Analysis of Driving Factors, Sustainability, and Investment Risks of the Commercial Aerospace Sector's Surge

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

-

In August 2025, the Ministry of Industry and Information Technology issued the Guiding Opinions on Optimizing Business Access to Promote the Development of the Satellite Communication Industry, clearly proposing the quantitative target of

‘over 10 million satellite communication users by 2030’, setting a clear timeline and roadmap for industrial development [1] -

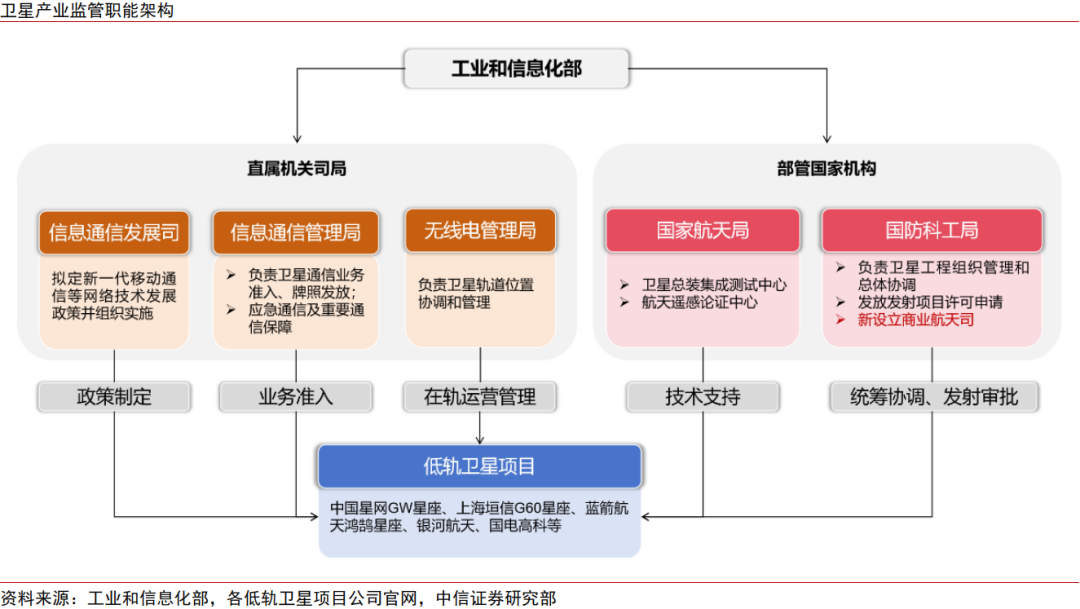

The China National Space Administration (CNSA) established the Commercial Aerospace Department for the first timeand set up the first2 billion yuan industrial special fund, injecting strong impetus into core technology research and ecological construction [1]

-

On December 26, 2025, the Shanghai Stock Exchange released the

Guidelines for Commercial Rocket Enterprises Applying the Fifth Set of Listing Standards on the Science and Technology Innovation Board, marking the official opening of the channel for commercial rocket enterprises to enter the capital market, and the IPO process of leading private commercial rocket enterprises is expected to accelerate [3]

-

The Phase I project of the

“Qianfan Constellation”led by Shanghai Yuanxin Satellite is being accelerated, with multiple batches of satellites successfully entering orbit and the on-orbit scale continuing to expand -

The GW constellation has advanced to the key technology and system testing stage, verifying cross-regional and cross-high-latitude communication capabilities, laying the foundation for subsequent large-scale deployment [1]

-

In March 2025, China significantly optimized the orbital entry efficiency and cost structure of commercial satellites through launch methods such as “one rocket carrying 18 satellites” and other multi-satellite networking launches

- Aerospace Development gained 7 daily limits in 11 trading days

- *ST Chengchang gained 9 daily limits in 13 trading days [5]

- China Satellite Communications had 5 daily limits in 6 days, with a market value exceeding 150 billion yuan

-

New formats such as

direct satellite connection for mobile phonesand consumer-grade satellite services have emerged, allowing aerospace technology to truly enter people’s daily lives -

Galaxy Space has successfully developed and launched two satellite internet technology test satellites with direct mobile phone connection functions, and is accelerating the development of subsequent direct mobile phone connection satellites [2]

-

The integration of satellite internet with 5G and IoT is accelerating, and its applications in smart agriculture, ocean monitoring, telemedicine and other fields are continuously deepened, forming a “communication-navigation-remote sensing integration” service capability [1]

- The sector’s annual increase has exceeded 80%, and the price-to-sales ratio of some targets is as high as 65 times, far exceeding the average of technology stocks

- Many companies have issued announcements to warn of risks, clearly stating that “main business does not involve commercial aerospace” or “company products are not directly applied to commercial aerospace” [5]

- Aerospace Electronics’ share price rose 4.62% on the day, with a turnover of 15.698 billion yuan, but the main funds had a net outflow of 2.831 billion yuan in the past five days

- China Satellite had a strong daily limit with a turnover of 12.857 billion yuan, but the main funds had a net outflow of 609 million yuan in the past five days [5]

This “price-volume divergence” phenomenon is a typical signal of main capital withdrawal.

- Logic: Hot spot speculation deviates from performance fundamentals

- Current situation: The sector’s annual increase exceeds 80%, and the valuation of some targets far exceeds the performance support range

- Consequence: Once industry catalysis is not as expected or funds retreat, a 20%-30%valuation correction is likely to occur [6]

- Logic: Concept speculation is seriously disconnected from performance realization

- Current situation: Executives of 29 listed companies collectively reduced their holdings, and many companies clarified that their main business does not involve commercial aerospace

- Consequence: Failure to realize performance will lead to significant valuation corrections, and investors face the risk of losses

- Logic: Uncertainty exists in technical verification

- Current situation: Reusable rocket technology will enter a key verification period in 2026

- Consequence: Failure of technical route or progress not as expected will affect enterprise competitiveness and valuation

- Logic: Industry development is highly dependent on policy guidance

- Current situation: There is uncertainty in the promotion progress of constellation networking planning, market access policies, etc.

- Consequence: Policy promotion not as expected will directly affect the rhythm of demand release and performance realization

- Suggest cautious wait-and-see. The current sector is obviously overheated, with main funds outflow and industrial capital reduction, facing greater correction pressure in the short term

- If you must participate, choose targets that truly have core business, not concept stocks

- Strictly control positions and do a good job of stop-loss discipline

- Wait for valuation regression. The current valuation has seriously overdrawn future growth, and it is more明智 to wait for the bubble to fade and valuation to return before布局 [5]

- Focus on core targets. Choose companies that meet the following four standards:

- High business proportion: Commercial aerospace-related business is one of the core businesses (avoid “edge沾” layout)

- Hard technical barriers: Have core patents, exclusive technology or scarce qualifications

- Relatively low position: Targets in震荡区间 and not fully speculated

- Strong industrial catalysis: Have clear project orders or technical breakthrough expectations [6]

- Track industrial progress for a long time. Pay attention to core catalytic factors such as low-orbit satellite constellation construction progress, reusable rocket technology verification, and application scenario commercialization progress

“

History always惊人地 similar. Looking back at the development history of emerging industries such as new energy vehicles and the Internet,

As a national strategic emerging industry, commercial aerospace has broad long-term development prospects, and industrial development has entered a golden development period of “capital empowerment + technological breakthrough + scale expansion” [3]. However,

For investors, the core lies in grasping the

- Be alert to correction risks in the short term and avoid blind chasing of highs

- Focus on performance realization in the medium term and distinguish between real leaders and concept stocks

- Grasp industrial trends in the long term and layout enterprises with real competitiveness when valuations are reasonable

[1] Sina Finance - “China Commercial Aerospace Milestone Year: Accelerating Networking and Application Breakthrough”

https://finance.sina.com.cn/jjxw/2025-12-31/doc-inherfce4013825.shtml

[2] Xinhuanet - “Intensive Catalysis: Commercial Aerospace May迎来 Rapid Growth Inflection Point”

http://www.news.cn/fortune/20251222/7783592c83a74010b548b66376901843/c.html

[3] Eastmoney.com - “Commercial Aerospace Enters Golden Development Period of ‘Capital Empowerment + Technological Breakthrough + Scale Expansion’!”

https://finance.eastmoney.com/a/202512303605511187.html

[4] Sina Finance - “Behind SpaceX’s Trillion-Dollar Valuation: How Space Economy Reconstructs Global Capital Allocation Pattern?”

https://news.sina.cn/bignews/insight/2025-12-29/detail-inheneyq4855677.d.html

[5] Caifuhao - “Commercial Aerospace Sector Risk Warning: Retail Investors Need to Be Alert to Valuation Traps Under Overheated Speculation”

https://caifuhao.eastmoney.com/news/20251228015316229857110

[6] Eastmoney.com - “Full Analysis of Trillion-Dollar Commercial Aerospace Opportunity Mining Logic”

https://caifuhao.eastmoney.com/news/20251227082757359496190

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.