Analysis of Shensis Electronics Winning the 199.8 Million Yuan Jinan Low-Altitude Platform Project: Balancing Growth and Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

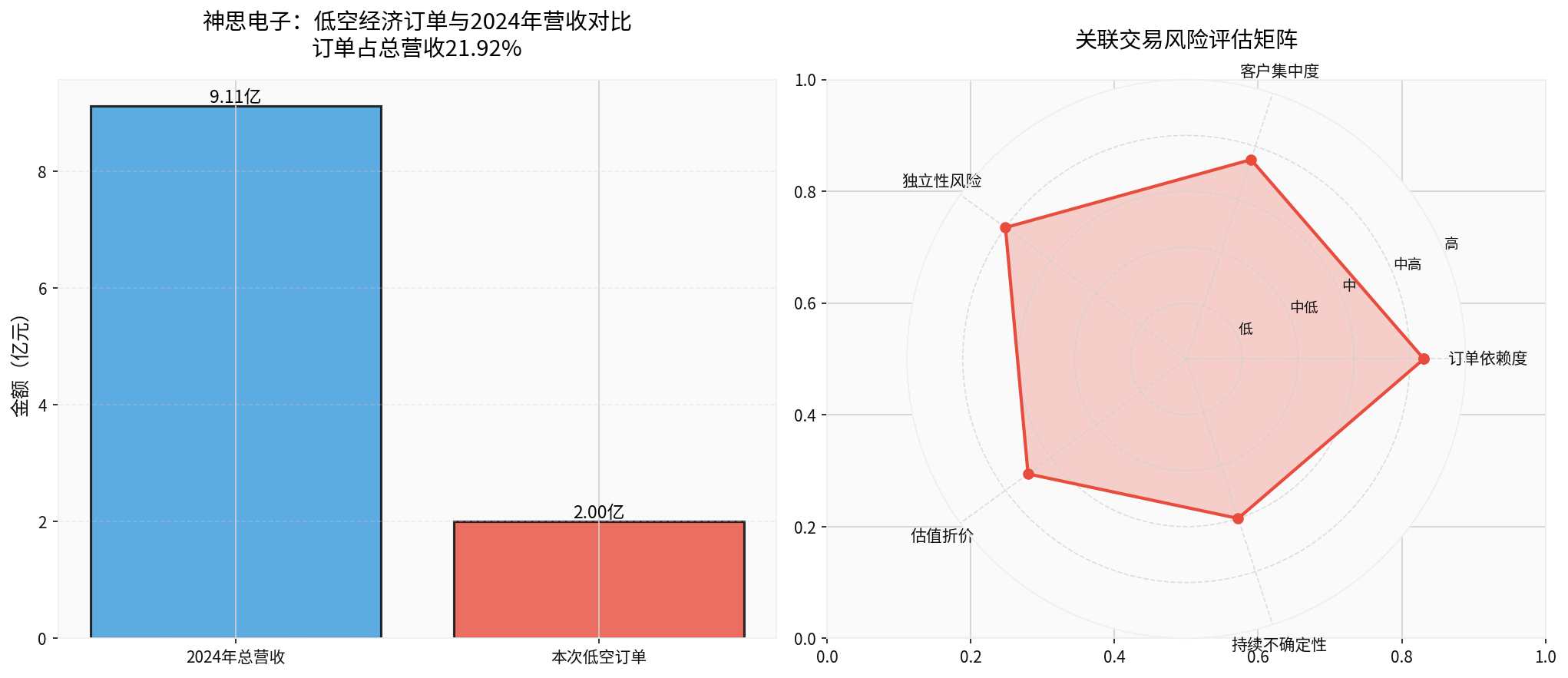

Shensis Electronics recently won the bid for the Jinan Digital Low-Altitude Flight Management Service Platform construction project, with a project amount of 199.8 million yuan, accounting for 21.92% of its audited operating revenue in 2024. This indicates a highly concentrated implementation of the company in the core track of the “low-altitude economy”. Against the backdrop of the current stock price of 18.91 yuan, valuation still at 160x P/E, 8.47x P/B, net profit margin of only 2.25%, and free cash flow of -43.34 million yuan, investors need to comprehensively consider the balance between growth and risks [0][1]. In an environment where the low-altitude economy continues to expand and is driven by policies, if the proportion of related-party transactions can be controlled and independent customers expanded, this large order has certain sustainability; however, if it relies on the “internal circulation” of the same controlling group, the pressure on independence and valuation discount will remain.

- The project aims to build a “fully functional and technologically leading” low-altitude flight service system and construct a flexible, convenient, and safe digital support for low-altitude airspace. The tenderer, Jinan Low-Altitude Economy Development Co., Ltd., and Shensis Electronics are jointly controlled by Jinan Energy Group. The transaction has been identified as a related-party transaction, and the payment and pricing still need to be disclosed to regulators and undergo independence review [1][2].

- The project can be regarded as an extension of multi-dimensional empowerment such as the “Jinan Digital Low-Altitude Flight Management Service Platform”, “lifeline monitoring”, and “low-altitude emergency rescue”. It focuses on global surveillance, full-time communication, full-process service, and safe access. Technical achievements (such as the “Kunpeng Zhifei” 1.0 system) have been formed and are simultaneously connected to the “space-air-ground” data network [5][6].

- This winning bid is not an isolated event: in the first three quarters of 2025, Shensis Electronics has announced related-party projects from the Jinan system totaling about 490 million yuan, further indicating the joint implementation rhythm of the company and this region/group in the low-altitude digitalization process [3][4]. Against the policy background where the national level emphasizes “the output value of the low-altitude economy exceeding 10 billion yuan by 2027” and “airspace management system construction”, this platform can be regarded as a local-level model project and is expected to be replicated in other cities or regions in the future [6][7].

- Policy and Market Foundation: The low-altitude economy has been listed as a key “new-quality productive force” by the state and local governments. There are financial supports such as local industrial funds and special bonds, as well as capital investment from thousands of related enterprises. The industry track is still in the expansion stage from concept to commercialization [6][7].

- Capability Matching: Shensis Electronics’ business covers digital governance, identity authentication, security perception, etc., which matches the system integration needs of the low-altitude platform’s “global surveillance + full-process service”. The continuous digital upgrading of cities such as Nanjing/Jinan enables it to expand from government projects to general aviation, emergency support, logistics and other fields [5].

- Order Replicability: Considering the trend of accelerating pilots, improving approval efficiency, and building digital platforms for low-altitude governance nationwide, if Shensis Electronics can accumulate reusable technical modules and product templates during project execution, it will be expected to obtain more “low-altitude economy + informatization” orders; however, the premise is to obtain external bidding opportunities that are “non-controlling related” to avoid over-reliance on the Jinan Energy Group system.

- Proportion and Concentration: A single related-party order accounts for about 22% of the annual revenue. If we add the previously disclosed related-party projects (accumulating nearly 490 million yuan), it means that the Jinan system contributes a high degree to the company’s revenue, potentially forming an operating characteristic of “concentrated customers + concentrated pricing” [1][3][4].

- Independence Risk: The tenderer and bid winner of the same controlling group are jointly controlled. If multiple projects continue to be signed through related-party methods in the future, it may trigger regulatory questions about the reasonableness of pricing and the performance of independent directors, especially during periods of weak profitability (fluctuations in EPS in the first three quarters of 2025, and still fluctuating quarterly profits this year) [0].

- Valuation Pressure: The current P/E ratio (160x) and P/B ratio (8.47x) are far higher than the industry average, while ROE is only 4.69%, operating profit margin is 1.46%, and free cash flow is negative, indicating that the market has high growth requirements for it. Once related-party transactions are interpreted by the market as “interest transfer” or “internal circulation”, it may lead to valuation discounts and increased stock price volatility. In addition, technical aspects show that the stock price is in a narrow range (support at 18.70, resistance at 19.12), and Beta is extremely low (-0.03), further indicating that funds have not heavily weighted this theme and there is price sensitivity [0].

The bar chart on the left of the chart compares the 2024 revenue with this 199.8 million yuan order (accounting for 21.92%). The radar chart on the right scores risks in the dimensions of “order dependence, customer concentration, independence, valuation discount, and continuous uncertainty” (non-quantitative, only for auxiliary understanding); the data in the chart comes from Jinling AI Brokerage API and announcement disclosures [0][1].

- Focus on Diversification of Order Sources: It is recommended that investors focus on identifying government/enterprise customers outside the control scope of the “Jinan Energy Group” when tracking subsequent bidding announcements to verify whether its capabilities can be replicated in other provinces and cities.

- Strengthen Transparency of Related-Party Transactions: If the proportion of related-party projects continues to rise in the future, it is necessary to pay attention to whether the company improves transaction transparency through mechanisms such as independent pricing, independent financial advisors, and independent director reviews to avoid constraints from regulatory “excessive related-party transactions”.

- Preconditions for Valuation Recovery: Considering that the profit side is still fluctuating, to maintain a high valuation, in addition to continuously expanding low-altitude orders, it is necessary to improve the net profit margin and cash flow, and prove to the market that the revenue structure has become diversified.

- Policy and Technology Trends: The low-altitude economy is still in the construction period. If the company can continue to promote core capabilities such as “airspace collaboration” and “digital twin + flight rule database” (such as the “Kunpeng Zhifei” system), it is expected to take the lead in the next round of project competition. It is recommended to judge the rhythm in conjunction with the industry white paper/government promotion rhythm.

For more in-depth industry and competitor comparisons, valuation models, or chart combinations, you can consider enabling the

[0] Jinling AI Brokerage API Data (Real-time Market, Financial Analysis, Technical Analysis, Python Calculation)

[1] Daily Economic News - “Shensis Electronics Wins 199 Million Yuan Jinan Digital Low-Altitude Flight Management Service Platform Low-Altitude Support Facility Construction Project” (https://finance.eastmoney.com/a/202512303605899559.html)

[2] Daily Economic News/NBD - “Wins 199 Million Yuan Jinan Digital Low-Altitude Flight Management Service Platform Low-Altitude Support Facility Construction Project” (https://www.nbd.com.cn/articles/2025-12-30/4202209.html)

[3] NetEase Finance - “Shensis Electronics Wins 490 Million Yuan Related Orders for Two Digital Projects in Jinan, Revenue Doubles in the First Three Quarters” (https://www.163.com/dy/article/KHIOMVMC0552NVEU.html)

[4] East Money Wealth Account - “Shensis Electronics Wins 490 Million Yuan Related Orders for Two Digital Projects in Jinan…” (https://caifuhao.eastmoney.com/news/20251224200913480026140)

[5] Yuanxiang Sky - “Jinan Digital Low-Altitude Flight Management Service Platform Goes Online for Trial Operation” (https://yuanxiangsky.com/N/567.html)

[6] Jin Yuan Securities - “Low-Altitude Economy Weekly Report (16th Week of 2025)” (https://pdf.dfcfw.com/pdf/H3_AP202504221660395908_1.pdf?1745327340000.pdf)

[7] KPMG China - “2025: Sorting Out the 5 Key Stages of Growth for Low-Altitude Economy Enterprises” (https://www.eet-china.com/mp/a458203.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.