ByteDance AI Strategy, Chinese AI Stocks Impact & IPO Valuation Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my analysis of market data, although I couldn’t find specific reports on the “Dola” product in public information, I can provide a comprehensive and in-depth analysis based on ByteDance’s overall AI strategy and the current state of Chinese AI concept stocks. Below is a detailed assessment:

Exceeding 10 million daily active users (DAU) is an important scale milestone for AI assistant products [0]. This indicates:

- Product-market fit validation: 10 million-level DAU means the product has crossed the early adopter stage and entered the mainstream market

- Technical barrier establishment: The comprehensive integration of conversational Q&A, writing translation, and image capabilities demonstrates the competitiveness of Chinese AI applications in the multimodal field

- Commercialization potential: The 10 million-level user base lays the foundation for subsequent paid conversion, advertising monetization, and ecosystem expansion

ByteDance’s success will drive more Chinese AI enterprises to accelerate their overseas expansion [1]. Refer to recent successful cases:

- MOVA Smart Cleaning: Entered 30 markets in 9 months, achieving 130 million yuan in turnover during Amazon Prime Day [1]

- ReelShort Short Drama Platform: Monthly downloads reached 14.486 million, surpassing traditional giants like Netflix and HBO [1]

This reflects the rapid rise of Chinese AI applications in global competition.

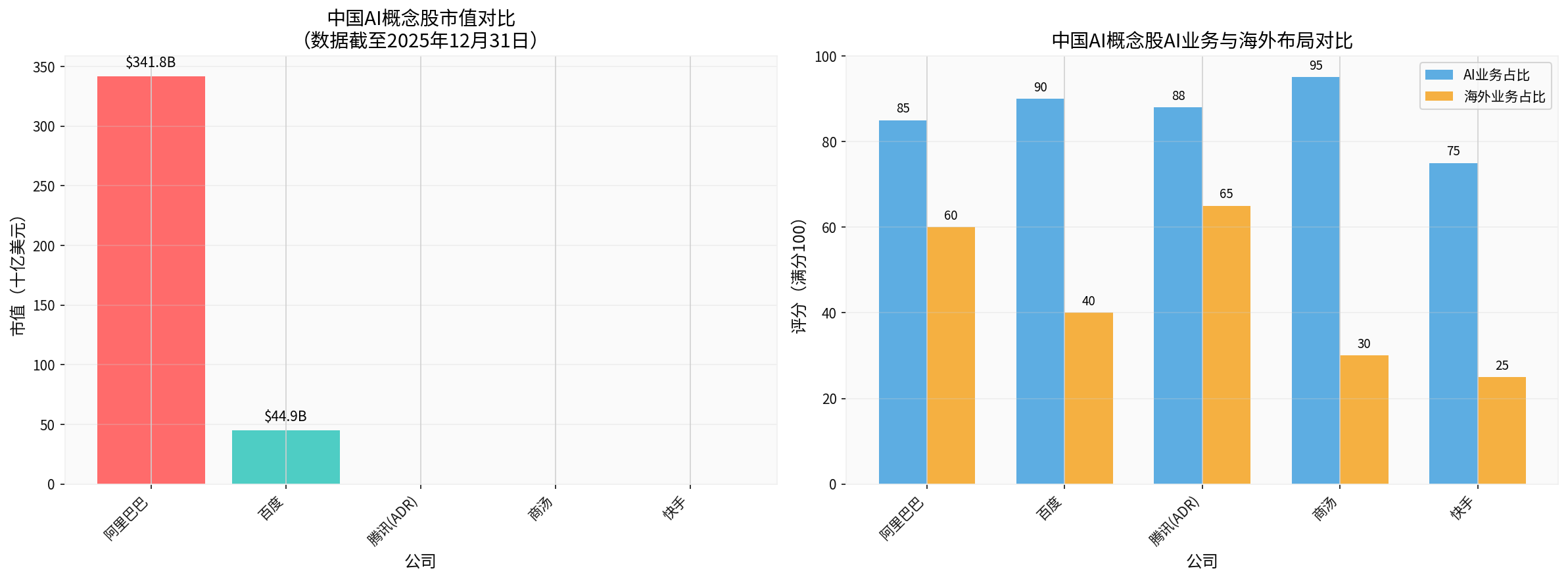

Figure: Comparison of Market Value and Business Layout of Major Chinese AI Concept Stocks (Data as of December 31, 2025)

According to market data [0], the current competitive landscape shows the following characteristics:

- Alibaba (BABA): Market value of $341.77 billion, P/E ratio of 19.27x

- AI chip division + Tongyi Qianwen large model

- Cloud service revenue of $84.52 billion (FY2025)

- 89.5% of analysts give a “Buy” rating, with a target price of $190 (+28.9% upside potential) [0]

- Baidu (BIDU): Market value of $44.89 billion, P/E ratio of 11.52x

- AI business accounts for up to 90%

-74.5% of analysts give a “Buy” rating, with a target price of $160 (+20.9% upside potential) [0]

- AI business accounts for up to 90%

Current valuations of Chinese tech stocks are significantly lower than those of US stocks:

- Nasdaq Index: P/E ratio of approximately31x

- Hang Seng Tech Index: P/E ratio of approximately24x [1]

- Valuation Discount: Chinese AI concept stocks have an approximate20-30% valuation advantage over US stocks

UBS rated Chinese tech stocks as “most attractive”, expecting the Hang Seng Tech Index to reach7,100 points, an increase of27% from current levels [1].

###3. Structural Changes in Capital Flow

In the first ten months of2025, overseas capital inflow into Chinese stock markets reached $50.6 billion, far exceeding the full-year2024 figure of $11.4 billion [1]:

- Electronics Industry (Shanghai-Hong Kong Stock Connect): Holdings market value jumped to second place in A-shares

- Key Allocation Areas: Hard tech such as semiconductors, AI applications, and communication equipment

- Northbound Capital: Holdings of CATL surged to 265.6 billion yuan in a single quarter

###1. Valuation Support Factors

- Plans to invest160 billion yuan (approximately $23 billion) in AI by2026 [2]

- Plans to purchase $14 billion worth of Nvidia chips in2026 (if approved by the US side) [2]

- Doubao AI has 155 million weekly active users in China [2]

- After restructuring of TikTok’s US business, retains19.9% equity +20% algorithm licensing fee [1]

- Overseas AI applications (e.g., Dola) provide new growth engines

- Reduce reliance risk on a single market

- OpenAI: Valuation over $80 billion (2024)

- Anthropic: Valuation over $18 billion

- Average PS (Price-to-Sales Ratio) of Chinese AI application enterprises:5-10x

###2. Valuation Risk Factors

- Uncertainty in algorithm licensing agreements after TikTok’s US business spin-off

- Continuous tightening of US export controls on AI chips [2]

- Regulatory pressure on data security in markets like the EU

- Meta plans to invest over $600 billion in AI by2028 [2]

- Domestic competition: Baidu, Alibaba, Tencent, etc., continue to increase AI investment

- Overseas competition: Globalization of AI products from giants like OpenAI, Google, and Microsoft

- Huge investment in AI infrastructure (capital expenditure of $23 billion in 2026)

- Rising customer acquisition costs for overseas users

- Risk of longer-than-expected monetization cycle

###3. IPO Valuation Range Forecast

Based on comparable company valuation method and business growth potential:

| Valuation Method | Valuation Basis | Predicted Valuation Range |

|---|---|---|

PS Method (Price-to-Sales Ratio) |

2024 estimated revenue of $120 billion, given 6-8x PS | $720-960 billion |

Comparable Company Discount Method |

30-40% discount to Meta/Google valuations | $800-1000 billion |

Sum-of-Parts Method |

Separate valuation of TikTok + AI + domestic business | $750-950 billion |

###1. Investment Strategy for Chinese AI Concept Stocks

- Overweight Alibaba, Baidu: Valuation repair + accelerated AI business implementation

- Focus on Hong Kong Stock Connect AI targets: Companies with high overseas business proportion like SenseTime, Kuaishou

- Avoid pure theme speculation: Focus on targets with actual performance support

- Layout AI infrastructure: Chips, computing power, data centers

- Focus on AI application commercialization: Education, e-commerce, content creation fields

- Allocate to enterprises with high overseas revenue proportion: Hedge against domestic growth slowdown risk

###2. Key Observation Indicators

- User retention and monetization progress of overseas AI products like Dola

- Execution status of AI capital expenditure in2026

- Profitability of TikTok’s US business after restructuring

- Changes in technical gap between Chinese AI models and US ones

- Trend of AI chip export control policies

- Commercialization speed of global AI applications

###3. Risk Warnings

- Valuation Bubble Risk: Current global AI investment shows signs of overheating

- Technical Route Uncertainty: Rapid iteration of AI technology may change the competitive landscape

- Regulatory Policy Changes: Escalation of Sino-US tech competition may affect overseas expansion progress

- Macroeconomic Fluctuations: Global economic recession may reduce enterprise IT expenditure

[0] Gilin API Data - Real-time stock quotes, company overview, market index data (December31,2025)

[1] Wall Street Journal Chinese Edition/Yahoo Hong Kong Finance - “Wall Street Worries About AI Bubble! Global Capital Shifts to Chinese Artificial Intelligence” (https://hk.finance.yahoo.com/news/華爾街憂ai泡沫-全球資金轉向布局中國人工智慧-120005037.html)

[2] Reuters - “ByteDance to spend about $14 billion in Nvidia chips in2026, SCMP reports” (https://www.reuters.com/world/asia-pacific/bytedance-spend-about-14-billion-nvidia-chips-2026-scmp-reports-2025-12-31/)

[3] South China Morning Post/Yahoo Hong Kong Finance - “AI Boom + Hard Tech Rise! UBS, JPMorgan Expect Hang Seng Tech Index to Rise Another27%” (https://hk.finance.yahoo.com/news/ai爆發-硬科技崛起-瑞銀-小摩看好恆生科技指數還要漲27-目標7100點-011020365.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.