Impact Analysis of Tencent Cloud AI Large Model Implementation in Financial Scenarios

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

As of December 30, 2025, Tencent’s Hong Kong stock price is HK$600, with a total market capitalization of approximately HK$5.45 trillion, a trailing P/E ratio of 21.89x, ROE of 20.3%, and operating and net profit margins close to 30%[0]. The stock price rose by about 44% for the full year, indicating that the market has partially recognized the long-term value of its AI and cloud transformation[0].

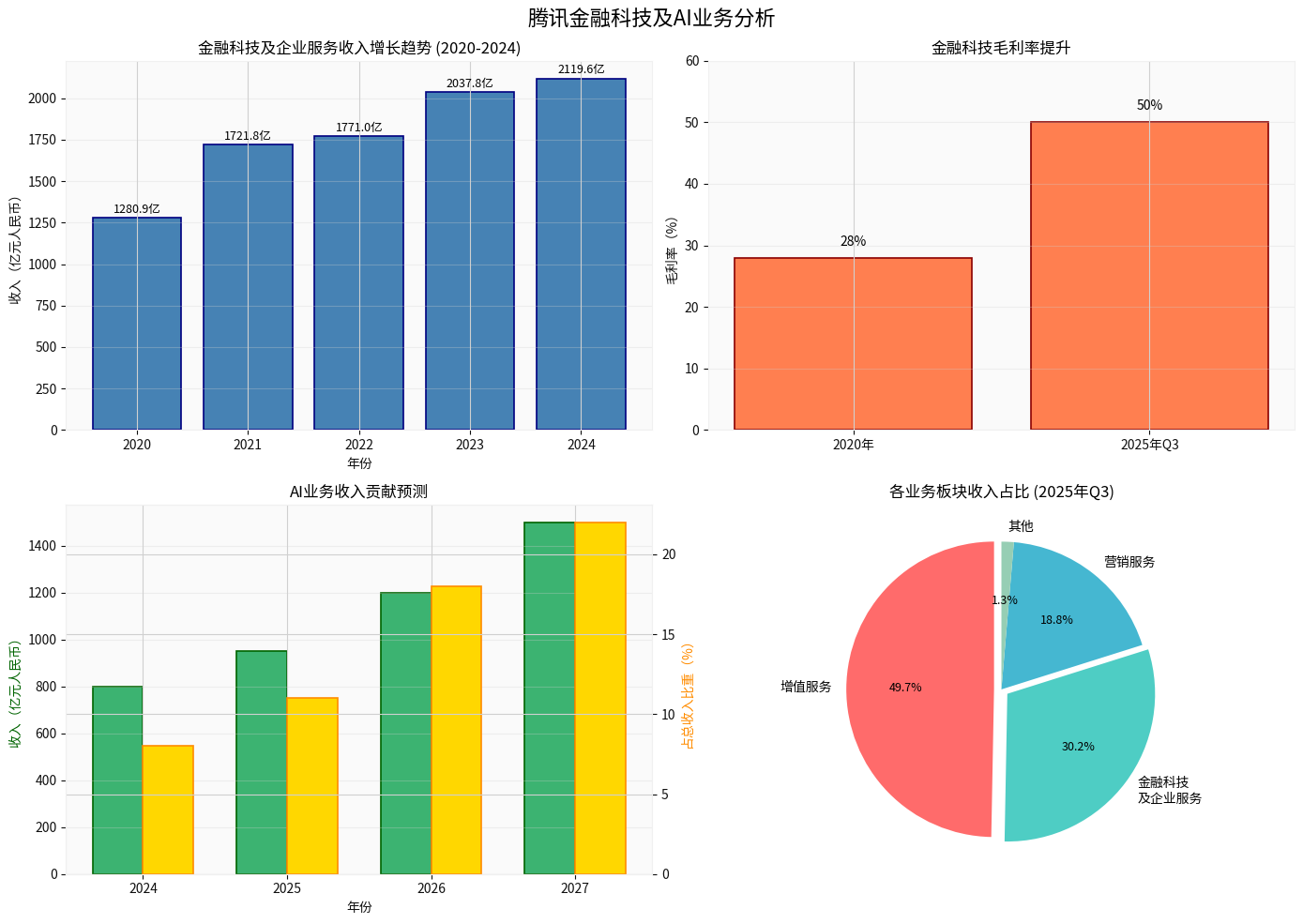

In Q3 2025, the FinTech and Enterprise Services segment achieved revenue of RMB 58.17 billion, a year-on-year increase of 10%, accounting for approximately 30% of total revenue, with gross margin rising to 50%, showing continuous improvement in scale and efficiency[0][2]. The segment’s revenue has grown from RMB 128.086 billion in 2020 to RMB 211.956 billion in 2024, with a four-year CAGR of approximately 13.4%, firmly supporting the ToB and ToC linkage of Tencent’s three major ecosystems: “Social + Tools + Finance”[0].

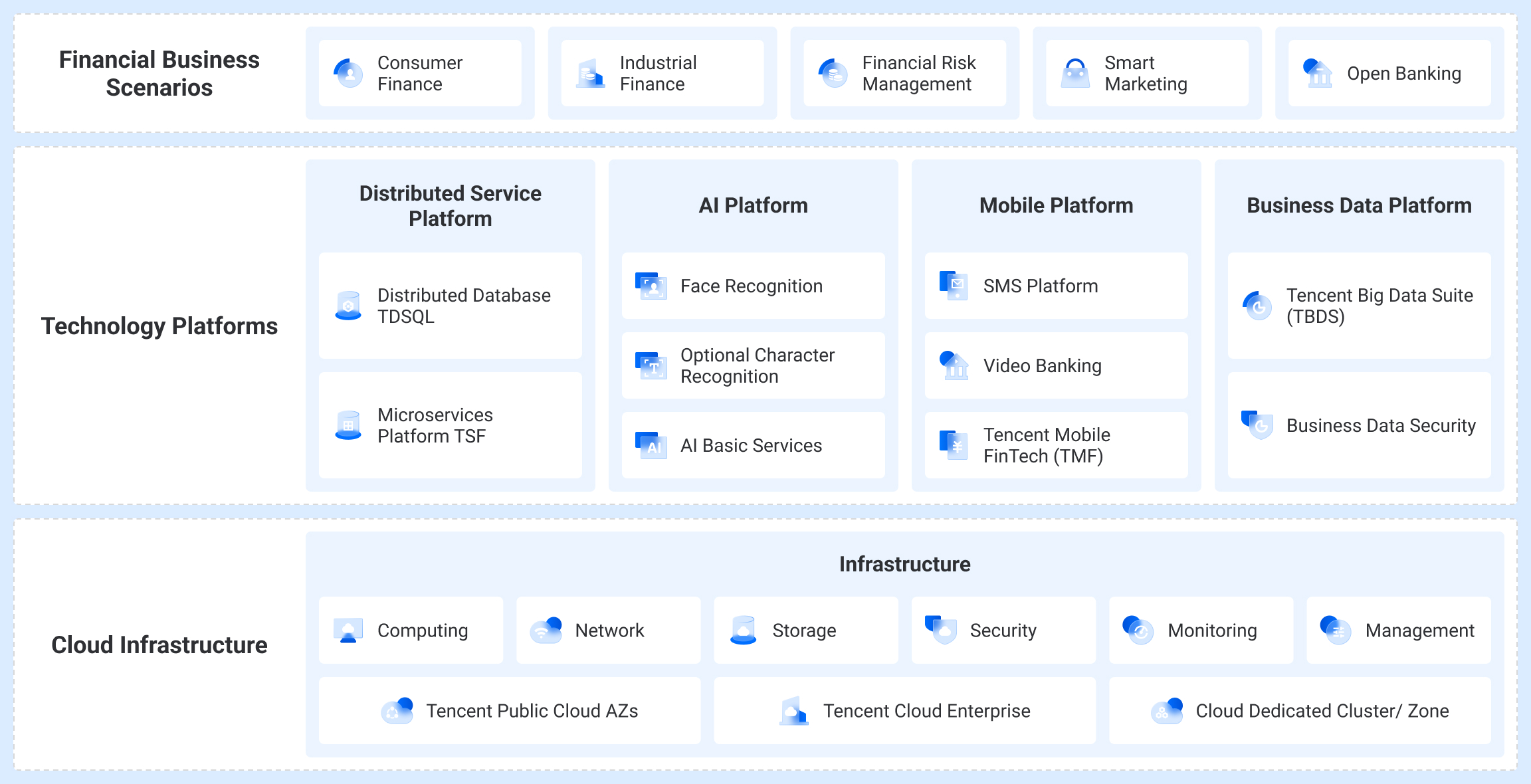

Tencent Cloud has implemented over 100 financial scenarios with institutions such as the Shanghai and Shenzhen Stock Exchanges, Bank of China, Industrial and Commercial Bank of China, CICC, and Taiping Insurance Group, backed by deep integration of the Hunyuan Large Model, big data, and intelligent agents, covering risk management, customer service, asset allocation, and intelligent operations[0]. Capital expenditure has also increased significantly: in Q4 2024, spending on AI infrastructure such as GPUs increased by 386% year-on-year, and the investment scale is expected to reach the RMB 100 billion level in 2025, accounting for a low double-digit percentage of revenue[0][1]. With this investment, the penetration of AI in Tencent’s marketing services, cloud computing, and payment businesses has directly improved gross margins and traffic value[1].

Building on the FinTech milestone, AI is opening a new demand curve. Third-party estimates show that if the penetration rate of AI business on the B-side continues to expand to 35% similar to Alibaba Cloud, it will bring significant valuation revaluation space for Tencent: AI revenue is expected to reach RMB 120 billion in 2026, accounting for 18% of total revenue, and further increase to RMB 150 billion (22% share) in 2027, with an estimated ROI of 3.2, significantly higher than Alibaba (2.1) and ByteDance (2.5). This means AI can not only cover a large amount of marginal costs but also catalyze higher valuation multiples[3]. Combined with the closed-loop of payment, credit, and wealth management already formed in FinTech, AI capabilities further enhance risk management efficiency and customer stickiness, and are expected to continue contributing high-quality growth in the next 4-6 quarters.

The implementation of AI scenarios in FinTech business has three effects: first, increasing cloud service ARPU; second, strengthening the digital base of WeChat Pay/Tenpay; third, outputting AI to partners (such as exchanges and banks) to form replicable SaaS performance. As of Q3 2025, Tencent Cloud’s penetration in financial scenarios has exceeded 900 applications, and industry demand is shifting from Proof-of-Concept to large-scale commercial use[0]. With the intervention of AI intelligent agents and Hunyuan Large Model generation capabilities in financial decision-making, compliance, and customer communication, Tencent Cloud’s FinTech business is transforming from a “cost center” to a “growth engine”, providing a double-helix drive for overall valuation: on one hand, revenue leverage for many years to come; on the other hand, market recognition of the “AI-driven technology platform” positioning[3].

The following figure integrates the evolution of FinTech revenue, gross margin improvement, AI business share forecast, and Q3 2025 segment share, intuitively showing the weighted amplification effect of AI and FinTech on Tencent’s revenue structure[0].

- Revenue and Valuation Aspect: The integration of AI + FinTech is bringing stable and sustainable revenue and profit growth to Tencent. In the next few quarters, FinTech is still expected to contribute about 30% of total revenue, while AI-related services have the potential to drive overall valuation under the “high ROI” logic[0][3].

- Growth Engine Positioning: As a “testbed” for AI implementation, the FinTech segment has closed-loop businesses such as payment, credit, and wealth management. The efficiency and customer experience upgrades provided by AI are enhancing the moat and long-term repurchase, fully capable of becoming a new performance growth engine.

- Risk Reminders: Need to pay attention to the pressure of high AI infrastructure investment on short-term cash flow, compliance regulatory requirements in financial scenarios, and key customer procurement rhythm; also need to monitor whether the marginal benefits after AI implementation continue to increase.

For further in-depth quantification (e.g., splitting AI-driven revenue by scenario, valuation sensitivity modeling, or benchmarking against other large cloud vendors), consider enabling the

[0] Gilin AI Brokerage API Data (real-time market, company overview, financial analysis, Python visualization output).

[1] Securities Times - “2025 China Tech Trends: Big Players Invest 100 Billion in AI to Compete for Super Entrance” (https://www.stcn.com/article/detail/3563827.html)

[2] Yicai - “Tencent Holdings: FinTech and Enterprise Services Revenue Grew 10% YoY in Q3” (https://www.yicai.com/brief/102910562.html)

[3] NetEase - “Ditching DeepSeek, Tencent AI is Also Back” (https://www.163.com/dy/article/KHDBPN2U05566T0A.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.