performance Elasticity: The performance growth of optical module manufacturers directly benefits from the acceleration of data center construction

-

Malaysia:

- Digital economy investment reached 54.1 billion ringgit in Q3 2025, of which AI-related investment created 8,328 jobs [6]

- Electrical and electronic industry accounts for 40% of total exports, semiconductors account for 65% of its exports [2]

- Target to become an “AI Nation” by 2030 [6]

-

Singapore:

- Important participant in the global data center competition, focusing on sustainability rather than pure capacity [7]

- The global data center market size was about 243 billion US dollars in 2024, and is expected to increase to 270 billion US dollars in 2025 [7]

-

Cross-border Cooperation:

- Shenzhen-Singapore cross-border data verification platform has been launched for trial operation [8]

- The Greater Bay Area-ASEAN is shifting from “manufacturing complementarity” to “innovation integration” [8]

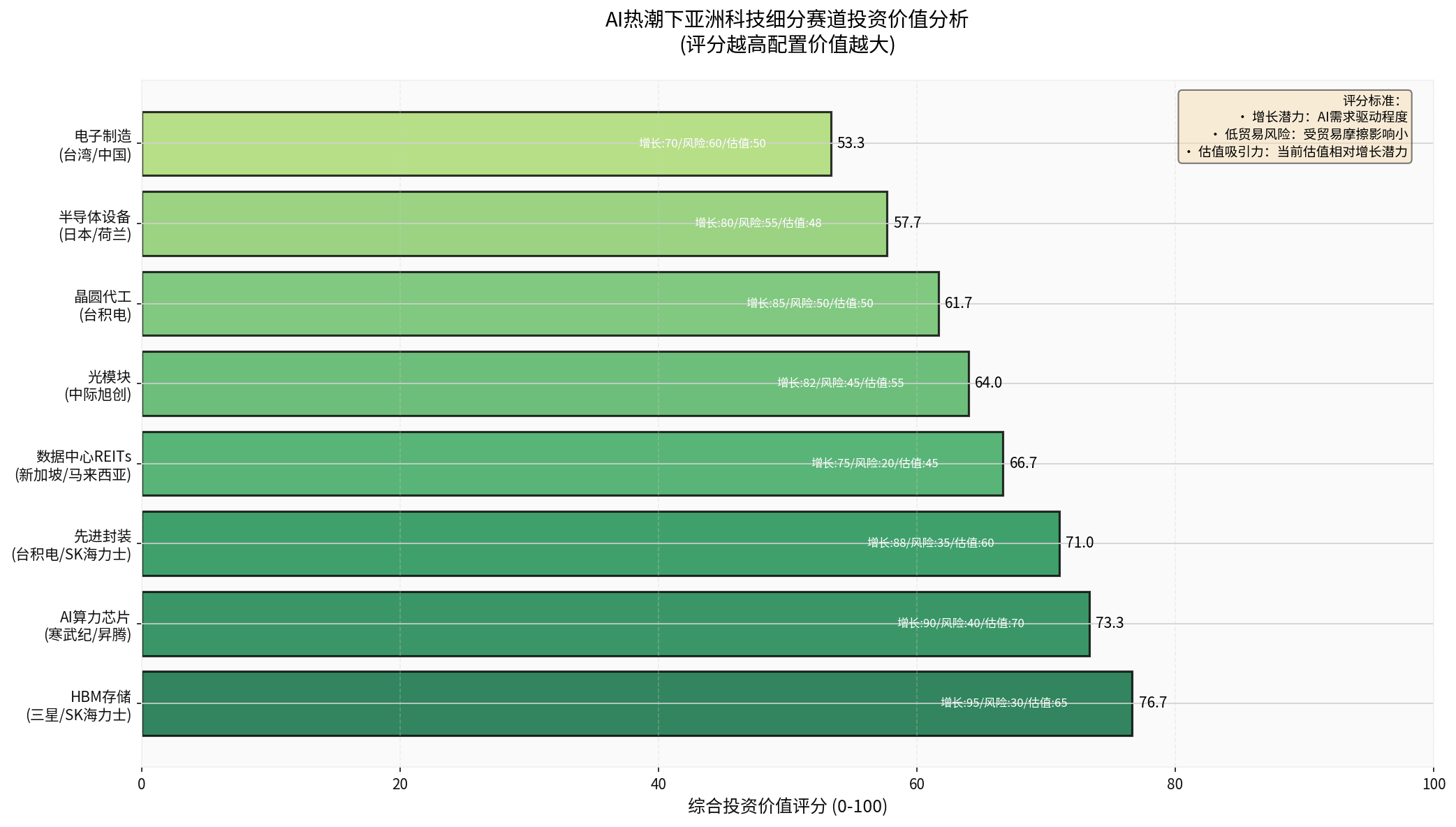

###4.1 Strategic Allocation Framework

| Allocation Direction | Recommended Weight | Core Reason |

|---|---|---|

HBM Storage |

30% | Core demand for AI inference, supply-demand gap continues until 2026 |

Domestic AI Computing Power |

25% | Accelerated domestic substitution, shifting from policy-driven to market-driven |

Advanced Packaging |

20% | 2.5D/3D packaging becomes the key to AI chip competition |

ASEAN Data Center |

15% | Low trade risk, benefit from global AI infrastructure expansion |

Optical Modules |

10% | Clear global competitiveness, high performance elasticity |

###4.2 Regional Allocation Strategy

- Overweight: South Korea (HBM), China (Domestic Computing Power), Malaysia (Data Center)

- Standard: Taiwan (Wafer Foundry + Packaging), Singapore (Data Center Hub)

- Underweight: Japan (High valuation, relatively slow growth)

###4.3 Risk Tips

- Trade Friction Escalation Risk: If the United States, Japan, the Netherlands and other countries further upgrade export controls, it may affect the core links of relevant enterprises [3]

- AI Demand Below Expectations: If the landing speed of AI applications slows down, it may affect the profit expectations of the entire industry chain [3]

- Valuation Risk: Some sub-sectors (such as HBM) have experienced large increases, and their valuations are already at high levels

- Geopolitical Risk: Sino-US relations, cross-strait situation, etc. may affect market sentiment

- Grasping thestorage demand explosion in the AI inference era

- Seizing thehistoric opportunity of domestic substitution shifting from “policy-driven” to “market demand”

- Layout ASEANas the best beneficiary of global AI data center expansion

For investors, adopting the

[0] Jinling API Data - Real-time quotes and historical price data of Asian market ETFs

[1] Lianhe Zaobao - “Looking at new opportunities in the AI ecosystem, seizing opportunities for innovation and diversified returns in Asia” (https://www.zaobao.com.sg/finance/singapore/story20251228-8000964)

[2] Invesco - “Bullish on Asian stocks in 2026: AI remains a structural growth theme for Asian markets” (https://finance.sina.com.cn/stock/hkstock/ggscyd/2025-12-25/doc-inhcywam9005678.shtml)

[3] DIGITIMES - “Benefiting from strong demand for energy storage systems and transformers, Chinese power suppliers’ exports grow against the trend” (https://www.digitimes.com.tw/tech/dt/n/shwnws.asp?id=0000742022_PPILLXOY3G1DZ91COJFFQ)

[4] TechNews - “SK Hynix invests in US 2.5D advanced packaging to challenge TSMC, to be put into production in 2028” (https://technews.tw/2025/12/29/sk-hynix-will-invest-in-a-2-5d-advanced-packaging-line-in-the-united-states-to-challenge-tsmc/)

[5] Sina Finance - “When Cambricon and Huawei Ascend are adapted at the same time, what is SenseTime planning?” (https://finance.sina.com.cn/tech/roll/2025-12-15/doc-inhawpkc2313125.shtml)

[6] Nanyang Siang Pau - “Digital investment reached 54.1 billion in the third quarter, 88% flowed into Selangor and Kuala Lumpur, creating 20,000 jobs” (https://www.enanyang.my/news/20251229/Finance/1117155)

[7] Business Times - “Data Center Race: Singapore bets on quality over quantity, observers say” (https://www.businesstimes.com.sg/zh-hans/startups-tech/technology/data-centre-race-singapore-betting-quality-over-scale-say-observers)

[8] Nanfang+ - “When AI becomes a ‘key chess piece’ for ASEAN cooperation, what role will Qianhai play?” (https://www.nfnews.com/content/v3aO1EPzo1.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.